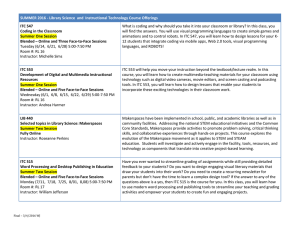

eChoupals: Financial Village Rural

advertisement