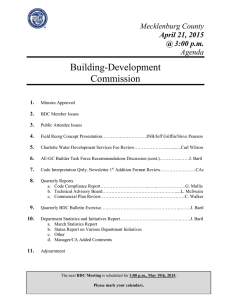

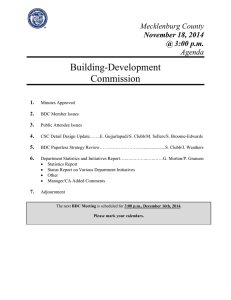

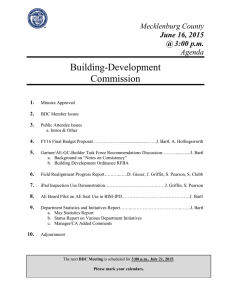

Building-Development Commission Mecklenburg County

advertisement

Mecklenburg County February 17, 2015 @ 3:00 p.m. Agenda Building-Development Commission 1. Minutes Approved 2. BDC Member Issues 3. Public Attendee Issues 4. AE-GC-Builder Task Force Report / Best Practice……….….J.Bartl/G.Morton/P.Granson 5. Adjournment The next BDC Meeting is scheduled for 3:00 p.m., March 17th, 2015. Please mark your calendars. BUILDING DEVELOPMENT COMMISSION Minutes of January 20, 2015 Meeting Jonathan Bahr opened the Building-Development Commission (BDC) meeting at 3:07 p.m. on Tuesday, January 20, 2015. Present: Jonathan Bahr, Rob Belisle, Tom Brasse, Melanie Coyne, Bernice Cutler, Travis Haston, Hal Hester, Ed Horne, Ben Simpson and John Taylor Absent: Chad Askew 1. MINUTES APPROVED Bernice Cutler made the motion to approve the BDC Meeting Minutes from the January 20th meeting; seconded by Ed Horne. The motion passed unanimously. 2. BDC MEMBER ISSUES Tom Brasse asked for an update on the County City collaborative to repair the holds process. Jim Bartl replied that we are working on it and have a three (3) part strategy to address it. Tom Brasse asked how many demo permits we have per month and is it broken out by residential and commercial? Patrick Granson stated that this is difficult to break out; although we can break it out by UCC codes. There is total demo and renovation demo. The total demo is what you look for. Jonathan Bahr asked how this information is beneficial. Tom Brasse shared that it allows him to see how many projects are being built on areas that had a structure previously. 3. PUBLIC ATTENDEE ISSUES No public attendee issues. 4. BDC BUDGET SUBCOMMITTEE WORK Jim Bartl discussed the upcoming budget subcommittee work and the memo in draft that will be distributed to budget members. The Department has tentatively planned these meetings for Friday, Feb. 6th, Wednesday, Feb. 25th and Friday March 13th with meetings lasting 2-3 hours. The March 17th BDC meeting will be entirely made up of the budget presentation. Jim stated last year’s volunteers as Jonathan Bahr, Elliot Mann, John Taylor, Travis Haston and Bernice Cutler/Chad Askew then asked for volunteers for the FY16 budget subcommittee work. Volunteers included Jonathan Bahr, Travis Haston, Tom Brasse, John Taylor (problem w/ the 26th but can attend all others). Bernice Cutler suggested collaborating with Chad Askew and tag teaming the subcommittee meetings since she is only available to attend the 2nd budget subcommittee meeting being held on Wed. Feb. 25th. Bernice to contact Chad Askew then get back to JNB if this works. Jonathan Bahr asked that JNB contact Jon Morris to see if he would be interested in participating on this budget subcommittee. Ed Horne suggested that previous BDC member Wanda Towler did a great job on the budget subcommittee in the past. 5. UPDATE STATUS OF HYBRID COLLABORATIVE DELIVERY TEAM Howard Grindstaff presented an update status on the Hybrid Collaborative Delivery Team. Team initiatives include the web page on Meckpermit.com that went live on Friday, Jan. 16th, have finalized the internal policy and procedures manual, Plan Submittal Guidelines Document and the HCDT BIM/IPD Process Flow Chart. Currently benchmarking the use of Surface pro with data connected through an IPhone 6 which includes data use and compatibility; ease of accessing BIM models on intranet G: drive and the use of BIM software on surface cloud account for transferring Models. Project updates include the VA Care Center with the completion of footings foundations with exterior skin 50% complete. The interior build out has begun on all levels in all phases, rough-in inspections are taking place on the basement and level 1, Plan review is ongoing as changes occur. The estimated completion date is December 2015. The Davidson College Martin Science Building has footings complete, the foundation structural elements are being erected. Most of the underground trade work has been completed. The interior build out review of model is underway with an estimated completion date June 2017. Davidson College New Athletic Building (Baker Arena) currently has footings complete and under slab trade work is complete. Slab on grade is 60% complete with structural steel erection BDC Meeting January 20, 2015 Page 2 of 8 to begin end of January. Plan review is 100% complete and estimated completion date is November 2015. Currently our open positions include one (1) BIM Navigator Position; this opening to post January 21, 2015. Four (4) HCDT Code Officials (previously approved and funded). We know there are large BIM-design/build projects in the works that will double the HCD Team’s workload in the next 9-12 months. Consequently, we requested & received permission from the LUESA Director to begin advertising and fill the 4 open HCDT positions. The team is currently working with management to identify new HCDT projects to include downtown high-rises, construction on area hospitals and construction at Charlotte Douglas Airport. BC: Do you work off a schedule from the design team? HG: The model is in the cloud, put in app with scoping letter approve at that time and move forward. BC: Do they typically have semi-weekly meetings that you get invited to? HG: VA yes, at one point in VA we went to RPA design once per week. BS: What makes this process better? This process saves times because reviews are going on simultaneously? JB: The cycles have been replaced by validation documents and encourages continuous dialogue; not set cycles. BS: What’s negative? HG: None. We have had nothing negative at all. JT: I asked our teams about the Davidson projects. Our teams had a different experience. Have you reached out to different contractors and owners what the experienced been so far on the pros/cons and have you created a pro/con list? HG: One of the owners of the VA contacted me after the topping out. He wanted to sit w/ me, put it down on paper and take it across the country. He had never had a project move so swift, fast and the collaboration was so good. JT: What is going to be the outlook? Our involvement w/ BIM is that it is different w/ every project. How is Building Standards going to incorporate it after going through the test pilots? JB: We are assuming it is going to be different. RB: What is the fee? JB: Hourly on the plan review side and will come back to you on the inspection side once we have assessed this. HG: At every preliminary we give an estimate timeframe per trade. BC: See strong benefit on inspection end and will go back and look at that? HG: We are already seeing it. RB: How are you identifying folks that can change direction and be open minded on procedures that can be done? JB: Hiring process having a strong understanding that this is different and doesn’t run the way typical P&I processes work. It’s a hard agreement that is working well. TB: Can’t see this on your iPad now? HG: We can. You can give me rights to log into your cloud account. Jim shared that if other questions, Howard will stay after the meeting to answer all your questions. 6. QUARTERLY REPORTS Code Compliance Report Joe Weathers provided the Code Compliance Report as listed below: o Note; all of the Department quarterly reports we’re available in the drop box last week. You should have received an e-mail around last Friday (Jan 16) from Rebecca advising of same. o “Not ready”; Bldg – 6.98% (was 7.31%), Elec – 7.52% (was 8.54%), Mech – 6.71% (was 5.6%), plbg – 7.93% (was 9.45%) o Rough/finish % split varies, some up, some down o Bldg; rough @ 36.81% (was 39.52%), finish @ 21.67% (was 19.63%) o Elec; rough @ 23.29% (was 19.89%), finish @ 52.02% (was 53.52%) o Mech; rough @ 29.49% (was 30.62%), finish @ 52% (was 58%) BDC Meeting January 20, 2015 Page 3 of 8 o o Plbg; rough @ 26.01% (was 30.32), finish @ 41.25% (was 40.57%) “Top 15” repeating topics; building at 87%, Electrical at 93%, Mech at 74% and Plbg at 87% Technical Advisory Board Quarterly Report Lon McSwain reported that The TAB held no meetings in the last quarter. Consistency Team Report Lon McSwain summarized the Consistency Team Report as listed below: o Building: held three sets of meetings this quarter. Bldg-Residential: addressed a total of 17 questions. Contractor attendance averaged 7.5 at each meeting. Bldg-Commercial: addressed a total of 24 questions. There were no contractor or AE attendees at any of these meetings. Bldg December meeting: the regular meeting was replaced by the December 3 legal presentation, followed by a presentation on Chapter 4 of the NC Energy code by an outside vender. o Electrical: held two consistency meetings. In total, the October and November meetings addressed 30 topics, with 14 contractors attending the November meeting. The December meeting was conducted by an outside vendor discussing Hazardous locations surrounding fuel dispensers and proper wiring methods. o Mechanical/Fuel Gas: there were two Mechanical/ Fuel Gas meetings, addressing 12 Mechanical questions. Contractors attending included 4 in October and 7 in November. The December meeting was cancelled due to the holiday. o Plumbing: there were two Plumbing meetings, addressing 14 questions. Contractors attending included 3 in October and 4 in November. The December meeting was cancelled due to the holiday. Commercial Plan Review Report Part I: 65% of projects pass on 1st rev’w (down from 74%); 91% passed on 2nd rev’w (up from 81%) o pass rates on 1st review by trade: Bldg–75% (was 84%); Elec – 88% (was 89%); Mech – 85% (was 81%); Plbg – 82% (was 81%); Part II: most common defects: examples Bldg: Appendix B, exit related (3), structural, UL assembly , energy summary, hardware, Elec: services/feeders, general, branch circuits, grounding & bonding, transformers, swimming pools, class 1 locations Mech: eqpt location & installations, duct systems, exhaust, fresh air req’t, gas pipe size & inst’l, gas eqpt installation Plbg: plbg syst inst’l, drainage piping, venting, minimum facilities, water distr piping & mat’ls, water heater installation, traps Part III: 1st use of “approved as noted” (AAN) at 34% by all trades on average (last quarter was 35%) biggest users; CFD (84%) and MCFM (78%) critical path users; Bldg (30%, down from 32%), Elec (15%, up from 14%), Mech (13%, down from 15%), Plbg (10%, down from 12%) So Bldg and M/P down 2%, Elec up a little. Clarification on Commercial Plan Review Stats sent to members on February 10th, 2015. The Commercial Plan Review numbers on individual discipline pass rates were double checked. The 1st cycle pass rates read in the meeting were correct at: Building 75%, Electrical 88%, Mechanical 85%, and Plumbing 82%. The projection also indicated the total average discipline pass rates for all cycles. These were also correct at Building 84%, Electrical 86%, Mechanical 88%, and Plumbing 88%. BDC Meeting January 20, 2015 Page 4 of 8 7. QUARTERLY BDC BULLETIN EXERCISE Previous bulletin topics: January, 2013 IOS Commercial score of 1 BOCC approves 21 positions April, 2013 Change of BDC leadership Lien agent legislative change July, 2013 Ft14 Code Enforcement budget proposal October, 2013 New BDC members Racking permit process discussions Status of 12/4/2012 betterment Economic data trends and betterment proposal Code interp search engine goes live Revisions to inspections auto notification Trends considered in Fy14 budget development CTAC-EPS installation takes Dept to 98% paperless POSSE upgrade announcement Fy14 budget technology enhancements Owner-developer webpage and “starting a small business” webpage BIM-IPD and future Department challenges January, 2014 April, 2014 Role of the BDC CA web search engine available 2014 CSS survey distribution Customer Service Center design project work HCD Team concept CSC design project BDC discussion of BCC 6 year code cycle proposal BDC Select Comm to meet with industry IRT Subcommittee recommendation to add inspector positions July, 2014 Customer Service Center Project status Phased Occupancy Best Practice Summary October, 2014 AE-GC-Builder Task Force startup and progress MF Elec Service revised DOI interpretation Reminder on paperless review process Select Committee status and following Task Force work AE feedback tool Fy14 results Overview of the Department’s work BDC Select Committee completes assignment January, 2015 Gartner Report Status AE-GC-Builder Task Force Recommendations Best Practice Summaries Hybrid Collaborative Delivery (HCD) Team Progress Looking Forward to the FY16 Budget Process 8. DEPARTMENT STATISTICS AND INITIATIVES REPORT Permit Revenue: December permit (only) rev - $1,512,231, compares to November permit rev - $1,314,145 Fy15 budget projected monthly permit rev = $1,716,109; so Dec is $204k below projection YTD permit rev = $10,746,524, is above projection ($10,296,655) by $450k or 4.37%. o Note: for comparison, December 2013 permit (only) revenue was $1,681,309 Construction Value of Permits Issued: November total - $326,300,737, compares to November total - $295,546,037 BDC Meeting January 20, 2015 Page 5 of 8 YTD at 12/31/14 of $2,654,418,991; 37% above Fy14 constr value permitted at 12/31/14 of $1.930M Permits Issued: Nov Dec 3 Month Trend 3879 3872 4490/4784/3879/3872 Residential 2226 3237 2855/2835/2226/3237 Commercial 387 461 434/546/387/461 Other (Fire/Zone) 6492 7570 7779/8165/6492/7570 Total Changes (Nov-Dec); Residential same; commercial up 45%; total up 16.6% Note; after 6 months, SF new construction permits total 1637; up 8% from 1517 SF permits at 12/31/13 Inspection Activity: Inspections Performed: Insp. Req. Nov Dec Insp. Perf. Nov Dec % Change Bldg. 5944 6532 Bldg. 5872 6327 +7.75% Elec. 6413 7198 Elec. 6376 7275 +14.1% Mech. 3541 4163 Mech. 3437 4313 +25.5% Plbg. 2865 3092 Plbg. 2835 3119 +10% Total 18,673 20,985 Total 18,520 21,034 +13.57% Changes (Nov-Dec); all trades down 23-25%; Insp performed were 100.2% of insp requested Inspection Activity: Inspections Response Time (New IRT Report) Total % After 24 Hrs. Late Total % After 48 Hrs. Late Average Resp. in Days Insp. Resp. Time Nov Dec Nov Dec Nov Dec Nov Dec Bldg. 80.2 81.9 96.2 96.7 99.13 99.5 1.24 1.24 Elec. 61.3 59.9 94.1 93.1 99.2 99.4 1.45 1.47 Mech. 60.3 44.9 92.2 74.1 98.8 94.5 1.48 1.87 Plbg. 77.5 67.6 98.1 96.7 99.9 99.5 1.23 1.37 Total 69.6 64.6 95.0 90.8 99.2 98.5 1.35 1.47 OnTime % Per the BDC Performance Goal agreement (7/20/2010), the goal range is 85-90%, so the IRT report indicates the December average is currently 20.4% below the goal range. Inspection Pass Rates for December, 2014: OVERALL MONTHLY AV’G @ 81.63% in November, compared to 82% in November Bldg: November – 76.87% Elec: November – 78.97% December – 77.36% December – 77.77% BDC Meeting January 20, 2015 Page 6 of 8 November – 86.04% Plbg: November – 90.34% December – 84.61% December – 90.59% Bldg and Plbg up <1/2%; Elec down 1%, Mech down 1.4% Overall average down <1/2% from last month, and above 75-80% goal range Mech: OnSchedule and CTAC Numbers for December, 2014: CTAC: 78 first reviews, compared to 108 in November. Projects approval rate (pass/fail) – 64% CTAC was 32% of OnSch (*) first review volume (78/78+162 = 240) = 32.5% *CTAC as a % of OnSch is based on the total of only scheduled and Express projects OnSchedule: November, 13: 207 -1st rev’w projects; on time/early–95.87% all trades, 94% B/E/M/P only December, 13: 157 -1st rev’w projects; on time/early–96% all trades, 92.5% B/E/M/P only January, 14: 252 -1st rev’w projects; on time/early–92.38% all trades, 94% B/E/M/P only February, 14: 199 -1st rev’w projects; on time/early–85% all trades, 95.25% B/E/M/P only March, 14: 195 -1st rev’w projects; on time/early–97.38% all trades, 95% B/E/M/P only April, 14: 242 -1st rev’w projects; on time/early–94% all trades, 90.5% B/E/M/P only May, 14: 223 -1st rev’w projects; on time/early–97.63% all trades, 96% B/E/M/P only June, 14: 241 -1st rev’w projects; on time/early–94% all trades, 95% B/E/M/P only July, 14: 203 -1st rev’w projects; on time/early–90.4% all trades, 96% B/E/M/P only August, 14: 248 -1st rev’w projects; on time/early–85.75% all trades, 96% B/E/M/P only September, 14: 189 -1st rev’w projects; on time/early–92% all trades, 94.75%B/E/M/P only October, 14: 239 -1st rev’w projects; on time/early–95% all trades, 94%B/E/M/P only November, 14: 194 -1st rev’w projects; on time/early–95.6% all trades, 95.25% on B/E/M/P only December, 14: 203 -1st rev’w projects; on time/early–95.25% all trades, 94.25% on B/E/M/P only Booking Lead Times: o On Schedule Projects: for reporting chart posted on line, on December 29, 2014, showed o 1-2 hr projects; at 2 work days booking lead, except Health-4 and City Zoning - 6 work days o 3-4 hr projects; at 2 work days lead, except Health-4 and City Zoning - 6 work days o 5-8 hr projects; at 3-6 days, except Health at 9 work days o CTAC plan review turnaround time; BEMP at 4 work days, and all others at 1 day. o Express Rev’w booking lead time; 10 work days for small projects, 19 work days for large projects Status Report on Various Department Initiatives Follow-up from BDC December Meeting Discuss Gartner recommendations with AE-GC-Builder Task Force In meeting #7 the Task Force reviewed the Gartner Executive Summary recommendations, in comparison to the Task Force work on the 19 action items referred by the BDC. In meeting #8 the Task Force agreed to a specific recommendations related to Gartner’s report, which will be included in the Task Force Final Report, to be delivered to the BDC in their February meeting. BDC Meeting January 20, 2015 Page 7 of 8 Organize BDC Participation in “Best Practice” Discussions Best Practice discussions held with the industry on Commercial inspections; Monday, January 5, with 5 construction industry attendees; on Residential inspections; Tuesday, January 6, with 6 construction industry attendees; and on Commercial Plan Review; January 9, with 15 AE attendees. The plan moving forward to confirm results of all three sessions includes meeting notes distributed to session attendees, along with a draft of best practice summaries for both inspection requests (how the work is presented to the Department) and inspections performed (how the inspector goes about their work). After incorporating any final comments, a final drafts will be distributed to TF members before the January 22 and Feb 5 meetings. The final draft will be incorporated in the Task Force Final Report and presented to the BDC in their February 17 meeting. Consistency Data Report Follow-up on Defect Codes This is a follow up to July 15 and Sept 16 meeting discussions with the BDC on the Consistency Data Report work executed by the Department at the request of upper County Management. Topics to cover, identified in JNB’s Sept 8 memo to BDC members, include develop common language among the individual trade defect lists. The defect lists were initially developed in 1998 on a trade-by-trade basis with industry representatives; consequently, the same topics may use different language in differing trades. An example of this is “not ready” vs. “task requested is incomplete”. Another is “defect on previous list not corrected”. Develop common criteria for the use of “too many defects to list”. Eliminate obsolete terms; such as “call clerk”, replacing with direct connection to inspection failure information on the web. Develop new tools for paper based sites; so that failure notes left on site are also auto entered into the project’s POSSE record. Eliminate all code defect references to “other; further research required. In a meeting on November 3, items ‘’, ‘c’ and ‘e’ were resolved, as reported in the December Special Report to the BDC. The 2nd meeting to discuss item “b” (“too many defects to list”) and ‘d’ is scheduled for Feb 3rd at 10-11:30am in Hoffman conference room. AE-GC-Builder Task Force The Task Force held meetings on December 18th and January 7th. Work is now focused on wrapping up the Best Practice summaries and developing a final report. Task Force meetings scheduled in the next month include: Meeting #9; Thursday, January 22 Topic #2 ; AE-plan review Best practice summary conclusions Continue review of final report Meeting #10; Thursday, February 5 Topic #2 ; GC-inspector Best practice summary conclusions Complete review of final report Wrap up all TF work We would like to deliver this report to you in the February 17th meeting. The front end of the report summarizes all the task force work and has 5 parts w/ 17 pages, the appendix is over 110 pages. Our goal is to take the next 4 days to make the remaining changes then send the document to you on February 10th or 11th so you will have a week to review prior to our next BDC meeting. The four items that will come out of this will require recommendation on action by the BDC. #4 Training on services/mechanisms/staff roles #5.5 Consistency #17 Contractor priority based on pass rates #18 Inspection trip time allocation Jim reiterated we would send e-copies on February 10th or 11th. He also asked if any members would like paper copies. T. Brasse, T. Haston, B. Cutler, R. Belisle, R. Kiser Updates on Other Department Initiatives in the Works Customer Service Center (CSC) Design Project Patrick Granson shared that an RFBA will go before BOCC in February. This pushes back our Phase I regarding acquisition of technology and process consultant; the four added positions are part of Phase II. Staffing to include a Senior Customer Liaison/CSC Manager, Sophia Hollingsworth started Jan. 5; BDC Meeting January 20, 2015 Page 8 of 8 currently orienting to our mission, processes, and customer base. Offering on training coordinator position currently in the works. Acquisition of Phase I tech purchases and process consultant (to define next steps & workflows) pending BOCC ok of RFBA. Also relates to Gartner report discussed in December. Next steps include incorporating findings from Gartner report, as instructed by CM and LUESA Director. Train manager and training coordinator; they will then spearhead work on developing CSC Answer Book, processes and workflows and actual CSC startup. Purchase tech/hire tech & workflows consultant. Phase 1 (all of above) to be in place by March 31; followed by hiring of remaining two customer liaison positions. The design criteria frame of reference will be the 3 parts the BDC accepted on 5/20/2014, including; design criteria grid, how the CSC might work, and supporting tech list. Specific features included in the strategy are “tiered deployment” as requested by the CSC Focus Group. Interim space plan, until plans for relocation to former Charlotte School of Law Building are finalized. Ideally, this move will include a custom space for the CSC. CSC won’t replace PM-CEM’s ownership of projects, problems and resources to solve them. PM/CEM Support Pilot Revising the draft responsibility list to include MCFM related issues. Managers and staff still working to review/confirm; goals and expectations, duty list, and BDC streamlining pilot. Directors are studying staffing strategies with HR and LUESA leadership, to initiate the pilot as soon as possible. 7. MANAGER/CA ADDED COMMENTS Chuck Walker shared that the local PENC chapter on 2-14th needs graders or proctors at the Cone Center UNCC. Rob Belisle also shared they are looking for donations. Melanie Coyne asked where we are in raising some of the salary levels. JNB shared that the directors are currently working with Maia Setzer on this. 8. ADJOUNMENT The January 20th meeting of the Building Development Commission adjourned at 4:35 p.m. Next meeting of the Building Development Commission is scheduled for, Tuesday, February 17, 2015. INCREASE/DECREASE Building Permit Revenue Fiscal YTD January 2015 Permit Revenue = $1,550,736 FY15 Year-To-Date Permit Revenue = $12,297,260 2.87% above Projected YTD Permit Revenue Building Permit Revenue $25,000,000.00 $20,000,000.00 $15,000,000.00 $12,297,260.00 $10,746,524.00 $10,000,000.00 9,234,293.00 7,920,148.00 5,910,480.00 $5,000,000.00 3,794,721.00 2,079,120.00 $0.00 Projected Revenue Actual Revenue 836,225 Dec-10 Feb-11 1,038,733 Dec-11 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 1,314,146 1,285,337 1,550,736 1,512,231 2,009,668 2,115,759 2,079,120 1,901,786 1,715,601 1,683,122 1,693,065 1,982,761 1,850,839 1,655,765 1,549,193 1,960,638 1,822,539 1,681,309 1,610,116 1,975,965 1,913,729 1,735,610 1,575,334 1,642,508 1,550,206 1,636,152 1,461,628 Jan-13 Dec-12 1,642,006 1,477,828 1,437,356 1,200,325 1,422,721 1,528,107 Nov-12 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 1,435,293 1,361,488 1,443,556 1,535,978 2,000,000.00 May-12 Apr-12 Mar-12 Feb-12 1,155,078 1,034,529 Jan-12 1,308,747 1,324,688 1,171,784 1,039,734 1,434,551 1,291,868 1,182,380 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 1,053,631 1,024,208 1,500,000.00 Mar-11 806,942 821,110 Jan-11 1,063,264 961,032 898,073 854,523 1,141,393 995,293 Nov-10 Oct-10 Sep-10 Aug-10 Jul-10 Jun-10 May-10 Apr-10 1,000,000.00 904,248 746,607 Mar-10 745,827 0.00 Jan-10 500,000.00 Feb-10 PERMIT REVENUE 1-2009 thru 1-2015 2,500,000.00 INCREASE/DECREASE January 2015 Total = $391,339,768 FY15 YTD Total = $3,045,758,759 FY14 YTD Total = $2,247,863,976 FY15 up 35.54% from this time FY14 Construction Valuation $600,000,000 $500,000,000 $400,000,000 $300,000,000 $200,000,000 $100,000,000 $0 Residential Commercial Total FISCAL YEAR TO DATE PERMIT TOTALS Permits Issued Residential December FY15 = 30,468 FY14 = 28,401 Commercial December FY15 = 19,601 FY14 = 17,233 Total FY15 = 53,263 FY14 = 48,858 INCREASE/DECREASE Residential sm 0.01% Commercial up 23.7% Overall up 11.4% 10,000 8,767 8,324 6,492 1,000 0 Residential Commercial Total 2,471 3,893 3,872 3,237 2,226 2,835 2,855 3,879 4,490 4,171 2,000 2,758 3,219 2,959 3,014 2,809 2,740 . 4,784 5,379 5,242 5,563 4,922 3,970 3,227 3,960 5,870 2,213 3,000 6,727 6,644 6,000 7,570 7,421 7,253 7,000 4,000 8,165 7,779 2,264 Number of Permits 8,000 5,000 9,109 9,088 9,000 Inspections Performed INCREASE/DECREASE January 2015 Inspections Performed dn 7.1% 30,000 25,000 20,000 15,000 10,000 5,000 0 Building Electrical Mechanical Plumbing Total Trade Inspections IRT REPORT January 2015 Inspection Activity: Inspection Response Time (IRT Report) Insp. Resp. Time OnTime % Dec. Jan. Total % After 24 Hrs. Late Dec. Jan. Total % After 48 Hrs. Late Dec. Jan. Average Resp. in Days Dec. Jan. Bldg. 81.9% 81.6% 96.7% 94.3% 99.5% 97.5% 1.24 1.36 Elec. 59.9% 65.5% 93.1% 92.8% 99.4% 99.1% 1.47 1.68 Mech. 44.9% 73.8% 74.1% 95.5% 94.5% 99.5% 1.87 1.31 Plbg. 67.6% 72.0% 96.7% 91.2% 99.5% 98.9% 1.37 1.37 Total 64.6% 73.1% 90.8% 93.5% 98.5% 98.6% 1.47 1.46 January 2015 Pass Rates Inspection Pass Rates Building Electrical Mechanical Plumbing OVERALL: 100 Percent Passed 95 90 85 80 75 70 Building Electrical Mechanical Plumbing 77.38% 77.11% 85.28% 90.71% 81.41% January 2015 CTAC First Reviews 122 117 129 136 120 118 118 128 108 92 83 78 75 64% 64% CTAC Approval Rate 83% 71% 72% 73% 68% 70% 72% 75% 67% 72% 75% CTAC % of On-Sch. & Express 44% 45% 43% 45% 42% 40% 35% 40% 37% 35% 32% 32% 34% January 2015 OnSchedule 1st Reviews 252 242 199 248 241 223 203 195 239 189 194 203 95.6% 95.3% 185 OnTime/Early All Trades 97.4% 97.5% 97.63% 95.0% 94.00% 92.9% 92.4% 92.00% 90.38% 90.38% 90.4% OnTime/Early BEMP 95.0% 94.0% 95.0% 90.5% 96.0% 96.0% 96.0% 94.0% 95.0% 94.0% 93.5% 90.5% 85.0% Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 February 2, 2015 Plan Review Lead Times for OnSchedule Review 2/2/15 Electrical Working Days 5 4 2/2/15 Building Electrical Working Days 6 9 2/2/15 Building Electrical 6 11 Mech / County Fire Plumbing County Zoning Backflow CMUD Health City Zoning City Fire 2 4 2 5 9 County Zoning Backflow CMUD Health City Zoning City Fire 2 4 2 5 9 County Zoning Backflow CMUD Health City Zoning City Fire 3 4 3 5 9 1-2 hour Reviews Building 6 3 3-4 hour Reviews Mech / County Fire Plumbing 6 3 5-8 Hour Reviews Mech / County Fire Plumbing Working Days 13 Green: Booking Lead Times within 2 weeks Yellow: Booking Lead Times within 3-4 weeks Red: Booking Lead Times exceeds 4 weeks 4 (10 - 14 work days = The Goal) (15 - 20 work days) (21 work days or greater) All booking lead times indicated are a snapshot in time on the date specified. The actual booking lead time may vary on the day you submit the OnSchedule Application. February 2, 2015 Express Review Appointments are available for: Small projects in 11 working days Large projects in 16 working days Appointments are typically determined by the furthest lead time. For Example: If M/P is 11 days, the project's appointment will be set at approximately 11 days. Plan Review Lead Times for CTAC Review B/E/M/P County Fire County Zoning Health City Zoning City Fire 3 1 1 1 1 1 CTAC Reviews 2/2/15 Working Days Green: Review Turnaround Times are within CTAC goal of 5 days or less Red: Review Turnaround Times exceed CTAC goal of 5 days or less -