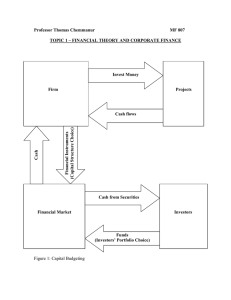

Chapter 2 The Two Key Concepts in Finance 1

Chapter 2

The Two Key Concepts in Finance

1

It’s what we learn after we think we know it all that counts.

- Kin Hubbard

2

Outline

Introduction

Time value of money

Safe dollars and risky dollars

Relationship between risk and return

3

Introduction

The occasional reading of basic material in your chosen field is an excellent philosophical exercise

• Do not be tempted to include that you “know it all”

– E.g., what is the present value of a growing perpetuity that begins payments in five years

4

Time Value of Money

Introduction

Present and future values

Present and future value factors

Compounding

Growing income streams

5

Introduction

Time has a value

•

If we owe, we would prefer to pay money later

•

If we are owed, we would prefer to receive money sooner

• The longer the term of a single-payment loan, the higher the amount the borrower must repay

6

Present and Future Values

Basic time value of money relationships:

PV

FV

DF

FV

PV

CF where PV = present value;

FV = future value;

DF = discount factor = 1/(1

R ) t

CF = compounding factor = (1

R ) t

R = interest rate per perio d; and

t = time in periods

7

Present and Future Values

(cont’d)

A present value is the discounted value of one or more future cash flows

A future value is the compounded value of a present value

The discount factor is the present value of a dollar invested in the future

The compounding factor is the future value of a dollar invested today

8

Present and Future Values

(cont’d)

Why is a dollar today worth more than a dollar tomorrow?

•

The discount factor:

– Decreases as time increases

•

The farther away a cash flow is, the more we discount it

– Decreases as interest rates increase

• When interest rates are high, a dollar today is worth much more than that same dollar will be in the future

9

Present and Future Values

(cont’d)

Situations:

•

Know the future value and the discount factor

– Like solving for the theoretical price of a bond

• Know the future value and present value

–

Like finding the yield to maturity on a bond

•

Know the present value and the discount rate

– Like solving for an account balance in the future

10

Present and Future Value

Factors

Single sum factors

How we get present and future value tables

Ordinary annuities and annuities due

11

Single Sum Factors

Present value interest factor and future value interest factor :

PV

FV

PVIF

FV

PV

FVIF where

PVIF

1

(1

R ) t

FVIF

R ) t

12

Single Sum Factors (cont’d)

Example

You just invested $2,000 in a three-year bank certificate of deposit (CD) with a 9 percent interest rate.

How much will you receive at maturity?

13

Single Sum Factors (cont’d)

Example (cont’d)

Solution: Solve for the future value:

FV

$2, 590

3

14

How We Get Present and

Future Value Tables

Standard time value of money tables present factors for:

•

Present value of a single sum

•

Present value of an annuity

•

Future value of a single sum

•

Future value of an annuity

15

How We Get Present and

Future Value Tables (cont’d)

Relationships:

•

You can use the present value of a single sum to obtain:

–

The present value of an annuity factor (a running total of the single sum factors)

–

The future value of a single sum factor (the inverse of the present value of a single sum factor)

16

Ordinary Annuities and Annuities Due

An annuity is a series of payments at equal time intervals

An ordinary annuity assumes the first payment occurs at the end of the first year

An annuity due assumes the first payment occurs at the beginning of the first year

17

Ordinary Annuities and Annuities Due (cont’d)

Example

You have just won the lottery! You will receive $1 million in ten installments of $100,000 each. You think you can invest the $1 million at an 8 percent interest rate.

What is the present value of the $1 million if the first

$100,000 payment occurs one year from today? What is the present value if the first payment occurs today?

18

Ordinary Annuities and Annuities Due (cont’d)

Example (cont’d)

Solution: These questions treat the cash flows as an ordinary annuity and an annuity due, respectively:

PV of ordinary annuity

$671, 000

PV of annuity due

$724, 680

19

Compounding

Definition

Discrete versus continuous intervals

Nominal versus effective yields

20

Definition

Compounding refers to the frequency with which interest is computed and added to the principal balance

• The more frequent the compounding, the higher the interest earned

21

Discrete Versus

Continuous Intervals

Discrete compounding means we can count the number of compounding periods per year

• E.g., once a year, twice a year, quarterly, monthly, or daily

Continuous compounding results when there is an infinite number of compounding periods

22

Discrete Versus

Continuous Intervals (cont’d)

Mathematical adjustment for discrete compounding:

FV

PV (1

/ ) mt

R

annual interest rate m

number of compounding periods per year t

time in years

23

Discrete Versus

Continuous Intervals (cont’d)

Mathematical equation for continuous compounding:

FV

PVe

Rt e

2.71828

24

Discrete Versus

Continuous Intervals (cont’d)

Example

Your bank pays you 3 percent per year on your savings account. You just deposited $100.00 in your savings account.

What is the future value of the $100.00 in one year if interest is compounded quarterly? If interest is compounded continuously?

25

Discrete Versus

Continuous Intervals (cont’d)

Example (cont’d)

Solution: For quarterly compounding:

FV

PV (1

/ ) mt

$103.03

4

26

Discrete Versus

Continuous Intervals (cont’d)

Example (cont’d)

Solution (cont’d): For continuous compounding:

FV

PVe

Rt

$100.00

e

0.03

$103.05

27

Nominal Versus

Effective Yields

The stated rate of interest is the simple rate or nominal rate

•

3.00% in the example

The interest rate that relates present and future values is the effective rate

•

$3.03/$100 = 3.03% for quarterly compounding

• $3.05/$100 = 3.05% for continuous compounding

28

Growing Income Streams

Definition

Growing annuity

Growing perpetuity

29

Definition

A growing stream is one in which each successive cash flow is larger than the previous one

• A common problem is one in which the cash flows grow by some fixed percentage

30

Growing Annuity

A growing annuity is an annuity in which the cash flows grow at a constant rate g :

PV

(1

C

R )

C

(1

(1

R ) g

2

)

C (1

(1

R g

)

3

)

2

C

1

R

g

1

1

1

g

R

N

C (1

g ) n

(1

R ) n

1

31

Growing Perpetuity

A growing perpetuity is an annuity where the cash flows continue indefinitely:

PV

(1

C

R )

C

(1

(1

R ) g

2

)

C

(1

(1

R g

)

3

)

2

t

1

C (1 g ) t

t

(1

R ) t

1

C

1

R

g

C (1

g )

(1

R )

32

Safe Dollars and Risky Dollars

Introduction

Choosing among risky alternatives

Defining risk

33

Introduction

A safe dollar is worth more than a risky dollar

•

Investing in the stock market is exchanging bird-in-the-hand safe dollars for a chance at a higher number of dollars in the future

34

Introduction (cont’d)

Most investors are risk averse

•

People will take a risk only if they expect to be adequately rewarded for taking it

People have different degrees of risk aversion

•

Some people are more willing to take a chance than others

35

Choosing Among

Risky Alternatives

Example

You have won the right to spin a lottery wheel one time.

The wheel contains numbers 1 through 100, and a pointer selects one number when the wheel stops. The payoff alternatives are on the next slide.

Which alternative would you choose?

36

[1-50]

Choosing Among

Risky Alternatives (cont’d)

A B C D

$110 [1-50] $200 [1-90] $50 [1-99] $1,000

[51-100] $90 [51-100] $0 [91-100] $500 [100] -$89,000

Avg. payoff $100 $100 $100 $100

37

Choosing Among

Risky Alternatives (cont’d)

Example (cont’d)

Solution:

Most people would think Choice A is “safe.”

Choice B has an opportunity cost of $90 relative to Choice A.

People who get utility from playing a game pick

Choice C.

People who cannot tolerate the chance of any loss would avoid Choice D.

38

Choosing Among

Risky Alternatives (cont’d)

Example (cont’d)

Solution (cont’d):

Choice A is like buying shares of a utility stock.

Choice B is like purchasing a stock option.

Choice C is like a convertible bond.

Choice D is like writing out-of-the-money call options.

39

Defining Risk

Risk versus uncertainty

Dispersion and chance of loss

Types of risk

40

Risk Versus Uncertainty

Uncertainty involves a doubtful outcome

•

What you will get for your birthday

•

If a particular horse will win at the track

Risk involves the chance of loss

•

If a particular horse will win at the track if you made a bet

41

Dispersion and Chance of Loss

There are two material factors we use in judging risk:

•

The average outcome

•

The scattering of the other possibilities around the average

42

Dispersion and Chance of Loss

(cont’d)

Investment value

Investment A

Investment B

Time

43

Dispersion and Chance of Loss

(cont’d)

Investments A and B have the same arithmetic mean

Investment B is riskier than Investment A

44

Types of Risk

Total risk refers to the overall variability of the returns of financial assets

Undiversifiable risk is risk that must be borne by virtue of being in the market

•

Arises from systematic factors that affect all securities of a particular type

45

Types of Risk (cont’d)

Diversifiable risk can be removed by proper portfolio diversification

•

The ups and down of individual securities due to company-specific events will cancel each other out

•

The only return variability that remains will be due to economic events affecting all stocks

46

Relationship Between Risk and

Return

Direct relationship

Concept of utility

Diminishing marginal utility of money

St. Petersburg paradox

Fair bets

The consumption decision

Other considerations

47

Direct Relationship

The more risk someone bears, the higher the expected return

The appropriate discount rate depends on the risk level of the investment

The risk-less rate of interest can be earned without bearing any risk

48

Direct Relationship (cont’d)

Expected return

R f

0 Risk

49

Direct Relationship (cont’d)

The expected return is the weighted average of all possible returns

•

The weights reflect the relative likelihood of each possible return

The risk is undiversifiable risk

•

A person is not rewarded for bearing risk that could have been diversified away

50

Concept of Utility

Utility measures the satisfaction people get out of something

•

Different individuals get different amounts of utility from the same source

– Casino gambling

– Pizza parties

– CDs

–

Etc.

51

Diminishing Marginal

Utility of Money

Rational people prefer more money to less

•

Money provides utility

•

Diminishing marginal utility of money

– The relationship between more money and added utility is not linear

– “I hate to lose more than I like to win”

52

Utility

Diminishing Marginal

Utility of Money (cont’d)

$

53

St. Petersburg Paradox

Assume the following game:

•

A coin is flipped until a head appears

•

The payoff is based on the number of tails observed ( n ) before the first head

• The payoff is calculated as $2 n

What is the expected payoff?

54

St. Petersburg Paradox

(cont’d)

Number of Tails

Before First

Head Probability Payoff

Probability x Payoff

Total

2

3

0

1

4 n

(1/2)1 = 1/2

(1/2)

2

= 1/4

(1/2)

3

= 1/8

(1/2)

4

= 1/16

(1/2)

5

= 1/32

(1/2) n + 1

1.00

$1

$2

$4

$8

$16

$2 n

$0.50

$0.50

$0.50

$0.50

$0.50

$0.50

55

St. Petersburg Paradox

(cont’d)

In the limit, the expected payoff is infinite

How much would you be willing to play the game?

•

Most people would only pay a couple of dollars

• The marginal utility for each additional $0.50 declines

56

Fair Bets

A fair bet is a lottery in which the expected payoff is equal to the cost of playing

•

E.g., matching quarters

•

E.g., matching serial numbers on $100 bills

Most people will not take a fair bet unless the dollar amount involved is small

•

Utility lost is greater than utility gained

57

The Consumption Decision

The consumption decision is the choice to save or to borrow

•

If interest rates are high, we are inclined to save

– E.g., open a new savings account

•

If interest rates are low, borrowing looks attractive

–

E.g., a higher home mortgage

58

The Consumption

Decision (cont’d)

The equilibrium interest rate causes savers to deposit a sufficient amount of money to satisfy the borrowing needs of the economy

59

Other Considerations

Psychic return

Price risk versus convenience risk

60

Psychic Return

Psychic return comes from an individual disposition about something

•

People get utility from more expensive things, even if the quality is not higher than cheaper alternatives

–

E.g., Rolex watches, designer jeans

61

Price Risk Versus

Convenience Risk

Price risk refers to the possibility of adverse changes in the value of an investment due to:

•

A change in market conditions

• A change in the financial situation

•

A change in public attitude

E.g., rising interest rates and stock prices, a change in the price of gold and the value of the dollar

62

Price Risk Versus

Convenience Risk (cont’d)

Convenience risk refers to a loss of managerial time rather than a loss of dollars

• E.g., a bond’s call provision

– Allows the issuer to call in the debt early, meaning the investor has to look for other investments

63