Document 13453894

advertisement

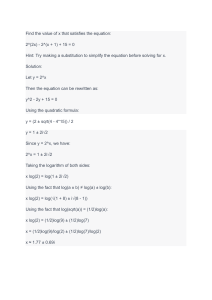

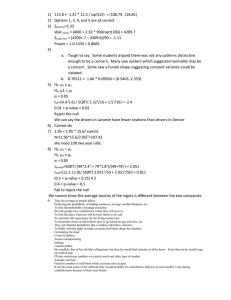

2/16/12 Problem Set 3 Option Pricing and Hedging Problem 1 C(S,X,t) + B(X,t) = S + P(S,X,t) $12 + $86 $98 $95 + $2.50 $97.50 Profit = 50 cents 1 2/16/12 Problem 2 C(S,X,t) + B(X,t) = S + P(S,X,t) $11 + $42.70 $53.70 $50+ $3 $2+ $47.44 $50+ $5 $53 $55 $49.44 Build a Box! Problem 2 So, what comes from building the box? Initially: $11–$3+42.70 –$2+ $5–$47.44 = $6.26 At expiration you will pay$5 no matter what 45 50 S $50 – $45 = $5 Receive more now than you pay later! 2 2/16/12 Problem 3 C(S,X,t) + B(X,t) = S + P(S,X,t) $14.50 + $80.75 $95.25 $11.875+ $85.50 $97.375 $91.50+ $3.75 $95.25 $91.50+ $5.875 $97.375 Build a box & borrow at riskless rate Problem 4 • If stock goes up by $2, call will go up by less than $2 • The only choice that fits is answer b (rise by $1.80) 3 2/16/12 Problem 5 • More time means more value for option • Both options have same exercise price and same underlying asset • So, Option B is worth more than Option A (choice B is correct) Problem 6 • For a call option, lower exercise price means more value for the option • Both options have same expiration • So, Option A is worth more than Option B (choice A is correct) 4 2/16/12 Problem 7 • Remember Put-Call Parity: C(S,X,t) + B(X,t) = S + P(S,X,t) • This rearranges to C(S,X,t) = S – B(X,t)+ P(S,X,t • If interest rate goes up, value of bond goes down, so less would be subtacted • So, call premium would rise. Choice A is correct Problem 8 • PV = $50 * e(-179/365*0.05) = $48.79 5 2/16/12 Problem 9 • d1 = (ln(56/48.79))/.2*sqrt(179/365) + .5(.2*sqrt(179/365) = 1.0543 • d2 = (ln(56/48.79))/.2*sqrt(179/365) – .5(.2*sqrt(179/365) = 0.9142 • Delta is 0.8541 • Call premium is $7.84 • Put premium is $0.6275 6