Hedge Funds Alert

December 2009

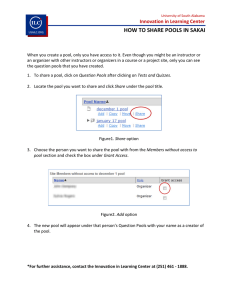

Author:

Lawrence B. Patent

lawrence.patent@klgates.com

CFTC Amends Reporting Requirements for

Commodity Pool Operators

+1.202.778.9219

Introduction

K&L Gates is a global law firm with

lawyers in 33 offices located in North

America, Europe, Asia and the Middle

East, and represents numerous GLOBAL

500, FORTUNE 100, and FTSE 100

corporations, in addition to growth and

middle market companies,

entrepreneurs, capital market

participants and public sector entities.

For more information, visit

www.klgates.com.

On November 9, 2009, the Commodity Futures Trading Commission (CFTC)

published amendments to its regulations governing periodic account statements and

annual reports that commodity pool operators (CPOs) must prepare for the

commodity pools that they operate.1 Several of these amendments will affect those

registered CPOs that operate pools in accordance with CFTC Regulation 4.7,2 and

address (1) the reporting of the amount of a participant’s interest in a pool, (2) pools

with more than one class or series of ownership interest, (3) when annual reports

must be prepared, and how certain fees must be disclosed, in the “fund of funds”

context, (4) the use of international financial reporting standards (IFRS), and (5) the

report required upon a pool’s termination. In addition, one of the amendments

eliminates the requirements that CPOs who are exempt from registration under

CFTC Regulation 4.13 and that distribute an annual report to pool participants must

(1) prepare the report in accordance with generally accepted accounting principles

(GAAP), and (2) have the report certified in accordance with CFTC Regulation 1.16,

if the pool’s financial statements are audited by an independent public accountant.

These amendments are effective generally on December 9, 2009, and the provisions

related to annual reports will be applicable to pool annual reports for fiscal years

ending December 31, 2009, and later.

CFTC Regulation 4.7

CFTC Regulation 4.7 provides registered CPOs with an exemption from the specific

requirements of CFTC Regulations 4.21, 4.22(a)-(d), and 4.23-4.26 concerning

disclosure, recordkeeping, and periodic and annual reporting, provided the CPO

restricts the participants in its pools to “qualified eligible persons” (QEPs). QEPs

generally include industry professionals, a “qualified purchaser” as defined in

Section 2(a)(51)(A) of the Investment Company Act of 1940, a “knowledgeable

employee” as defined in Securities and Exchange Commission (SEC) Regulation

270.3c-5, a non-U.S. person, certain trusts and charitable organizations, as well as

“accredited investors” as defined in Rule 501 of Regulation D under the Securities

Act of 1933 that meet a portfolio requirement of (1) $2 million in securities, (2)

$200,000 in initial margin and option premiums on deposit with a futures

commission merchant for six months, or (3) some combination of (1) and (2),

expressed as a percentage of those minimum requirements, that equals 100 percent.

1

2

74 Fed. Reg. 57585 (November 9, 2009).

CFTC Regulations may be found in Title 17 of the Code of Federal Regulations.

Hedge Funds Alert

Participant’s Interest in a Pool

Although a registered CPO operating a pool in

accordance with CFTC Regulation 4.7 is exempt

from the specific requirements of CFTC Regulation

4.22(a) and (b) regarding periodic reporting, the

CPO is required by CFTC Regulation 4.7(b)(2) to

prepare and distribute to pool participants, on a

periodic basis (at least quarterly), a statement in

accordance with GAAP that includes (i) the net asset

value (NAV) of the pool as of the end of the

reporting period, and (ii) the change in NAV from

the end of the previous reporting period. In addition,

registered CPOs operating in accordance with CFTC

Regulation 4.7 have been required to include, in the

periodic statement, the NAV per outstanding unit of

participation in the pool as of the end of the

reporting period. With respect to the last amount, the

CFTC is now permitting CPOs to report either that

amount or the total value of the participant’s interest

or share in the pool as of the end of the reporting

period. This change is intended to provide pool

participants with sufficient information to determine the value of their investment in the pool

from the periodic statement, particularly for nonunitized pools. This amendment also conforms the

periodic account statement requirements with

respect to a participant’s interest in a pool that is

operated in accordance with CFTC Regulation 4.7

with the requirements applicable to periodic

reporting of a participant’s interest in a non-exempt

pool under CFTC Regulation 4.22(a).

Pools with More Than One Class or

Series of Ownership Interest

CPOs may decide to establish more than one class or

series of ownership interests in a particular pool to

provide for different fees and expenses to be

assessed on different classes or series, as well as

differences in currency denomination, trading or

cash management strategy, or other aspects of a

pool’s operation. Previously, the CFTC regulations

governing periodic statements and annual reports of

pools did not address the issue of the information

that should be included about other classes or series

of pool ownership, either with respect to non-exempt

pools or to pools operated in accordance with CFTC

Regulation 4.7. The amendments provide that, for

both types of pools, where one class or series is not

responsible for the liabilities of any other class or

series, the periodic statement and annual report need

include only information for the class or series

being reported. CPOs who have established such

liability limitations among the different classes or

series of pool ownership interests, thereby

essentially ring fencing each class or series and

creating a structure of separate “silos,” are free to

present information on the pool as a whole, and if

the CPO has not established such limitations on

liability, it must provide consolidated information.

Fund of Funds

A. Distribution of Annual Reports

Over the last few years, the CFTC and National

Futures Association (NFA) have expressed greater

concern about, and brought several enforcement and

disciplinary actions charging, the failure to

distribute and file pool annual reports in a timely

manner.3 This issue has been especially difficult for

CPOs of pools that make any investment in other

pools, commonly referred to as a “fund of funds”

(i.e., where there is no minimum level of investment

by the investor pool required for the relationship

between the pools to be considered a fund of funds).

The general rule has been that registered CPOs,

whether operating a non-exempt pool or a pool in

accordance with CFTC Regulation 4.7, must

provide each participant in each pool that the CPO

operates an annual report for the pool within 90

days4 of the end of the pool’s fiscal year. The CPO

is further required to submit a copy of the annual

report electronically to NFA.

In the fund of funds context, a CPO operating a

non-exempt pool has been able to claim up to an

additional 60 days to distribute and file the annual

report by filing a notice with NFA making specified

representations. This ability to claim an automatic

60-day extension has not been available to CPOs of

funds of funds that distribute unaudited annual

reports in accordance with CFTC Regulation 4.7;

3

See, e.g., In the Matter of Citigroup Private Bank GP, Inc.,

CFTC Docket No. 10-01 (October 1, 2009), available at:

http://www.cftc.gov/ucm/groups/public/@lrenforcementactions

/documents/legalpleading/enfcitigrouporder10012009.pdf; In

the Matter of JST Capital Management LLC, NFA Case No.

07-BCC-038 (July 2, 2008), available at:

http://www.nfa.futures.org/basicnet/CaseDocument.aspx?seq

num=1636

4

All time periods referred to are based upon calendar days.

December 2009

2

Hedge Funds Alert

such CPOs may, however, petition NFA for an

extension of up to 90 days, in accordance with

CFTC Regulation 4.22(f)(1).

The amendments will permit registered CPOs

operating in the fund of funds context, whether

under CFTC Regulation 4.7 or a non-exempt pool,

to claim an automatic extension of 90 days, for a

total of 180 days from the pool’s fiscal year-end, for

distributing and filing an annual report.5 The CFTC

recognized that, even where annual reports prepared

under CFTC Regulation 4.7 are unaudited, the

reports must be prepared in accordance with GAAP.

Accordingly, CPOs need information from the

acquired funds to establish the value of the investor

fund’s investment. Because such information is

frequently unavailable until the acquired funds

complete their own audited financial statements, all

registered CPOs are now able to claim an automatic

90-day extension of time, even when operating a

pool in accordance with CFTC Regulation 4.7.6

The CFTC also eliminated the requirement that a

CPO who filed a claim of automatic extension of

time to distribute and file an annual report for a

particular pool must restate certain representations in

a statement filed with the pool’s annual reports in

subsequent years. The amendments presume that the

CPO continues to operate the pool as a fund of funds

and to qualify for the automatic extension.

B. Fees Related to Investment in Investee

Pools

The annual report distributed and filed under CFTC

Regulation 4.7(b)(3) has previously been required to

5

Therefore, if a CPO is operating a fund of funds with a

calendar year fiscal year, and it claims this automatic

extension under CFTC regulations, the next annual report will

be due June 29, 2010. The 180-day time frame is also

consistent with the period within which registered investment

advisers must distribute annual reports to investors in funds of

funds to avoid being required to comply with certain provisions

of the SEC custody rule. See 17 C.F.R. § 275.206(4)-2(a)(3),

(b)(3) and (c)(4).

6

NFA commented on the proposal that, if multi-tiered funds

were involved, even 180 days might not be sufficient to

distribute and file an annual report, because the level below

may be taking 180 days to prepare its report. NFA suggested

that CPOs be permitted up to 210 days to distribute and file

annual reports in such circumstances, but the CFTC was not

persuaded to provide more than six months from the end of

the fiscal year for distribution of a pool annual report.

include, at a minimum, a Statement of Financial

Condition, a Statement of Income (Loss),7 and

“[a]ppropriate footnote disclosure and any other

material information.” The CFTC is now

mandating that the notes to the financial statements

include (1) the amounts of management and

incentive fees incurred as a result of investing in

any investee pool where the investment exceeded

five percent of the investor pool’s NAV, or (2) if

such specific amounts cannot be obtained by the

registered CPO, a statement to that effect and the

percentage amounts and computational basis for

each fee. In addition, the income derived from

investments in such acquired funds must be

included. The CFTC staff has encouraged CPOs to

make these disclosures for over a decade in its

annual CPO guidance letters, but the information

was not required previously.8

Use of IFRS

CFTC regulations requiring the preparation of

financial statements in accordance with GAAP have

generally been interpreted to mean GAAP as

established in the United States. Nevertheless,

CFTC staff has previously provided relief to certain

CPOs to permit use of IFRS, subject to conditions.

The amendments codify this relief and permit

registered CPOs of non-exempt pools, and pools

operated in accordance with CFTC Regulation 4.7,

to use IFRS. To qualify for using IFRS, the CPO

7

The Statement of Income (Loss) has been renamed by

these amendments as the Statement of Operations.

8

The so-called “Dear CPO” letters issued since 1999 are

available at the following URL:

http://www.cftc.gov/industryoversight/intermediaries/guidancec

poreports.html. The income, management and incentive fees

associated with an investment in an investee fund that is five

percent or less of the pool’s net assets may be combined and

reported in the aggregate with the income, management and

incentive fees of other investee funds that, individually,

represent an investment of five percent or less of the pool’s

net assets. (Although the amended regulation refers to

aggregating investments that are less than five percent of the

pool’s net assets, that would leave a gap for investments of

exactly five percent. Because the particularized disclosure is

only required if the investment exceeds five percent, it is

logical to conclude that aggregation may apply to any

investment of five percent or less of a pool’s assets in another

pool.) The total income on the detail schedule should agree

with the amount of income reported for the income from investments in other funds in the pool’s Statement of

Operations.

December 2009

3

Hedge Funds Alert

must file a notice with NFA, within 90 days of the

end of the pool’s fiscal year, representing that:

•

the pool is organized under the laws of a foreign

jurisdiction;

•

the annual report will include a condensed

schedule of investments, or, if required by the

alternate accounting standards, a full schedule of

investments;

•

the preparation of the pool's financial statements

under IFRS is not inconsistent with

representations set forth in the pool's offering

memorandum or other operative documents

made available to participants;

•

special allocations of ownership equity will be

reported in accordance with CFTC Regulation

4.22(e)(2); and

•

if IFRS require consolidated financial

statements for the pool, such as a feeder fund

consolidating with its master fund, all applicable

disclosures required by GAAP for the feeder

fund will be presented with the reporting pool's

consolidated financial statements.

The amendments also permit CPOs that use IFRS

for the pool’s financial statements presented in the

annual report to present the periodic account

statements on the same basis.9

Pool Termination

Previously, CFTC Regulation 4.7 did not address the

CPO’s reporting obligation upon the termination of a

pool operated in accordance with that regulation.

However, CFTC staff stated in annual guidance

letters to CPOs that operators of pools under CFTC

Regulation 4.7 are subject to the same requirements

as the operators of non-exempt pools regarding the

final annual report upon the pool’s termination. The

amendments codify this guidance for CPOs

9

A year ago, the SEC proposed a “Roadmap” that could lead

to the required use of IFRS by U.S. issuers of securities in

2014. 73 Fed. Reg. 70815 (November 21, 2008). See also

Statement by SEC Chairman Schapiro on International

Accounting Standards Board and Financial Accounting

Standards Board Commitment to Improve IFRS and U.S.

GAAP and to Bring About Their Convergence (November 5,

2009), available at http://www.sec.gov/news/press/2009/2009237.htm

operating pools in accordance with CFTC

Regulation 4.7 and attempt to streamline the

procedures related to the termination of those pools

as well as non-exempt pools.

The amendments require a CPO to provide a final

report for a pool within 90 days of the cessation of

trading, which must include:

•

Statements of Operations and Changes in Net

Assets;

•

an explanation of the winding down of the

pool’s operations; and

•

a statement, (i) if true, that all interests in, and

assets of, the pool have been redeemed,

distributed or transferred on behalf of the

participants; or, (ii) if all funds have not been

distributed at the time the report is issued,

disclosure of the value of the assets remaining

to be distributed and the expected date of their

distribution.

If the CPO does not complete the distribution of

funds by the date specified in the final report, the

CPO must notify NFA and the pool’s participants

about the value of the pool’s remaining assets, the

expected date of liquidation, any fees and expenses

that will continue to be charged to the pool, and the

extent to which reports will continue to be provided

to participants pursuant to the pool’s operative

documents. In addition, CPOs must continue to

comply with periodic and annual reporting

requirements under CFTC regulations until final

distribution.

CPOs Exempt from Registration Under

CFTC Regulation 4.13

CFTC Regulation 4.13 provides an exemption from

registration for those CPOs, among others, who

restrict the amount of commodity interest trading

undertaken to a de minimis amount and place certain

restrictions on participants (CFTC Regulation

4.13(a)(3)), or who restrict their pool participants to

certain highly sophisticated investors (CFTC

Regulation 4.13(a)(4)). These CPOs are not

required to distribute an annual report to pool

participants; however, if they decide to do so, the

CFTC has previously required that the report be

prepared in accordance with GAAP and, if audited

by an independent public accountant, certified in

December 2009

4

Hedge Funds Alert

accordance with CFTC regulations. The

amendments remove these requirements, with the

CFTC explaining that, if the reports are not required,

the CFTC should not prescribe the form of the

reports.

Conclusion

The CFTC’s amendments to its reporting

requirements for registered CPOs provide some

relief on the timing of filing annual reports in the

fund of funds context and on the ability to use IFRS,

provided that the pool operator files the appropriate

notice with NFA. The amendments are also intended

to streamline the report required when a pool

terminates. More detailed information about pools

with more than a single ownership series or class

will be required, and operators of pools in

accordance with CFTC Regulation 4.7 may have to

disclose the total value of a participant’s share of the

pool in the periodic statement. CPOs exempt from

registration under CFTC Regulation 4.13 will no

longer have to prepare an annual report in

accordance with GAAP or have it certified in

accordance with CFTC regulations. The

amendments were well received by those who filed

comments upon them, and they should make the

upcoming reporting season a little easier.

Anchorage Austin Beijing Berlin Boston Charlotte Chicago Dallas Dubai Fort Worth Frankfurt Harrisburg Hong Kong London

Los Angeles Miami Newark New York Orange County Palo Alto Paris Pittsburgh Portland Raleigh Research Triangle Park

San Diego San Francisco Seattle Shanghai Singapore Spokane/Coeur d’Alene Taipei Washington, D.C.

K&L Gates is a global law firm with lawyers in 33 offices located in North America, Europe, Asia and the Middle East, and represents numerous

GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market

participants and public sector entities. For more information, visit www.klgates.com.

K&L Gates comprises multiple affiliated partnerships: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and

maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in

Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), and in Singapore; a limited liability partnership (also named K&L

Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an office in

Taipei; and a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong. K&L Gates maintains appropriate

registrations in the jurisdictions in which its offices are located. A list of the partners in each entity is available for inspection at any K&L Gates office.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2009 K&L Gates LLP. All Rights Reserved.

December 2009

5