New Issue: 2013A&B; Outlook stable Global Credit Research - 06 Aug 2013

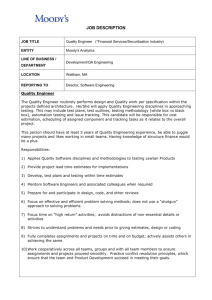

advertisement

New Issue: Moody's asssigns Aaa to Charlotte's (NC) $137.7M GO Bonds, Series 2013A&B; Outlook stable Global Credit Research - 06 Aug 2013 Affirms Aaa and stable outlook on $722.6M of outstanding GO debt CHARLOTTE (CITY OF) NC Cities (including Towns, Villages and Townships) NC Moody's Rating ISSUE RATING Taxable General Obligation Housing Bonds, Series 2013A Sale Amount $34,370,000 Expected Sale Date 08/13/13 Rating Description General Obligation Aaa General Obligation Refunding Bonds, Series 2013B Sale Amount $103,290,000 Expected Sale Date 08/22/13 Rating Description General Obligation Aaa Moody's Outlook STA Opinion NEW YORK, August 06, 2013 --Moody's Investors Service has assigned Aaa rating to the City of Charlotte's (NC) $34.37 million Taxable General Obligation Housing Bonds, Series 2013A and $103.29 million General Obligation Refunding Bonds, Series 2013B. Concurrently, Moody's has affirmed the Aaa rating on the city's $722.6 million of outstanding general obligation debt. The outlook remains stable. SUMMARY RATINGS RATIONALE The Series 2013A&B general obligation bonds are secured by a pledge of faith, credit and taxing power of the city. The Aaa long-term general obligation rating reflects the city's healthy financial operations, strong management characterized by formal financial policies, as well as a large, diverse and expanding tax base. The Aaa also factors a relatively high, though manageable, debt burden with a modest level of variable rate and swap exposure, which has been significantly reduced in recent years. The Series 2013A bonds will finance various city housing projects primarily for seniors and the Series 2013B bonds will refinance Series 2003 bonds for significant net present value savings. STRENGTHS -Stability provided by the city's large, growing and diverse tax base -Conservative budgeting of revenues and expenditures resulting in solid financial position CHALLENGES -Somewhat high debt burden with a variable rate component that poses potential for budgetary pressures DETAILED CREDIT DISCUSSION ECONOMIC RECOVERY CONTINUES WITH ADDITIONAL BOOST FROM HOSTING DEMOCRATIC NATIONAL CONVENTION Recovery continues in the Charlotte economy at a faster pace than in recent years. The city's unemployment rate has stabilized at 8.4% in June 2013. According to city officials, Charlotte added 9,595 new jobs with roughly $1.3 billion of investments in 2012. MetLife recently announced 1,300 new jobs at an estimated average salary of $80,000. Chiquita recently moved its headquarters to Charlotte from Cincinnati (rated Aa2/negative). Additionally, Time Warner Cable just added 225 new jobs and more than $100 million in investment. The city has also seen encouraging signs in terms of additional energy sector growth including a sizable $135 million investment by Siemens for the expansion of a plant in the county, which is expected to result in 825 new jobs over the next three years. The $13.7 billion merger of Duke Energy (Baa2/RUR) and Progress Energy resulted in the nation's largest public power utility with headquarters in the city. TZ Insurance Solutions LLC is opening a new office in Charlotte, creating 125 new high paying jobs with plans to expand to 250 jobs in the near to medium term. Pactera Technology International recently announced the establishment of its US Headquarters in the city with approximately 200 employees. Financial services remain an extremely important part of the Charlotte economy. Wells Fargo NA (Aa3/stable) and Bank of America NA (A3/stable) are Charlotte's second- and fourth-largest employers, respectively, composing 8.7% of all jobs the city. In 2012, Wells Fargo, which acquired the beleaguered Wachovia in 2009, employs 22,500 individuals, while Bank of America employs 15,000. Bank of America assessed property valuation is $1.5 billion, accounting for 1.9% of the city's total assessed value, and Wells Fargo is $1.2 billion, or 1.6%. Given the city's sizable banking presence, it has developed into one of the largest concentrations of financial services in the US. Indicative of the city's exposure to the volatility of the sector, the city lost nearly 6,000 jobs from October 2008 to May 2009 or a contraction of 7.7%, compared to a 4.1% loss for the nation. Significant restructuring has already occurred, and we believe a level of stability has returned. Notwithstanding the relative concentration in the financial services industry, Charlotte's economy is diverse in the significant trade, services and manufacturing interests including a notable number of international firms. The cityowned Charlotte-Douglas International Airport employs several thousand people in the city, and is US Airways (B3/stable) main hub which recently announced a merger with American Airlines (Baa3/stable). The new NASCAR Hall of Fame, located in the downtown area, opened in 2010 and is bringing a significant tourism component to the city. Further, a level of economic stability is brought about by the presence of major non-profit and educational institutions, including Presbyterian Healthcare/Novant Health, Carolinas HealthCare System (rated Aa3) and the University of North Carolina-Charlotte (rated Aa3/stable) with nearly 22,000 students. The Democratic National Committee held its national convention in the City in September 2012 with approximately 35,000 attendees, including 15,000 members of the media and 6,500 delegates. According to the report by consultant group, Tourism Economics, the convention lead to $91 million in direct spending in the local economy and nearly $163.6 million in total economic impact. Area hotels booked 61,246 hotel room nights for the DNC which generated $20.9 million in revenue. Visitors spent an estimated $5.7 million on food and beverage, $3.0 million on recreation, and $5.4 million on local transportation. The city's assessed value growth has averaged 5.8% over the last five years. Mecklenburg County (rated Aaa/stable), which is responsible for assessments, had intended to complete revaluation in 2009, but opted to delay revaluation until 2011 in light of the recession. The recent revaluation lead to 16.5% spike last year to a total of $90.4 billion. Wealth levels in the city remain stronger than the state and nation, with the 2010 American Community Survey per capita income representing 125.1% of the State of North Carolina (G.O. rated Aaa/stable) and 113.0% of the nation. Full value per capita of $116,970 is also strong. SOUND FINANCIAL OPERATIONS SUPPORTED BY PROACTIVE MANAGEMENT PRACTICES Charlotte's financial operations are expected to continue to be well-managed, characterized by considerable operating flexibility, a trend of ample reserves and a strong cash position. The city has a formal policy to maintain operating fund balances at 16% of the current year expenditures. Strong results for fiscal 2012 reflect improved sales tax receipts up 9% from the previous year and tight expenditure controls. The city achieved a $9.6 million surplus for a total General Fund balance of $159.2 million. The unassigned balance was $88.4 million at fiscal year-end, representing 16.3% of General Fund revenues. The city maintains strong liquidity with General Fund cash at the end of fiscal 2012 equaling $163.1 million or 30.1% of revenues. Positively, the city maintains additional financial flexibility available for debt service in its Debt Service Fund which maintained a balance of $229.9 million at the end of fiscal 2012. The fiscal 2013 budget was conservatively balanced. City officials conservatively estimate a modest operating surplus of $10-15 million for the recently closed fiscal 2013. Property taxes are the city's primary source of operating revenues (57% of fiscal 2012 General Fund revenues). The lack of property tax levy limits affords the city substantial budgetary flexibility. The city adopted the fiscal 2014 budget in June which includes a 3.17 cent property tax increase to fund the comprehensive $817 million 2014-20 capital improvement plan. Revenues are projected to increase by 2.3%, fees in permits up 6% and sales tax is projected to grow by 3.5%. The North Carolina General Assembly recently signed into law legislation that would allow for the creation of a Douglas International Airport Commission to take over operations of the city-owned and operated airport. It is unclear at this point how this situation will unfold but city officials are extremely confident that there is no negative potential impact on the city's overall finances. DEBT LEVELS REMAIN ABOVE AVERAGE; MODERATE VARIABLE RATE EXPOSURE The city's slightly elevated debt burden (direct 1.5% of full value) should remain manageable for the medium-term given the city's careful debt planning. Following the current issue, Charlotte will have $757.3 million of general obligation debt and an additional $922 million of appropriation backed debt. Of the city's outstanding general obligation debt, approximately 36% is financed by self-supporting utility enterprises, including water, sewer and storm water. As a result, we remove these obligations from calculations of the city's debt burden. For appropriation-backed debt, a substantial portion is paid from dedicated revenues outside of General Fund operations, mostly comprised of various taxes levied to support the transit system, the convention center and a sports arena. These separate credit entities outside of the General Fund, established to capture revenues to support debt service for the city's convention center, arena, arts facilities, the NASCAR Hall of Fame and the transit system, maintained fund balances equal to $229.9 million, or 24% of total special credit entity debt outstanding, at the end of fiscal 2012, providing an additional source of financial cushion. Further, the city's overall debt burden of 2.6% of full valuation, including approximately $2.4 billion of overlapping debt of Mecklenburg County, is higher than the Moody's median for all cities. The ability of the city to balance operating expenditure pressures and lease payments as part of its annual budget process while maintaining a strong financial position will be key facets of future credit analysis. Approximately 12% of general obligation and certificate of participation debt is in a variable rate mode. All but $221.8 million of the city's certificates of participation variable rate debt is unhedged. The city's one general obligation interest rate swap, which is associated with variable rate debt issued to finance the NASCAR Hall of Fame, was moved from debt associated with city's water and sewer enterprise in July 2009. All of the city's variable rate debt, including the CP, has liquidity support from third party providers. The city entered into a swaption with Wachovia, now Wells Fargo N.A., in 2005 and received an upfront payment of $5.8 million, which were tied to the Series 2003G COPs. As per the agreement, in March 2013 the bank chose to exercise its option after which the city pays the bank a fixed-rate of 5.097% and receives a floating-rate based on SIFMA. The Series 2013G COPs effectively create a synthetic fixed-rate refunding. The notional amount of the swap, currently $128.2 million, will decrease as the sinking fund prepayments are made on the 2013G COPs. As noted above, the city recently adopted a $817 million 2014-20 CIP to be partially funded with the 3.17 cent property tax increase. The city also has an extensive pay-go program. The city participates in the North Carolina Local Government Employees Retirement System, multi-employer, defined benefit retirement plans sponsored by the State of North Carolina (GO rated Aaa/stable). The city also has its own Firefighter Retirement and Law Enforcement Separation Allowance systems. The city's combined annual required contribution (ARC) for the plans was $32.4 million or 6% of General Fund expenditures. The city's combined adjusted net pension liability, under Moody's methodology for adjusting reported pension data, is $463 million or approximately 0.89 times General Fund revenues. Moody's uses the adjusted net pension liability to improve comparability of reported pension liabilities. The adjustments are not intended to replace the city's reported liability information, but to improve comparability with other rated entities. We determined the city's share of liability for the state-run plans in proportion to its contributions to the plans. WHAT COULD CHANGE THE RATING DOWN (or revise the outlook to negative): -Negative budget variances in revenues coupled with an inability or unwillingness to implement corresponding expenditure reductions or alternate revenue generators -Declines in liquidity and/or fund balances to levels that exceed current expectations -Economic stagnation that impedes tax base growth and detracts from the success of economic revitalization efforts -Failure to appropriate debt service funding KEY STATISTICS 2012 population: 731,424 (increase of 35.2% from 2000 to 2010) 2012 Full valuation: 90.4 billion Debt burden: 2.6% overall/ 1.5% direct Amortization of principal (including installment purchase bonds): 62.5% Fiscal 2012 General Fund balance: $149.5 million (28.6% of General Fund revenues) Median Family Income as a % of state (2010): 111.2% Per Capita Income as % of state, % of nation (2010): 125.1% General obligation debt outstanding post-sale: $757.3 million The principal methodology used in these ratings was General Obligation Bonds Issued by US Local Governments published in April 2013. Please see the Credit Policy page on www.moodys.com for a copy of this methodology. REGULATORY DISCLOSURES For ratings issued on a program, series or category/class of debt, this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or note of the same series or category/class of debt or pursuant to a program for which the ratings are derived exclusively from existing ratings in accordance with Moody's rating practices. For ratings issued on a support provider, this announcement provides certain regulatory disclosures in relation to the rating action on the support provider and in relation to each particular rating action for securities that derive their credit ratings from the support provider's credit rating. For provisional ratings, this announcement provides certain regulatory disclosures in relation to the provisional rating assigned, and in relation to a definitive rating that may be assigned subsequent to the final issuance of the debt, in each case where the transaction structure and terms have not changed prior to the assignment of the definitive rating in a manner that would have affected the rating. For further information please see the ratings tab on the issuer/entity page for the respective issuer on www.moodys.com. Regulatory disclosures contained in this press release apply to the credit rating and, if applicable, the related rating outlook or rating review. Please see www.moodys.com for any updates on changes to the lead rating analyst and to the Moody's legal entity that has issued the rating. Please see the ratings tab on the issuer/entity page on www.moodys.com for additional regulatory disclosures for each credit rating. Analysts Edward Damutz Lead Analyst Public Finance Group Moody's Investors Service Robert Weber Backup Analyst Public Finance Group Moody's Investors Service Kristin Button Additional Contact Public Finance Group Moody's Investors Service Contacts Journalists: (212) 553-0376 Research Clients: (212) 553-1653 Moody's Investors Service, Inc. 250 Greenwich Street New York, NY 10007 USA © 2013 Moody's Investors Service, Inc. and/or its licensors and affiliates (collectively, "MOODY'S"). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. ("MIS") AND ITS AFFILIATES ARE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODY'S ("MOODY'S PUBLICATIONS") MAY INCLUDE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODY'S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY'S OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS AND MOODY'S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODY'S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODY'S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY'S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY'S PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODY'S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided "AS IS" without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources Moody's considers to be reliable, including, when appropriate, independent third-party sources. However, MOODY'S is not an auditor and cannot in every instance independently verify or validate information received in the rating process. Under no circumstances shall MOODY'S have any liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligent or otherwise) or other circumstance or contingency within or outside the control of MOODY'S or any of its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if MOODY'S is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The ratings, financial reporting analysis, projections, and other observations, if any, constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities. Each user of the information contained herein must make its own study and evaluation of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY'S IN ANY FORM OR MANNER WHATSOEVER. MIS, a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MIS's ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading "Shareholder Relations — Corporate Governance — Director and Shareholder Affiliation Policy." For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY'S affiliate, Moody's Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody's Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to "wholesale clients" within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY'S that you are, or are accessing the document as a representative of, a "wholesale client" and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to "retail clients" within the meaning of section 761G of the Corporations Act 2001. MOODY'S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail clients. It would be dangerous for retail clients to make any investment decision based on MOODY'S credit rating. If in doubt you should contact your financial or other professional adviser.