Math 490: Computer Assignment

Math 490: Computer Assignment

Turn in short responses to each of the questions below along with a spreadsheet to show your work. You may turn this in electronically via e-mail or as a hard copy.

Due: May 3rd (Last day of class)

Modified Duration and Convexity

Find file on Blackboard: Math490 Bond Price.xls

Modified Duration and Convexity can be used to predict price changes due to changes in interest rates. For this we make two major assumptions

• there is a single interest rate i for all lengths of investment (flat yield curve)

• the cash flows we are using do not depend on the interest rate

Let P ( i ) denote the present value of a set of cash flows c t at interest rate i (i.e. the price ). By Taylor’s theorem we can approximate the percent change in price if interest rates change by amount :

P ( i + ) − P ( i )

≈

P ( i )

P

0

( i )

P ( i )

+

2

2 P

00

( i )

P ( i )

= − v +

2

2 c where v is the modified duration and c is the convexity . It shouldn’t take too much to verify the following formulas:

P ( i ) =

X

1

(1 + i ) t c t t v ( i ) =

1

1 + i

X

1 t

(1 + i ) t c t t

P c ( i ) =

1

(1 + i ) 2

X

1 t ( t + 1)

(1 + i ) t c t t

P

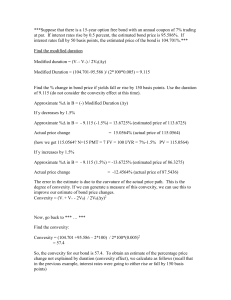

Consider the following bond: Par: $1000, Semi-annual Coupon rate: 6.1%, redeemable at Par in 6 years.

1. Calculate the Modified Duration and Convexity of this bond at yield rate i = 10% compounded semi-annually.

2. For interest rates 8 .

00% , 8 .

25% , . . . , 11 .

75% , 12 .

00% estimate the relative change in the price of this bond using just the modified duration term from the Taylor expansion above. How does this compare to the actual percent change? Now estimate the bond

price. How does this compare to the actual bond price for these yield rates? Does the linear term seem good enough?

3. Do the same, but now include the convexity term. Does this work better?

4. Now consider 12 level payments of $1000 (occuring every six months). How do the modified duration and convexity change? Does ignoring the convexity term seem like a better idea in this case?