Shale sign up Issue 587 07•April•2016

advertisement

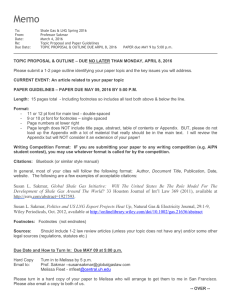

Issue 587 07•April•2016 Week 13 Shale sign up BP has signed a shale gas PSC with CNPC, giving the IOC a better position to capitalise on other opportunities within the wider Chinese energy market. Supply diversity China’s efforts to secure additional gas suppliers in Central Asia have had mixed results so far. Ratings downgrade Standard & Poor’s has downgraded CNPC, CNOOC and Sinopec Group a day after downgrading the country’s outlook rating. SOS signal Sinopec Oilfield Service (SOS) has said it will look overseas for new business after posting a US$1.8 million net loss for 2015. ChinaOil CONTENTS ChinaOil w w w. N E W S B A S E . c o m ChinaOil China Oil & Gas Monitor COMMENTARY Shale sector struggles persist China looks beyond Turkmen gas 4 6 PIPELINES & TRANSPORT COSCO: niche opportunities, co-operation key in current market 8 PERFORMANCE Russia outlines 2016 oil exports to China Standard & Poor’s downgrades Big Three Gas price cut drives consumption SOS seeks growth overseas 8 9 9 10 POLICY NEA raises 2016 gas output target, lowers oil Vietnam holds Chinese oil tanker, crew 11 11 PROJECTS & COMPANIES PetroChina completes Qinghai gas wells Poly GCL seeks spot LNG cargoes Sinopec plans to double gas production by 2020 Chinese state refiners forced to cut runs 12 12 13 13 NEWS IN BRIEF 14 OUR CUSTOMERS 20 Have a question or comment? Contact the editor – Andrew Kemp (andrew.kemp@newsbase.com) Copyright © 2016 NewsBase Ltd. All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents Week 13 07•April•2016 w w w. N E W S B A S E . c o m P3 ChinaOil C O M M E N TA R Y ChinaOil Shale sector struggles persist BP and CNPC have agreed to develop shale in China, but Callum Cyrus finds that this may be more the exception than the rule when it comes to foreign investment in China’s shale plays W H AT: While BP was announcing its entry into China’s shale gas scene Shell said it had quit its PSC in Sichuan. W H Y: Geological, political and economic challenges continue to plague the sector’s development. W H AT N E X T: Investing in China’s shale gas sector may accrue BP political capital which could be used to chase more attractive investment options. BP is set to enter China’s shale scene after signing a production-sharing contract (PSC) with China National Petroleum Corp. (CNPC) for exploration and development at the Neijiang-Desu block in the Sichuan Basin. The PSC has been signed as part of the pair’s strategic partnership agreed in October 2015, and indicates BP’s ability to seek out opportunities in the historically closed Chinese exploration space. BP’s 2016 Energy Outlook projects shale gas to provide 25% of global gas production by 2035, with China expected to become the world’s second largest producer of the fuel. China is believed to hold the largest reserves globally with an estimated 25 trillion cubic metres of shale gas, but explorers must overcome numerous technical and economic hurdles to development. BP’s arrival comes as other international oil companies (IOCs) exit Chinese shale opportunities citing the difficult geology and prohibitive costs of investment. On April 1, Bloomberg reported that Royal Dutch Shell had decided to leave its PSC with PetroChina for the Fushun-Yongchuan block in the Sichuan Basin, despite having once pledged US$1 billion in annual investment to kickstart Chinese unconventional development. “We have decided that there is no follow-up investment that can be justified,” Shell spokesperson Jessica Miao said. Similarly, US super-major ConocoPhillips had signed up to a joint study agreement at Neijiang-Dazu in 2013, but pulled out prior to the conclusion of a production agreement. Geological hurdles Progress in shale has been slow for China’s national oil companies (NOCs), with only two shale assets currently producing gas for PetroChina and Sinopec at Changing-Weiyuan and Fuling respectively. Changning-Weiyuan was producing 3.62 million cubic metres per day from 47 demonstration wells as of August 2015, according to reports, while Fuling was producing 15 mcm per day from 44 wells as of December 2015. In September 2015, CNPC said it had added 207.87 square km of shale gas bearing areas in its Sichuan Basin demonstration zone, with technically recoverable reserves estimated at 40.88 bcm. As part of Sinopec’s plans to double its overall natural gas production to 40 billion cubic metres P4 by 2020, shale gas output will rise to 10 bcm per year. (See: Sinopec plans to double gas production by 2020, page 13) But gains in the Chinese shale space have been slow and hard won. Sinopec and CNPC’s output is understood to have fallen short of a national target of 6.5 bcm for 2015, reaching just 5.1 bcm. Innovation in Chinese shale has been held up by geological challenges which made directly transferring US technologies problematic. The country has a greater prevalence of shale-bearing continental and marine-continental facies, with tectonic movements producing deformed and eroded shale which complicates explorers’ ability to identify sweet spots. Speaking to NewsBase, Trusted Sources analyst Stephen O’Sullivan said: “It’s hard for [China] to do [shale] because of the nature of the geology. Shale in China is often found in mountainous areas that are short of water – in a country which is short of water anyway; that’s not the same as the situation in the US where the geology is easier to drill in.” This has made it difficult for technologies to be developed without significant costs, and the Chinese shale industry has lacked the land-usage rights prevalent in the US, and the innovation of start-ups responsible for the shale boom stateside. China’s hope of sparking a shale gas revolution of its own has always been pinned on its NOCs, which invested billions in North American shale gas assets trying to make the technological breakthrough. But China’s major companies have been hamstrung in their ability to make major progress, both by low oil prices, and by the anti-corruption probe which has snared NOCs in recent years. “The investment in shale has pretty low because of the low prices, but also because the companies have been very much embroiled the anti-corruption probes and investigations,” Energy Aspects’ Michal Meidan told NewsBase, “They’ve been virtually paralysed on a number of levels, so they haven’t made that much progress on the geology.” Shale in China is often found in mountainous areas that are short of water – in a country which is short of water anyway Stephen O’Sullivan Analyst Trusted Sources Low priority Another question is whether shale gas remains as big a priority to Beijing as it once was, or if the government is willing to pursue other angles now development has proven more difficult than first imagined. w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil C O M M E N TA R Y In 2012, Beijing introduced a four-year 0.40 yuan (US$0.06) per cubic metre subsidy programme to encourage production. This has been reduced to 0.3 yuan (US$0.05) per cubic metre for 2016-18, and to 0.2 per cubic metre (US$0.03) for 2019-20. By contrast, China increased the subsidy for coal-bed methane (CBM) in March from 0.2 yuan (US$0.03) per cubic metre to 0.3 yuan per cubic metre for the period ending 2020 to help cushion CBM profits against domestic price cuts and weakening demand growth. Although subsidies are less concerning to NOCs, which have solid balance sheets backed by the Chinese state, Meidan argued that Beijing would need to signal shale’s importance to national objectives if it wants to encourage further development. “There’s very few incentives for them to invest in shale, unless of course the government signals that shale is its priority, and then the NOCs will try and align with those political goals,” she said, “For now, there is not much to suggest that shale is a priority for the government, but we’ll have to wait and see for [China’s 13th economic and social development five year plan covering 2016-20].” If shale is pushed down Beijing’s list of priorities in the latest five-year plan, then China’s NOCs are likely to lose interest in the face of sharpening capital expenditure restraints and overflowing global gas supplies. Other hurdles include China’s lack of a comprehensive pipeline network to carry shale production to consumers, necessitating even greater spends by NOCs to realise widescale profits. While both Changning-Weiyuan and Fuling are to be woven into local pipeline links as part of Beijing’s push toward a gas-powered economy, China still lacks the extensive pre-existing infrastructure that unlocked the US shale boom in recent decades. Week 13 07•April•2016 ChinaOil Meidan said these complications were likely to discourage IOCs from partnering on Chinese shale for a long time yet, even if China’s companies eventually rediscover their confidence in the technology. “The main opening for IOCs is on the oilfield service side of things rather than in exploration and production. Shell had a miserable experience in Chinese shale, and I think [that despite the talk they] want to get potentially into conventional upstream or even lucrative downstream projects,” she said. What next? China’s economic circumstances have changed considerably since the US shale boom caught Beijing’s imagination. Although the government is chasing a climate change target which will be underpinned by increasing gas to 10% of the energy mix by 2020, the slowing Chinese economy has meant that domestic demand has been shown to be fragile. China’s NOCs also face tightening prices domestically, with Beijing moving to slice around 25% from wholesale gas rates in November 2015 in an attempt to improve the competitiveness of gas versus other fuels. All of this makes shale an unlikely near-term bet for both the government and NOCs while geological barriers remain, and while other unconventional sources are available. Developing shale assets on a small-scale experimental basis could well bring NOCs technical expertise, but there is no evidence to suggest China has made the gains necessary to lead to a production revolution. NewsBase believes BP is probably strengthening its ties with CNPC in pursuit of more enticing opportunities outwith shale, with the exit of Shell and ConocoPhillips likely more indicative of the sector’s general trajectory.v w w w. N E W S B A S E . c o m P5 ChinaOil C O M M E N TA R Y ChinaOil China looks beyond Turkmen gas China’s efforts to secure additional gas suppliers in Central Asia have had mixed results so far, writes Jennifer DeLay W H AT: Uzbekistan and Tajikistan have scant hope of launching gas exports to China, while Kazakhstan has a better chance. W H Y: CNPC’s ability to extract gas in Kazakhstan is not hampered by shareholder disputes or difficulties in sustaining production. W H AT N E X T: Conditions may improve in Uzbekistan if commodity prices rise, but Tajikistan has little chance of seeing Line D come on stream. SINCE the opening of Line A of the Trans-Asia Gas Pipeline (TAGP) in late 2009, Turkmenistan has become one of biggest suppliers of natural gas to China National Petroleum Corp. (CNPC). Delivery volumes have not risen quite as quickly as officials in Beijing and Ashgabat had originally anticipated, but TAGP does handle substantial amounts of gas. As of August 2015, it had supplied a total of 125 billion cubic metres of gas to the Chinese market. This puts Turkmenistan far ahead of Myanmar, the only other country in the world that exports gas to China via overland pipeline. It also cements the Central Asian state’s position as a major foreign source of gas for China. CNPC never intended, though, to use TAGP as a delivery route for Turkmen gas alone. It also saw the network as a means of importing production from Kazakhstan and Uzbekistan, and it appears to have drawn up plans for building Line D of the pipeline in the hope of securing some gas from Tajikistan as well as increasing purchases from Turkmenistan. So far, though, China has experienced more failures than successes in its quest to access other sources of gas in Central Asia. Tajikistan CNPC’s plans for Line D, first unveiled in 2013, envision the construction of a gas P6 pipeline originating in Turkmenistan and crossing Uzbekistan, Tajikistan and Kyrgyzstan on the way to China. The company has said it expects this pipe, which will have a design capacity of 30 bcm per year, to begin operating before the end of the decade. Line D is slated to carry mostly Turkmen gas. But it is also set to follow a route that would allow it to handle gas from Tajikistan, where CNPC has joined with Total and Tethys Petroleum to implement the Bokhtar production-sharing contract (PSC). The Bokhtar licence area has been estimated to hold more than 3 trillion cubic metres of gas, enough to cover Chinese consumption at current levels for over 20 years. Despite the partners’ initial rush of enthusiasm for the project, the prospects of shipping gas from Tajikistan to China seem to have dwindled to almost nil. For at least the last six months, Total and CNPC have been sharply at odds with Tethys, the original investor in Bokhtar. Last autumn, the French and Chinese companies sought to push Tethys out of the project, citing the latter’s failure to cover its financial obligations in a timely manner. Then in January, Tajik authorities joined the fray, complaining that very little progress had been made at Bokhtar to date and demanding the transfer of a 25% stake in the project to the government. w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil C O M M E N TA R Y This wrangling among shareholders and Dushanbe suggests that the Bokhtar scheme could fizzle out. If so, Tajikistan, which is almost wholly dependent on imported hydrocarbon fuels, will have no opportunity to load gas into the TAGP system. Uzbekistan Unlike Tajikistan, CNPC’s hopes for Uzbekistan never hinged on the construction of a new pipeline branch. Instead, the Chinese company hoped to see Uzbek gas flowing through the main part of the network. After all, TAGP’s Lines A and B pass through Uzbekistan on the way from eastern Turkmenistan to the Kazakh-Chinese border, and a section of Line C from Kazakhstan crosses Uzbek territory. In 2012, Beijing and Tashkent laid out their plans for gas shipments and signed a framework contract outlining plans for the delivery of up to 10 bcm per year. Accordingly, small-scale shipments of Uzbek gas began before the end of that year. So far, though, the volume of gas piped from Uzbekistan to China has remained very low. There have been several trial shipments, but little beyond that. Most of the time, deliveries have been on hold for one reason or another. There is little reason to hope for a reversal of this trend before the end of the decade, Uzbekistan’s ability to sustain its hydrocarbon output and competently manage the operations of the sector has noticeably been eroded in recent years, Additionally, Tashkent has recently agreed to supply extra gas to Russia, which has halted imports from Turkmenistan. Kazakhstan The outlook is brighter in Kazakhstan. CNPC and its local partner have finished work on Week 13 07•April•2016 ChinaOil TAGP’s Line C, which runs from western Kazakhstan to Shymkent. The link was officially launched in November 2015 and may eventually see throughput reach 25 bcm per year. Although Line C has not been operating for long, it is more likely to prove a success than Line D. Unlike Uzbekistan, Kazakhstan has actually managed to bring gas production rates up in recent years, and it now needs a means to move surplus volumes to market. Additionally, CNPC’s ability to produce gas in Kazakhstan is not in doubt, as it is in Tajikistan. The company is already carrying out upstream development operations at a number of fields in western Kazakhstan, while in Tajikistan it is at odds with the government and one of its partners and has yet to fulfil its exploration commitments. Prospects Going forward, Uzbekistan has a better chance of contributing gas for the TAGP network than Tajikistan within the next five years. As noted above, the country already has access to the pipeline system absent the construction of Line D. Moreover, it is a gas producer, even if its output levels have been disappointing in recent years, while Tajikistan’s ability to extract sizeable volumes of gas has yet to move beyond the theoretical level. Conditions may improve after the end of the decade, especially if commodity prices rise. Tajikistan, however, will need more than higher oil and gas prices. It will need a resolution to the disputes between the parties involved in the Bokhtar PSC – and also access to the modern technologies needed to explore the deep-lying strata that may hold the block’s oil and gas.v w w w. N E W S B A S E . c o m P7 ChinaOil PIPELINES & TRANSPORT ChinaOil COSCO: niche opportunities, cooperation key in current market SPECIALIST shipping customers in the oil and gas sector can expect a co-operative approach to business in order to help both parties ride out the current depressed market, China COSCO Holdings has told its shareholders. The troubled firm – which is restructuring as it seeks to transform from an integrated shipping conglomerate to a pure player in the container shipping value chain – recorded a 46.3% yearon-year drop in gross profit in 2015, from 4.02 billion yuan (US$621.2 million) to 2.16 billion yuan (US$333.7 million)). In terms of net profit attributable to shareholders, this amounts to a 21.8% decline: from 363 million yuan (US$56.04 million) in 2014 to 283 million yuan (US$43.7 million) in 2015. Blaming overcapacity in the sector and rising costs compounded by low oil prices for the poor results, Offshore Energy Today quoted China COSCO’s chairman, Wang Yu Hang, as saying on March 31 that most of the offshore marine and related industries were similarly struggling with a challenging immediate future. “As oil companies struggle to stay afloat, we expect to see further budget cuts, project deferments and order cancellations across the offshore marine industry,” Wang said. China COSCO confirmed it would be open to discussion in relation to rescheduling orders providing there was no threat to its commercial interests, Offshore Energy Today said. Taking a view that niche demand for offshore construction vessels, floating production units and underwater construction units was likely to continue, China COSCO intends to focus its efforts on making the most of such opportunities to diversify its portfolio, the news service added. China COSCO was created in February after Beijing orchestrated a merger between China Ocean Shipping (Group) Co. (COSCO) and China Shipping (Group) to consolidate the floundering sector. While industry observers have criticised the move owing to its lack of transparency, it is unlikely its full effect will be realised until the hydrocarbon market has emerged from the doldrums.v PERFORMANCE Russia outlines 2016 oil exports to China RUSSIA will export around 27 million tonnes (540,000 barrels per day) of crude oil to China this year, a senior Transneft official said on March 31. For 2016, “the overall volume of oil supplied to China amounts [to] 27 million tonnes,” Transneft’s vice president, Sergey Andropov, told reporters on the sidelines of the Russia-China Oil & Gas Conference. Of this, 16.5 million tonnes (330,000 bpd) will be shipped via the Skovorodino-Mohe branch of the Eastern Siberia-Pacific Ocean (ESPO) pipeline, he said. Seven million tonnes (140,000 bpd) will be transported through Kazakhstan and 3.5 million tonnes (70,000 bpd) will travel to China via Kozmino Port in eastern Russia as part of an intergovernmental agreement. China has doubled its purchases of crude from Russia over the past five years, becoming the country’s biggest oil customer in 2015, according to the International Energy Agency (IEA). It bought 4.81 million tonnes (1.14 million bpd) of Russian crude in December 2015 – up 30% year on year – according to China’s General Administration of Customs (GAC). Transneft is currently investing in the Skovorodino-Mohe link with a view to expanding P8 its capacity to 30 million tonnes (600,000 bpd), from 20 million tonnes (400,000 bpd) at present. “We plan to invest some 4.8 billion rubles [US$70.7 million] and finish all the work in 2017,” Andropov said. Around 5 million tonnes (100,000 bpd) of crude currently travels through the link each year. This will be raised to 15 million tonnes (300,000 bpd) in 2018-37. At the same time, however, China’s increasingly influential independent oil refiners appear to be falling out of love with Russia’s ESPO blend, and this could threaten Moscow’s export ambitions. Their appetite for the grade – largely driven by its low-sulphur content, short haul and smaller cargo size than similar Middle Eastern grades – has supported ESPO prices in recent months, with premiums for the grade hitting a nearly two-year high in February. But many now appear to have over-bought, while those that do not have bulging inventories to burn through are switching just as quickly to other grades that represent the latest bargain. “Chinese ports are congested, the domestic margin is no longer favourable and product stocks are high,” an unnamed trader in Singapore told Platts last week.v w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil PERFORMANCE ChinaOil Standard & Poor’s downgrades Big Three RATINGS agency Standard & Poor’s has downgraded a number of China’s state oil companies a day after downgrading the outlook rating for the country itself. China National Petroleum Corp. (CNPC), China National Offshore Oil Corp. (CNOOC) and Sinopec Group, along with various subdivisions, were downgraded to negative from stable on April 1 along with others making up a group of 20 “government-related corporate and infrastructure entities” (GREs). Others included telecoms, real estate and power companies. The downgrade follows a similar move by Moody’s at the beginning of March. Standard & Poor’s report also mentioned 31 other state-owned enterprises (SOEs) whose ratings remained unchanged, including China Oilfield Services Ltd (COSL), China Resources Gas and Kunlun Energy. The report said: “We are revising the outlook on these entities because we believe their credit profiles are affected by their importance and strong links with the Chinese central government. At the same time, we have revised the Greater China regional-scale ratings on these entities accordingly.” This refers to the agency’s own downgrading of China and Hong Kong – which it refers to as Greater China – to negative from stable. The rating, released on March 31, states that the decision was taken “because economic rebalancing is likely to proceed more slowly than we had expected”. The agency emphasised the close connection between government and GREs, saying: “These revisions reflect our view that China’s potentially weakening credit strength in the next 24 months might negatively affect the extent of its timely and sufficient extraordinary support to the Chinese GREs if needed.” This is despite Standard & Poor’s saying: “Following China’s legislative meetings in March 2016, we believe the country’s reform agenda is on track.” The agency has continued to keep its sovereign credit ratings for China unchanged. The report does not raise points such as the issues facing the global oil industry nor the oil majors’ recent dramatic profit falls or reductions to planned capital expenditure. Chinese state media have criticised the downgrading, with China Daily quoting Vice Minister of Finance Shi Yaobin as saying: “Rating agencies have overestimated the difficulties the economy faces and underestimated the ability of the Chinese government to press ahead with reforms and tackle risks.”v Gas price cut drives consumption CHINA’S natural gas use increased by double-digit figures for three consecutive months following the government-ordered price cut in November 2015, official figures show. Consumption grew 44% year on year in December 2015, followed by an 18% rise in January and 19% in February, Xinhua quoted the National Energy Administration (NEA) as saying. The rises follow the slashing of wholesale gas prices up to 28%, and were also helped by a cold weather period. Prior to the cut for commercial users, gas consumption in 2015 had been sluggish. For the whole year it grew by only 2.9% – its slowest pace for 10 years. The weak growth was blamed on both high prices prior to the cut and the general slowing of China’s economy as the country moves from a smokestack industrial economy to a more consumer-driven one. The NEA forecast last week that the country’s gas consumption would grow this year to account for 6.3% of total energy use, state media reported. Industrial users are being encouraged to switch from coal to gas as their main fuel, a policy driven by Beijing’s twin objectives of Week 13 07•April•2016 reducing greenhouse gas (GHG) emissions and urban air pollution. This policy includes forcing the closure of coal-fired power plants, or their conversion to gas, in the more heavily populated eastern provinces. Despite China’s economic slowdown it was the one bright spot in Asia for LNG exporters in 2015, the latest annual report of the International Group of Liquefied Natural Gas Importers (GIIGNL) said. China’s LNG imports increased by 5.5% year on year, while Asia’s share overall declined by 1.7%. The top two global markets, Japan and South Korea, saw import falls of 4.7% and 11.2% respectively, GIIGNL said. The volume of LNG imported into China last year came to 20 million tonnes. And at the end of 2015, eight of the 15 onshore LNG receiving terminals under construction were in China, GIIGNL said.v w w w. N E W S B A S E . c o m P9 ChinaOil PERFORMANCE ChinaOil SOS seeks growth overseas SINOPEC Oilfield Service (SOS), a subsidiary of state-owned Sinopec Group, has restated its aim to seek new business overseas after slipping into the red in 2015. The company, which provides drilling and construction services chiefly to its sibling firm Sinopec, booked a net loss of 11.54 million yuan (US$1.79 million) in 2015, reversing a profit of 1.26 billion yuan (US$195 million) in 2014. As with many Chinese service providers, SOS has seen dwindling returns from its domestic business as a result of cutbacks by Beijing’s Big Three oil giants. The company suffered a 23.6% decline in revenues year on year to 60.35 billion yuan (US$9.33 billion) as weak demand dragged down industry rates. Its workload – including well-related activities, data collection and facility construction – fell by 25-40%, likely influenced by the 27.4% reduction in spending by Sinopec in 2015. “The overseas market has the best market potential for us, and its development is one of our key strategies going forward,” SOS’ chairman, Jiao Fangzheng, told reporters on March 31. The service firm wants to see its international operations account for 35% of total revenues by 2020, up from 23% last year. Specifically, it is targeting new business in the Middle East, Africa, South America, Central Asia and Russia, Jiao said. SOS could take part in an oilfield services joint venture which Sinopec is setting up with Riyadh’s Saudi Aramco in Saudi Arabia. P10 In December 2015, the Chinese government penned a memorandum of understanding (MoU) for the supply of Chinese oilfield equipment to Iraq. The paper also provided for China’s participation in Iraqi oil projects. A trend SOS is not the only Chinese service firm banking on overseas expansion for its survival. Sinopec Engineering announced last week it anticipated over 40% of its new business this year coming from abroad, compared with around 37% in 2015 and less than 20% in 2014. Revenues from its Chinese activities fell by 14.4% to 36.4 billion yuan (US$5.63 billion) last year, while its overseas division saw growth of 32.9% to 9.1 billion yuan (US$1.41 billion). Private players such as Anton Oilfield Services and Petro-King Oilfield are also relying increasingly on international revenues. Anton, which booked a loss in the first half of 2015, managed to bolster overseas revenues by 26.5% during the period, while its domestic sales slumped by 54.8%. Petro-King raised international sales 61% year on year during the same period, while its domestic revenues dropped by 24%. SOS is also likely to see domestic gas projects play a larger role in its revenue mix. Sinopec last week announced ambitious plans to double its annual gas production to 40 billion cubic metres by 2020 in line with Beijing’s drive to encourage use of the relatively clean fuel. Moving forward, SOS expects its workload to shrink by 19-35% this year with the exception of facility construction contracts, which are set to rise by 2.7%. It aims to cut 1.3 billion yuan (US$201 million) in costs this year compared with the 1.18 billion yuan (US$182.4 million) it managed to save in 2015.v w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil POLICY ChinaOil NEA raises 2016 gas output target, lowers oil THE Chinese government has decided to raise this year’s natural gas production target while lowering the target for crude. In new energy development guidelines issued by the National Energy Administration (NEA) late last week, the government has raised the domestic gas output goal to 144 billion cubic metres from an earlier target of 140 bcm announced at the national annual energy conference in late 2015. The use of gas will account for 6.3% of the total energy mix. The NEA’s guidelines did not mention gas demand changes, but Beijing-based industry officials have said that consumption will likely climb from 191 bcm in 2015 to 205 bcm this year. Residential demand will rise by 9.1% to 82.7 bcm, power generators will use 8.7% more at 31.9 bcm, industrial demand will climb by 6.1% to 61.1 bcm and petrochemical demand will expand by 3.7% to 29.3 bcm. The target for crude production, however, has been lowered to 200 million tonnes (4 million barrels per day), from 220 million tonnes (4.4 million bpd) announced at the energy conference. The latest guideline also slightly lowered the country’s overall energy consumption target from 4.36 billion tonnes of coal equivalent down to 4.34 billion tonnes. The target for domestic energy production remained unchanged at 3.6 billion tonnes. The government is keen to replace coal with natural gas in order to reduce urban air pollution. The country’s industrial sector still consumes large quantities of coal, with China’s 600,000 industrial boilers burning mostly coal. With industry shifting from coal to gas, demand for the cleaner-burning fuel could rise to 450 bcm by 2030, industry officials have said. Nearly 100 million households in central and southern China are without a piped gas connection and, as a result, the residential sector still consumes around 50 million tonnes per year of coal.v Vietnam holds Chinese oil tanker, crew A Chinese ship and its three-man crew are being held by Vietnamese authorities following an alleged intrusion into disputed South China Sea waters last week, Vietnamese state media have confirmed. On April 4, Vietnam News Agency (VNA) said the Qiong Yangpu, which was disguised as a fishing boat and was carrying more than 100,000 litres of oil, was stopped and seized near Vietnam’s northern maritime border on March 31. Having been spotted “12 nautical miles [22 km] from the marine delineation line in the Tonkin Gulf to the northwest of Vietnam’s Bach Long Vi Island”, the vessel was impounded at the Hai Phong Port by the Coast Guard, VNA said, adding that the crew had been handed over to the police. State-run Tuoi Tre newspaper said the Qiong Yangpu was selling oil to Chinese fishing boats in the area but its captain had “failed to present relevant documents to prove the origin of the oil” and its two crew members had “no operating licence”. Meanwhile, Channel News Asia said Hai Phong police, military and coast guard officials had declined to comment on April 4. Similarly, at the time of going to press, there had been no comment from Beijing. Vietnam and China are involved in a longstanding territorial dispute over the waters of the South China Sea and sovereignty to its islands, which include the Paracel and Spratly chains among smaller atolls, reefs, rocky outcrops and sandbanks. Week 13 07•April•2016 As well as being rich in fish, the area in question is thought to hold substantial oil and gas reserves, resulting in frequent disputes over fishing rights and hydrocarbon exploration. This latest dispute will add to Hanoi’s growing list of complaints about Chinese fishing boats in the disputed waters.v w w w. N E W S B A S E . c o m P11 ChinaOil P R O J E C T S & C O M PA N I E S ChinaOil PetroChina completes Qinghai gas wells PETROCHINA has completed 10 gas wells at the Qinghai field in the Qaidam Basin as part of the state major’s ongoing upgrade programme, according to local media reports. Xinhua news agency reported on March 31 that PetroChina had undertaken work to limit exploration costs while improving the quality and quantity of hydrocarbons produced. PetroChina is believed to have added 30 million tonnes (219.9 million barrels) of oil equivalent in reserves. Development at Qinghai started in 1955, and by 2009 the area had estimated crude reserves of 370 million tonnes (2.7 billion barrels) plus 290 billion cubic metres of gas after a string of discoveries in recent decades. Qinghai Province is considered PetroChina’s fourth largest gas-producing region behind the Sichuan and Tarim Basins and Chongqing. According to China.org, the Qinghai field accounted for 25% and 11% of the wider province’s oil and gas reserves respectively. Xinhua reported that PetroChina’s Niu-1 well had struck a 190-metre gas column in the Jurassic reservoir. PetroChina is believed to be proceeding with a well-testing programme. Qinghai supplies oil and gas to Tibet on the former’s southwestern border, having delivered 24 million cubic metres of gas to Tibetan capital Lhasa since October 2011, according to recent reports. In 2010, PetroChina announced it would pump 23 billion yuan (US$3.54 billion) into supporting production at Qinghai under a contract signed with the provincial government. Qinghai hosts both an oil refinery with 1.5 million tonne per year (30,000 barrel per day) capacity as of 2011, and a 20 million cubic metre per year gas facility which supplies 30,000 residents in Yushu County. The local infrastructure reportedly supplied 1,000 compressed natural gas (CNG) and LNG vehicles operating in the province as of 2010. After a 7.1 magnitude earthquake killed at least 2,698 people in Yushu six years ago, PetroChina parent China National Petroleum Corp. (CNPC) played a crucial role in maintaining energy supplies via a 6,000 cubic metre oil tank and LNG terminal constructed in the region.v Poly GCL seeks spot LNG cargoes CHINA’S POLY-GCL is understood to be looking to secure spot LNG cargoes for import through terminals operated by Sinopec or China National Offshore Oil Corp. (CNOOC). The company, which has no LNG trading experience, has engaged a trading house in Singapore to initiate talks with suppliers, including those in Russia, said one Singapore-based trading source. POLY-GCL is a joint venture between stateowned China POLY and privately owned Hong Kong-based Golden Concord Holdings Ltd (GCL). The company has no Chinese LNG operations or sales outlets, typically focusing on the Ethiopian upstream. Reuters reported in January that POLY-GCL had finished drilling two appraisal wells in the Calub and Hilala fields in southeastern Ethiopia’s Ogaden Basin. Official field estimates put resources at 4.7 trillion cubic feet (133.1 billion cubic metres) of gas and 13.6 million barrels of associated liquids. The company is keen to take advantage of its newly bought LNG Libra carrier before the unit is converted into a floating storage unit in late 2017 and installed at the Ethiopian development. The 126,000 cubic metre LNG Libra, which POLY-GCL bought from Norway’s Hoegh LNG in 2015 for US$20 million, arrived in Singapore P12 in early March and is currently awaiting certification by classification agency ABS at Keppel Shipyard. The first cargo could come from an unnamed supplier in Russia and was initially negotiated to be delivered to Sinopec’s terminal in Qingdao City. But sources said third-party access to the terminal was still in doubt, with one adding: “It has not been finalised.” The Chinese government is encouraging third-party access to the terminals owned and operated by the state majors. While the country has 12 state-run terminals, only three, all operated by PetroChina, have so far handled spot cargoes for Chinese independents.v w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil P R O J E C T S & C O M PA N I E S ChinaOil Sinopec plans to double gas production by 2020 SINOPEC is aiming to double its natural gas production to 40 billion cubic metres per year by 2020, Beijing’s target year for the cleaner-burning fuel to account for 10% of China’s energy mix. Sinopec’s chairman, Wang Yupu, said his company would produce 29.5 bcm of conventional gas, plus 10 bcm of shale gas and 500 million cubic metres of coal-bed methane (CBM), not including an additional 2 bcm output from a Sichuan Province shale project slated for construction this year. When including gas imports, Sinopec expects to reach 53 bcm of gas supplies in four years’ time, according to the South China Morning Post. “Our proven gas reserves and development work are sufficient to meet our target,” Yupu said. “We have made significant new discoveries in the Sichuan and Ordos [gas] basins.” Sinopec expects the bulk of its conventional gas target to be realised from its fields in northern China as well as assets in Sichuan and the East China Sea, where the Chunxiao field is the subject of a dispute between China and Japan. With a reported breakeven price of US$60 per barrel, Sinopec is cutting domestic production, and was recently overtaken by CNOOC Ltd as China’s second biggest national oil company (NOC) in terms of domestic output. Sinopec reported a 32% fall in net profits at 32.2 billion yuan (US$4.96 billion) on March 30, as oil and gas exploration slumped to a 17.4 billion yuan (US$2.68 billion) operating loss, offset by a 20.96 billion yuan (US$3.23 billion) profit at Sinopec’s refining unit. Domestic gas projects feature highly in Sinopec’s 100.4 billion yuan (US$15.48 billion) capital expenditure programme for 2016, which has been reduced by 10.6% year on year. Work on a second phase at the Fuling shale gas field and development at the CNOOC Ltd-operated Pingbei-Huangyan gas fields are among the projects to receive a share of the 47.9 billion yuan (US$7.38 billion) Sinopec is investing in exploration. Sinopec is also performing pressure boosting upgrades at its 12 bcm per year Sichuan-East China pipeline, while the company will invest 19.5 billion yuan (US$3 billion) in its refining segment for work that includes upgrades at the Zhenjiang and Maoming plants.v Chinese state refiners forced to cut runs SOME of China’s state oil firms were reportedly forced to cut refinery throughput earlier this year, as the balance of power in China’s refining industry continues to shift. In the first two months of the year, state refiners reined in operations, while independent refineries ramped up output, Reuters said citing industry officials. State refiners including Sinopec and PetroChina recorded a 2.5% year-on-year drop in their combined crude processing in January and February, according to data from an unnamed company official. Independent refiners raised their output by 30% year on year in the same period, the official told Reuters. Strong demand from independents has meant that Chinese loadings of West African crude oil are on track to hit an 18-month high in April, the report added. Most of China’s crude oil has traditionally been imported by state giants PetroChina, Sinopec and China National Offshore Oil Corp. (CNOOC), as well as a few government-owned traders. Week 13 07•April•2016 But Beijing has slowly begun to issue import licences to private companies, thus loosening control over its oil imports. The loosening of previous restrictions on crude imports is part of major reforms that are set to intensify competition in China’s refining sector. Smaller refiners – which are called teapots – can now win quotas for imported crude if they meet certain environmental conditions, including the closure of older, polluting facilities. The new rules mean these companies can import directly, without having to go through a state trader as an agent. China has been strengthening its refining capacity over the last 20 years in an attempt to fill the gap left by rapid demand growth. Several refinery expansions are anticipated after 2015, including Sinopec’s Luoyang expansion in 2016, CNPC’s Karamay expansion in 2017 and Sinochem’s Ningbo expansion in 2020.v w w w. N E W S B A S E . c o m P13 ChinaOil UPSTREAM Sino Gas and Energy has different take on China’s gas market China’s shock reduction in liquefied natural gas imports in 2015 is clearly a setback for LNG exporters but for Australia’s only gas producer within the Middle Kingdom it’s a different story. As LNG imports get priced out of the domestic market in China, even at current low prices, Sino Gas and Energy is sitting on gas reserves that fall much further down the cost curve. Sino Gas managing director Glenn Corrie takes encouragement that China’s latest fiveyear plan gives for gas, identifying as it does natural gas as a key component in the future energy mix. The goal to increase gas’s share of China’s energy mix to more than 10 per cent implies significant demand growth in the coming years. And with gas prices within China only indirectly linked to crude oil prices, the ASXlisted company is in the happy position of being relatively insulated from the commodity price weakness that is causing headaches for many of its peers. The key competitive advantage for Sino is the low cost base of its ventures in the Ordos Basin in China’s remote central north, with production costs of around $US2 per million British thermal units and sales prices of $US7. That gives roughly $US5/MMBTU margins that Corrie says are probably among highest available worldwide. With its fixed gas prices, China’s challenge is to find the right balance in pricing, so that indigenous supplies are encouraged, as well as domestic demand. Failing to find that equilibrium point hurts one or the other. THE AUSTRALIAN, April 7, 2016 NEWS IN BRIEF China may adjust gas prices amid market-based shift, ICIS says China may harmonize wholesale natural gas prices for residential and industrial users as early as this year in an effort to make pricing of the fuel more market based. The National Development and Reform Commission is discussing a plan to set a single wholesale gas price for all users in 2016 and let suppliers and customers negotiate rates around the benchmark, ICIS China, a Shanghai-based commodity researcher, said in an e-mailed report citing people familiar with the plans. Industrial and commercial users in most regions pay a premium of as much as 1.73 yuan a cubic meter for gas compared to residential consumers, it said. China is reforming its state-controlled energy industry to make prices more reflective of supply and demand. The world’s largest energy consumer is targeting raising the share of natural gas in its energy mix to 10 percent by the end of the decade from about 6 percent last year in an attempt to shift consumption from coal and reduce pollution. “The move will benefit upstream players such as PetroChina and Sinopec as they won’t have to provide a wholesale discount to residential users under the new policy,” said Shi Yan, a Shanghai-based analyst at UOBKay Hian Ltd., indicating that residential users may pay more. NDRC didn’t immediately respond to a faxed request for comment. China cut natural gas prices for commercial and industrial users in November by 26 percent for Beijing and 24 percent for both Shanghai and Guangdong as the nation’s gas demand expanded by the least in in a decade in 2015 amid a price slump in alternative fuels such as coal. ChinaOil The cost for distributors to supply residential users is higher than industrial consumers. China Gas Holdings Ltd. Chairman Liu Ming Hui said in a December interview that 80 percent of the company’s manpower was catering to residential users who generated around 20 percent of revenue. BLOOMBERG, April 7, 2016 MIDSTREAM China’s perfect diesel storm poised to hit Asian fuel market Should Asia be bracing itself for a flood of gasoil from China in the second quarter? It would certainly appear that the conditions for a sharp rise in exports of gasoil, the refinery term for middle distillate fuels diesel and kerosene, are in place. These include stocks of Chinese oil products at a four-year high, rising refinery runs but soft domestic consumption, and gains in crude imports. So far this year China has already been ramping up exports of middle distillates, with diesel shipments rising 736 percent to 1.52 million tonnes in the first two months of the year compared to the same period last year, while jet kerosene gained 28.8 percent to 1.92 million tonnes. Converting the Chinese customs data to barrels per day (bpd) shows diesel exports at 190,000 bpd and jet kerosene at 250,000 bpd in the January-February period. By comparison China exported about 147,000 bpd of diesel and 264,000 bpd of jet kerosene in 2015, meaning that while jet kerosene shipments are roughly steady so far in 2016, there has been a big jump in diesel shipments. It’s likely that diesel exports will continue to rise in coming months, given the internal dynamics of China’s refining and fuel markets. Commercial fuel inventories reached a four-year high in February, rising 17.3 percent from the previous month, according to a March 28 report from the official Xinhua News Agency. Diesel inventories were 11.4 million tonnes in February, or about 85.5 million barrels, up 37.3 percent from 8.3 million tonnes in January, according to Reuters calculations based on the official data. REUTERS, March 31, 2016 China bans export of jet fuel to North Korea China’s commerce ministry announced Tuesday that it would restrict imports P14 w w w. N E W S B A S E . c o m Week 13 07•April•2016 ChinaOil NEWS IN BRIEF from North Korea, after being urged by the international community to strengthen its stance against Pyongyang following its fourth nuclear test, and missile and rocket launches, Yonhap reported. Beijing also announced that it will ban the export of jet fuel to the Kim Jong Un regime, going by the sanctions slapped on the country by the United Nations Security Council. The Security Council, with the backing of China, had adopted the harshest sanctions against North Korea last month after Pyongyang’s fourth nuclear test in January and a rocket launch the following month. China has so far been the most important ally of the reclusive country, whose leader has called for more nuclear weapons and stronger defense capabilities. The latest U.N. sanctions need member states to prohibit imports of North Korean gold and rare earth metals. However, the trade in the coal and iron ore from Pyongyang is allowed to continue if the proceeds from it are related to “livelihood purposes.” Beijing added that it will continue to import coal, iron and iron ore from North Korea if the transactions are related to the livelihood purposes and if the revenues are not used to develop North Korea’s nuclear and missile programs. Myanmar currently imports most of its fuel. The Myanmar Investment Committee granted the Chinese firm approval to build a 100,000 barrels-per-day (bpd) refinery in the southeast coastal city of Dawei, Li Hui, a vice president of Guangdong Zhenrong and head of the company’s refining business, told Reuters. The Chinese firm will hold 70 percent of the project, and the remaining 30 percent shared by three Myanmar firms - militarylinked Myanmar Economic Holdings Limited, Myanmar Petrochemical Corp, an entity affiliated with the country’s energy ministry and Yangon Engineering Group, controlled by privately-run HTOO Group of Companies, Li said. As the approval came before the government led by Aung San Suu Kyi’s National League for Democracy was sworn in, Li said his firm was ready to work with the new Myanmar authorities to ensure the project gets off the ground. “We are confident (about the project) as it has taken into considerations interests from all parties and the refinery will benefit the local people as well as the economic development of the country,” said Li. Guangdong Zhenrong, which first announced the project in 2011, won the green light from Beijing in late 2014 to proceed with the plan. DOWNSTREAM Petrochemical prices rise in Asia amid plant repairs IBT, April 4, 2016 China firm wins Myanmar approval for $3 bln refinery Chinese state-controlled commodity trader Guangdong Zhenrong Energy Co has won approval from the Myanmar government to build a long-planned $3 billion refinery in the Southeast Asian nation in partnership with local parties including the energy ministry, company executives said on Tuesday. The project, which also includes an oil terminal, storage and distribution facilities, would be one of the largest foreign investments in decades in Myanmar. Week 13 07•April•2016 REUTERS, April 5, 2016 Prices of petrochemicals are rising in Asia, reflecting higher crude oil prices last month as well as supply reductions resulting from periodic checkups of production facilities. Petrochemical products, especially intermediate materials, are now quoted at prices 10% to 40% higher than their most recent lows. While demand remains firm in China and other Asian markets, prices of synthetic resins are expected to fall by narrow margins as part of price-cut negotiations in Japan. Spot prices of ethylene, used to make a variety of synthetic resins and other w w w. N E W S B A S E . c o m ChinaOil petrochemicals, are now around $1,200 per ton, 40% higher than the most recent low in early February. Periodic repairs of ethylene production facilities in Thailand started in February. Japanese producer Tosoh and South Korean petrochemical manufacturers are also conducting regular checkups. Repairs are concentrated this year, with a number of them planned to take place in Japan and other countries in May or later. Demand for petrochemical products remains strong in China and has only been affected to a limited extent by the slowdown in the country’s economy. China’s imports of low-density polyethylene, used to make wrapping materials, increased about 30% in volume in February from a year earlier. The nation’s imports of benzene, for production of engineering plastics, exceeded 100,000 tons for the first time in eight months. Inventories of petrochemicals have been building up in China since the Chinese New Year, said an official at a major Japanese trading house. NIKKEI, April 4, 2016 SERVICES KBR wins refinery work in China Houston engineering and consulting firm KBR won a contract to work on a refinery for a client in China. KBR will revamp a fluid catalytic cracker unit, which plays an important role in gasoline production, by bringing in its Maxofin technology. The Maxofin technology allows for higher production of propylene. “This project demonstrates our commitment to deliver innovative technologies that help the client meet their performance objectives,” John Derbyshire, President of KBR Technology & Consulting, said in a statement Thursday. In the announcement KBR also said it developed the world’s first fluid catalytic cracker commercial unit in 1942, and has done 120 such projects around the world since. The price of the deal was not disclosed. The client’s identity was kept confidential. As part of the restructuring KBR initiated in December 2014 the company has looked for opportunities to expand in Asia. It has also narrowed its focus on several business segments, including its proprietary technologies in oil and gas processing, as it sheds others. KBR’s stock was down slightly in early trading Friday. CHRON, April 1, 2016 P15 ENERGY FINANCE WEEK NewsBase’s new weekly monitor covering energy-specific project finance, acquisitions and company performance from around the world. To find out more and sign up for a Free Trial, click here or call us on +44 131 550 9281 Decom Special Report 2016 £700 BUY TODAY TO CLAIM YOUR 10% DISCOUNT A Special Report on decommissioning in 2016, containing the following and much more: Cost cutting Improved cost-cutting and cost estimation is fundamental in the low-price environment. We discuss enhanced cost-optimisation strategies with Amec Foster Wheeler. Brent’s big lift High-profile projects remain on course, such as the removal of Shell’s Brent Delta platform’s topside in the North Sea. We spoke to the project’s director to gain crucial and exclusive insight. Innovation Finding new solutions to old problems is critical in the decommissioning field. We look at lessons that can be learned from nuclear power decommissioning and other sectors. To find out more and buy the report, click here or visit: shop.newsbase.com Implementation Day Iran Special Report - Update £600 January 2016 Implementation Day: sanctions lifted Implementation of the lifting of sanctions on Iran signals a new era for Iran and the world oil market. Fate of the nation Burdened by years of international sanctions, Iran is in dire need of foreign investment, particularly in its energy sector. Land of opportunity Home to the world’s fourth and second oil and gas reserves respectively, Iran presents unique opportunities to firms throughout the value chain. Stiff competition Investors from China and Russia lead the queue, but Tehran is also keen to attract players from Europe, the Americas and elsewhere in Asia. Click here for more information and to buy this Special Report in the NewsBase shop. v NEWSBASE Our customers include... If you are interested in your company’s logo appearing on this page, please contact your Customer Accounts Manager on +44 131 478 7000.