VoIP: New regulatory paradigm or more plain old telephony?

advertisement

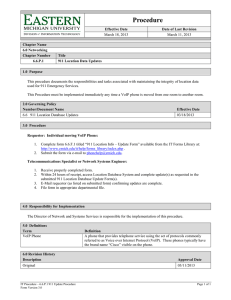

VoIP: New regulatory paradigm or more plain old telephony? Will VoIP change the regulatory landscape? About ECTA European Competitive Telecommunication Association represents some 150 operators across Europe Aims to drive forward liberalisation and competition across the telecoms sector Our operator members are diverse – panEuropean & national, consumer & business most have made substantial investments in infrastructure Contents Same market or something new? Removing barriers to VoIP development -Economic -Administrative A need for a whole new paradigm? Same market or something new? Voice continually evolving • analogue digital IP, 1 to 1 conf call, per min flat rate Would customers switch PSTN fixed voice for VoIP? Depends on quality and reliability, service, price… • Voice over Broadband (VoB): Offered over private IP access. Usually substitute, sometimes with additional functionality • Voice over Internet (VoI): Offered as an application over the public Internet. Not full substitute at present, may evolve Will it impact fixed mobile substitution? For access, no – cost, bandwidth factors prevail. For calls, maybe Substitution of VoIP for PSTN signals success. POTS+ How can we facilitate substitution? VoIP development is indicator, not cause, of competitiveness Action needed to open markets, prevent leverage, address PSTN lock-in • Fixed: Full LLU, naked DSL (not available in UK, Spain, Germany). Does price allow provision of voice only? Whilst not effective, safeguards to prevent leverage? • Mobile: Are consumers benefiting from VoIP (eg 3 and Skype in UK)? Is the market competitive enough? A competitive market will offer consumers choice of provider, payment model, bundles or single services Case studies: France triple-play Voice over IP (VoIP) is increasingly making inroads in countries like France and Japan… France had a relatively high level of VoIP (high QoS) take-up – a reflection of the success of alternative operator Free in marketing VoIP services, and of France Telecom’s subsequent response. Ofcom – Nov 2006 Case studies: Japan fibre 25,000,000 FTTH Broadband subscribers Total:24.22million DSL 【NTT’s investment in fiber local loops & total investment in equipment】 1,200 (\bn) CATV 1,100 1,097.7 20,000,000 1,000 FTTH:26% (6.31million) 15,000,000 Total Investment 900 775.4 766.2 800 885.1 810.0 796.9 696.6 700 600 10,000,000 DSL:60% (14.49million) Investment for fiber local loops 500 400 349.0 333.0 283.0 300 200 about 350.0 237.0 164.0 149.0 100 5,000,000 0 FY00 FY01 FY02 FY03 FY04 FY05 FY06 (planned) CATV:14% (3.41millon) 01 /0 3 01 /0 9 02 /0 3 02 /0 9 03 /0 3 03 /0 9 04 /0 3 04 /0 9 05 /0 3 05 /0 9 06 /0 3 00 /9 - Competition in broadband including through fibre unbundling has contributed to VoIP success Addressing the network effect Interconnection also critical for VoIP success – issue is overcoming network effect. Absent regulation: Operators with control over largest customer base have the most valuable asset and greatest bargaining power. This provides an incentive to deny interconnection Lack of explicit voluntary VoIP termination arrangements with incumbents may signal the likely outcome when starting with an operator having a large inherited customer base. Migration from the PSTN to NGNs will extend this power Operators of similar size may have greater incentives to interconnect or ‘peer’, although this is far from guaranteed Experience from instant messaging, VoI and the birth of telephony suggest possible market outcomes for more evenly sized players. Voluntary peering has occurred for SMS Addressing the network effect The termination ‘game’ Regulators action Market response Any-to-any connectivity Excessive termination pricing and margin squeeze by biggest ‘club’ owner Price control on dominant player Relative increase in bargaining power of smaller players Termination bottleneck. All dominant Enforcement issues. Cost recovery concerns for entrants Regulatory intervention inevitable, except if true substitute emerges for termination Regulators should provide advance guidance on principles including the price control mechanism. Options are: • Bill and keep: suitable for ‘best efforts’ with plentiful bandwidth • Quality and element/capacity: where QoS guarantees needed A new regulatory paradigm? … IP opens the way for a logical separation between the passive networks (cables and ducts) and the more active elements …That is why I am noting with great interest some of the experiments around the world, notably in the UK, New Zealand, and now also in Italy and Ireland, where there are attempts to functionally separate the regulation of access loop of the incumbent – the key bottleneck assets – from the rest of the business. Commissioner Viviane Reding, 4 Dec ITU Conference VoIP itself is not a new service, and the problems are familiar, but there is now real scope for competition to flourish if we tackle the problems at their core for legacy networks and their NGN successors In a market where voice can be made competitive, separating access from services (including VoIP) also makes sense for a forward-looking universal service, giving all customers the benefit of choice Administrative/technical barriers Administrative and technical/standardisation as well as economic issues blocking VoIP expansion Numbering: need for all ranges to be available for VoIP; number ranges should indicate cost not lock in geographic position Authorisations should at least be consistent – or room for a pan-European authorisation system? Number portability: must be available for VoIP on reciprocal basis Emergency access: issue for universal service, technical/ economic feasibility issues relevant for nomadic services Standards: ENUM (E164 NUMber Telephone Mapping to IP) - the technology together with SIP enables all VoIP islands to interconnect Data protection/security: consistency/proportionality ERG highlighted VoIP fragmentation as key barrier to European development – have committed to address through Best Practice template. Relevant internationally also? Conclusions VoIP is an evolution, not a revolution: POTS+ Success in VoIP indicates, but doesn’t cause competitiveness Access bottlenecks and the ‘club effect’ remain key economic barriers to VoIP development Role of regulators will be critical in addressing blockages. VoIP will not make them disappear! Functional separation may be the new paradigm we need to ensure that the future of voice is vibrant and competitive Time for pan-European authorisations, and geographically neutral approach to numbering?