On 25

advertisement

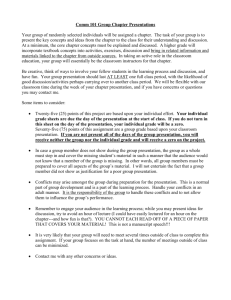

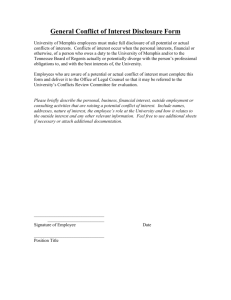

On 25th April 2012 the UCL Centre for Ethics and Law held its third think tank, led by John Mair, EBRD, and John Smart, Ernst & Young LLP. Corporates, lawyers and academics from a range of disciplines came together to discuss the challenges presented by the many conflicts of interest that arise in our professional lives. Participants brought their diverse backgrounds and expertise to the discussion, a summary of which follows. Delineating Conflicts of Interest It is unwise to attempt to define conflicts of interest in absolute terms, for what is a conflict in one social context may be entirely appropriate in another. The same decision will look differently legitimate in different contexts. Moreover, the imposition of standards defining conflicts of interest can have a damaging effect, as it may impinge on the variety of social constructs that enable different cultures to flourish. This is not a case of diminishing the importance of conflicts of interest, but of recognising that perception is key, and that different people look at things in different ways. We must be receptive to this fact when deciding what is, and what is not, a conflict of interest, and how it should be managed. We may nevertheless think it a mistake not to identify some situations as conflicts of interest. The business entertainment exception to the UK Bribery Act allows professionals to go considerable lengths towards encouraging others to make decisions in a certain way. Indeed, if such entertainment did not have an incentivising effect it would constitute fraud as a waste of the shareholders’ money. To create this sort of bias must at some point become illegitimate, but the difficult question is where. A worthwhile aim is to identify how, and why, conflicts of interest are wrong. When interests conflict, our decisions become the product of considerations that we should not be relying upon. We are thinking in the wrong way, and our mental processes are defective whether or not we know they are. This defectiveness of process persists regardless of whether the eventual decision was the right one, for the right decision will then have been made for the wrong reasons. Unresolved conflicts of interest are wrong, then, because they stand for defective or otherwise substandard mental states. Given the complexity of mental states, it may seem easier to abandon our approach and look instead to the wrongness of consequences. Yet to do so would give insufficient importance to the value of process, the value of reaching the right decision for the right reasons and being seen to do so. We care not just about consequences themselves, but how those consequences were reached, particularly when our focus is on a public system such as the courts. Appearance, and its associated focus on mental states, must take precedence. Perception takes a central role. It is not enough just to act well; one must be seen to act well, to display a good character. With this in mind we can perhaps reformulate what a conflict of interest actually is: it is a conflict of perceptions. It is a conflict between, for example, being seen as an ethical investor, and being seen as a prudent investor. Conflicts of interest affect image, making good decisions look like bad decisions, and in doing so reflecting badly upon the decision-maker. We may attempt to distinguish conflicts of interest from the other dilemmas we commonly face in our professional and personal lives, such as those between competing moral values. One possible way to do so is to recognise that we can sometimes resolve conflicts of interest by disclosing them to relevant parties, obtaining their consent to continue. Such a simple act of disclosure may – in some cases – itself resolve conflicts of interest. In contrast, when disclosing moral dilemmas we do so in order to inform ourselves better, so that we can choose between values; disclosure itself does not resolve our moral dilemmas. Such a diagnostic tool is of limited use, however. At least some conflicts of interest will be unaffected by third-party knowledge or consent. The decisionmaker’s mental states will remain defective in spite of such limited external approval. At best, the distinction set out above looks able to distinguish between transparency-dependent conflicts, and all other conflicts, whatever they may be between. It cannot capture the difference between moral dilemmas and conflicts of interest, if indeed one exists. Managing Conflicts of Interest Once we have an understanding of what conflicts of interest are, we are faced with the separate challenge of how to manage them. Within professional organisations, the traditional way of doing so is to implement ‘Chinese walls’: information barriers that in theory prevent the leakage of information from one group within an organisation to another. Such barriers are essential to acting for clients with competing interests. Professional firms must strive to achieve the best possible outcome for each client. That will not necessarily be the same as the best possible outcome overall, and as a result firms cannot do their best by their clients unless those clients’ information and interests are screened from one another. It is not proper for firms to manage and balance the interests of competing clients. Yet there are significant challenges involved in implementing effective information barriers. As in Prince Jefri Bolkiah v KPMG [1999] 1 All ER 517, typically the focus is on ensuring physical distance between those acting for competing clients, but when modern communications technology makes it so easy to interact with others around the world, it is difficult to justify such a geographical focus. A leak-free information barrier may be extremely difficult to implement, regardless of distance. A barrier that looks impermeable despite all of the potential for leaks brought by the ease of communication may be impossible to achieve. Given that appearance is so central to conflicts of interest, and against a background of risk aversion, with great importance placed on procedural justice, it is especially problematic that even the strongest and most carefully-implemented information barrier will nevertheless appear vulnerable. One solution is perhaps a change of approach by firms towards their clients. The risk of conflicts, whether in the present or future, arguably overrides the financial interests of a firm in keeping one or both competing clients. Conflicts of interest present an entirely different set of challenges to individuals. The burden placed upon professionals to resolve conflicts of interest is a heavy one. They are faced with difficult and complex questions of how to balance interests, and may be operating within a legal or ethical grey area. They must also reconcile this professional duty with their personal lives. What would otherwise be perfectly legitimate and normal human relationships can be transformed by individuals’ professional roles into a source of conflict, regardless of whether they do in fact influence the individual, or just create the perception of influence. Professionals have a duty to avoid conflicts of interest. There is an expectation that they are avoidable; an expectation that is not shared with moral dilemmas, which are perhaps unavoidable. This suggests that conflicts of interest are, or are perceived to be, of our own creation. However, we are very often influenced, and driven to act in certain ways, unconsciously. It may often be the case that conflicts arise not due to personal failures or misconduct. These unconscious biases are not the sorts of things we can be taught to look for in the ‘normal’ classroom; they arise not from a lack of expertise or training but as a consequence of how we, as human beings, think, live and feel. Placing too much importance on the unconscious can leave us in a situation where we are powerless, paralysed by situational factors, yet those factors must be accorded some significance. How much we expect individuals to manage unrecognised conflicts is contingent on the importance we assign to the unconscious, but finding the right middle ground is difficult. The conflicts of interest that we face, yet are not consciously aware of, may at times be caused by, and therefore the responsibility of, others. Incentive schemes that encourage the selling of financial products, some of which may not be best suited to the customer, can create conflicts that are not recognised by the salespeople themselves. Moreover, such conflicts are arguably not their creation, but are the product of the structures implemented at a more senior level. In assigning responsibility for resolving such conflicts we should perhaps look towards more senior professionals within the corporation, or to the culture of the firm itself. Even once we are aware of the conflicts we face, our task in resolving them does not become any easier. It may even become harder, for the awareness of conflict can in itself influence our decisions. It would take great, if not unrealistic, levels of confidence to ignore conflicts that are pointed out to us, even if those conflicts themselves were not biasing our decisions. Even if an individual could possess such confidence, projecting that confidence to the extent necessary to avoid the perception of bias would present an even greater challenge. Preparing for Conflicts of Interest Given the tremendous challenges involved in managing conflicts of interest, it is essential that individuals are given as much help as possible. This help is in part the product of how we define the boundaries of acceptable conduct, and in particular the distinction between rules and guidelines. Rules can often be unhelpful. Because rules purport to be inviolable but are in fact regularly not, they often fail to serve as a guide or predictor of behaviour. They also risk creating a system whereby, so long as the letter of the rules is followed, anything goes. There must be more to making the right decision than making rules. It is preferable therefore to implement guidelines that can go as far as possible towards creating a framework within which it is easier for individuals to identify, manage, and resolve conflicts of interest. Such a framework may also be the product of a firm’s culture. The established patterns of behaviour and associated attitudes that are dominant within a firm will have significant effects on individual behaviour; a positive culture can encourage and enable the proper management of conflicts of interest. Of equal, if not greater, importance to frameworks to guide behaviour is training. Heightening individuals’ awareness and capacity to reflect is key to making them professionals who can manage the challenges triggered by conflicts of interest. Part of this project must involve reinforcing our awareness of and capacity to deal with the myriad of situational factors that are likely to influence our moral judgment. This is not a straightforward process, however, and it carries the risk of formatting individuals to respond in a particular way, or encouraging them to overcompensate for their automatic judgments, going too far in the other direction. We should also ask whose responsibility it is to ensure this training takes place. Law schools, business schools, and corporations must have some role to play, but perhaps this alone is not enough. There is arguably a need to heighten the importance of conflicts of interest more generally, to try to establish a global culture of ethical behaviour. Within such a culture, the training of professionals to establish how to manage conflicts of interest can be coupled with a broader awareness of why it is important to manage those conflicts. Furthering the Debate Can we be more specific in defining what a conflict of interest is? o Miguel Kottow, ‘Ethical quandaries posing as conflicts of interest’ [2010] 36(6) Journal of Medical Ethics 328 How should conflicts of interest be regulated? Do professionals such as lawyers warrant specific regulation, holding them to higher standards? o Joan Loughrey. ‘Large Law Firms, Sophisticated Clients, and the Regulation of Conflicts of Interest in England and Wales’ [2011] 14(2) Legal Ethics 215 What is the impact of the unconscious on conflicts of interest, and how can we best manage these cognitive biases? o Paul Thagard, ‘The Moral Psychology of Conflicts of Interest: Insights from Affective Neuroscience’ [2007] 24(4) Journal of Applied Philosophy 367