19 September 2014

Practice Group:

Insurance Coverage

Earthquakes: Are You Covered, and If Not, Should

You Be?

By John M. Hagan and Ngofeen Mputubwele

The earthquake that struck Northern California in August 2014 serves as a reminder of how

quickly business policyholders can face devastating losses. In the aftermath of an

earthquake, businesses may face pressing challenges, including restoring interrupted

operations and repairing damaged buildings or equipment. To help ensure that they have

maximized the financial resources available to meet those daunting challenges, companies

should also be sure to consider whether their insurance policies afford coverage for

earthquake-related losses. Furthermore, business policyholders not affected by an

earthquake now may nonetheless wish to assess their property coverages to determine the

degree to which they may have coverage for earthquake-related losses in the future and

whether to purchase additional coverage.

The scope of each policyholder’s earthquake coverage and the prospects for success on its

claim for insurance coverage will vary depending upon a number of factors, including the

policy language at issue, the governing law, and the facts of a claim.

In this Alert, we (i) identify first-party property policies as the main source of coverage for

earthquake-related losses, (ii) provide information regarding financial considerations involved

in purchasing earthquake insurance, (iii) examine certain key issues related to the

application of earthquake exclusions in property policies, (iv) describe types of losses that

may be covered, and (v) suggest some initial steps policyholders should consider taking

when confronted with seeking insurance coverage for earthquake-related losses.

First-Party Property Policies Provide the Main Source of Coverage for

Earthquake-Related Losses

Multi-Peril and Stand-Alone Property Policies May Provide Earthquake Coverage

The first place for policyholders to look for coverage for earthquake-related losses is their

first-party property policies. Such policies insure the assets of businesses. Regarding

earthquake coverage, these policies may take the form of general “all-risk” or “difference-inconditions” property policies that add earthquake coverage by endorsement or stand-alone

earthquake insurance policies. Policyholders that do not currently have insurance

specifically for earthquakes may wish to consider purchasing such coverage for future

earthquake-related losses, taking into consideration the sometimes-significant premiums and

deductibles associated with such insurance.

Purchasing Earthquake Insurance—Financial Considerations

If a business is seeking to purchase earthquake insurance, it should be aware that premiums

can vary widely based upon a number of factors, including the level of earthquake risk, the

property insured (including the age, design, materials, and condition of any structures), the

Earthquakes: Are You Covered, and If Not, Should You Be?

scope of coverage provided, and the insurer. Typically, premiums are calculated on the

basis of the value of the insured property, with the premium rate stated as being applicable

to $1,000 of property value. 1 According to the California Department of Insurance, the

average premium rate for policies providing earthquake coverage as part of a commercial

multi-peril policy in that state in 2013 was $1.36; 2 thus, if a commercial policyholder

purchased a multi-peril policy that included earthquake coverage for property valued at $1

million, applying the average 2013 California premium rate per $1,000 in insured property

would result in a premium of $1,360. 3

Policyholders should also be aware that earthquake insurance typically does not provide

first-dollar coverage. Deductibles may range from 2 percent to 20 percent of the

replacement cost of insured property, although deductibles are more typically in the range of

10–20 percent in locations with an increased risk of earthquakes.4 Going back to the

example of a policyholder with property valued at $1 million, if a deductible applicable to

property losses for a particular policy was set at 15 percent, or $150,000, coverage would

only be available under that policy for property losses in excess of $150,000.

Despite what may be substantial premiums and large deductibles, policyholders may

nevertheless still find it to their advantage to purchase earthquake insurance. Whereas the

6.0-magnitude Napa earthquake that occurred in August 2014 is estimated to have caused

damage potentially exceeding $1 billion, 5 previous earthquakes have caused much more

damage: the 8.3-magnitude 1906 San Francisco earthquake caused $524 million in

combined earthquake and fire damage (unadjusted for inflation), although it is estimated that

a similar earthquake in San Francisco today would cause more than $96 billion in property

damage. 6 The Loma Prieta earthquake that struck the Bay Area in October 1989 caused an

estimated $10 billion in total property damage, and the Northridge (Los Angeles) earthquake

in January 1994 inflicted roughly $44 billion in damage (both numbers unadjusted for

inflation).7 Thus, although the United States has been fortunate in avoiding the proverbial

“Big One” in recent times, the not-too-distant past cautions that future earthquakes could

very well cause enormous levels of property damage.

Furthermore, although earthquakes are commonly associated with states like California, in

actuality, the risk of earthquakes spreads across the United States. According to a recent

report from the U.S. Geological Survey, 42 of the 50 states have “a reasonable chance of

experiencing damaging ground shaking from an earthquake in 50 years.” 8 Moreover, the 16

states at the highest level of risk for earthquakes are not only on the West Coast but

1

See “Earthquakes: Risk and Insurance Issues,” INSURANCE INFORMATION INSTITUTE (Aug. 2014). For the sake of

comparison, the premium rate for commercial multi-peril policies that excluded earthquake coverage issued in California

in 2013 was $1.13.

2

See “Earthquake Premium and Policy Count Data Call; Summary of 2013 Residential & Commercial Market Totals,”

CALIFORNIA DEPARTMENT OF INSURANCE (June 10, 2014), available at http://insurance.ca.gov.

3

These numbers are only intended to be illustrative, and premium rates and deductibles could vary substantially based

upon a number of factors, including those discussed above. Policyholders should consult with their brokers regarding the

premiums and deductibles that may be available for earthquake coverage.

4

See “Earthquakes: Risk and Insurance Issues,” INSURANCE INFORMATION INSTITUTE.

5

See “PAGER - M 6.0 - 6.8 km (4.2 mi) NW of American Canyon, CA,” UNITED STATES GEOLOGICAL SURVEY (2014, Alert

Version 26), available at http://earthquake.usgs.gov.

6

See “Earthquakes: Risk and Insurance Issues,” INSURANCE INFORMATION INSTITUTE.

7

See id.

8

See, “New Insights on the National’s Earthquake Hazard,” UNITED STATES GEOLOGICAL SURVEY (Jul. 17, 2014), available

at http://www.usgs.gov.

2

Earthquakes: Are You Covered, and If Not, Should You Be?

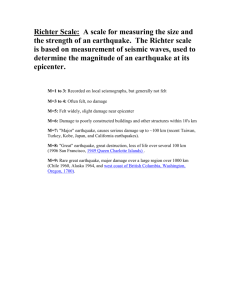

throughout the central and eastern United States.9 Many readers in the eastern U.S. may

recall feeling the tremors of the earthquake centered in Virginia in August 2011. 10 Also, it is

worth recalling the New Madrid earthquakes of 1811 and 1812, which (1) struck Missouri,

Tennessee, and neighboring states; (2) involved three quakes ranging from approximately

7.3 to 7.5 on the Richter scale; (3) caused damage across approximately 600,000 square

kilometers; and (4) reshaped the land in the area surrounding the earthquakes. 11 In

consideration of such past experiences, policyholders outside of states traditionally

associated with earthquakes may wish to consider the benefits of obtaining earthquake

insurance.

In addition, it is useful to consider the earthquake insurance market in a country with much

more recent experience with devastating earthquakes than the United States. In Japan, in

the wake of the 1995 Kobe earthquake and the 2011 earthquake and tsunami, the

percentage of consumers purchasing earthquake insurance has increased for 11

consecutive years. 12 Furthermore, the area of the country with the highest percentage of

earthquake insurance penetration is an area that was hit hard by the 2011 earthquake and

tsunami. 13 The Japanese experience suggests that policyholders there learned to value

earthquake insurance in the wake of catastrophic earthquake-related damage, and it may

also counsel that policyholders elsewhere also consider purchasing such insurance before

the next earthquake strikes.

Possibility of Coverage Despite Earthquake Exclusions

As a general matter, unless a policyholder has specifically purchased earthquake coverage,

most first-party property insurance policies contain exclusions for losses related to

earthquakes. The following are examples of earthquake or “earth movement” exclusions:

This policy does not apply to earth movement, including but not limited to,

earthquakes, landslide, mudflow, earth sinking, earth rising, or shifting.

*

*

*

This policy does not apply to … earth movement, meaning earthquake, including

land shock waves or tremors before, during or after a volcanic eruption; landslide;

mine subsidence; mudflow; earth sinking, rising or shifting.

Policyholders and insurers often dispute whether such earthquake exclusions apply to a

particular loss. Several states apply an “efficient proximate cause” rule, such that earth

movement exclusions do not apply unless an excluded peril, like an earthquake, was the

single proximate cause of the policyholder’s loss. 14

9

See id. The 16 states at highest risk are of experiencing an earthquake are Alaska, Arkansas, California, Hawaii, Idaho,

Illinois, Kentucky, Missouri, Montana, Nevada, Oregon, South Carolina, Tennessee, Utah, Washington, and Wyoming. Id.

10

See Joel Achenbach, “5.8 Virginia Earthquake Shakes East Coast, Rattles Residents,” WASHINGTON POST (Aug. 23,

2011), available at http://www.washingtonpost.com.

11

See, “Historic Earthquakes: New Madrid 1811-1812 Earthquakes,” UNITED STATES GEOLOGICAL SURVEY (2014),

available at http://www.usgs.gov.

12

See “Quake insurance buyers’ ratio hits new high in Japan,” JAPAN ECONOMIC NEWSWIRE (Aug. 25, 2014), via

http://www.advisen.com.

13

See id.

14

See, e.g., State Farm Fire & Cas. Co. v. Von Der Leith, 820 P.2d 285, 291 (Cal. 1991); Safeco Ins. Co. v. Hirschmann,

773 P.2d 413, 414-16 (Wash. 1989); Murray v. State Farm Fire & Cas. Co., 509 S.E.2d 1, 12-15 (W. Va. 1998).

3

Earthquakes: Are You Covered, and If Not, Should You Be?

However, California policyholders should be aware that Section 10088 of the California

Insurance Code narrows the application of the “efficient proximate cause” rule in that state,

providing that policies with an earthquake exclusion do not provide coverage for earthquakerelated losses if the earthquake was a proximate cause of the loss. 15 Thus, insurers will

utilize Section 10088 as a basis to argue for the application of earthquake exclusions in a

variety of circumstances. Significantly for policyholders, Section 10088 does not apply to

coverage under a fire insurance policy for losses related to a fire following an earthquake.16

Application of an earthquake exclusion is necessarily fact-sensitive, particularly in states

applying a version of the “efficient proximate cause” rule. Simply because an insured’s

losses may be partially attributable to an earthquake does not mean that the earthquake

exclusion applies. Policyholders should consider whether another risk, such as fire or the

negligent design or construction of a building, was the proximate cause of loss.

Policyholders should be prepared to challenge insurer attempts to escape coverage by

relying upon an earthquake exclusion.

Know the Losses That Your Policy May Cover

Policies Cover More Than Just Property Losses

In order to maximize their insurance recovery, policyholders should compare their

earthquake-related losses with the categories of loss covered by their policies:

• “Property Damage” coverage for any property that may be classified as “insured

property;”

• “Business Interruption” coverage, which may cover the policyholder’s loss of earnings or

revenue resulting from property damage caused by an insured peril (although insurers

often dispute the proper quantification of the insured loss);

• “Contingent Business Interruption” coverage, which may cover the insured with respect to

losses, including lost earnings or revenue, as a result of damage to property of a supplier,

customer, or some other business partner or entity;

• “Extra Expense” coverage, which may cover the insured for certain extra expenses

incurred by the insured in order to resume normal operations and to mitigate other losses

from the insured event;

• “Ingress and Egress” coverage, which may cover the policyholder when access to a

business premises or location is blocked for a time;

• “Civil Authority” coverage, which may cover the insured for losses arising from an order of

a governmental authority that interferes with normal business operations;

• “Service Interruption” coverage, which may cover the policyholder for losses related to a

power supply interruption;

• “Defense” coverage, which may cover the insured for defense costs incurred with respect

to claims alleging that the insured is responsible for damage to covered property of

others; and

15

16

CAL. INS. CODE § 10088 (2014).

Id. § 10088.5.

4

Earthquakes: Are You Covered, and If Not, Should You Be?

• “Claim Preparation” coverage, which may cover the costs associated with compiling and

certifying a claim for coverage.

Coverage for any one or more of the types of losses a policyholder may incur can provide

valuable sources of recovery for a business and should be considered carefully. In addition,

each of these types of coverage may be subject to differing limits of coverage as well as

varying deductibles, meaning that even if an insured’s losses in one category are insufficient

to exhaust a deductible and attach coverage, losses in another category may exceed a

deductible’s limits or not be subject to a deductible at all.

Business Interruption Coverage

As noted above, an insured may have a claim for business interruption coverage when its

income is adversely affected by an insured event such as an earthquake. Coverage for this

category of loss may be vital to a business working to recover from an earthquake. Previous

earthquakes demonstrate that an earthquake can cause huge business interruption losses.

According to one report, the 1994 Northridge earthquake caused an estimated $6.5 billion in

business interruption losses, 17 as compared to an estimated $44 billion in property damage

from that earthquake. Moreover, estimates of business interruption losses caused by the

1995 earthquake in Kobe, Japan, reached $100 billion. 18 In light of such losses, business

interruption coverage can be enormously valuable to policyholders affected by an

earthquake.

In response to claims for such coverage, insurers often contest numerous issues. For

example, insurers may take a narrow view of what constitutes an “interruption,” and they may

also challenge whether the interruption to or reduction in an insured’s business was

necessarily because of damage to the insured’s property. Insurers may also seek to dispute

the amount of loss by arguing that the amount of lost profits that the policyholder is claiming

is overstated because it does not take into account economic downturns, market trends, or

other factors that the insurer may argue affected profits at the time of the interruption. There

may be other limitations on coverage as well; for example, some policies limit the length of

time for which business interruption coverage is available after the insured event occurs (i.e.,

the recovery period).

Nevertheless, policyholders whose income has been negatively affected by an earthquake

should consider the availability of this potentially valuable coverage under their policies. In

some instances, depending upon the amount of loss, available limits, and relevant

deductibles, an insured may be entitled to a larger recovery for its business interruption

losses than for its property damage losses.

In addition, although some policies require damage to “insured property” as a prerequisite to

recovery of business interruption losses, other policies may include “contingent business

interruption” coverage that permits an insured to recover losses that occur when a supplier,

customer, or other entity has incurred property damage that results in an interruption to the

insured’s business. The wording of an insured’s policy is critical to the availability of

contingent business interruption coverage in such instances.

17

See “Business Interruption After Disasters: What Do We Know?” Peter Gordon (Jan. 16–17, 2014) (presented at the

Northridge 20 Symposium), available at http://www.northridge20.org.

18

See id.

5

Earthquakes: Are You Covered, and If Not, Should You Be?

Advance Payments

Businesses may need an insurance recovery to resume normal business operations. Some

insurance policies require that insurers make advance payments to cover losses as incurred

while the full extent of the loss is being adjusted. Policyholders should review their policies

to determine whether they provide for such payments.

Presenting a Claim for Coverage

Most policies identify specific procedures to be followed in presenting a claim, and some of

these procedures may have timing deadlines associated with them. Failure to comply with

these procedures may give insurers a basis to attempt to deny a claim otherwise covered

under the policy.

An insured that has suffered earthquake-related losses should promptly collect and

document its loss information, evaluate the information in light of the policy wording and

applicable law, and present it to the appropriate insurers in a timely and coverage-promoting

manner.

Evaluating Coverage for Earthquake-Related Losses

A policyholder’s right to recover losses related to an earthquake will depend upon the

specific policy language at issue, the facts related to the insured’s claim, and the governing

law. Careful and prompt evaluation of these issues can be crucial in determining whether a

policyholder is able to recover. Additionally, policyholders may benefit from giving thought to

the potential availability of coverage in advance of future earthquakes.

Authors:

John M. Hagan

john.hagan@klgates.com

+1.412.355.6770

Ngofeen Mputubwele

ngofeen.mputubwele@klgates.com

+1.412.355.8915

Contacts:

Thomas E. Birsic

thomas.birsic@klgates.com

+1.412.355.6538

David F. McGonigle

david.mcgonigle@klgates.com

+1.412.355.6233

6

Earthquakes: Are You Covered, and If Not, Should You Be?

Anchorage Austin Beijing Berlin Boston Brisbane Brussels Charleston Charlotte Chicago Dallas Doha Dubai Fort Worth Frankfurt

Harrisburg Hong Kong Houston London Los Angeles Melbourne Miami Milan Moscow Newark New York Orange County Palo Alto Paris

Perth Pittsburgh Portland Raleigh Research Triangle Park San Francisco São Paulo Seattle Seoul Shanghai Singapore Spokane

Sydney Taipei Tokyo Warsaw Washington, D.C. Wilmington

K&L Gates comprises more than 2,000 lawyers globally who practice in fully integrated offices located on five

continents. The firm represents leading multinational corporations, growth and middle-market companies, capital

markets participants and entrepreneurs in every major industry group as well as public sector entities, educational

institutions, philanthropic organizations and individuals. For more information about K&L Gates or its locations,

practices and registrations, visit www.klgates.com.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in

regard to any particular facts or circumstances without first consulting a lawyer.

© 2014 K&L Gates LLP. All Rights Reserved.

7