Document 13725529

advertisement

Advances in Management & Applied Economics, vol. 5, no.5, 2015, 55-70

ISSN: 1792-7544 (print version), 1792-7552(online)

Scienpress Ltd, 2015

The Exchange Market Contagion in an Asymmetric

Framework before and after Abenomics

Chien-Chung Nieh1 and Hsun-Fang Cho2

Abstract

This study analyzes the contagion caused by the currency depreciation war in a multivariate

time varying asymmetric framework, focusing on countries competing with Japan for trade

during the Abenomic period. We employed not only the linear models of Engle and Granger

(1987), and the Johansen (1988) co-integration models but also the Enders and Siklos (2001)

asymmetric threshold co-integration model to investigate whether the contagion effects

between Japan’s exchange rate market and the exchange rate markets of major countries in

completion with Japan for export markets before and after Abenomics for the period 20112014 existed. The empirical evidence confirms a contagion effect particularly in Asian

countries where there is export competition with Japan with the exception of South Korea

during Abenomics. The contagion of the Japanese yen depreciation is not transmitted to

Australia, the Euro zone (France, Germany, Italy, and Netherlands), Qatar, Saudi Arabia,

and USA in competitive trade with Japan. We can apparently find the effect of yen

devaluation only occurred in the region of Asia close to Japan and does not spread Europe

and America. In general, our results support the contagion phenomenon for Abenomics.

Nevertheless, the effect of the contagion is regional not global.

JEL classification numbers: C32, F31, G01, G15

Keywords: Abenomics, Contagion, Currency depreciation war, Momentum threshold

autoregressive (M-TAR)

1

Introduction

Globalization and deregulation of financial markets promotes prosperity in the global

economy. The trend of trade liberalization has also led to more frequent financial dealings.

However, the impact of a shock to the finance, economy, and the politics in one country

1

2

Department of Banking and Finance of Tamkang University, Taiwan.

Department of Banking and Finance of Tamkang University, Taiwan.

Article Info: Received : July 2, 2014. Revised : July 31, 2015.

Published online : October 15, 2015

56

Chien-Chung Nieh and Hsun-Fang Cho

often crosses to countries in the same region or countries in other regions, which result in a

regional or a global economic crisis, such as the Mexico peso crisis in 1994, the Asian

financial crisis in 1997, the Russian financial crisis in 1998, the U.S. Dot-com bubble in

2000-2002, and the global financial crisis in 2007-2008. Currency crises have occurred

repeatedly over the past twenty years. Researcher has investigated how attacks of

speculative behavior create a currency crisis in one country; the market volatility tends to

spread to other countries in the specific region and elsewhere. Researchers and academic

institutes have proposed that exogenous events, and shock transmission explains this

phenomenon, generally referred to as contagion. The recent crisis-contagion theory is

ardently discussed by the academic authorities and policy makers, especially in light of the

frequent economic and financial crises all over the world.

As we all know, the Japanese economy has been depressed for 26 years since the asset

bubble burst in 1989 (The Nikkei 225 index reached its highest point at 38,913). The

Japanese economy required a stimulus to escape from this pattern of long-term sluggish

growth. The Liberal Democratic Party (LDP) overwhelmingly won a general election

which took place in Japan on December 16th, 2012. Abe Shinzo regained the power to

govern as Prime Minister on December 26th, 2012. His prescription for economic

reactivation was referred to as Abenomics which is a new economics policy regime and a

new term – Abenomics – that is used to refer to the three pillars or arrows for the Japanese

economy and economic policy. The first arrow is the unconventional monetary policy; the

second arrow is the expansionary fiscal policy and the third arrow is the economic growth

strategies. The Japanese government tried to revive its economy through implementing bold

economic policies that will pull its economy out of prolonged deflation. The Abenomics

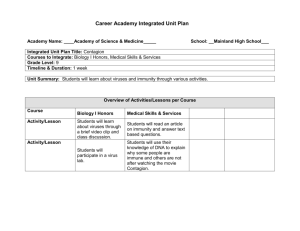

policy led to a dramatic weakening of the Japanese yen. According to Figure 1, the yen

became about 25% lower against the U.S. dollar in the second quarter of 2013 compared to

the same period in 2012, with an extremely loose monetary policy being followed. The

Bank of Japan adopted a policy of quantitative easing aimed at creating a sharp depreciation

of the yen. This caused Japan’s trading competitors to become afraid that their exports are

uncompetitive. These countries joined together with a policy of competitive devaluation of

currencies in order to maintain export competitiveness. Japan triggered a currency war

causing contagion in competitive devaluation of currencies. Understanding this issue is one

of the purposes of this study by investigating the effect of the sharp depreciation of the yen

during the period of Abenomics. Therefore, the general discussion about contagion explores

how to define contagion t in the first and then considers how to measure contagion.

In terms of the definition, generally, the influential definitions of contagion refer to a

significant increase in cross-market linkages after a shock to one country or group of

countries and a cross-market correlation. Otherwise, where there is a continued market

correlation at high levels, this is considered to be “no contagion, only interdependence”

(Forbes and Rigobon, 2002, Bekaert et al., 2005). Commonly, contagion refers to the spread

of financial disturbances from one country to others. The literature on financial contagion

has literally exploded since the publication of the paper by Forbes and Rigobon (2002)

stimulated extensive debate and discussion. Much of the extant empirical literature on

contagious currency crises stresses the phenomenon of regional contagion. Lee and Kim

(1993), Forbes and Rigobon (2002), Dungey, Fry, González-Hermosillo, and Martin (2006),

Lucey and Voronkova (2008), and Arouria, Bellalahb, and Nguyenc (2009) about the

transmission effect and the contagion effect were based on the backgrounds of several crises

since the late 1990s, such as those in Mexico (1994), Thailand (1997), Russia (1998), and

Argentina (1999). Calvo and Reinhart (1996) reported correlation shifts during the Mexican

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

57

Crisis, while Baig and Goldfajn (1999) supported the contagion phenomenon during the

East Asian Crisis.

In the light of the need to quantify contagion, during recent last years, scholars have been

using more advanced techniques to measure contagion. For example, Patton (2006)

pioneered the study of time-varying copulas for modelling asymmetric exchange rate

dependence. Bartram et al. (2007) estimated time-varying copula dependence models for

17 European stock market indices, following the methodology of Patton (2006). In the

recently developed area of regime-switching copulas, Rodriquez (2007) modeled

dependence with switching-parameter copulas to study financial contagion and provides

evidence of changing dependence and asymmetry during the Asian and the Mexican crises.

Okimoto (2008) estimated regime-switching copulas for the US–UK pair and found that

the bear regime was better described by an asymmetric copula with lower dependence. In

terms of other empirical literature, Caporale, Cipollini, and Spagnolo (2005) modeled the

conditional variance by the application of both heteroskedasticity and endogeneity biases

and invented a common shock to deal with the omitted variable problem. They found the

existence of contagion within the stock markets in Hong Kong, Japan, South Korea,

Singapore, Taiwan, and Malaysia during the 1997 Asian Financial Crisis. The findings were

consistent with the crisis-contingent theories of stock market linkages. Bekaert, Harvey,

and Ng (2005) also reported that co-integration relationships did exist among the Asian

stock markets during the period of the 1997 Asian Financial Crisis, which demonstrated a

contagion effect. Li and Lam (1995), Koutmos (1998), and Chiang (2001) pointed out that

co-integration between stock markets was asymmetric; Wang and Lin (2005), Shen, Chen,

and Chen (2007), and Chang (2008, 2010) further employed the asymmetric co-integration

test for their empirical studies. This paper presents a theory for analyzing whether intercountry trade can be responsible for the transmission of a currency crisis, which has

important implications for understanding the empirical phenomenon in general and

possibly also its regional dimensions.

To investigate how the asymmetric adjustment phenomenon influences the contagion effect

or the transmission effect, we apply the asymmetric threshold co-integration method to

compare the transmission effect or the contagion effect from the Japanese exchange rate

market to the exchange rate markets of import and export countries trading with Japan in

the pre-Abernomics and during the Abenomic period; therefore, asymmetric adjustments

could exist in an upward status (positive impact) or a downward status (negative impact).

How do the two phenomena influence the transmission effects or contagion effects of the

exchange rate markets? Do different correlations, co-movement, interdependence, or

contagion effects exist during currency depreciation? These issues were seldom discussed

in previous literature; therefore, we decided to explore these problems by the asymmetric

threshold co-integration model. What is the impact of the Japanese yen depreciation on the

countries which have a trade relationship with Japan during the period of Abenomics? Is

co-integration strengthened during the great depreciation? The issue of the contagion effect

in some countries in Asia, Europe and America, which we have selected for this paper, is

carefully examined.

The structure of the paper is organized as follows. Section 2 presents data description and

the econometric method. Section 3 shows empirical results. Finally, concluding remarks

are stated in Section 4.

58

2

Chien-Chung Nieh and Hsun-Fang Cho

Data Description and the Econometric Method

2.1 Data and Variables

The study aims to investigate the asymmetric contagion effect of the Japanese exchange

rate on the exchange rate of the major export and import countries trading with Japan3 such

as European countries including Germany, France, Netherlands, and Italy, Asian countries

consisting of China, South Korea, Thailand, Saudi Arabia, Taiwan, Malaysia, Hong Kong,

Indonesia, Singapore, United Arab Emirates, and Qatar, North America including the

United States, Canada and Australia. Because the four European countries have adopted the

euro (€) as their common currency and sole legal tender, the currencies of these countries

are identical utilizing the euro (€) in this study. The exchange rates are quoted in the paper

employs the price per unit of US dollar expressed in the currency of the target country. Here,

the US dollar is called the "Fixed currency", while other country’s currencies are referred

to as a "Variable currency". The exchange rate of the Unite States adopts the U.S. Dollar

Index4. All of the variables in this study are taken from logarithms.

In order to sufficiently investigate the long equilibrium relationship of variables, this

research utilizes sample data over four years. Therefore, daily data arranged in 5-day weeks

is selected for this dissertation from 1st January2011 to 31st December 2014 and downloaded

from the Datastream database for exchange rates of nineteen countries including sixteen

currencies. A total of 1,043 observations are obtained for each variable, which are utilized

to analyze the extent of co-movements and contagion effect of exchange rare depreciation

from Japan to other countries. To account for the impact of Abenomics on the exchange

rates of countries importing and exporting to Japan, The study conducts a process of

analysis observing all variables over the same period. Table 1 displays the descriptive

statistics showing the exchange rates of all the countries investigated.

The study wants to investigate the influence of the implementation before and after

Abenomics. The periods before and after Abenomics need to be defined for observing

whether there exists significant difference between two periods. According to Prime

Minister Yoshihiko Noda’s announcement, the House of Representatives was dissolved by

Prime Minister Yoshihiko Noda on November 16th, 2012 as so this marks the cut off point

for the pre-Abenomic period. After that, the Japanese exchange rate started to dramatically

depreciate as illustrated in Figure 1. The period before Abenomics is defined as being from

January 1st, 2011 to November 16th, 2012 to provide a total of 490 daily observations. The

period of Abenomics is defined as being from November 19th, 2012 to December 31st, 2014

with 553 days of daily data. We, therefore, compared the estimated results for the different

periods.

All variables are transformed into natural logarithms namely 𝐿𝐸𝑅𝑖,𝑡 = 𝑙𝑛𝐸𝑅𝑖,𝑡 . Where ER

is the abbreviation for exchange rate. t denotes the time period of observation. i represents

observed the countries. The equation can be expressed as:

3

For more details regarding the information, the reader is referred to the website of the observatory

of economics complexity: Source: https://atlas.media.mit.edu/en/profile/country/jpn/

4

The US Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar

relative to a basket of foreign currencies, often referred to as a basket of US trade partners' currencies.

Source: https://en.wikipedia.org/wiki/U.S._Dollar_Index

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

59

∆𝐿𝐸𝑅𝑖,𝑡 = (𝑙𝑛𝐸𝑅𝑖,𝑡 − 𝑙𝑛𝐸𝑅𝑖,𝑡−1 ) × 100

where ∆𝐿𝐸𝑅𝑖,𝑡 , 𝑖 = 1,2 … 16 represents the variables in the first difference.

(1)

125

Yen / US

115

105

95

85

75

1/3/2011

1/3/2012

1/3/2013

1/3/2014

Figure 1: The graph of Japanese yen from 2011 to 2014

Table 1: Summary statistics for return on exchange rates

Max

Std.

Skewnes Kurtosi

Mean

Min.

J-B

.

Dev.

s

s

3.71 Japan

0.037

0.586

0.655

7.763 1,059***

0

2.327

4.10 Australia

0.021

0.666

0.283

6.454 532***

8

3.277

2.95 Canada

0.015

0.467

0.165

6.228 457***

5

1.962

0.49 China

-0.006

0.100

-0.101

7.947 1,064***

9

0.586

2.10 Euro

0.010

0.550

0.064

4.519 101***

4

2.307

0.14 Hong Kong

0.027

-0.301

13.547 4,845***

0.0002 9

0.222

3.13 Indonesia

0.031

0.370

0.457

11.509 3,180***

9

1.726

1.68 Malaysia

0.013

0.402

-0.187

6.293 477***

1

2.648

0.07 Qatar

0.000

0.010

-0.052

19.968 12,501***

8

0.072

0.07 447,455**

Saudi Arabia

0.0001

0.005

-0.136

104.519

3

0.076

*

2.14 Singapore

0.003

0.359

0.368

9.151 1,666***

0

2.290

2.79 South Korea

-0.002

0.472

0.606

6.092 479***

7

1.709

1.54 Taiwan

0.008

0.202

0.703

9.954 2,185***

0

0.851

0.008 1.47 0.306

-0.245

6.975 697***

Thailand

Obs.

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

3

1,04

60

Chien-Chung Nieh and Hsun-Fang Cho

United Arab

Emirates

US

2

0.01

0.000

1

1.86

0.013

6

2.267

0.002

0.011

0.431

1.861

0.343

0.182

3

1,04

10.946 2,762***

3

1,04

4.696 131***

3

Notes:

1. Std. Dev. denotes the standard error. Max. represents the maximum. Min. is the

minimum. Obs. is the observation

2. J-B denotes the Jarque–Bera normality test.

3. *** indicates significance at the 1%, respectively.

2.2 Econometric Method

The Engle and Granger (1987) threshold autoregressive (TAR) and momentum threshold

autoregressive (M-TAR) models for unit root testing to permit unit root tests within a

multivariate framework, and to allow for nonlinear adjustments were generalized by Enders

and Siklos (2001). They are better in picking up these asymmetries than the linear models

of Engle and Granger (1987) or the Johansen (1988) co-integration models. The

methodology involves enforcing two procedures where the first stage estimates a long-run

relationship based on:

𝑌𝑡 = 𝛼 + 𝛽𝑋𝑡 + 𝜇𝑡

∆𝜇𝑡 = 𝜌𝜇𝑡−1 + ∑𝑘𝑖=1 𝜙𝑖 ∆𝜇𝑡−1 + 𝜀𝑡

(2)

(3)

where 𝑌𝑡 and 𝑋𝑡 are two I(1) series, t denotes the time period, 𝜇𝑡 is a stationary random

variable that denotes deviation from the long-term equilibrium, assuming that a long-run

relationship exists. α , β , 𝜌 and 𝜙𝑖 are estimated parameters. 𝜀𝑡 is a white noise

disturbance term. 𝑘 is the number of lags.

In the first stage of estimating the long-term relationship between the variables, the

regression is normalized on the downstream variable 𝑌𝑡 . In the second stage, the residuals

𝜇𝑡 are utilized to enforce a cointegration test. The number of lags is chosen by the Akaike

information criterion (AIC), Schwarz Bayesian information criterion (SBC), or Ljung–Box

Q test, so that there is no serial correlation in the regression residuals. If the null hypothesis

of 𝐻0 : ρ = 0 is rejected, then the two variables are regarded as to be linearly co-integrated.

The above co-integration tests assume symmetric transmission. Enders and Siklos (2001)

declared a two-regime threshold co-integration method to permit asymmetric adjustments

in the co-integration test. To introduce asymmetry in the adjustment to the long-term

equilibrium, the adjustment process is dependent on a change in 𝜇𝑡 , (∆𝜇𝑡 ). The residuals

from Eq. (3) are utilized to evaluate a model of the form. The next stage requires estimation

of two parameters, 𝜌1 𝑎𝑛𝑑 𝜌2 in the following equations:

∆𝜇𝑡 = 𝐼𝑡 𝜌1 𝜇𝑡−1 + (1 − 𝐼𝑡 )𝜌2 𝜇𝑡−1 + ∑𝑙𝑖=1 𝛾𝑖 𝛥𝜇𝑡−𝑖 + 𝜀𝑡

where 𝐼𝑡 = [𝑇𝑡 , 𝑀𝑡 ], such that:

(4)

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

1

𝑖𝑓 𝜇𝑡−1 ≥ 𝜏

𝑇𝑡 : TAR = {

0

1

𝑀𝑡 :M-TAR={

0

61

(5)

𝑖𝑓𝜇𝑡−1 < 𝜏

𝑖𝑓 ∆𝜇𝑡−1 ≥ 𝜏

(6)

𝑖𝑓∆𝜇𝑡−1 < 𝜏

where 𝜀𝑡 is a white-noise disturbance. 𝐼𝑡 is the Heaviside indicator function. 𝑙 is the lag

term which is again specified to interpret serial correlation in the residuals and it can be

chosen by the AIC, SBC, or Ljung–Box Q test. τ is the threshold value, which is priorly

unknown and has to be estimated. The threshold value is endogenously decided by using

the Chan (1993) grid search method to find out an estimate of the consistent threshold value.

The Heaviside indicator 𝐼𝑡 can be specified by two alternative definitions of the threshold

variable, either the lagged residual (𝜇𝑡−1 ) or the change of the lagged residual (∆𝜇𝑡−1 ).

Equations (4) and (5) denote the threshold autoregressive model (TAR). Equations (4) and

(6) represent the momentum threshold autoregressive model (M-TAR). Enders and Granger

(1998) found the M-TAR model was particularly valuable when adjustment was

asymmetric such that the series displayed more “momentum” in one direction than the other.

In the TAR model, the adjustment is modified by 𝜌1 𝜇𝑡−1 that 𝐼𝑡 = 𝑇𝑡 = 1 when the

residual according to equation (5) is above the threshold value 𝜏 and by the term 𝜌2 𝜇𝑡−1

that 𝑇𝑡 = 𝐼𝑡 = 0 when the residual is below the threshold value. In the M-TAR model, the

adjustment is modeled by 𝜌1 𝜇𝑡−1 that 𝐼𝑡 = 𝑀𝑡 = 1 when the residual according to

equation (6) is above the threshold value 𝜏 and by the term 𝜌2 𝜇𝑡−1 that 𝑀𝑡 = 𝐼𝑡 = 0

when the residual is below the threshold value.

Since there is generally no consensus about which specification should be used, it is

suggested that the proper adjustment mechanism is chosen through the model selection

criteria of AIC and SBC (Enders and Siklos, 2001). The model with the lowest AIC and

SBC will be utilized for further analyses. Insights into asymmetric adjustments in the

context of a long-term co-integration relationship can be acquired through two tests on the

coefficients estimated from the threshold co-integration equations. First, Enders and

Granger (1998) and Enders and Siklos (2001) concluded that in either case, under the null

hypothesis of no convergence, the F-statistic for the null hypothesis of 𝐻0 : 𝜌1 = 𝜌2 = 0

had a nonstandard distribution. Enders and Granger (1998) also found that if the series is

stationary, the least square estimates of 𝜌1 and 𝜌2 have an asymptotic multivariate

normal distribution. We test the null hypothesis of 𝐻0 : 𝜌1 = 𝜌2 = 0 for a co-integration

relationship, and rejection implies the existence of a cointegration relationship between the

two variables. Second, if the null hypothesis of no co-integration is rejected, it would enable

us to advance to further test for symmetric adjustment of the null hypothesis, which is

𝐻0 : 𝜌1 = 𝜌2 . We proceed with the asymmetric threshold cointegration test and symmetric

adjustment test by using the standard F-statistic. Rejection of the null hypothesis indicates

the existence of an asymmetric adjustment process between the two variables.

62

3

Chien-Chung Nieh and Hsun-Fang Cho

Empirical Results

3.1 Advanced Non-linear ESTAR5 Unit Root Test

The conventional linear unit root tests6 might have a lower power when they are applied to

a finite sample. In this situation, the advanced non-linear ESTAR unit root test is found to

be of great help provided that they permit an increase in the power of the order of the

integration analysis by allowing for asymmetric adjustment to the equilibrium level. The

results of the nonlinear unit root test are provided in Table 2. As can readily be seen from

the table, the results of the test suggest that the null hypothesis of the unit root is rejected

in the circumstance of the first difference at the 1% significant level for most variables of

all exchange rate markets in this paper.

Table 2: Results of the non-linear unit root test

Level

First difference

0.762(0)

-32.69(0)***

Japan

0.149(0)

-4.656(3)***

Australia

-0.064(0)

-2.397(5)**

Canada

-2.338(0)**

-33.05(0)***

China

-1.525(4)**

-9.589(5)***

Euro

-1.354(4)

-16.46(3)***

France

-1.264(4)

-11.10(5)***

Germany

-2.672(1)**

-29.41(0)***

Hong Kong

0.437(5)

-12.55(4)***

Indonesia

-1.376(4)

-16.54(3)***

Italy

-0.327(4)

-17.66(3)***

Malaysia

-1.293(4)

-11.85(5)***

Netherlands

-6.817(4)***

-17.64(6)***

Qatar

1.232(5)

-19.85(4)***

Saudi Arabia

-2.560(0)**

-34.32(0)***

Singapore

-2.247(3)**

-17.48(2)***

South Korea

-1.061(2)

-19.47(1)***

Taiwan

-1.368(1)

-31.19(0)***

Thailand

-18.53(0)***

-33.55(1)***

United Arab Emirates

-0.332(1)

-33.99(0)***

US Index

Notes:

1. *** , **and * denote significance at 1%, 5% and 10% levels, respectively.

2. The numbers in the parentheses are the appropriate lag lengths selected by MAIC

(modified Akaike information criterion) suggested by Ng and Perron (2001).

3. The simulated critical values for different K were tabulated in Kapetanios et

al.(2003) (Table 1 as of p. 364).

5

We employ the exponential smooth transition autoregressive (hereafter, ESTAR) unit root tests

proposed by Kapetanios et al. (2003).

6

The conventional linear unit root tests include the Augmented Dickey-Fuller (Dickey and Fuller,

ADF, 1981), test, Phillips, the Perron (Phillips and Perron, PP, 1988) test, and the KwiatkowskiPhillips-Schmidt-Shin (Kwiatkowski et al., KPSS, 1992) test.

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

63

3.2 Engle-Granger Co-integration Test

We can conclude that all variables are integrated of the same order after running unit root

tests. The next task is to check for co-integration so the co-integration test is utilized to

analyze the data. This approach is executed to investigate the long-run equilibrium

relationship between variables. The results of the Engle-Granger co-integration relationship

between Japan and the exchange rates of other countries over the entire period, the period

of the pre-Abenomics, and the period of during-Abenomics, and the null hypothesis of no

co-integration is shown in Table 3. The results of the Engle-Granger ADF statistics show

that there are co-integration relationships between Japan’s exchange rate and the exchange

rates of Canada, Hong Kong, Qatar, and United Arab Emirates over the entire period.

Furthermore, the results show that there are co-integration relationships between Japan and

Australia, Canada, Hong Kong, Qatar, Saudi Arabia, United Arab Emirates during the preAbenomic period. As shown in the table, the results show that there are co-integration

relationships between Japan and Hong Kong, Qatar, and United Arab Emirates in the

during-Abenomics period. It can be seen from Table 3 that there is a significant increase in

the co-integration relationships between Japan’s exchange rate and the exchange rates of

Hong Kong and the United Arab Emirates around the time that Abenomics were applied;

this result does not support the contagion theory by Dornbusch et al. (2000) and Forbes and

Rigobon (2001).

Table 3: Results of the Engle-Granger test for co-integration

Australia

Canada

China

Euro

Hong Kong

Indonesia

Malaysia

Qatar

Saudi Arabia

Singapore

South Korea

Taiwan

Thailand

United Arab

Emirates

US Index

Entire period

Engle-Granger

ADF Statistic

-2.945(0)

-3.139(0)

-0.947(0)

-1.819 (0)

-3.207 (1)

-1.725(0)

-2.595(0)

-7.263(3)

2.593(10)

-2.818(0)

-2.279 (0)

-2.160(2)

-2.000(0)

-13.75(1)

Pre-Abenomics

Engle-Granger

ADF Statistic

-3.131(0)

-3.276(0)

-2.094(1)

-2.845(0)

-3.835(0)

-2.465(2)

-2.721(0)

-9.582(1)

-4.647(4)

-2.344 (0)

-2.241 (0)

-2.623(2)

-2.370(0)

-10.93(1)

During Abenomics

Engle-Granger

ADF Statistic

-2.362 (0)

-3.009 (0)

-1.022(0)

-1.055(0)

-4.231(2)

-1.457(0)

-2.502(0)

-5.973(1)

-0.302(12)

-2.757(0)

-1.245(0)

-2.589(0)

-1.968(0)

-12.35(0)

-1.752(1)

-2.822(0)

-0.781(1)

Notes:

1. The numbers in the parentheses are the appropriate lag lengths selected by

minimizing AIC.

2. The critical values of the Engle-Granger ADF Statistics are taken from Engle and

Yoo (1987).

3. *, ** and *** denote significance at the 10%, 5% and 1% significance levels,

respectively.

64

Chien-Chung Nieh and Hsun-Fang Cho

It is clear from Table 4 that the results of the Johansen maximum eigenvalue co-integration

test for the entire period are that there are co-integration relationships of one co-integrating

rank between Japan’s exchange rate and the exchange rates of Hong Kong, Qatar, and

United Arab Emirates. As can be seen from the table, there are co-integration relationships

of two co-integrating ranks between Japan and Hong Kong, Saudi Arabia, and United Arab

Emirates in the pre-Abenomics period. The evidence for the during-Abenomics is shown

in Table 4; the empirical evidence shows that Japan and Hong Kong, Qatar, and the United

Arab Emirates have cointegration relationships of one rank. According to the results, it does

not support the contagion theory by Dornbusch et al. (2000) and Forbes and Rigobon (2001).

Table 4: Results of the Johansen maximum eigenvalue co-integration test

Rank

Australia

Canada

China

Euro

Hong Kong

Indonesia

Malaysia

Qatar

Saudi Arabia

Singapore

South Korea

Taiwan

Thailand

United Arab

Emirates

U.S.

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

r=0

r≦1

Entire

period

Max-Eigen

statistic

13.76

4.057

9.874

3.110

3.532

1.881

5.346

3.364

26.77

3.162

6.431

2.941

9.461

4.563

68.63

3.212

9.388

0.367

7.980

3.258

5.771

3.428

5.495

3.793

6.400

4.785

149.0

3.192

5.823

3.592

PreAbenomics

Max-Eigen

statistic

11.78

4.747

11.71

4.930

5.402

4.014

10.62

4.685

19.31

5.751

7.468

6.680

9.693

3.391

62.41

4.881

41.25

5.038

8.443

4.337

7.155

3.597

10.32

2.546

6.390

3.851

81.88

4.892

11.39

4.721

During

Abenomics

Max-Eigen

statistic

14.91

4.235

11.93

3.514

4.421

1.056

11.24

0.0354

27.444

3.486

4.398

2.476

11.00

3.408

30.82

3.476

13.28

0.3259

12.59

2.876

11.82

1.728

12.53

2.340

6.593

5.143

74.33

3.408

11.96

0.024

3.3 Results of the Threshold Co-integration Test

Enders and Granger (1998) and Enders and Siklos (2001) proposed two models for the

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

65

threshold co-integration test, namely, the TAR model and the M-TAR model. This study

adopts the M-TAR model. Enders and Granger (1998) suggested that when asymmetrical

adjustments occurred in the data series, the determination of the Heaviside indicator

function might also be decided by the first difference value of error correction term on the

period t − 1 (∆𝜀𝑡−1 ) . Boucher (2007) pointed out that the speed of convergence of

parameter estimation by using the M-TAR model would be faster than that of the TAR

model. Table 5 presents the results for the threshold co-integration relationship between the

exchange rate market of Japan and the exchange rate markets of observed countries in this

study. The null hypothesis of no co-integration (𝐹𝑐 ) and symmetric adjustment (𝐹𝐴 ) are

also shown in Table 5. The empirical evidence shows that the null hypothesis of no cointegration (𝐹𝐶 ) is rejected at the 10% significant level for the entire period, which

indicates the existence of long-run equilibrium relationships between Japan’s exchange rate

and exchange rates of other countries. What is more, the null hypothesis of symmetric

adjustment (𝐹𝐴 ) is rejected at the 10% significant level in the entire period except for

China, the Euro, and Malaysia, suggesting that there is a significant threshold of cointegration and asymmetric adjustment between the two variables considered. The null

hypothesis of no co-integration (𝐹𝐶 ) is rejected in the pre-Abenomics of Table 5 with the

exception of China, Indonesia. Furthermore, the null hypothesis of symmetric adjustment

(𝐹𝐴 ) is rejected, suggesting that there exists asymmetric adjustments between Japan and

Euro, Hong Kong, Qatar, Saudi Arabia, Singapore, South Korea, Taiwan, and the U.S..

Moreover, Japan has co-integration relationships (𝐹𝐶 ) with all observed countries during

the Abenomics period except for the Euro. In terms of asymmetric adjustment (𝐹𝐴 ), there

is an asymmetric relationship between Japan and other countries during the Abenomics

except Euro, Malaysia, Saudi Arabia, Taiwan. By further comparisons of the 𝐹𝐶 statistics

in the pre-Abenomics period and the during-Abenomics period shown in the (10) column

of Table 5, we have found that the co-integration relationships significantly increased

between Japan exchange rates and the exchange rates of observed countries in the study

except Australia, Euro, Qatar, Saudi Arabia, and South Korea. The result shows that there

is a “contagion effect” or “transmission effect” between the Japanese exchange rate and the

exchange rates of observed countries in the study, but there is only an “interdependence

effect” between Japan and Australia, Euro, Qatar, Saudi Arabia, and South Korea. Forbes

and Rigobon (2001) defined the contagion of the international financial markets as a

significant increase in cross market linkages or co-movement between one market and

others after a shock or during a crisis, and our results supported the “contagion effect”

between Japan exchange rate market and parts of exchange rate markets in the surveyed

countries in our study. In addition, by further comparisons of the 𝐹𝐴 statistics in preAbenomics and during-Abenomics in the (11) column of Table 5, we have found that the

asymmetry in the co-integration relationships has also significantly increased after the end

of Abenomics between Japan and most of the observed countries in the paper. The result

shows that a result of Abenomics was the quick transmission of massive amounts of

negative information between many exchange rate markets. This led to higher risk aversion

among international investors.

According to the empirical results, we find out that there are quite large differences between

utilizing the Enders-Siklos’ asymmetric threshold test (M-TAR), and the Engel-Grange and

Johansen co-integration tests with the Enders-Siklos test producing better results. It is

apparent from Table 3 and Table 4 that the co-integration relationships between the

Japanese exchange rates and exchange rates of surveyed countries during the Abenomics

66

Chien-Chung Nieh and Hsun-Fang Cho

period do not significantly increase. Some researched results demonstrate that the

relationships between international exchange markets should have a closer co-integration

correlation when the emergence of severe risk impacts the global economy. We are unable

to obtain results showing the co-integration degree increases when we apply the EngelGrange and Johansen co-integration tests because the hypotheses of the two co-integration

tests rely on a symmetric adjustment process. However, the result of the Enders-Siklos

asymmetric threshold co-integration shows that there is a significant increase in the cointegration correlation during the Abenomics period between the Japanese exchange rate

and the exchange rate of the surveyed countries in the study. The co-integration

relationships are regarded as a trend of mutual movement. After Abenomics, the cointegration relationships increased between Japanese exchange rates and the exchange rates

of Canada, China, Hong Kong, Indonesia, Malaysia, Singapore, Taiwan, Thailand, United

Arab Emirates, and the U.S.. The results also illustrate that exchange rate depreciation in

Japan caused contagion effect. That can also be called the phenomena of competitive

depreciation of exchange rates. However, there are only interdependent effects between

Japan and Australia, Euro, Qatar, Saudi Arabia, South Korea. During Abenomics, Asian

countries in competition with Japan to export adapted their currency devaluation to promote

competitive advantage for export products. However, the exchange rate relationship

between Japan and South Korea during Abenomics is lower than that in the pre-Abenomics.

Because the prices of the products of South Korea export had a more competitive advantage

than that of Japanese exports, there is a little bit influence in short term during Abenomics,

however, the effect of the depreciation of Japan exchange rate to South Korea exchange

rate is insignificant in long term.

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

67

Table 5: Results of the Enders-Siklos test for threshold co-integration

Entire period

Australia

Canada

China

Euro

Hong Kong

Indonesia

Malaysia

Qatar

Saudi Arabia

Singapore

South Korea

Taiwan

Thailand

United Arab Emirates

U.S.

Pre-Abenomics

During Abenomics

(1)𝑭𝒄

(2)𝑭𝑨

(3)𝛄

(4)𝑭𝒄

(5)𝑭𝑨

(6)𝛄

(7)𝑭𝒄

(8)𝑭𝑨

(9)𝛄

6.378

5.649

2.668

2.570

12.59

3.504

4.441

54.57

10.03

6.133

4.612

3.183

5.609

94.60

3.507

4.418

3.827

0.667

2.646

15.15

3.540

2.682

15.99

5.760

5.132

4.065

3.364

7.089

4.984

4.542

0.0049

-0.0038

6.5e-04

0.0019

-7.3e-05

-0.0051

0.0014

5.5e-05

-2.2e-05

0.0020

-0.0038

0.0015

0.0022

1.4e-05

0.0016

6.217

5.260

1.296

2.383

6.178

0.728

3.951

46.44

34.54

4.097

3.816

3.670

3.813

49.97

3.263

2.179

2.186

1.845

3.020

8.183

1.454

1.457

14.20

4.907

3.374

3.885

2.941

2.572

0.654

4.208

0.0015

-0.0049

1.5e-04

-0.0023

-3.9e-05

5.6e-04

-0.0042

5.7e-05

1.1e-05

0.0020

-0.0038

0.0023

-0.0013

-1.4e-05

-0.0046

5.476

5.464

2.776

1.435

10.79

3.690

3.978

24.84

8.143

5.170

3.641

4.482

4.384

60.87

6.612

5.406

3.285

4.683

1.136

8.907

5.015

1.855

13.27

2.234

4.051

5.110

2.334

5.386

13.40

11.79

0.0024

-0.0037

8.2e-04

-4.1e-04

-6.3e-05

-0.0050

8.5e-04

-1.3e-06

2.2e-05

-0.0015

5.0e-04

0.0013

-0.00275

1.6e-08

-2.0e-04

Co-integration

statistics

(10)=(7)-(4)

Decrease

Increase

Increase

Decrease

Increase

Increase

Increase

Decrease

Decrease

Increase

Decrease

Increase

Increase

Increase

Increase

Asymmetric

Statistics

(11)=(8)-(5)

Increase

Increase

Increase

Decrease

Increase

Increase

Increase

Decrease

Decrease

Increase

Decrease

Decrease

Increase

Increase

Increase

Contagion

Yes/No?

No

Yes

Yes

No

Yes

Yes

Yes

No

No

Yes

No

Yes

Yes

Yes

Yes

Notes:

1. The lag-length of difference Ks selected by minimizing AIC; r is the estimated threshold value.

2. Fc and FA denote the F-statistics for the null hypothesis of no co-integration and symmetric adjustment. Critical values of cointegration test are taken from Enders and Siklos (2001).

3. *, ** and *** denote significance at the 10%, 5% and 1% significance levels, respectively.

68

4

Chien-Chung Nieh and Hsun-Fang Cho

Conclusion

In this paper, we propose the linear models of Engle and Granger (1987) or the Johansen

(1988) co-integration models and threshold co-integration of Enders and Siklos (2001), in

order to investigate financial contagion. This threshold co-integration approach goes

beyond linear co-integration models, analyses the nonlinear adjustment of financial timeseries, and enables us to overcome the estimation error problems of asymmetries. This

enables us to analyze the behavior among exchange rate markets when at least one of them

is under financial crisis (crisis country). To check the robustness of the co-integration

results, we also apply the M-TAR model which can capture an accumulation of changes in

the disequilibrium relationship between variables below and above the threshold followed

by a sharp movement back to the equilibrium position. We successfully apply the threshold

co-integration methodology to the investigation of contagion effect of Japanese yen

devaluation. This study focuses on major trade countries of Japan. To test the existence of

contagion in the exchange rate markets, this paper uses Japan as the crisis country and

Abenomics as triggering off a currency depreciation war. We then estimate the correlations

between the crisis country and all other countries which are surveyed in this study during

both stable and crises periods. Therefore, we split the estimation procedure into subgroups

in order to compare the impact and the magnitude of the spread of the crises in each

individual country. This paper contributes to the literature in the following aspects. First,

we introduce the momentum threshold autoregressive (M-TAR) model of Enders and

Siklos (2001) into the multivariate framework that allows us to capture the correlation

dynamics and asymmetries in a more flexible and realistic way than the linear models of

Engle and Granger (1987) and the Johansen (1988) co-integration models that have been

proposed in the study. Second, we compare the contagion effect of the Japanese yen

depreciation crisis before and after the Abenomics period, and find that most countries with

export trade with Japan follow the depreciation of the yen in applying threshold cointegration model. Third, the empirical evidence confirms a contagion effect particularly in

Asian countries in competition with Japan except South Korea to export. The prices of the

export products of South Korea are far lower and more competitive than that of Japan so

the exchange rate of South Korea is not influenced by the Japanese yen devaluation during

the period of Abenomics. Therefore, the contagion of Japanese yen depreciation does not

transmit to Australia, Euro (France, Germany, Italy, and Netherlands), Qatar, Saudi Arabia,

and the USA with trade competition countries of Japan. We can apparently find out the

effect of yen devaluation just only occurred in Asian area of being close to Japan and does

not spread Europe, America and other countries. Furthermore, Australia is the largest

exporting country of iron ore in the world. However, Japan is the second largest importing

country of iron ore. Depreciation of the yen favored Australian iron ore exports during

Abenomics. In addition, Japan is the third largest importing country of crude petroleum all

over the world. Saudi Arabia is the largest exporting country of crude petroleum.

Devaluation of the yen is an advantage to Saudi Arabia. Qatar also received the same benefit

as Saudi Arabia. In general, our results support the contagion phenomenon for Abenomics.

Nevertheless, the effect of the contagion is regional not global.

Exchange Market Contagion in Asymmetric Framework before and after Abenomics

69

References

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

M. E. H. Arouria, M. Bellalahb and D. K. Nguyenc, The co-movements in

international stock markets: new evidence from Latin American emerging Countries,

Applied Economics Letters, 18, (2009), 1 - 6.

T. Baig and I. Goldfajn, Financial market contagion in the Asian crisis, IMF Staff

Papers, 46, (1999).

S. M. Bartram, S. J. Taylor and Y.-H. Wang, The Euro and European financial market

dependence, Journal of Banking & Finance, 31, (2007), 1461 - 1481.

G. Bekaert, C. R. Harvey and A. Ng, Market integration and contagion, Journal of

Business, 78, (2005), 39 - 69.

C. Boucher, Asymmetric adjustment of stock prices to their fundamental value and

the predictability of US stock returns, Economics Letters, 95, (2007), 339 - 347.

S. Calvo and C. M. Reinhart, Capital flows to Latin America: is there evidence of

contagion effects?, In: G. Calvo, M. Goldstein and E. Hochreiter, (Eds.), Private

Capital Flows to Emerging Markets, Institute for International Economics,

Washington, DC, (1996).

G. M. Caporale, A. Cipollini and N. Spagnolo, Testing for Contagion: A Conditional

Correlation Analysis, Journal of Empirical Finance, 12, (2005), 476 - 489.

S. K. Chan, Consistency and limiting distributions of the least squares estimators of a

threshold autoregressive model, Annals of Statistics, 21, (1993), 520 - 533.

S. Chang, Asymmetric Cointegration Relationship among Asian Exchange Rates,

Economic Change and Restructuring, 41, (2008), 125 - 141.

S. Chang, Effects of Asymmetric Adjustment among Labor Productivity, Labor

Demand, and Exchange Rate Using Threshold Cointegration Test, Emerging Markets

Finance and Trade, 46, (2010), 55 - 68.

M. H. Chiang, The Asymmetric Behavior and Spillover Effects on Stock Index

Returns: Evidence on Hong Kong and China, Pan Pacific Management Review, 4,

(2001), 1 - 21.

D. A. Dickey and W. A. Fuller, Likelihood ratio statistics for autoregressive time

series with unit root, Econometric, 49, (1981), 1057 - 1072.

R. Dornbusch, Y. C. Park and S. Claessens, Contagion: Understanding How It

Spreads, The World Bank Research Observer, 15(2), (2000), 177 - 197.

M. Dungey, R. Fry, B. González-Hermosillo and V. Martin, Contagion in

international bond markets during the Russian and the LTCM crises, Journal of

Financial Stability, 2, (2006), 1 - 27.

W. Enders and C. W. J Granger, Unit-root tests and asymmetric adjustment with an

example using the term structure of interest rates, Journal of Business and Economic

Statistics, 16(3), (1998), 304 - 311.

W. Enders and P. L. Siklos, Cointegration and threshold adjustment, Journal of

Business and Economic Statistics, 19(2), (2001), 166 - 176.

R. Engle and S. Yoo, Forecasting and Testing in Co-integration Systems, Journal of

Econometrics, 35, (1987), 143 - 159.

R. F. Engle and C. W. Granger, Co-integration and error correction: Representation,

estimation, and testing, Econometrica, 55, (1987), 251 - 276.

70

Chien-Chung Nieh and Hsun-Fang Cho

[19] K. Forbes and R. Rigobon, Measuring Contagion: Conceptual and Empirical Issues,

The International Bank for Reconstruction and Development organizing conference

of World Bank on International Financial Contagion: How it Spreads and How it Can

Be Stopped, (2001).

[20] K. J. Forbes and R. Rigobon, No contagion, only interdependence: measuring stock

market comovements, Journal of Finance, 57, (2002), 2223 - 2261.

[21] S. Johansen, Statistical Analysis of Cointegration Vectors, Journal of Economic

Dynamics and Control, 12(3), (1988), 231 - 254.

[22] G. Kapetanios, Y. Shin and A. Snell, Testing for a unit root in the nonlinear STAR

framework, Journal of Econometrics, 112, (2003), 359 - 379.

[23] G. Koutmos, Asymmetries in the Conditional Mean and the Conditional Variance:

Evidence from Nine Stock Markets, Journal of Economics and Business, 50, (1998),

277 - 290.

[24] D. Kwiatkowski, P. C. B. Phillips, P. Schmidt and Y. Shin, Testing the Null Hypothesis

of Stationarity against the Alternative of a Unit Root: How Sure are We that Economic

Time Series Have a Unit Root?, Journal of econometrics, 54(1), (1992), 159 - 178.

[25] S. B. Lee and K. J. Kim, Does the October 1987 crash strengthen the co-movements

among national stock markets?, Review of Financial Economics, 3, (1993), 89 - 102.

[26] W. K. Li and K. Lam, Modelling Asymmetry in Stock Returns by a Threshold

Autoregressive Conditional Heteroscedastic Model, The Statistician, 44, (1995), 333

- 341.

[27] M. B. Lucey and S. Voronkova, Russian equity market linkages before and after the

1998 crisis: Evidence from stochastic and regime-switching cointegration tests,

Journal of International Money and Finance, 27, (2008), 1304 - 1324.

[28] S. Ng and P. Perron, Lag length selection and the construction of unit root tests with

good size and power, Econometrica, 69, (2001), 1519 - 1554.

[29] T. Okimoto, New evidence of asymmetric dependence structures in international

equity markets, Journal of Financial and Quantitative Analysis, 43, (2008), 787 - 815.

[30] A. J. Patton, Modelling asymmetric exchange rate dependence, International

Economic Review, 47, (2006), 527 - 556.

[31] P. C. B. Phillips and P. Perron, Testing for a Unit Root in Time Series Regression,

Biometrica, 75(2), (1988), 335 - 346.

[32] J. C. Rodriquez, Measuring financial contagion: a copula approach, Journal of

Empirical Finance, 14, (2007), 401 - 423.

[33] C. H. Shen, C. Chen and L. Chen, An Empirical Study of the Asymmetric

Cointegration Relationships among the Chinese Stock Markets, Applied Economics,

39, (2007), 1433 - 1445.

[34] C. Wang and C. A. Lin, Using Threshold Cointegration to Examine Asymmetric Price

Adjustments between ADR's and Their Underlying Securities—The Case of Taiwan,

South African Journal of Economics, 73, (2005), 449 - 461.