The Gambia: ICT Sector & Matarr Touray PURA

advertisement

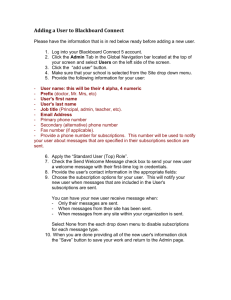

The Gambia: ICT Sector & Data Collection Matarr Touray PURA Presentation Outline Key Statistics Penetration 2G & 3G Services Rationale for Data Collection Data Collection in The Gambia Challenges Way Forward 18/11/2009 Key Statistics 2012 Fixed Line Operators 2013 2014 1 1 1 4 4 4 5 5 5 Fixed Line Subscriptions 64,196 50,334 47,540 Mobile Subscriptions 1,526,181 1,986,490 2,159,099 Fixed Internet Subscriptions 3,112 2,501 3,200 Mobile Internet Subscriptions 127,809 157,488 308,393 Mobile Operators ISPs Status of Submarine Cables in The Gambia Cable Name Landing Point Design Capacity Allocated Capacity (GAMBIA) Launch Date Est. Cable Cost ACE Brusubi 5.12 Tb/s 10 Gb/s Dec. 2012 US$ 35,000,000 DYNAMIC COUNTRY!! Fixed Lines Subscription Fixed Subscriptions 70,000 64,196 60,000 50,334 50,000 47,540 40,000 2012 2013 30,000 2014 20,000 10,000 0 2012 2013 2014 Mobile Subscriptions Active Subscriptions Mobile 2,500,000 2,159,099 1,986,490 2,000,000 1,526,181 1,500,000 2012 2013 2014 1,000,000 9% increase in Subscriptions 2013 -2014 500,000 2012 2013 2014 SUBSCRIPTIONS SUB. Growth Rate Fixed & Mobile Internet Subscription Mobile Data Subscribers Fixed Internet Subscribers 250,000 3,500 3,000 200,000 Data Subscribers 2,500 150,000 2,000 2012 3G 2013 GPRS 1,500 100,000 2014 1,000 50,000 500 0 2012 0 2012 2013 2014 2013 2014 Postpaid vs Prepaid Subscriptions 0.65% 0.45% Prepaid 99.35% 2012 Prepaid and Postpaid Subscriptions Postpaid 99.55% 2013 Prepaid and Postpaid Subscriptions 0.30% 2014 Prepaid and Postpaid Subscriptions 99.70% Operator Growth Mobile Customers 1,600,000 1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 2009 2010 GAMCEL 18/11/2009 2011 AFRICELL 2012 COMIUM 2013 2014 QCELL Q1-2015 Mobile Penetration 140 120 Fixed 100 African Avg. Fixed 80 Mobile 60 African Avg. Mobile 40 Total 20 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2G & 3G Mobile Services Population Coverage (Very High) 96% Connections over 2.5m Market Penetration 120% African Avg -72% 3G Penetration 8-10% Annual Growth Rate >22% Tariffs & Revenue per minute 83% O/G = On-Net Voice tariff = GMD 3 per minute (7.5 cents US$) Revenue per minute = GMD 1-1.5 / minute (i.e., Discounts 50%) ARPU US$ (2.00 - 2.50) Rationale for Data Collection Market Assessment Fastest growing sector Market Comparisons Competition Considerations Need for Reliable Statistics Evidenced Based Policy Making Targeted Interventions ICT Sector Growth Growth Rates in Regulated Sectors 16 14 12 % 10 Communication 8 Electricity, Gas and Water GDP Growth 6 4 2 0 2009 2010 2011 2012 2013 2014 ICT Data Collection in The Gambia MOICI GBOS •Policy Making •Universal Service •New Investment •Surveys •National Census •National Accounts PURA Consumers •Tariffs •Education Operators •Appraisal •Competition •Market Trends Data Collection E-mail based platform with focal points Quarterly Data submitted to Economics Department Data Submissions submission only by recognized focal person Responsible for Data Validation Identified Gaps Correlations with previous periods Flexible mechanism to allow for Data correction e.g Active Subscribers Market Surveys Prohibitive due to Financial Constraints Relies on Census Data for Internet Usage etc. GBOS Infrequent Time Period Dynamic Sector (10 Years) PURA initiatives Quality of Experience Survey Growth Centers Actual Customer Perception Deviates from QOS Challenges Challenges to be expected in most Data Collection exercises Two Public Sector Operators (GAMTEL & GAMCEL) Timeliness & Accuracy of Submissions by both Frequent Back & Forth delaying updating of Statistics Operators Understanding of Some Indicators Private Operators understand the importance of the Collection Indicator Definitions especially for Mobile Broadband. (GPRS vs 3G, Dedicated Mobile Data Subs) Data Collection – Way Forward Develop Online Data Collection Tool Log-in Credentials provided to Operators Electronically signed after submission Identified focal Persons Data may-be modified before deadlines Immediate Back-end Comparisons between services Develop accompanying Android & iOS Apps Hosted on www.pura.gm ICT Indicators Portal Public Consumption Conducting First Market Assessment Study THANK YOU mtt@pura.gm