Feasibility Study of the New Orleans Digital Media Center

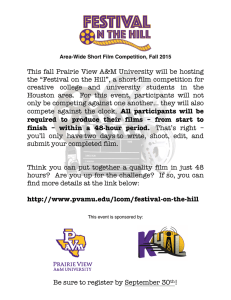

advertisement