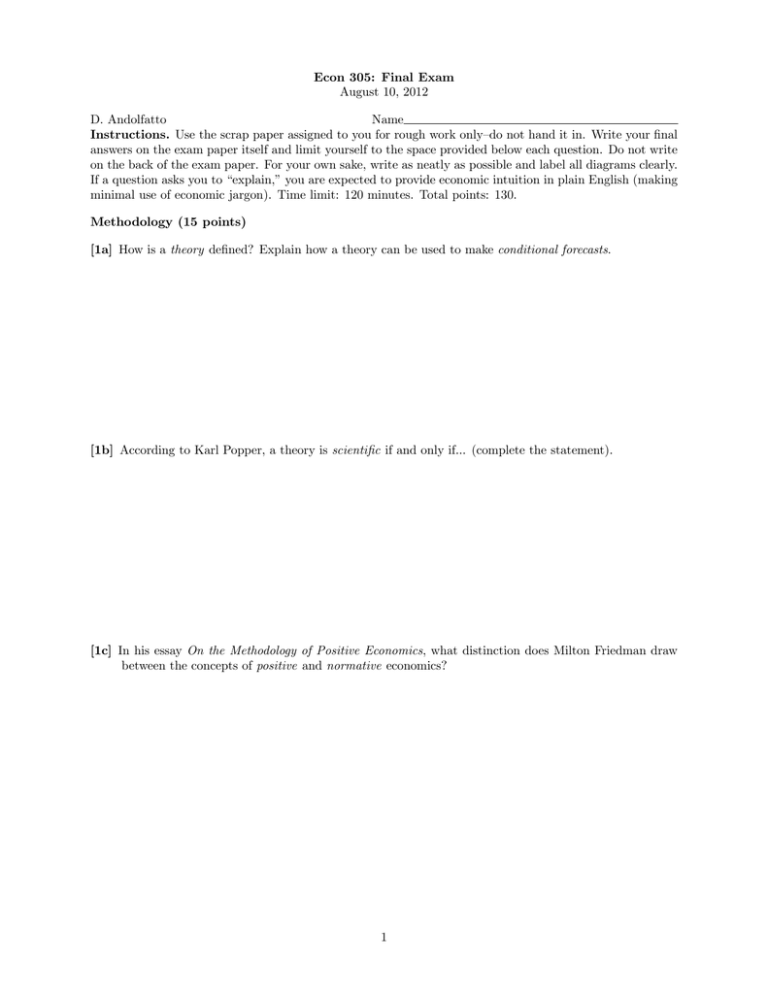

Econ 305: Final Exam August 10, 2012 D. Andolfatto Name

advertisement

Econ 305: Final Exam August 10, 2012 D. Andolfatto Name Instructions. Use the scrap paper assigned to you for rough work only—do not hand it in. Write your final answers on the exam paper itself and limit yourself to the space provided below each question. Do not write on the back of the exam paper. For your own sake, write as neatly as possible and label all diagrams clearly. If a question asks you to “explain,” you are expected to provide economic intuition in plain English (making minimal use of economic jargon). Time limit: 120 minutes. Total points: 130. Methodology (15 points) [1a] How is a theory defined? Explain how a theory can be used to make conditional forecasts. [1b] According to Karl Popper, a theory is scientific if and only if... (complete the statement). [1c] In his essay On the Methodology of Positive Economics, what distinction does Milton Friedman draw between the concepts of positive and normative economics? 1 Productivity Growth and Employment (20 points) [2] Consider the following model economy. There is a representative individual with preferences for consumption and leisure ( ) given by ( ) = ln() + ln() where 0 Consequently, we have ( ) = () There is a time constraint + = 1 where denotes time spent working. There is also a resource constraint = where 0 indexes productivity (the rate of return on labor). (a) Give a mathematical statement of the individual’s choice problem and explain what it means. (b) Provide a mathematical characterization of the solution. Provide a diagrammatic characterization of the solution. (c) Using the mathematical characterization in (b), solve for the equilibrium level of output and employment ( ∗ ∗ ) as a function of parameters ( ) (Just report your answer—no need to show derivation.) (d) Over the last century, productivity (the real wage) has increased significantly, while the amount of time devoted to employment has remained relatively stable. Is the theory developed here consistent with this observation? Explain the interpretation offered by the theory. (A diagram may be helpful) 2 [3] [20 marks] A government agency has planned a temporary increase in its purchases of nondurable goods and services from the private sector. There is a debate, among members of this agency, concerning the best way to finance this expenditure. One side insists on a temporary increase in income and sales taxes (sufficient to keep the budget balanced). The other side is against any tax increase, and instead favours deficit finance (issuing bonds). (a) You are asked to serve as a consultant in this debate. What would you recommend and why? (b) How would your answer to part (a) change if the increase in expenditure was permanent, instead of temporary? Explain. 3 [4] [15 marks] How are each of these terms defined in the Labor Force Survey: employment, unemployment, nonparticipant. Employment: someone who has done any paid work in the previous four weeks. Unemployment: someone who is not employed and who is actively searching for work. Nonparticipant: Those that are neither employed or unemployed. [5] [15 marks] Let denote the level of unemployment rate at date The stock of unemployed workers evolves over time according to the following dynamic equation: +1 = + ( − ) − where is the labor force, is the job destruction rate, and is the job finding rate. (a) Solve for the steady-state (long-run) level of unemployment. µ ¶ ∗ = + (b) Explain how the long-run level of unemployment depends on and The long-run level of unemployment is increasing in the job destruction rate and decreasing in the job finding rate. (c) How is a government program that subsidizes hiring likely to affect the unemployment rate and why? (Use the model above, emphasizing a change in either or and use what you have learned in class to explain.) A hiring subsidy is likely to make employers increase their recruiting efforts. An increase in recruiting intensity is likely to increase the probability that unemployed workers find jobs. The subsidy is not likely to have much of an effect on worker retention, so is not likely to change very much. 4 [6] [15 marks] Define what is meant by a “lack of double coincidence of wants.” Is a lack of double coincidence of wants a necessary or sufficient condition to explain monetary trade? (Explain what you mean by monetary trade; i.e., define money.) Explain. A lack of double coincidence of wants is defined to be a situation in which there are no bilateral gains to trade. LDCW is a necessary, but not sufficient, condition to explain monetary trade (the use of an object which circulates widely as a medium of exchange). In small societies, most trade is conducted through credit (gift-giving) arrangements. With sufficient commitment and credit history information (record keeping), money is not necessary—people will behave “correctly” since they will otherwise be punished by society. In large societies, record keeping becomes very costly. In this case, money can become a form of information about a person’s credit history. Somebody with a lot of money is likely to have made many “gifts” to society. Money is demanded for its record-keeping ability. [7] [15 marks] Insurance companies, pension funds, and banks are all financial intermediaries. Explain how each of these types of agencies transform assets into particular liability structures. What makes banks “special” relative to other intermediaries? Insurance companies take deposits (premiums) and use them to buy assets. They construct state-contingent liabilities (insurance contracts) that are backed by these assets. Pension funds take deposits (contributions) and use them to buy assets. They construct time-contingent liabilities (pension obligations) that are backed by these assets. Banks take deposits of cash and capital (collateral). They construct demandable liabilities that are backed by these assets. Banks are special in the sense that only their liabilities are used as money. [8] [15 marks] Explain why governments might prefer to borrow using short-term debt instead of long-term debt? Explain how the use of short-term debt exposes the debor to “rollover risk” (explain what is meant by rollover risk). How is this rollover risk currently playing out in the European sovereign debt crisis? (Identify the principle problem countries and what is currently happening.) Because the yield curve is generally upward sloping, it is cheaper to issue short-term debt relative to long-term debt (you must pay a higher rate of interest on longer term debt). The problem with short-term debt is that it typically needs to be rolled over. That is, new debt must be issued to pay for the maturing debt. If country’s fiscal situation is suddenly questioned by the financial market, then they may have trouble rolling over their debt as it comes due. In this case, a country may be compelled to default. Rollover risk is currently being played out in Europe, notably with Greece. Greece has already partially defaulted on its sovereign debt. But the big concern at present is with Italy and Spain. Both of these countries need to roll over a huge amount of debt and it is not so clear how successful they will be. Because the banking system holds much of this debt, the fear is that there will be a bank run if these countries default. 5