Modern Portfolio Theory

advertisement

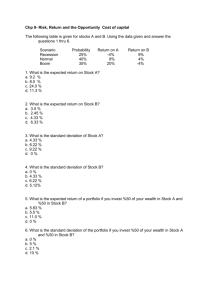

Modern Portfolio Theory Purpose: Review the highlights of portfolio theory, Value Additivity Principle, Tobin’s separation theorem -1- Why take a portfolio viewpoint? • Diversification reduces risk – Additional securities increase reward, reduce risk – Small holdings are inefficient • Individual securities are fungible (unless you have inside information) – Any stock is a perfect substitute for another in a diversified portfolio – All portfolios have the same probability of beating the safe investment -2- -3- Demonstration of Diversification • Let’s start with one stock picked at random Expected Return s -4- Demonstration of Diversification • Let’s start with one stock picked at random • Then, pick another and invest equally in each Expected Return s -5- Demonstration of Diversification This forms a portfolio in which: • E(R) is average of the two • sd is less than the weighted average Expected Return s -6- Demonstration of Diversification • Now, pick another stock at random Expected Return s -7- Demonstration of Diversification • Now, pick another stock at random and • Make a new portfolio with equal proportions Expected Return s -8- Demonstration of Diversification Each repetition has reduced impact as we approach Expected Return CML Mkt efficient frontier – efficient frontier – market portfolio – capital market line s -9- Highlights of Portfolio Theory • Fundamental Assumption – Two dimensions: Risk & Reward • Law of One Price Reward Market Line Risk - 10 - Measuring risk and reward for diversified portfolios • Why mean and standard deviation of return were chosen – Mean = best estimate of future performance – Standard deviation defines the confidence interval around this estimate • Together – They express the probability of an event - 11 - We Know • 67% of all events within 1 s.d. above or below the mean • 95% of all events within 2 s.d. about the mean • 99% of all events within 3 s.d. about the mean - 12 - Examples Assume: – Expected Return = 10% – Standard Deviation = 5% Find: Probability return will be 5% to 15% Probability return will be 0% to 20% Probability of return -5% to +25% - 13 - Examples Assume: – – Expected Return = 10% Standard Deviation = 5% Find: Probability of return greater than 20% Probability of losing anything - 14 - Examples Assume: – Expected Return = 10% – Standard Deviation = 5% Find: Probability of return 5% or more Probability of return 0% or more Probability of return better than negative 5% - 15 - Practice For practice in estimating probabilities, see problems 1 through 3 in the problem set Given the best available expert opinion … 95% certain … return will be somewhere in the range from 0% to 30%. Assuming a symmetric normal probability distribution, translate into a mean and standard deviation. Given the best available expert opinion … 95% certain … return will be somewhere in the range from -5% to +40%. Assuming a symmetric normal probability distribution, translate into a mean and standard deviation. An investment has expected return of 10% with standard deviation of 2%. Assuming the probability distribution is symmetric normal, what is the probability of return 12% or higher? - 16 - Implication: • A simple investment rule is implied by the linear relationship between mean return and standard deviation: – All portfolios on the CML have the same probability of earning a higher return than Treasury Bills E(R) CML 9% 7% 5% s 2% 4% - 17 - Practice For practice in calculating probabilities of beating the T-bill rate, see problems 4 & 5 in the problem set An investment has expected return of 12% with standard deviation 3%. Return on U.S. Treasury bills is 6%. What is the approximate probability that the risky investment will perform better than Treasury Bills? An investment has expected return of 10% with standard deviation 2%. Return on U.S. Treasury bills is 8%. What is the approximate probability that the risky investment will perform better than Treasury Bills? - 18 - Markowitz Formulae • Expected Return for a Portfolio n R p = Â wi Ri i=1 • Variance n n s 2p = Â Â wi w j s i s j rij i=1 j=1 • Standard deviation is square root of variance - 19 - Example Calculations • Expected Return for a Portfolio Security 1 Security 1 Security 2 Security 3 n R p = Â wi Ri i=1 Security 2 Security 3 Weight x Mean Weight x Mean Weight x Mean - 20 - Example Calculations • Expected Return= 16.5% Security 1 Security 1 n R p = Â wi Ri i=1 Security 2 Security 3 .2 x 10% Security 2 .3 x 15% Security 3 .5 x 20% - 21 - Example Calculations • Expected Return= 14% Security 1 Security 1 Security 2 Security 3 n R p = Â wi Ri i=1 Security 2 Security 3 .5 x 10% .2 x 15% .3 x 20% - 22 - Practice For practice in calculating expected return of portfolios, see problems 6 & 7 in the problem set Calculate the expected return for a portfolio made from equal proportions of investments with expected returns of 10%, 12%, and 14%. Calculate the expected return for a portfolio with $200 invested in stock A, $300 in stock B, and $500 in stock C. Expected returns for the individual stocks are 10% for stock A, 12% for stock B, and 14% for stock C. - 23 - Example Calculations • Variance n n s 2p = Â Â wi w j s i s j rij i=1 j=1 Security 1 Security 1 Security 2 Security 3 Security 2 Security 3 w12 s12 w2 w1s 2 s1r 21 w3w1s 3s1r31 w1w2s1s 2r12 w22 s 22 w3w2 s 3s 2r32 w1w3s1s 3r13 w2 w3s 2s 3r23 w32 s 32 - 24 - Practice For practice in calculating standard deviation for portfolios, see problems 8 & 9 in the problem set 8. Suppose a portfolio is has equal proportions of investments with standard deviation of 10%, 12%, and 14%, respectively. Which of the following could possibly be the standard deviation of the returns for the portfolio? A. 14% B. 15% C. 9% D. 20% 9. Suppose a portfolio includes $200 invested in stock A, $300 in stock B, and $500 in stock C. Standard deviations for the individual stocks are 10% for stock A, 12% for stock B, and 14% for stock C. Which of the following could possibly be the standard deviation of the returns for the portfolio? A. 14% B. 13% C. 8% D. 15% - 25 - Practice For more practice in estimating the mean return and standard deviation for a portfolio, see problem 10 in the problem set - 26 - Example: Mean Return TCS TCS ACU .4 * 15% ACU .6 * 20% Mean = 6% + 12% = 18% - 27 - Example: standard deviation TCS TCS (.4 * .05)2 ACU 2(.4*.6*.05*.1*.2) ACU (.6 * .1)2 Variance = 0.0004 + 0.0036 + (2 * 0.00024) = .00448 Standard Deviation = 6.69% - 28 - Practice For more practice in estimating the mean return and standard deviation for a portfolio, see problem 10 in the problem set - 29 - Under what circumstances would mean and standard deviation be insufficient? • Skewed distributions – i.e., options • “Fat-tailed” distributions – i.e., day-to-day returns for individual stocks - 30 - Practice See problem 11 in the problem set Cost: 10,000 Recovery: 9,000 0.6 0.5 0.4 Possible Outcomes: -1000 0 15000 0.3 Probablity 0.2 0.1 0 -1000 15000 - 31 - Efficient Frontier • Is there a dominant portfolio? • Why is efficient frontier concave? • Could all investors agree on an “optimal portfolio”? Expected Return B A C efficient frontier standard deviation - 32 - Practice For practice in recognizing dominant portfolios, see problems 12 & 13 in the problem set A: B: C: 12% 12% 14% 5% 7% 5% A: B: C: 15% 15% 14% 9% 7% 8% - 33 - Tobin's capital market theory • The capital market line • Now, is there a dominant portfolio? • Optimal investment strategy – the second separation theorem Expected Return CML P* efficient frontier Rf standard deviation - 34 - Practice See problem 14 in the problem set Someone says that a risk-averse investor should select a portfolio of low-risk stocks such as utilities, plus longmaturity municipal bonds … “Broad Index too risky” … “Treasury Bills have too little return” What is wrong with this advice? - 35 - Practice See problem 15 in the problem set Jones is risk averse. Smith is more risk tolerant. Can both be satisfied with portfolios built around an index fund and a money market fund? - 36 - Practice: See problem 16 in the problem set Market portfolio, 95% confidence interval: -20% to +40% Expected Return = 10% Standard Deviation = 15% Target portfolio, 95% confidence interval: -7.5% to +22.5% Expected Return = 7.5% Standard Deviation = 7.5% Safe Rate is 5% - 37 - Problem 16 • A simple solution: – Half the money in the market portfolio, and half in treasury bills E(R) CML 10% 7.5% 5% s 7.5% 15% - 38 - Practice: See problem 17 in the problem set Market portfolio, 95% confidence interval: -4% to +28% Expected Return = 12% Standard Deviation = 8% Target portfolio, 95% confidence interval: +2% to +10% Expected Return = 6% Standard Deviation = 2% Safe Rate is 4% - 39 - Problem 17 • A simple solution: – 25% of the money in the market portfolio, and 75% of the money in treasury bills E(R) CML 12% 6% 4% s 2% 8% - 40 - Diversification reduces risk • A relatively small portfolio (12 to 15 securities) does a very good job. • Portfolio performance reverts to mean - 41 - Practice See problem 18 in the problem set - 42 - This leads to the Value Additivity Principle: • Diversification has no market value – If it did, there would be easy arbitrage opportunities – Conclusion: the value of the whole just equals the sum of the values of the parts • This realization serves as the springboard into Asset Pricing Theory – Which computes value based on an asset’s contribution to the risk and return of a portfolio • Does completing the market add value? – Answer: Yes – Conclusion: value of whole may be less than sum of parts - 43 - Discussion Questions • Why pay for an investment manager? • Who can pick stocks? • Who can time the market? • Do people need professional help with asset allocation? • Why revise portfolio? • Who is best advisor: broker, accountant, or lawyer? When capital markets are efficient - 44 -