Duke Law Journal THE DILEMMA OF ODIOUS DEBTS V

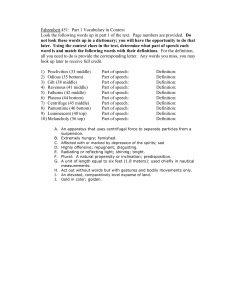

advertisement