Document 13453921

advertisement

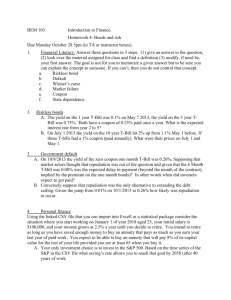

Problem Set 5 More Arbitrage Bonds as commodities (Problem 1) $1,017,408.41 7.00% $1,000,000 NY today NY 90 days 7.50% 7.25% NY 270 days $1,055,739.13 Profit = $650.46 $1,055,088.67 1 Bonds as commodities (Problem 2) $1,035,630.37 7.10% $1,000,000 NY today NY 180 days $1,035,758.04 7.50% 7.25% NY 270 days $1,055,088.67 Profit = $127.67 Bonds as commodities (Problem 3) $1,017,408.41 7.00% $1,000,000 NY today $1,017,634.17 7.15% 7.12% Profit = $225.76 NY 90 days NY 180 days $1,035,732.50 2 Problem 4 • Moving from 0% coupon to 6% coupon Adds extra income of $6 per year Adds $38.28 to price ($75.08 minus $36.80) • Moving from 6% coupon to 8% coupon Adds extra income of $2 per year Adds $3.92 to price ($79 compared with $75.08) Therefore an extra $6 per year should cost three times as much, $11.76 • The 0% bond is a bargain Problem 4 0 1 2 19 20 Sell $300.32 $12 $12 $12 $412 Buy $237.00 $12 $12 $12 $312 Buy $36.80 0 0 0 $100 0 0 0 Net $26.52 0 NPV is clearly positive 3 Problem 4 Yield 11.60% 10.24% 10.00% Risk (Convexity) Problem 5 • Moving from 6% coupon to 8% coupon Adds extra income of $2 per year Adds $9 to price ($76 compared with $67) • Moving from 8% coupon to 10% coupon Also adds extra income of $2 per year But, adds $12 to price ($88 compared with $76) • Therefore, the 10% bond is over-priced (compared with the 8% bond) 4 Problem 5 0 1 2 19 20 Buy $152.00 $8 $8 $8 $208 Sell $67.00 $3 $3 $3 $103 Sell $88.00 $5 $5 $5 $105 0 0 0 Net $3.00 0 NPV is clearly positive Problem 5 12.22% Yield 12.10% 11.68% Risk (Convexity) 5 Problem 6 Yield 8% 8% 7.75% Risk (Convexity) Problem 6 0 1 11 12 Sell $181.36 $6 $6 $6 Buy $90.61 $3 $3 $103 Buy $88.35 $3 $3 Net $2.40 0 0 $100 $3 $203 $3 $103 $3 14 13 15 16 $6 $206 $3 $3 $3 $103 NPV is always positive 6 Problem 7 8.5% Yield 8% 8% Risk (Convexity) Problem 7 0 1 11 12 Buy $174.00 $6 $6 $6 Sell $90.61 $3 $3 $103 Sell $88.35 $3 $3 Net $4.96 0 0 $100 $3 $203 $3 $103 $3 14 13 15 16 $6 $206 $3 $3 $3 $103 NPV is always positive 7 Problem 8 Yield 8.50% 8.38% 8.00% Risk (Convexity) Problem 8 0 1 11 12 Sell $178.88 $6 $6 $6 Buy $88.44 $3 $3 $103 Buy $86.35 $3 $3 Net $4.09 0 0 $100 $3 $203 $3 $103 $3 14 13 15 16 $6 $206 $3 $3 $3 $103 NPV is always positive 8 Problem 9 Yield 8.5% 8% 8% Risk (Convexity) Problem 9 0 1 11 12 Sell $178.88 $6 $6 $6 Buy $90.61 $3 $3 $103 Buy $85.70 $3 $3 Net $2.57 0 0 $100 $3 $203 $3 $103 $3 14 13 15 16 $6 $206 $3 $3 $3 $103 NPV is always positive 9 Problem 10 Yield 8% 7.75% 7% Risk (Convexity) Problem 10 0 1 11 12 Buy $181.36 $6 $6 $6 Sell $90.61 $3 $3 $103 Sell $93.95 $3 $3 Net $3.20 0 0 $100 $3 $203 $3 $103 $3 14 13 15 16 $6 $206 $3 $3 $3 $103 NPV is always positive 10 Equities as commodities (Problem 11) $ 1,500,000 CHF 1,725,000 ZUR today CHF 1.15 Spot 1500 Future 1575 Dividend 1% R = 6% CHF 1,776,799.41 ZUR later NY today =$1 CHF 1.14 =$1 CHF 1,812,600 Profit = CHF 35,800.59 NY later $ 1,590,000 What is not balanced? Problem 12 • Suppose you know Exxon will announce bad news – Beta is 0.95 – Describe a no-money-in, hedged position designed to benefit from the information 11 Problem 13 • Suppose you know GM will announce bad news – Beta is 1.05 – Describe a no-money-in, hedged position designed to benefit from the information Problem 14 Score Prime $ $ 0 X S Primes get dividends plus appreciation up to defined point 0 X S Scores get remaining appreciation What if Prime + Score > Stock? 12 JunkCo Arbitrage Illustration of a Floating/Fixed Swap Party Variable Variable Underwriter Fixed Counterparty Fixed If net is positive, underwriter pays party. If net is negative, party pays underwriter. JunkCo Arbitrage Lender Lender T + 3% JunkCo 11% Fixed T-Bill T-Bill Underwriter 11% Fixed AAA Corp 11% Fixed T-Bill Net for Underwriter: • Net flows are zero • Gains fees, future opportunities, & goodwill Net for JunkCo: • Net is 14% fixed • This is better than JunkCo could do by itself After 1st year Sinking Fund Net for AAA Corp: • During 1st year, borrows at T-Note rate • During remaining time, net flow is zero • This is better than AAA could do by itself 13 JunkCo Arbitrage How is this possible? Answer: Quality gap is inconsistent Junk Quality Gap Rate AAA Yield Curves Maturity Myron Labs Arbitrage Variation on a currency swap 8% Fixed, £ Principal 8% Fixed, $ Principal 1 1 BT, £ Principal BT, $ Principal 1st yr £ Principal after 1st yr Intermediary Myron Labs BT + 2% Lender £1,000,000 After 1st year $2,000,000 $2,000,000 End of last year £1,000,000 Advanced Devices Lender 8% Fixed BT-Bill Volatility After 1st year Sinking Fund, £ Dynamic Hedge 14 $5mm + Appreciation Fixed BT PEFCO 1% Coupon Undisclosed Flow Appreciation Appreciation What happens to Tokyo Index? Nikkei Put Warrants (Bringing Dep Public Market Option Premium At Beginning Depriciation At Maturity Dep Flow Kingdom of Denmark Flow Goldman Sachs innovation to retail) Counterparty SCPERS $5 mm Counterparty PENs 15 App App Flow Dep Price Public Market Flow Kingdom of Denmark $5mm + App Fixed BT 1% PEFCO SCPERS $5 mm Goldman Sachs Alternative Plan Dep Volatility Dynamic Hedge 16