Prosperity Hucks Study Area Market Analysis Prepared For: December 2012

Prepared For:

December 2012

Prosperity Hucks Study Area Market Analysis

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

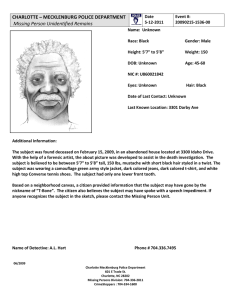

Exhibit 1

Prosperity-Hucks Study Area Strengths, Challenges, and Opportunities

Golf

G

G

G

Strengths:

• Improving regional access via the extension of I-485

• Abundance of stable neighborhoods in a relatively quiet suburban setting

Study area includes park space and public golf

• Solid access to neighborhood retail, including numerous grocery stores

• Access to several elementary schools, a middle school and several private schools

• Close to University Research Park and adjacent office employment

Golf

Stable Neighborhood

G

G

G

Challenges:

• Access today is somewhat limited and area lacks regional access beyond URP.

• Area still lacks a sense of place and location, with village concept partially formed, but needing to advance further.

• Access to community and regional-serving retail has been limited in the past, but will improve in coming years.

• Access to office uses, both local and regional-serving, has been limited.

Opportunities:

• Further a sense of neighborhood location and tie different land uses together to create a whole greater than the sum of its parts

• Further the sense of value and location in the area to enhance home price appreciation, rent and lease growth, and demand for residential and commercial products.

• Broaden housing offerings in the area to appeal to a wider array of market audiences.

SWOT

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 2

Employment by Type in Prosperity-Hucks and a Comparison to the Northeast District and Mecklenburg County Overall

Industry Sector

Agriculture, Forestry, Fishing and Hunting

Construction

Manufacturing

Wholesale Trade

Retail Trade

Transportation and Warehousing

Information

Finance and Insurance

Real Estate and Rental and Leasing

Professional, Scientific, and Technical Services

Management of Companies and Enterprises

Admin. & Support, Waste Mgt and Remediation

Educational Services

Health Care and Social Assistance

Arts, Entertainment, and Recreation

Accommodation and Food Services

Other Services (excluding Public Administration)

Public Administration

Total

Prosperity-

Hucks

0

42

62

171

296

58

2

40

29

85

0

23

41

231

80

423

72

2

1,657

Northeast

District

Charlotte ETJ

8,714

932

3,702

1,099

4,932

4,372

4,608

591

5,938

952

88

62,132

120

3,079

5,129

6,235

5,701

3,209

2,731

338

22,360

28,715

35,429

49,286

22,791

18,075

37,762

8,922

39,766

19,730

39,400

14,958

62,944

9,922

42,951

12,046

12,969

478,364

Location Quotient

(Study Area to NE

District)

0.2

0.4

1.9

5.1

2.7

0.2

1.2

0.9

0.0

2.8

0.9

1.0

0.0

0.5

0.5

1.0

1.9

0.7

0.0

The Prosperity-Hucks area is not a significant employment area today, with the greatest concentrations of employment being in local-serving industries, including restaurants (Food Services), Health Care, and Retail Trade. The majority of these jobs are low to moderate-paying, with higher -paying professional services and Finance & Insurance jobs being located closer to the University Research Park.

Relative to the Northeast District, and particularly to the county overall, the area is lacking in higher paying Finance &

Insurance and Professional Services jobs--jobs which are largely located around Center City and in areas south.

Location Quotient Relative to NE District

Construction

0.54

0.51

Manufacturing

0.62

0.45

Wholesale Trade

1.39

1.03

Retail Trade

1.73

1.95

Transportation and

Warehousing

0.73

0.68

Information

0.03

0.03

Finance and Insurance

0.31

0.17

Real Estate and Rental and

Leasing

0.94

Professional, Scientific, and

Technical Services

0.62

0.86

Management of Companies and Enterprises -

Admin. & Support, Waste Mgt and Remediation

0.17

0.17

1.17

Educational Services

0.79

0.35

Health Care and Social

Assistance

Arts, Entertainment, and

Recreation

Accommodation and Food

Services

Other Services (excluding

Public Administration)

Public Administration

0.04

0.85

1.06

1.88

2.33

1.73

2.84

2.67

2.84

- 1.00 2.00 3.00 4.00 5.00

Rel to Meck Cty Rel to NE District

SOURCE: Noell Consulting Group based on data obtained from the US Census Bureau via LED on the Map.

ZIP Emp Gro

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 3

2011 Households by Income and Median Income by Age Cohort; Prosperity-Hucks Study Area and the Charlotte ETJ

$120,000

Under 35

35 to 54

70 to 79

$60,000

$47,888

$40,000

$31,582

18%

50%

6%

6%

Median Income by Age Cohort, Study Area and the Charlotte ETJ

22%

50%

18%

$99,755

5%

5%

$59,890

$50,661

$87,699

$65,110

$78,956

$56,399

$58,644

$36,648

$40,919

$29,108 $26,311

$23,224

$20,000

Overall, households in the Prosperity-

Hucks area are more affluent than those found in the Charlotte ETJ. Of particular note is the lack of low-income households in the area and the high amount of middle- to upper-middle income households (those earning between $75,000 and $150,000), which equates to home prices of around

$200,000 to $400,000.

$0

Age 15 - 24 Age 25 - 34 Age 35 - 44 Age 45 - 54

Prosperity Hucks

Age 55 - 64

Charlotte ETJ

Age 65 - 74 Age 75 - 84 Age 85+

30%

25%

20%

15%

10%

5%

Comparison of Households by Income--Study Area vs. the Charlotte ETJ

Prosperity HuckCharlotte ETJ

Under $25k

$25k - $35k

$35k - $50k

$50k - $75k 20%

$75k - $100k

$100k - $150k

$150k and Ab

5.7%

3.6%

8.0%

21.5%

22.1%

25.9%

13.2%

20%

12%

17%

21%

12%

11%

17%

21%

21%

22%

12%

26%

11%

8%

6%

4%

0%

Under $25k $25k - $35k $35k - $50k $50k - $75k

Prosperity Hucks Charlotte ETJ

$75k - $100k $100k - $150k

Source: Claritas, Inc.

13%

8%

$150k and Above

Demographic Summary

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 4

Study Area and Northeast District Worker & Resident Demographic Comparison

70%

60%

50%

40%

30%

20%

10%

0%

20%

27%

24%

64%

61%

Characteristics of Northeast Planning District Workers and Residents

64%

Overall, residents of the Northeast District tend to be slightly younger and slightly less affluent than those working in the area.

16%

13% 13%

16%

20%

17%

35%

39%

38%

49%

41%

45%

29 or younger 30 to 54 55 or older

Workers Residents

Earning Under $1,250/mo. Earning $1,251 to $3,333/mo. Earning More than $3,333/mo.

Workers and Residents

Comparison of Study area Residents and Workers, and Northeast Planning District Residents and Workers

80%

70%

60%

50%

40%

30%

20%

10%

0%

24%

27%

35%

20%

64%

61%

54%

64%

Study area resident profiles are very similar to those who work in the larger Northeast

District overall, reflecting the short commute distances many opt to have in the area.

Given the nature of employment in the area, it is not surprising that local employees

12% 13% are younger and lower-paid relative to area residents.

11%

16%

29 or younger 30 to 54

Study Area Residents

SOURCE: Noell Consulting Group based on data obtained from the US Census.

55 or older

NE Residents

17%

20%

30%

16%

32%

39% 40%

35%

Earning $1,250 per month or less

Study Area Workers

Earning $1,251 to

$3,333 per month

NEWorkers

51%

41%

30%

49%

Earning more than

$3,333 per month

LED Stats

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 5

Retail Market Overview

National Trends/Factors

- Spending by US consumers continues to gain momentum as economy improves.

- National chains still paring marginal stores/consolidating to more strategic locations--very few in expansion mode

- Lifestyle/"experiential" retail on the rise--particularly retail in more walkable formats

- Large-scale fallout in commercial lending claiming poorly situated/conceptualized centers

North East Charlotte Trends/Factors

- Northeast Mecklenburg retail market dominated by power centers and mainline retail tenants

- Little exists today in terms of lifestyle or Main Street retail--centers that have sustainability and "holding power"

- Vacancy rates remain stubbornly high, fueled in part by cannibalistic retail environment, including competition beyond Mecklenburg County

- Retail rents are relatively low overall, reflecting the oversupply that exists in the market today.

Prosperity Hucks Study Area

- Features significant neighborhood retail, including an oversupply of grocery stores

- Current retail environment largely comprised of auto-oriented neighborhood retail centers with plenty of "in-line" tenant space

- Retail rents are relatively cheap, reflecting what today is a secondary retail location with moderate demand.

- Area currently lacks any big boxes or destination retail users, although the Walmart under construction at Bryton will help to fill that role.

- As I-485 opens, retail opportunities will increase in the study area and potential will open up for big-box users such as Target and discount clothiers

- Additional undersupply exists for a number of tenant types, including dining opportunities, both full-service and limited-service

- Ongoing growth at Bryton will continue to add to competitive supply and will temper demand growth in the future and may satiate location opportunities that exist today between I-77 and I-85.

SOURCE: Noell Consulting Group

Retail Market Overview

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 6

Map of Retail Offerings and Cores in the Greater Prosperity-Hucks Area

Prosperity/Hucks

Largely serves as a neighborhood-serving retail core anchored by grocery, drug stores, and local-serving retail and office users. While we do not anticipate big box retailers being attracted to the Prosperity-Hucks area, it is worth noting the significant distance that exist between this area and other big box cores, most of which are five or more miles away. Bryton has the potential to capture this market, but the study area geographically is well-positioned to catch these retailers attention.

Neighborhood-

Serving Retail

N'hood to

Community-

Serving Retail

Regional-

Serving

Retail

Neighborhood-

Serving Retail

Regional-

Serving

Retail

Retail Cores Map

12/19/2012

Neighborhood-

Serving Retail

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 7

Retail Space Delivered by Planning District and the Prosperity-Hucks Study Area, 2000 - 2010

District

Central Square Feet Totals

Central Capture

North Square Feet Totals

North Capture

Northeast Square Feet Totals

Northeast Capture

Prosperity-Hucks Feet Totals

Prosperity-Hucks Capture

Northwest Square Feet Totals

Northwest Capture

South Square Feet Totals

South Capture

Southeast Square Feet Totals

Southeast Capture

Southwest Square Feet Totals

Southwest Capture

Total

140,000

2000 2001

Retail Development by Year (Square Feet)

2002 2003 2004 2005 2006 2007 2008 2009 2010 Totals

494,659

16.0%

538,947

19.9%

213,579

17.3%

85,998

7.8%

97,796

4.1%

1,051,165

26.5%

341,876

14.5%

346,476

22.6%

776,110

27.4%

106,929

15.2%

111,999

22.2%

4,165,534

19.7%

448,166

14.5%

327,601

12.1%

203,521

16.4%

245,807

22.4%

232,175

9.8%

109,021

2.7%

67,310

2.9%

412,410

26.8%

147,123

5.2%

36,451

5.2%

83,537

16.6%

2,313,122

10.9%

602,550

19.5%

235,382

8.7%

28,147

2.3%

119,439

10.9%

484,281

20.5%

169,416

4.3%

338,650

14.4%

166,295

10.8%

308,219

10.9%

293,411

41.7%

108,836

21.6%

2,854,626

13.5%

60,974

10.1%

14,660

6.2%

-

0.0%

-

0.0%

114,688

23.7%

14,041

8.3%

24,675

7.3%

20,574

12.4%

-

0.0%

4,791

1.6%

-

0.0%

254,403

8.9%

43,231

1.4%

113,682

4.2%

58,144

4.7%

35,325

3.2%

230,837

9.8%

1,370,287

34.6%

78,367

3.3%

107,520

7.0%

682,377

24.1%

132,888

18.9%

-

0.0%

2,852,658

13.5%

1,080,489

34.9%

484,779

17.9%

361,864

29.2%

270,701

24.6%

679,288

28.8%

803,222

20.3%

770,511

32.8%

379,743

24.7%

451,620

16.0%

35,593

5.1%

188,196

37.3%

5,506,006

26.0%

191,120

6.2%

788,164

29.1%

138,170

11.2%

209,005

19.0%

517,696

21.9%

276,692

7.0%

133,684

5.7%

84,042

5.5%

58,629

2.1%

45,595

6.5%

8,062

1.6%

2,450,859

11.6%

235,690

7.6%

221,560

8.2%

233,892

18.9%

132,485

12.1%

120,487

5.1%

185,596

4.7%

622,036

26.4%

39,554

2.6%

403,787

14.3%

53,494

7.6%

3,888

0.8%

2,252,469

10.6%

3,095,905 2,710,115 1,237,317 1,098,760 2,362,560 3,965,399 2,352,434 1,536,040 2,827,865 704,361 504,518 21,186,395

25%

120,000

Prosperity-Hucks Square Feet Delivered

Prosperity-Hucks Capture of NE District

2000

60,974

10.1%

2001

14,660

6.2%

2002

-

0.0%

2003

-

0.0%

2004

114,688

23.7%

2005

14,041

8.3%

2006

24,675

7.3%

2007

20,574

12.4%

2008

-

0.0%

2009

4,791

1.6%

2010

-

0.0%

80,000

60,000

40,000

20,000

-

2000 2001 2002 2003 2004

Prosperity-Hucks Square Feet Delivered

2005 2006 2007

Prosperity-Hucks Capture of NE District

2008 2009 2010

SOURCE: Charlotte-Mecklenburg Planning Department

20%

15%

10%

5%

0%

Retail Del. by District

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 8

Map of Retail Projects in Prosperity-Hucks Area

9

2

10

3

5

7

8

Retail Properties

1 Cheshire Place

2 Eastfield Shopping Center

3 Prosperity Shopping Plaza

4 Shoppes at Davis Lake

5 Shoppes at Highland Creek

6 Terraces at Cheshire

7 Cochrane Commons

8 The Arbors

Planned Properties

9 Huntersville Market (60,000 SF)

10 Walmart at Bryton (150,000 SF)

4

1

6

SOURCE: Noell Consulting Group and Mecklenburg Planning Department (Map)

Retail Map

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 9

Summary of Area Retail Centers

Center Name

Cheshire Place

Eastfield Shopping

Center

Prosperity Shopping

Plaza

Shoppes at Davis Lake

Shoppes at Highland

Creek

Terraces at Cheshire

Cochrane Commons

The Arbors

Center Photo Year Built Total SF

1990

2004 cnd

2005

2000

2001

2003

2007

2001

54,840

87,492

64,638

90,820

66,517

19,532

66,020

49,323

62,398

SF Avail.

15,679

% Occ.

Type

Quoted Lease

Rates Anchor Tenant

71%

Conv.

Neigh- borhood

$8.00

- $15.00

Tuesday Morning

Other Tenants

Rite Aid, Subway,

Domino's

4,270

4,000

11,800

3,932

3,114

0

1,000

5,474

87%

Conv.

Neigh- borhood

$21.00

- $24.00

94%

Conv.

Neigh- borhood

$20.00

- $20.00

87%

Conv.

Neigh- borhood

$20.00

- $23.00

201 Central

Bi-Lo

H&R Block, Golds Gym,

Bank of America, ABC former Blockbuster, smaller shops

Harris Teeter

Chick-fil-A, Taco Bell,

H&R Block, UPS Store

94%

Conv.

Neigh- borhood

$21.00

$21.00

84%

Conv.

Neigh- borhood

$21.00

- $23.00

Harris Teeter

-

Subway, Great Clips,

Dilworth Coffee

Jason's Deli

100%

Conv.

Neigh- borhood cnd cnd

98%

Conv.

Neigh- borhood

$25.00

- $25.00

91% $19.43

$21.57

Harris Teeter

Walgreen's, McAllister's,

FastMed

Trader Joe's Massage Envy, Petco

Summary, Other Nearby Centers

SOURCE: Noell Consulting Group

Retail Summary

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 10

Estimated Retail Demand Potential in the Prosperity-Hucks Study Area in 2012

Store Type (excl.

Autos & Gas)

2012 Population, Trade Area

Furniture and Home Furnishings

Furniture Stores

Home Furnishing Stores

Electronics & Appliance Stores

Bldg Mats., Garden Equip

Bldg Materials & Supply Stores

Lawn & Garden Equipment

Food & Beverage Stores

Grocery Stores

Specialty Food Stores

Beer, Wine & Liquor Stores

Health & Personal Care

Clothing & Clothing Accessories

Clothing Stores

Shoe Stores

Jewelry, Luggage & Leather

Sports, Hobby, Book & Music

Sports, Hobby, Musical Inst

Book & Music Stores

General Merchandise Stores

Department Stores

Other Gen. Merch. Stores

Miscellaneous Store Retailers

Florists

Office Supplies, Station. & Gifts

Used Merchandise Stores

Other Misc. Store Retailers

Food Service & Drinking Places

Full-Service Restaurants

Limited-Service Eating Places

Special Food Services

Drinking Places

TOTAL

Local Expenditure

Potential

1

Per Capita

Est. Sales/

SF

37,029

$14,051,570

$7,823,650

$6,227,920

$14,077,787

$67,405,229

$59,917,737

$7,487,492

$77,182,631

$66,460,055

$5,553,038

$5,169,538

$34,887,224

$33,381,892

$24,764,725

$3,957,417

$4,659,750

$12,753,664

$9,871,409

$2,882,255

$82,889,785

$35,261,780

$47,628,005

$17,467,893

$869,798

$6,084,811

$1,793,590

$8,719,694

$70,378,896

$32,933,362

$28,674,675

$5,572,974

$3,197,885

$424,476,571

$379

$211

$168

$380

$1,820

$1,618

$202

$2,084

$1,795

$150

$140

$942

$902

$669

$107

$126

$344

$267

$78

$2,239

$952

$1,286

$472

$23

$164

$48

$235

$1,901

$889

$774

$151

$86

$11,463

$328

$334

$241

$397

$458

$386

$368

$350

$595

$258

$264

$251

$413

$318

$321

$293

$253

$253

$188

$308

$444

$333

$193

$500

$285

$329

$365

$246

$188

$256

$157

$215

$226

Demand

Potential

54,447

29,635

24,812

34,087

212,021

186,466

25,555

235,344

199,281

23,042

13,022

76,173

86,480

67,341

11,307

7,832

38,799

27,082

11,716

441,104

137,741

303,363

81,370

3,849

24,051

7,089

46,381

228,308

106,927

86,110

28,876

6,396

1,488,132

Less Expenditures

Away from Home

No. of

Retail

Emps

-10%

49,498

26,941

22,557

30,988

192,746

169,515

23,231

213,949

181,164

20,947

11,838

69,248

78,618

61,219

10,279

7,120

35,271

24,620

10,651

401,004

125,219

275,785

73,973

3,499

21,864

6,445

42,165

207,553

97,206

78,282

26,250

5,814

1,352,847

67

11

11

0

0

389

374

4

11

88

75

13

24

57

44

13

59

41

4

1,163

504

645

7

7

1,950

0

27

106

2

18

9

9

27

SF per

Retail

Emp.

Est. Supply

Net

Demand

Store Types w/ Pos Dmd

500

500

500

1,000

500

700

500

500

500

500

500

500

500

500

700

700

500

500

500

500

150

100

150

200

44,000

37,500

6,500

12,000

50,500

44,000

6,500

269,300

261,800

2,000

5,500

48,500

5,500

5,500

0

0

9,000

4,500

4,500

168,900

0

168,900

53,000

1,000

29,500

20,500

2,000

142,550

75,600

64,500

1,050

1,400

803,250

5,498

-10,559

16,057

18,988

142,246

125,515

16,731

-55,351

-80,636

18,947

6,338

20,748

73,118

55,719

10,279

7,120

26,271

20,120

6,151

232,104

125,219

106,885

20,973

2,499

-7,636

-14,055

40,165

65,003

21,606

13,782

25,200

4,414

549,597

16,057

16,057

18,988

142,246

125,515

16,731

25,285

18,947

6,338

20,748

73,118

55,719

10,279

7,120

26,271

20,120

6,151

232,104

125,219

106,885

42,664

2,499

40,165

65,003

21,606

13,782

25,200

4,414

662,483

1

Based on data obtained from Claritas.

SOURCE: Noell Consulting Group, Claritas, Inc.

Retail Dmd--2013

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 11

Prosperity-Hucks Estimated Retail Demand, 2012 - 2030

Demand by Store Type, 2013

2011

2015

Furniture Stores

2030

Bldg Materials & Garden Supply

163,101

181,100

199,462

218,193

16,057

18,988

16,731 Lawn & Garden Storse

Grocery Stores

Specialty Food Stores

Beer, Wine, Liquor Stores

Health & Personal Care

Clothing Stores

Furniture Sto 29,863

Home Furnis 12,042

Shoe Stores

Appliances, T

Jewelry, Luggage, Leather

Computer & S 6,253

Camera/Phot 1,036

Building Mate ######

Grocery Stor 89,573

Books & Music Stores

Beverage Sto 4,646

Health/Perso General Merchandise

Clothing Stor -3,797

Shoe Stores 10,062

Jewelry/Lugg

Florists

Used Merchandise

Piece Goods

Full Service Restaurants

Office Suppli 10,399

Ltd. Service Restaurants

General Merc 261,295

Full Service R######

Limited Servi

Special Food Services

Drinking Plac -177 Drinking Places

125,515

-80,636

18,947

6,338

20,748

Drinking Places

Ltd Service Restaurants

55,719

-177

74,523

General Merchandise Stores

-161,754

261,295

Florist

Book Stores

Music Instruments

Piece Goods/Sewing

Hobby/Toy Stores

10,399

-5,840

-2,712

-4,472

512

125,219

2,499

Jewelry/Luggage/Leather

-7,636 Shoe Stores

-14,055

40,165

-32,019

7,128

10,062

21,606

Computer & Software

13,782

Appliances, TVs & Electronics

Home Furnishing Stores

6,253

-2,642

12,042

29,863

4,414

-100,000 -50,000 0 50,000 100,000 150,000

1,200,000

1,000,000

800,000

Estimated Retail Demand by Year--Prosperity-Hucks

600,000

536,069 536,069

400,000

200,000

614,275

464,275

805,909

505,909

1,031,337

431,337

0

2013 2020

Estimated Net Retail Demand Assuming Bryton

Estimated Net Retail Demand w/o Bryton

2025

Demand Indicators for Key Retail/Food Store Types

Opportunity for

Category

Study Area

Grocery Store Good

Comments

Market appears overbuilt, even without groceries at

Mallard Crk/ Mallard Crk Ch.

Health/Personal Care

Clothing Stores

Good

Moderate

Support exists for additional drug store

Lack of supply, but fundamentals don't exist in area

Fair

Demand exists, but being captured at Northlake Mall

Department Stores

General Merchandise/

Big Box

Full-Service,

Limited-Service

Good

Moderate

Definite opportunity exists in the study area if so desired, although not consistent with previous vision.

Lack of supply in the area that will be enhanced by I-485 opening and creation of stronger "location in the market.

SOURCE: Noell Consulting Group for ZIP 28269.

Retail Dmd

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 12

Potential Retail Opportunities in the Prosperity-Hucks Study Area

Several short- and long-term retail opportunities exist in the study area:

- Pull existing retail centers together via streetscaping, key design elements and infilling of neighborhood retail to create greater sense of a core;

- Infill restaurants and other food opportunities and add residential components to core;

- Recognize potential for big box retail and address through planning process

Bryton will provide long-term regional retail, although potential exists for big box users to look east to a more centralized location.

Pull existing retail together into a more consistent core that provides a sense of local destination

Interchange of I-485 and

Prosperity Church, and lack of big box retailers within four to five miles of location create potential for big box, if so desired.

Access/Visibility

Traffic volumes meet neighborhood retail thresholds, I-485 will enhance regional opps.

Quality Sites

Few currently exist and entitlements likely a challenge

Relationship to Other Retail

Overly competitive neighborhood retail market, but lack of regional/big box retail in the area

Housing

Moderate to low-density area appropriate for neighborhood retail and potentially some discount/big box users--area still lacks sense of location and destination (on a local level).

Summary of Retail Demand

Total Demand 2011-2030 Potential Acres 2011-2030

444,329 41.7

NOTE: Acreage estimates are gross and could include intensification of existing land uses in the market and thus are not necessarily net new acres needed.

Retail Opportunities

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 13

Office Market Overview

Macro Trends/Factors

- Moderate demand continuing to push positive absorption overall in 2012.

- Demand greatest in Center City/CBD followed by Southside office cores where fundamentals are strongest

- Office locations in areas with higher quality of life preferred both for retention and attraction of employees

Greater emphasis on walkable locations and mixed-use environments to attract strongest new talent

Northeast/North Charlotte Office Market

- I-77 North area continues to outperform the University area, gaining market share over the past decade while the University area has failed to keep up;

- Both areas have seen week office demand in 2012 and have actually seen negative absorption, albeit not too significant

- Rents have remained relatively flat in both cores, with both remaining relative value plays to the CBD and Southside cores

Fair Share Capture Ratio

(above 1.0 gaining market share)

3.32

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

0.60

1.33

Downtown Cotswold

1.36

Crown

Point

1.01

1.06

2.19

0.75

2.12

0.45 0.45

0.61

East Midtown NC

51/South

I-77 North University Northwest Park Road Southpark Airport/SW

- Neither have been able to establish a sense of location and a central core area

- Incomes around Lake Norman favor stronger long-term demand relative to University area, which generally lacks executive housing

Prosperity-Hucks Area

- Area's lack of regional access and historically fringe suburban location has tempered office demand;

- Continuing residential growth and lack of local-serving uses (medical, Realtors, accountants, etc) create opportunities to infill office in the study area;

- Regional-serving office not a realistic opportunity in the study area given lack of executive housing and stronger locations in the I-77 corridor;

- Potential to attract local-serving office users through enhancing mixed-use, walkable environment in the core of Prosperity-Hucks and provide a lifestyle

- that is largely missing in Northeast Mecklenburg today.

Office Market Overview

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 14

Context for Current & Future Office Development in the Prosperity-Hucks Study Area

Executive Housing

Office Core

Freeway Network

On a regional level the Prosperity-Hucks area has not offered the key factors needed to attract larger-scale office development:

- The area is not proximate to a significant base of executive housing, most of which can be found south of Center City with a secondary core around Lake

Norman;

- The area has also lacked access to the region's freeway network, something that will change in the next few years.

In the coming years Bryton and the I-77 North Corridor will likely account for a large share of "northside" multi-tenant office tenant growth while University

Research Park will account for the larger, back-office corporate users.

On a local level the Prosperity-Hucks study area lacks the demand generators and regional access found at nearby freeways.

The local/neighborhood-serving orientation of the retail already in the area, and the low-density environment found around

Prosperity-Hucks indicate a more local-serving office play may be most appropriate.

These factors, combined with the lack of nearby local-serving office cores, indicate a moderately-strong opportunity for neighborhood-type office uses.

Office Context Map

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Downtown

Cotswold

Crown Point

East

Midtown

NC 51/South

I-77 North

University

Northwest

Park Road

Southpark

Airport/SW

Totals

Exhibit 15

Historic Office Absorption by Submarket, Mecklenburg County

YE 2011

Ttl Space Vacant Occ'd Share

22,064,185

371,604

1,820,306

3,053,903

4,585,895

6,197,602

3,375,846

6,592,281

559,678

1,187,581

3.6%

17.8%

5,027,687 17.9%

11,691,584 20.6%

66,528,152 14.5%

11.1% 19,615,060 34.5%

12.5% 325,154 0.6%

16.6% 1,518,135 2.7%

12.9% 2,659,950

9.1% 4,168,579

15.8% 5,218,381

14.3% 2,893,100

15.9% 5,544,108

4.7%

5.1%

9.2%

5.1%

9.7%

539,530

976,192

4,127,731

0.9%

1.7%

7.3%

9,283,118 16.3%

56,869,036

Average Rents

2005

Annual

2011 Change

$20.27

$14.19

$16.65

$13.98

$18.54

$19.93

$19.03

$17.09

$14.19

$15.67

$20.44

$16.20

$18.11

$23.14

$20.26

$15.14

$13.29

$18.79

$23.90

$17.98

$17.25

$9.71

$16.31

$21.74

$15.90

$19.42

2005 2006

Annual Absorption (Square Feet)

2007 2008 2009 2010 2011 Total Share

2.4%

7.1%

-1.5%

-0.8%

0.2%

3.3%

-0.9%

0.2%

378,668

11,910

170,059

75,429

166,980

-990

-42,816

9,798

111,967 152,951

430,453 507,054

154,988 250,269

401,160 80,040

362,963

-2,292

67,027

87,161

108,192

43,606 -203,682

33,204

83,966

-6,928

10,363

69,822 138,222

71,309 47,636

498,127 177,968 108,472

121,046 -23,083

56,780 -10,088

-52,658

41,148

457,047

20,092

-34,447

49,322

13,737

270,532

248,070

-54,538

379,149

3,624

25,835

-66,905

102,247

48,736

1,584,731 20.5%

58,620

279,987

0.8%

3.6%

362,849 4.7%

418,341 5.4%

359,660 2,352,266 30.5%

159,880 858,512 11.1%

563,238 7.3%

-5.3%

0.7%

-99

-23,046

26,547

52,544

-10,605

-19,564

-3,942 105,225

13,411 -22,489

35,025

42,303

2,624

16,588

154,775 2.0%

59,747 0.8%

1.1% 194,110 16,458 340,648 -37,708 -290,008 -17,488 47,689 253,701 3.3%

-0.3% 101,876 318,015 384,748 359,860 -376,586 19,498 -42,541 764,870 9.9%

1.2% 2,007,475 1,536,850 1,994,231 778,325 -501,285 1,049,153 1,036,586 7,711,637

Capture

Ratio

0.60

1.33

1.36

1.01

1.06

3.32

2.19

0.75

2.12

0.45

0.45

0.61

500,000

400,000

300,000

2008 13,411

2009 -22,489

2010 42,303

2011 16,588

401,160

7.7% 401160

16.3% 80040

6.1% 56780

-3.0% -10088

10.5% 41148

23.6% -54538

15.4% 48736

20.0%

5.2%

2.8%

-1.3%

-8.2%

-5.2%

4.7% Average Abs. 2005 - 2011:

I-77 North: 122,000 SF

University: 80,500 SF

200,000

100,000

52,544

80,040

56,780

41,148 42,303

13,411

0

-23,046 -19,564

-10,088

-22,489

-100,000

-54,538

I-77 North University I-77 Capture of Meck University Capture of Meck

NOTE: Capture ratio is the ratio of the percent of space absorbed in a submarket over that submarket's share of total existing space at the beginning of that period.

Source: Colliers; CoStar; Noell Consulting Group

Office Abs. Trends

12/19/2012

16,588

48,736

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 16

Office Space Delivered by Planning District and the Prosperity Hucks Study Area, 2000 - 2010

District

Central District Totals

Central Capture

North District Totals

North Capture

Northeast District Totals

Northeast Capture

Prosperty Hucks District Totals

Prosperty Hucks Capture

Northwest District Totals

Northwest Capture

South District Totals

South Capture

Southeast District Totals

Southeast Capture

Southwest District Totals

Southwest Capture

Mecklenburg County

25,000

2000 2001 2002 2003

Office Delivered by Year (Square Feet)

2004 2005 2006 2007 2008 2009 2010 Totals

1,384,641

32.7%

1,232,950

43.8%

152,280

16.4%

39,421

2.6%

116,399

9.0%

153,382

8.7%

115,180

6.9%

217,727

12.1%

2,071,552

57.9%

503,504

14.1%

894,251

25.0%

6,881,287

35.1%

146,058

3.4%

330,201

11.7%

38,695

4.2%

185,642

12.3%

130,159

10.0%

133,521

7.6%

78,870

4.7%

300,517

16.7%

85,494

2.4%

60,389

1.7%

15,846

0.4%

1,505,392

7.7%

1,187,418

28.0%

454,052

16.1%

374,432

40.4%

268,182

17.8%

53,067

4.1%

193,312

10.9%

129,551

7.8%

84,412

4.7%

44,748

1.3%

10,760

0.3%

-

0.0%

2,799,934

14.3%

-

0.0%

-

0.0%

19,740

5.3%

2,368

0.9%

12,467

23.5%

-

0.0%

14,525

11.2%

7,284

8.6%

-

0.0%

-

0.0%

-

0.0%

56,384

2.0%

18,251

0.4%

14,912

0.5%

11,458

1.2%

20,644

1.4%

7,732

0.6%

11,914

0.7%

25,154

1.5%

21,008

1.2%

123,465

3.5%

-

0.0%

3,750

0.1%

258,288

1.3%

461,755

10.9%

534,215

19.0%

243,804

26.3%

626,881

41.7%

422,664

32.6%

560,582

31.7%

704,810

42.4%

634,025

35.1%

586,984

16.4%

9,832

0.3%

1,229

0.0%

4,786,781

24.4%

37,558

0.9%

2,227

0.1%

166,240

17.9%

26,830

1.8%

78,792

6.1%

53,388

3.0%

58,740

3.5%

38,002

2.1%

76,248

2.1%

15,914

0.4%

13,748

0.4%

567,687

2.9%

902,533

21.3%

216,889

7.7%

23,064

2.5%

192,833

12.8%

188,408

14.5%

60,602

3.4%

342,972

20.6%

474,206

26.3%

589,599

16.5%

25,444

0.7%

213,077

6.0%

3,229,627

16.5%

4,234,636 2,812,025 926,763 1,503,802 1,298,501 1,766,464 1,663,840 1,804,612 3,578,090 3,578,090 3,578,090 19,588,733

25%

Prosperty Hucks Capture of Northeast Di

-

0.0%

2001

-

0.0%

2002

19,740

5.3%

2003

2,368

0.9%

2004

12,467

23.5%

15,000

12,467

2005

-

0.0%

2006

14,525

11.2%

14,525

2007

7,284

8.6%

2008

-

0.0%

2009

-

0.0%

2010

-

0.0%

20%

15%

10,000 10%

7,284

5,000 5%

2,368

-

-

2000

-

2001 2002 2003 2004

Prosperty Hucks Study Area Totals

- -

2005 2006 2007 2008

Prosperty Hucks Capture of Northeast District

-

2009

-

2010

0%

SOURCE: Charlotte-Mecklenburg Planning Department

Office Del. by District

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 17

Map of Office Projects in Prosperity-Hucks Area and Analogous Locations

8

7

6

2

3

1

5

4

Office Properties

1 Prosperity Place

2 Linville Building

3 Harris Corners

4 640 W. Mallard Creek Ch

5 Mallard Professional Center III

6 Rosedale Medical Center

7 Shoppes at Birkdale Crossing

8 215 S. Main Street

SOURCE: Noell Consulting Group and Mecklenburg Planning Department (Map)

Office Map

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 18

Summary of Area Office Buildings

Photo Project Name

Prosperity Place I - III

Year Built # of Floors

1999 - 2001 3 - 4

Total SF

214,062

Vacant SF

93,164

% Occupied Current Lease Rates

56% $17.00

- $17.50

Comments

Three-bldg project-adjacent to URP

Linville Building 2008 5 125,000 7,629 94% $21.50

- $21.50

Spec office building by

Northlake Mall

Harris Corners Corporate

Park

2006

640 W. Mallard Creek Ch.

Road

2008

Mallard Professional

Center III

2004

Rosedale Medical Center 2005

Shoppes at Birkdale

Crossing

2009

215 S. Main

Summary, Regional Properties:

Summary, Smaller Properties:

SOURCE: Noell Consulting Group

Office Summary

12/19/2012

2010

2007

2007

5

2

1

2

2

3

5

2

130,000

36,913

27,785

38,249

58,757

21,000

156,354

36,541

33,867

6,780

8,848

1,650

3,755

3,000

44,887

4,807

74%

82%

68%

96%

94%

86%

71%

87%

$19.75 - $19.75

Most recent office addition to I-77 Corridor

$10.00

- $14.00

2nd floor office mixed with retail

$15.00

$15.00

Smaller, local-serving firms

$23.00

- $23.00

Medical office space in mixed-use environment

$26.00 - $29.00

Across from Birkdale

Village

$19.00 - $19.00

$19.42 - $19.58

$18.60 - $20.00

Downtown Davidson walking atmosphere

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 19

Small Service-Oriented Office & Retail Space Demand, 2012

Significant depth exists in the area for local-serving office tenants, many of which are located in retail centers today or are in nearby areas such as the University City core or along I-77. Assuming a better than fair share capture of demand, we believe the Prosperity-Hucks area can support around

60,000 square feet of local-serving office and 25,000 square feet of demand from retail-using services.

Industry

Code

Industry Code Description

Metro Firms

Less Than

19 Emps

Metrowide SF

@ 250

SF/Employee

Metrowide

Approx.

SF Per

Capita

Local Firms

Less Than

19 Emps

Approx.

SF Per

Capita

Potential

Unmet

Demand

Average

Tenant

Size

Estimated

Tenants

Supported

Typical Office Users

531 Real Estate

6214

6215

6216

8122

52231

54111

54194

541211

532

523

524

5414

6115

6116

6211

6212

6213

541213

541380

541519

Rental and Leasing Services

Securities, Financial Investments

Insurance Carriers and Related Act.

Specialized Design Services

Technical and Trade Schools

Other Schools and Instruction

Office of Physicians

Office of Dentists

Office of Other Health Practitioners

Outpatient Care Centers

Medical and Diagnostic Labratories

Home Health Care Services

Death Care Services

Mortgage and Non Mortgage Loan Brokers

Offices of Lawyers

Veterinary Services

Offices of CPAs

Tax Preperation Services

Testing Laboratories

Computer Related Services

Typical Retail Users

5172

6244

8123

8129

52211

52212

Wireless Telecommunication Carriers

Child Day Care Facilities

Dry Cleaning and Laundry Services

Other Personal Services

Commercial Banking

Savings Institutions

52213

71394

Credit Unions

Fitness and Other Rec. Centers

81211

81219

Hair, Nail, and Skin Care Services

Other Personal Services

Total, Office and Retail Users

1,789

340

354

557

213

39

267

501

673

661

125

73

102

68

60

756

111

322

179

32

60

59

368

246

221

259

15

74

179

464

128

4,472,500

850,000

885,000

1,392,500

532,500

97,500

667,500

1,252,293

1,682,500

1,652,500

312,500

182,500

255,000

170,000

150,000

1,890,000

277,500

805,000

447,500

80,000

150,000

147,500

920,000

615,000

552,500

646,250

37,500

185,000

447,500

1,160,000

320,000

23,236,043

2.49

0.47

0.49

0.78

0.15

0.05

0.37

0.70

0.94

0.92

0.17

0.10

0.14

0.09

0.08

0.26

0.15

0.22

0.25

0.04

0.08

0.08

0.51

0.34

0.31

0.36

0.02

0.10

0.25

0.65

0.18

11.78

52

1

9

11

19

16

21

11

16

3

2

5

2

4

1

1

2

2

5

0

3

0

8

7

5

7

0

0

9

15

3

240

2.14

0.86

0.45

0.66

0.12

0.04

0.37

0.45

0.78

0.66

0.08

0.08

0.04

0.04

0.08

0.16

0.08

0.21

0.21

0.00

0.12

0.00

0.33

0.29

0.21

0.29

0.00

0.00

0.37

0.62

0.12

9.88

29,844

0

3,419

9,957

2,111

1,118

117

20,816

13,193

22,272

7,802

1,644

8,578

4,552

105

8,380

6,144

1,565

3,696

3,789

0

6,986

15,577

4,630

8,670

6,110

1,776

8,763

0

2,444

4,657

208,718

2,500

-

2,500

2,500

2,500

-

-

2,000

2,000

2,000

2,000

2,500

2,500

2,000

-

2,500

2,000

2,500

2,000

2,000

-

1,500

4,900

1,500

1,500

3,000

3,000

3,000

-

1,500

1,500

3

6

5

3

2

1

3

-

2

3

95

SOURCE: Noell Consulting Group, US Census for Charlotte Metro and Zip Code 28269. Some user types discounted in local area due to factors of agglomeration.

3

1

-

3

3

2

4

1

2

2

-

12

-

-

10

7

11

4

1

-

1

Estimated

Demand By

SF

Capture,

Prosperity-

Hucks Area

58,800

24,480

83,280

147,000

8,000

2,500

7,500

4,000

-

7,500

6,000

2,500

4,000

4,000

-

30,000

-

2,500

10,000

2,500

-

-

20,000

14,000

22,000

61,200

7,500

14,700

4,500

9,000

6,000

3,000

9,000

-

3,000

4,500

208,200

Small Office Demand

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 20

Potential Office Development Opportunities in the Prosperity-Hucks Study Area

Focus on smaller, local-serving office users, those largely under 5,000 SF in size (most of those under 2,500 SF) in size.

This includes a mix of medical users, and smaller professional firms such as accountants, lawyers, architects,

Realtors--those that serve area residents.

I-485, while not enough to create a regional location, furthers the potential to attract localserving office users.

Location

Historically a low-visibility, suburban fringe location with limited appeal to local or regional-serving office. I-485 will enhance potential.

Retail/Services

Good access to retail and some services, although lacking a bit in dining opportunities.

Lifestyle

A significant office lifestyle environment doesn't exist today, as the area lacks walkability and a interactive environment.

Housing Quality

Limited amount of executive housing tempers demand for regional-serving office, although solid housing overall creates potential for local-serving office users.

Office Opportunities

12/19/2012

Create a greater sense of lifestyle in the area by furthering a mixed-use environment and enhancing walkability--providing a relatively unique environment in Northeast Mecklenburg.

Summary of Office Demand

Potential New SF 2010-2030 Potential Acres 2010-2030

97,550 9

NOTE: Acreage estimates are gross and could include intensification of existing land uses in the market and thus are not necessarily net new acres needed.

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 21

Factors Impacting Potential Residential Development Opportunities in the Prosperity-Hucks Study Area

The improved access to the Prosperity-Hucks area will further residential opportunities in the study area; opportunities that could extend to a wider range of housing opportunities beyond conventional single-family and townhouse product. This access will complement already solid neighborhood retail access, access to area parks and greenways, and solid schools. Still missing from the area is a lack of a walkable retail or mixed-use core, something that offers strong appeal to younger singles and couples in particular.

R

Access to neighborhood retail very strong and access to regional-serving retail improving

R

Regional access enhanced significantly by I-485, including access to cores along I-77 and

I-85

R

R

R

Good access to neighborhood park, greenway, and solid schools--all attractive to families.

SOURCE: Noell Consulting Group

Residential Context Map

12/19/2012

Stable neighborhood environment with growing potential for product diversification

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 22

Rental Residential Product Overview

National Trends/Factors

- Demand for rental apartments remains strong in spite of weak job growth, as the for-sale market remains tight.

- Demand likely to remain strong as Gen Y's continue to grow, move out from home--long-term indicators they'll value renting more so than previous generations.

- Lending for new construction picking up--seeing construction in best locations within solid markets.

- Strongest locations for rental product are convenient areas--those close to major employment cores and in walkable environments.

- Unit sizes anticipated to decrease as renters become less interested in paying for less excess space

- Condo-level finishes have become the norm in solid locations--not your old garden-style product.

Northeast Mecklenburg Trends

- The University City/Northeast Mecklenburg area has been among the most active apartment markets in the region, accounting for 25% of area absorption

- Rental product offered has consisted almost entirely of conventional garden product, most of which is not part of a mixed-use development or walkable to retail.

- Vacancy rates have dropped significantly in the last couple of years and are now considered relatively healthy, yet slightly higher than Mecklenburg County overall;

Rent growth continues to lag that of the county overall, related in part to both the increasing demand for product in more urban locations (Center City, South End,

- Southpark) and the consistently high vacancy rates found in the area (which, again, have declined in the last year or two);

- Growth in the area is fueled by a mix of those working in the University area and I-85 corridor (including a mix of white collar and retail employees), and UNC-Charlotte students seeking university proximity.

Prosperity-Hucks Trends

- Very little product exists in or adjacent to the study area today, although two new projects are under construction or imminent nearby

(Ridge at Highland Creek and planned apartments at nearby Bryton);

- Most apartment communities developed around the area has been delivered as freestanding garden product that relies on community amenities, convenience and lower rents to provide value, as opposed to greater lifestyle offerings;

- The two strongest performing communities in the area (Worthington and Windsor at the Vinoy) both enjoy strong interstate proximity and immediate adjacency to

University Research Park and major employers in the area;

- The extension of I-485 through the study area, combined with its residential feel and access to neighborhood-serving retail, will enhance opportunities for rental

- apartment development in the coming years.

SOURCE: Noell Consulting Group

Rental Residential Overview

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 23

Multifamily Residential Units Delivered by Planning District and in the Prosperity-Hucks Area, 2000 - 2010

District

Intown/ Central District Totals

Intown/ Central Capture

North District Totals

North Capture

Northeast District Totals

Northeast Capture

Prosperity Hucks Totals

Prosperity Hucks Capture

Northwest District Totals

Northwest Capture

South District Totals

South Capture

Southeast District Totals

Southeast Capture

Southwest District Totals

Southwest Capture

Total

250

200

Prosperity Hucks Totals

Prosperity Hucks Capture

150

100

50

-

2000 2001

2000

835

13.1%

651

10.2%

1,472

23.1%

376

5.9%

1,425

22.3%

2001 2002 2003

482

9.3%

1,864

29.9%

771

20.4%

687

13.2%

550

8.8%

535

14.1%

888

17.1%

959

15.4%

1,102

29.1%

136

9.2%

154

17.3%

171

17.8%

130

11.8%

97

1.9%

195

3.1%

601

15.9%

1,358

26.1%

1,420

22.8%

725

19.2%

Multifamily Units Delivered by Year

2004 2005 2006

657

14.9%

495

11.2%

817

15.0%

2007

1,646

26.6%

2008 2009 2010 Totals

1,195

26.0%

1,837

73.3%

689

129.5%

8,762

18.8%

224

5.1%

603

13.7%

645

11.9%

933

15.1%

255

5.5%

106

4.2%

95

17.9%

5,083

10.9%

869

19.7%

1,839

41.7%

788

14.5%

626

10.1%

822

17.9%

162

6.5%

64

12.0%

9,591

20.6%

194

22.3%

182

9.9%

100

12.7%

236

37.7%

17

2.1%

50

30.9%

56

87.5%

1,426

14.9%

79

1.8%

1,127

25.6%

403

6.3%

894

17.2%

428

6.9%

376

9.9%

363

8.2%

990

15.5%

1,032

19.8%

220

3.5%

132

3.5%

1,079

24.5%

6,381 5,205 6,227 3,784 4,401

493

11.2%

43

0.8%

245

4.0%

558

12.1%

12

0.5%

7

1.3%

2,687

5.8%

649

14.7%

1,316

24.2%

1,634

26.4%

890

19.4%

518

20.7%

185

34.8%

10,544

22.6%

515

11.7%

4,406

183

3.4%

261

4.2%

47

1.0%

332

13.3%

214

4.9%

748

13.8%

5,439

929

15.0%

6,199

832

18.1%

736

29.4%

4,599 2,505

106

19.9%

170

32.0%

6,176

13.2%

532

3,470

7.4%

46,641

100.0%

2000

136

9.2%

2002

2001

154

17.3%

2003

2002

171

17.8%

2004

2003

130

11.8%

2005

Prosperity Hucks Totals

2004

194

22.3%

90.0%

2005

182

9.9%

2006

100

12.7%

2007

236

37.7%

2008

17

2.1%

2009

50

30.9%

2010

56

87.5%

80.0%

70.0%

1,426

14.9%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

2006 2007

Prosperity Hucks Capture

2008 2009 2010

Source: Noell Consulting Group based on data obtained from the Charlotte-Mecklenburg Planning Department

MF Del. by District

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 24

Historic Apartment Vacancy, Mecklenburg County and the Harris Submarket

Northeast Mecklenburg, which includes the Prosperity-Hucks area, has a history of being slightly overbuilt, with vacancies averaging close to 8% since 1995. This said, the submarket has seen vacancy rates drop significantly over the last couple of years and is now approaching a 5% vacancy rate; a rate considered healthy for Class A rental apartments.

Harris Submarket

16%

14%

12%

13.0%

11.9%

10%

8%

9.6%

10.5%

9.2%

8.3%

9.6%

9.0%

8.4%

6%

4%

6.7%

6.5%

4.9%

4.4%

6.8%

6.5%

5.8%

3.7%

3.1%

2%

0%

1995 1996 1997 1998 1999 2000 2001 2002

Northeast

2003 2004 2005

Mecklenburg County

2006

SOURCE: REIS

2007 2008 2009 2010 2011 MY 2012

Apartment Occ. Trends

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 25

Historic Net Apartment Absorption, Mecklenburg County and Harris/Northeast Mecklenburg Submarket

1

5,000

The Harris/NE Mecklenburg submarket as been among the most active in the Charlotte region over the past 17 years, capturing nearly 25% of all Mecklenburg County absorption. This equates to an average annual absorption of more than 500 units annually during the entire period.

4,000

100%

80%

60%

3,000

40%

2,000

1,841

Historic Average: 25%

20%

1,000

0

1,016

946

873 839

723

337

383

541

499

342

453

0%

89

152 168 204

69

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 MY 2012

-215

-20%

-40% -1,000

Harris Submarket

SOURCE: Noell Consulting Group based on data obtained from REIS

Apartment Abs. Trends

12/19/2012

Mecklenburg County Harris as a % of Mecklenburg

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 26

Historic Apartment Rental Rate Growth, Mecklenburg County and Harris/Northeast Mecklenburg Submarket

8.0%

Due to a relatively consistently high vacancy rate and steady construction, rent growth in the Harris/Northeast Mecklenburg submarket has averaged around 1.2% since 1995, about half the rate seen in Mecklenburg County overall.

6.0%

5.8%

4.4%

4.0%

3.8%

3.2%

2.9%

2.0%

0.0%

1995

1.8%

Historic Average: 1.2%

1996 1997 1998

1.9%

0.3%

1999 2000

1.0%

2001 2002 2003

1.7%

1.4%

2004

1.0%

0.6%

2005 2006 2007 2008 2009 2010

1.4%

-0.6%

2012

-2.0%

-2.2% -2.2%

-4.0%

-3.8%

-6.0%

Harris/ NE Mecklenburg Mecklenburg County

SOURCE: Noell Consulting Group based on data obtained from REIS.

Apartment Rent Trends

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 27

Map of Apartment Communities Proximate to the Prosperity-Hucks Study Area

9

8

4

3

1

7

2

6

5

Apartment Communities

1 Colonial Grand at Legacy Park

2 Colonial Grand at Mallard Creek

3 Mill Pond

4 Reserve at Stone Hollow

5 Windsor at the Vinoy

6 Tradition at Mallard Creek

7 Worthington

Planned/Under Construction

8 Ridge at Highland Creek

9 Planned Bryton Apartments

Units

288

252

168

194

356

360

284

340

285

SOURCE: Noell Consulting Group.

Apartment Map

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 28

Summary of Key Rental Apartment Communities in the Greater Prosperity-Hucks Area

Community

Name

Colonial Grand at Legacy Park

Exterior Picture

Year

Deliv.

# of

Units

2001 288

Unit

Mix

42%

42%

17%

100%

Avail.

Units Leased Unit Type

6

6

5

17

95%

95%

90%

94%

1B/1b

2B/2b

2B/2b

Colonial Grand

@ Mallard

Creek

1B/1b

2B/2b

3B/2b

Mill Pond

Reserve at

Stone Hollow

2005 252 51%

41%

8%

100%

2008 168 21%

50%

29%

100%

2009 194 29%

58%

13%

100%

3

7

1

3

3

6

1

10

4

7

5

16

98%

94%

95%

96%

97%

96%

94%

96%

93%

94%

81%

92%

1B/1b

2B/2b

3B/2b

1B/1b

2B/2b

3B/2b

Windsor at the

Vinoy

Tradition at

Mallard Creek

Worthington

Average, Area Projects

SOURCE: Noell Consulting Group

2005 356 46%

48%

7%

100%

1999 360

2006 284

28%

48%

24%

100%

64%

35%

0%

299%

2004.7 271.7

0

7

0

7

1

9

0

8

12

6

11

1

18

96%

94%

96%

95%

100%

95%

99%

98%

100%

93%

100%

99%

96%

1B/1b

2B/2b

3B/2b

1B/1b

2B/2b

3B/2b

1B/1 - 2b

2B/1 - 3b

3B/3b

Unit Size

Range

Avg.

Size

745 - 795 775

1,045 - 1,260 1,174

1,526 - 1,526 1,526

745 - 1,526 1,066

Current Market Rent

Range

$700 - $764

$832 - $986

$1,011 - $1,011

$700 - $1,011

Avg.

Rent

$732

$909

$1,011

$852

617 - 738 734

983 - 1,286 1,057

1,430 - 1,430 1,430

617 - 1,430 923

650 - 650 650

1,050 - 1,050 1,050

1,300 - 1,300 1,300

650 - 1,300 1,036

955 - 1,005 980

1,106 - 1,188 1,129

1,274 - 1,274 1,274

955 - 1,274 1,106

740 - 862 771

1,026 - 1,157 1,108

1,454 - 1,454 1,454

740 - 1,454 978

712 - 806 789

985 - 1,348 1,060

1,428 - 1,533 1,481

712 - 1,533 1,084

534 - 1,152 816

879 - 1,180 1,070

1,934 - 1,934 1,934

534 - 1,934 896

534 - 1,934 1,013

$726 - $766

$846 - $1,430

$1,231 - $1,261

$726 - $1,430

$685 - $705

$705 - $805

$985 - $1,000

$685 - $1,000

$700 - $836

$750 - $900

$999 - $999

$700 - $999

$755 - $1,085

$815 - $1,335

$1,015 - $1,415

$755 - $1,415

$739 - $774

$884 - $1,090

$1,174 - $1,234

$739 - $1,234

$699 - $1,200

$865 - $1,100

$1,715 - $1,715

$699 - $1,715

$685 - $1,715

$920

$1,075

$1,215

$1,014

$769

$920

$1,204

$945

$833

$1,082

$1,715

$910

$890

$765

$907

$1,248

$862

$695

$755

$993

$810

$768

$838

$999

$839

Apartment Summary

12/19/2012

Avg. $/SF

$0.94

$0.77

$0.66

$0.80

$1.04

$0.86

$0.87

$0.93

$1.07

$0.72

$0.76

$0.78

$0.78

$0.74

$0.78

$0.76

$1.19

$0.97

$0.84

$1.04

$0.97

$0.87

$0.81

$0.87

$1.02

$1.01

$0.89

$1.02

$0.88

$/SF Range

$0.94 - $0.96

$0.80 - $0.78

$0.66 - $0.66

$0.66 - $0.96

$1.18 - $1.04

$0.86 - $1.11

$0.86 - $0.88

$0.86 - $1.11

$1.05 - $1.08

$0.67 - $0.77

$0.76 - $0.77

$0.67 - $1.08

$0.73 - $0.83

$0.68 - $0.76

$0.78 - $0.78

$0.68 - $0.83

$1.02 - $1.26

$0.79 - $1.15

$0.70 - $0.97

$0.70 - $1.26

$1.04 - $0.96

$0.90 - $0.81

$0.82 - $0.80

$0.82 - $0.96

$1.31 - $1.04

$0.98 - $0.93

$0.89 - $0.89

$0.82 - $1.04

$0.66 - $1.26

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 29

New Rental Residential Demand in Mecklenburg County, Northeast Mecklenburg, and the Prosperity-Hucks Area, 2011 - 2030

Cut Factor

Annual Job Growth, Mecklenburg County

Annual Apt Absorption, Mecklenburg County

Jobs/Apt Absorption Ratio, Mecklenburg County

2004 2005 2006 2007 2008 2009 2010 2011

Avgs,

'04 - '11

777 14,926 23,622 23,788 1,826 (33,728) (60) 14,411 5,695

1,166 1,220 2,012 2,026 956 1,374 3,798 1,490 1,755

0.7

12.2

11.7

11.7

1.9

(24.5) (0.0) 9.7

3.2

2011 -

2015 2016 -2020

58,785 58,686

2021 -

2025

52,068

2026 -

2030

Totals 2011 -

2030

56,513 226,052

Total HH Growth ('00 - '10)

Renter Propensity

New Renter HH Growth

Annualized

84,221

39%

33,108

3,311

40,027

44%

17,736

35,586

42%

15,057

3,547 3,011

33,197

44%

14,710

30,403

46%

14,080

2,942 2,816

139,213

44%

61,583

61,583

Est. Capture, Rental Apts

Harris/Northeast Mecklenburg Capture ('04 - 11)

Annual New Rental Apt Growth in the Harris/NE Mecklenburg Submarket

Prosperity-Hucks Study Area Capture

58%

22.7%

399

58%

20%

414

20%

58%

20%

352

20%

58%

20%

344

15%

58%

20%

329

10%

58%

20.0%

7,191

17%

Annual Supportable New Units, Prosperity-Hucks Study Area 83 70 52 33

With the extension of I-485 through the Prosperity Hucks area, and the increased regional access it will provide, we believe demand potential for new rental product in the area will increase significantly, particularly in the next 8 years. Over time, competition will likely shift to areas such as Bryton and along the planned Blue Line Extension to UNC-

0

Charlotte, tempering long-term demand. Still the presence of significant neighborhood retail, the existing low-density neighborhood environment, and the access provided by I-

485 will be attractive to many renters in the market.

1,188

Projected household growth via population projections provided by MUMPO

Renter propensities from US Census Bureau

Captures based on historic and current trends and estimates of where those captures will trend going forward.

Estimated demand potential estimates are gross and do not net out projects planned or in the pipeline.

SOURCE: Noell Consulting Group based on data obtained from Economy.com, MUMPO, the US Census Bureau and REIS.

Rental Res. Demand

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 30

For-Sale Residential Product Overview

Macro Trends/Factors

- Home prices in the nation's largest markets are showing steady improvement over the past year, with 18 of 20 markets, including Charlotte, posting positive gains in prices.

- Charlotte home prices have increased by roughly 4% year-over-year and are now back to mid-year 2005 price levels--a significant improvement over the past few years.

- Economists expect housing market conditions to improve gradually in 2013 and 2014, assuming no major economic shocks, such as the upcoming potential "fiscal cliff".

- Existing home inventories have dropped significantly in the past year and are now generally in ranges considered normal to healthy, with most areas posting less than six months of existing home inventory.

- Home prices in Mecklenburg County have rebounded over the past year, increasing by 4.2% over the past year; a healthy rate of growth.

- Nationally and locally, pain in the housing market has been focused largely at the more moderate end of the spectrum, particularly in the starter market as many who cannot afford new home ownership have been able to purchase new or existing homes and have subsequently given those homes back to the bank.

- The suburbs is most metros, including Charlotte, have largely been hit harder than intown areas given many buyers "drive for value" and are most susceptible to

downturns in the market. High gas prices have inflicted further pain on homeowners on the suburban fringe.

Current Regional Home Sales Statistics

Charlotte Metro Area

Mecklenburg County

Zone 1 (North/Northeast e. of I-77)

Zone 2 (East Mecklenburg)

Zone 9 (North/Northwest w. of I-77)

Change in Price

4.5%

4.2%

1.3%

-3.1%

1.6%

Median Price

$162,000

$165,000

$149,150

$95,000

$129,900

Mos. of Inventory

5.1

4.3

4.1

4.1

3.4

Northeast Mecklenburg/Study Area Trends

- Home price growth in NE Mecklenburg, inlcuding in the Prosperity-Hucks study area, has generally lagged that of the larger county, increasing by about 1.3% over the past year.

- Inventories, meanwhile, have dropped significantly over the past year, consistent with drops seen in the metro area and the county overall.

- Foreclosures, meanwhile, have remained stubbornly high, roughly 50% higher than Mecklenburg County overall, reflecting the pain still impacting more moderately-priced suburban markets.

Foreclosure/RealtyTrac Statistics

ZIP/Area

28269--Prosperity-Hucks

28262--University City

28078--Huntersville

Charlotte

Mecklenburg County

October 2012

Foreclosure Rates Average Price

0.34%

0.22%

0.17%

0.24%

0.23%

SOURCE: NCG based on data obtained from Realtytrac and Charlotte Regional Reatlor Association.

$152,105

$134,263

$238,436

$201,505

$214,308

For-Sale Overview

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 31

Summary of New Home Sales Trends in Northeast Mecklenburg, 2000 - MY 2012

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2,218

84.4%

11.8%

2,170

80.8%

17.1%

2,121

76.1%

21.8%

77.1%

1,902

20.7%

Mix of New Home Sales in NE Mecklenburg

80.5%

1,875

16.1%

81.6%

1,885

13.0%

81.5%

1,947

15.1%

84.9%

1,437

11.0%

89.0%

739

6.2%

Like the Charlotte region overall, Northeast Mecklenburg has seen a sharp drop-off in sales volumes (down 82%) and new home prices (down 20% from peak).

Over the next few years sales volumes will increase in Northeast

Mecklenburg, albeit at a level below that seen in the mid 2000's, with townhouses potentially accounting for a greater share of product mix.

2,500

89.4%

88.8%

83.5%

81.6%

2,000

388

6.2%

454

8.8%

15.0%

340

15.6%

244

1,500

1,000

500

0

2000 2001 2002 2003 2004

Total Sales

2005 2006 2007

Single-Family Detached

2008

Townhouse

2009 2010 2011 MY 2012

Median New Home Sales Price by Product Type

$215,000

$195,000

$175,000

$155,000

$135,000

$138,500

$115,000

$114,000

$95,000

$75,000

2000

$142,500

$118,500

2001

$155,500

$143,500

2002

$151,000

2003

$158,000

$118,000

$122,000

2004

$171,000

$133,000

2005

$180,000

$136,000

2006

Single-Family Detached

$197,500

$142,000

2007

Townhouse

$180,000

$129,000

2008

$175,000

$136,500

2009

$164,000

$113,000

2010

$152,000

$132,000 $135,500

2011

$153,000

MY 2012

SOURCE: Noell Consulting Group based on data obtained from MORE.

NE Meck Home Sales Summary

12/19/2012

CITY OF CHARLOTTE

PROSPERITY-HUCKS AREA PLAN MARKET ANALYSIS

Exhibit 32