Proceedings of 3rd Global Accounting, Finance and Economics Conference

advertisement

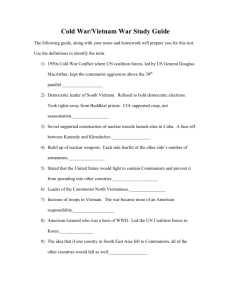

Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 Multinational Corporations’ (MNCs) Motivations to Invest in the Vietnamese Services Industry Thi Lan Anh Nguyen*, Ali Saleh** and Denis Vinen*** This study investigated the MNCs’ motivation to invest in the Vietnamese services industry. Consistent with the focus on eclectic paradigm to marketseeking and efficiency seeking factor, this study also analyses the influence of government policies, culture dimension and business networks on foreign direct investment (FDI) location decision. The data (from 288 MNCs operating in the services industry in Vietnam) was predominantly analysed through descriptive statistics, confirmatory factor analysis (CFA and structural equation modeling (SEM). The analysis confirmed the market-seeking and government policies factor had significant influences on the FDI location decision. In contrast, efficiency-seeking, culture dimension and business networks had an insignificant influence on the FDI location decision. The results from this study make a significant contribution to the literature given the lack of studies that examine the motivation of MNCs to invest in the Vietnamese services industry at firm level. JEL Codes: C12, D21, D78 and M10 1. Introduction In 1986, the Republic of Vietnam launched the “Doi Moi” policy – a home-grown, political and economic renewal campaign that restructured the economy from a planned economy, to a socialist-oriented market economy. After the “Doi Moi” policy was implemented, FDI into Vietnam increased rapidly both in terms of the number of projects and their capital volume. Since that time FDI has made a major contribution to Vietnam‟s economic growth and the living standards of all Vietnamese people. By 1990, Vietnam had licensed 211 projects with a registered capital of US$1.57 billion; however by December 2012, these numbers had increased to 14,522 projects and a registered capital of US$211 billion (FIA, 2013). In Vietnam‟s long term development strategy, the Vietnamese National Congress highlighted that one of the key elements for success is the continued ability to attract and utilise foreign inflow of capital including FDI and official development assistance (ODA). FDI has been considered as an important source of economic growth of Vietnam, therefore Vietnam has maintained a policy of encouraging FDI since the promulgation of the first Law on Foreign Investment in 1987. Foreign investors quickly responded to this * Thi Lan Anh Nguyen, Faculty of Business & Enterprise, Swinburne University of Technology, PO Box 218 Hawthorn, Victoria 3122, Australia. Email: thilananhnguyen@swin.edu.au ** Dr Ali Saleh. Email: asaleh@swin.edu.au *** Associate Professor Denis Vinen. Email dvinen@swin.edu.au 1 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 open door policy which resulted in Vietnam receives a large amount of foreign investment and also competing for more FDI. The major goal of Vietnam‟s FDI policy is to attract capital, advanced technology, and manage skills in order to effectively develop the country‟s potential, increase saving and improve people living standard. Although FDI has been considered as an important source of economic growth of Vietnam, there are very few empirical studies on the motivations of MNCs to invest in Vietnam. Most studies have focused on the relationship between FDI inflows and economic development by using secondary data, such as Dinh (2009) and Mirza and Giroud (2004). This study, using primary data, examines empirically various determinants and strategic motivations of FDI based on managerial perceptions. To our knowledge, the authors believe this is the first comprehensive study to examine the motivations of MNCs to invest in the Vietnamese services industry at the firm level. The motivations of MNC‟s to invest abroad, especially in developing countries like Vietnam have resulted in conflicting opinions between economists. Some have argued that economic variables (such as market-seeking, asset-seeking, efficiency-seeking and resource-seeking) together with government policies are the important factors affecting inward FDI (Sethi et al., 2003, Mirza and Giroud, 2004). Other economists, such as Blonigen and Piger (2011), Du et al. (2011) and Lei and Chen (2011) believed that not only the traditional economic factors and government policies, but also cultural dimension and business networks, are the main determinants of FDI. Therefore, the primary aims of this paper are as follows. To empirically test the significance of the underlying constructs and hypotheses derived from the conceptual framework and identify the importance of factors in the MNCs‟ investment decision. To introduce new constructs (business networks and cultural dimension) and validate them in the context of Vietnam with the aim of enhancing the current literature with regards to MNCs‟ motivation to invest into Vietnam. To develop a comprehensive model that incorporates a number of variables including market-seeking, efficiency seeking, government policies, cultural dimension and business networks. The combination of these variables in analysing the MNCs‟ motivation to invest in Vietnam has not been addressed in previous studies. To achieve the objective of this study, a numerical simulation of the theoretical macroeconomic model was conducted in order to analyse the determinants of FDI in the Vietnamese services industry. 2. Literature Review and Research Hypotheses Vernon (1966) argued that when the economic ties in a host country fit more easily into global production and trade patterns, the country would be more attractive to foreign investors. Thus, it is argued that FDI and openness of the economy will be positively related. Furthermore, the influence of market size and market potential on location decision making is also a widely examined variable in empirical studies, for example Kang & Lee (2007) and Sethi et al. (2003). These studies have identified a strong positive 2 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 relationship between the market size and market potential of the host country and FDI inflows. Thus, it was hypothesised that: Hypothesis1: Market-seeking would be positively related to FDI inflow in the Vietnamese services industry. Vernon (1966) also pointed out that foreign investment is related to the international product life cycle, so MNCs tend to invest in the countries that can produce their products at the lowest possible cost. Thus, factor cost considerations are a significant location advantage. According to Vernon (1966), the availability of cheap inputs is the main determinant to attract FDI. Moreover, empirical studies found a relationship between either operating cost or labour quality and FDI inflow. For example, Parcon (2008) reported that the relationship between labour costs and FDI inflows is negative at country level, but is positive at the firm level. The major reason for this positive relationship is that the higher level of labour cost implies a higher strength in labour skills and thus higher productivity. Thus, it was hypothesised that: Hypothesis 2: Efficiency-seeking would be positively related to FDI inflow in the Vietnamese services industry. Over the past two decades, most governments have been actively promoting their countries as investment locations to attract scarce private capital and associated technology and managerial skills in order to help achieve their development goals. Examples of such measures include liberalising the laws and regulations for the admission and establishment of foreign investment projects, providing guarantees for repatriation of investment and profits and establishing mechanisms for the settlement of investment disputes. Tax incentives are also part of these promotional efforts. Most of the empirical studies have tended to emphasize the impact of government policies (tax incentives) on FDI inflow, for example, Margalioth (2003) and Van Parys (2010). However, the findings from the previous researchers had been inconsistent and inconclusive as to whether the tax incentives are effective in influencing investment decision. While some researchers [e.g. De Mooij and Ederveen (2003) and Margalioth (2003)] supported the view that tax incentives effect foreign direct investment decisions, the results of other researchers‟ studies [such as Van Parys (2010)] were concluded that taxes and state incentive programs do not seem to have a major effect in attracting FDI inflow. Furthermore, many empirical studies focused on the influence of other type of government policies on FDI flows, such as trade agreement, infrastructure and policy promotions (Dinh, 2009, Pham, 2012, Binh and Haughton, 2002). Based on the existing theoretical and empirical work, it was hypothesised that: Hypothesis 3: Government policies would be positively related to FDI inflow in the Vietnamese services industry. Recently, some researchers have also adopted a cultural dimension and business networks approach to examine firm internationalisation. While some researchers, such as Asiedu (2002) and Gast and Herrmann (2008), supported an opinion of cultural distance effects to foreign direct investment decision, Sethi et al. (2002) pointed out cultural distance do not seem to have major effects to new business location decision. With regard to the business networks approach, a vast literature review found that MNCs' networks 3 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 have an important impact on MNCs‟ investment location decisions (Lei and Chen, 2011). Most business networks are measured based on internal or external relationships, for example, based on firm‟s relationships with supplies, competitors and other associations or government agencies (Welch et al., 1997) or based on firm‟s links with other firms, outsiders, government, customers, suppliers, competitors and vertical links with MNCs (Saleh and Harvie, 2010) or based on personal relation (Senik et al., 2011). Thus, it was hypothesised that: Hypothesis 4: There would be a relationship between FDI inflow and cultural and business network factors. H4a: There would be a negative relationship between FDI inflow and cultural factors. H4b: There would be a positive relationship between FDI inflow and business network factors. In summary, there are gaps in the empirical studies which examine MNCs‟ motivations to invest abroad. Firstly, although there is a growing interest in researching the factors influencing FDI, most studies in this field have used a cross-sectional procedure. Few studies have considered the primary data in examining MNCs‟ motivation to invest abroad [e.g. Chandprapalert (2000), Sandhu (2007), among others]. Secondly, there is little research on the growth and internationalisation of services firms. More specifically, studies focusing on the motivational factors behind MNC‟s willingness to invest in the Vietnamese services industry have been scarce. Thirdly, although most studies confirm the importance of the cultural dimension and business networks variables, there are few empirical studies that consider the cultural and network variables in examining the MNCs‟ motivations to invest in the services industry (Guiso et al., 2009, Siegel et al., 2011). Therefore, in order to better explain the determinants, which affect the inflow of FDI in Vietnam, the conceptual framework should include economic, government policies, cultural dimension and business networks factors. This study uses a combination of variables likely to attract FDI into the Vietnamese services industry, including market-seeking, efficiency-seeking, government policies, cultural dimension and business networks variables. The hypotheses and research model used in this research in order to fill the gap in the literature will be developed below. 3. The Methodology and Model 3.1 The Survey Instrument In this study, the constructs measured multi-items by using a five-point Likert scale. The knowledge scales were adopted from the empirical studies, such as Chandprapalert (2001), Lei and Chen (2011), Tatoglu and Glaister (1998) and Tuomi (2009). 3.2 Data and Sample Characteristics This study is based on a survey instrument delivered to 2,500 randomly selected MNCs in Vietnam. The selection of the sample MNCs was not limited to firms carrying out any particular business type. However, due to resource constraints, the sample was limited primarily to MNCs operating in Ho Chi Minh City, which has the biggest number of MNCs establishments in Vietnam (FIA, 2013). Details of MNCs were obtained from the Vietnam Statistical Yearbook 2010 published by the General Statistics Office. This directory was 4 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 chosen as it contains official information of MNC‟s operating in Vietnam. However, this directory also includes MNC‟s that have not commenced operations and MNC‟s that have ceased operations. In order to provide the most accurate data about MNC‟s operating in Vietnam, other sources [such as Vietnam industry bodies (e.g. Vietnam Chamber of Commerce & Industry (HCMC); the Association of International Businesses in Vietnam (such as AmCham Vietnam, AusCham Vietnam, German Business Association and Singapore Business Association); and the Vietnam Economic Times website (http://gda.com.vn/doanhnghiepfdi)] were used to update information. The questionnaire was sent to the senior management staff in each firm, such as the Chief Executive Officer (CEO), President or Managing Director. This approach was adopted as they were considered to be the senior management within an MNC responsible for the key investment and employment decision making. Five hundred and forty three (21.72%) of questionnaires were not delivered. According to post-office documentation on the returned questionnaires, the main reasons were company had moved or no such address or business had ceased. Just 62.36 percent of total questionnaire recipients declined to respond. Of the 1957 potential participants, three hundred and ninety eight (398) firms responded to the survey, representing a response rate of 20.34%. The response rate is comparable to other studies that use similar methodology, which typically report response rates that range from 14 to 27% [e.g. Zulkiffli (2011)]. Given the study‟s requirement for senior management involvement, sensitive information, firm diversity and industry range variety, 20.34% of response rate in this study is an acceptable sample size for further analysis. Table 7.1 shows the response and nonresponse rates of the distributed questionnaire. Since the focus of this study is to examine factors that motivate MNCs to invest in the Vietnamese services industry, the study used data from 288 services firms for analysis. Table 1: Respondents’ Response Rate Questionnaire Distribution Frequency (N=2500) First-period n Questionn aire Answered Questionn aire Not Answered Usable % After Follow-up Phone Calls n % Second-period (Reminder letter) n % Total n % 186 9.50 88 4.50 110 5.62 384 19.62 7 0.36 2 0.10 5 0.26 14 0.72 Total 193 9.86 90 4.60 115 5.88 398 20.34 Undeliverable 428 17.12 0 0 0 0 428 17.12 Business Ceased 115 4.60 0 0 0 0 115 4.60 Not Responded 1764 70.56 0 0 0 0 1559 62.36 Total 2307 92.28 0 0 0 0 2102 Unusable 3.3 Analytical Procedures This study used descriptive statistics, confirmatory factor analysis (CFA), and structural equation modelling (SEM) analysis. The data was analysed by using the computer 5 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 package AMOS (version 20) for SEM; and SPSS (version 20) for CFA and descriptive statistics. Results of the data analysis are presented in the following section. 4. The Findings 4.1 Descriptive Statistics The majority of responding firms were represented from a variety of sectors within the services industry including information & communications, hotel and restaurant, real estate, wholesale and retail (Figure 2). In terms of ownership structure, the wholly foreign owned firms accounted for 60.1 per cent of the total in comparison with 27.4 per cent of firms which had a joint-venture structure and 10.4 per cent of firms which had a partnership structure. Most of firms were from parent companies which have been involved in international business operations for more than 20 years (31%). Approximately 54% of the firms indicated operations in two foreign countries and 23% of firms were operating in more than four countries. Furthermore, most of the MNCs were established in Vietnam during the 2006-2010 period (37.8 per cent), 2001-2005 period (22.2 per cent) and 1991-1995 period (21.2 per cent), with only 18.8 per cent established during the 1980-1990, 1996-2000 and 2011-2012 time periods. In terms of total investment capital in Vietnam, the majority of MNCs invested capital of less than USD15 million (60.1 per cent), followed by 26.4 per cent of MNCs which invested over 35 million, only 13.5 per cent of MNCs which invested from USD16 million to USD35 million. Figure 2: Survey Respondents, by Sub-Industry, in Percent 4.2 Measurement Model Assessment In order to measure the model and ensure that a scale: (1) conforms to its conceptual definition; (2) is unidimensional; and (3) meets the necessary levels of reliability, scale validity must be assessed (Hair et al., 2010). This study evaluated four forms of validity, including content (face) validity, convergent validity, discriminant validity and nomological validity. 6 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 Firstly, content (face) validity was examined. In this study, the determination of content validity for research instruments is based on established scales that have been already subjected to test of content validity (Lei and Chen, 2011, Tuomi, 2009, Tatoglu and Glaister, 1998). To ensure the relevance of each instrument in the context of MNCs operating in Vietnam, the questionnaires were comprehensively screened by 9 respondents during the pilot-study stage: four academics and five CEOs of MNCs located in Ho Chi Minh city of Vietnam. Secondly, convergent validity was tested. The result in this study, showed confirmatory factor loadings of each measured item above 0.5 and Cronbach‟s alpha reliability scores of each construct above 0.7, is considered acceptable (Hair et al., 2010). Thus, convergent validity was confirmed successfully. Thirdly, discriminant validity was established following Fornell and Larcker problems (1981). All correlations among five independent variables (market-seeking, efficiencyseeking, government policies, culture dimension and business networks) were significant and there was the highest correlations between efficient-seeking construct and business networks construct (r2=0.583). Furthermore, the squared root of AVE scores was higher than the correlations between the constructs. Thus, the assessment of discriminant validity did not reveal any problems. Lastly, the entire measurement model is nomological valid since the χ2 is 416.045, with 412 degrees of freedom, at a probability of 0.435. In addition, the measurement also supported validity since the Goodness-Of-Fit index (GFI) is 0.92, the Root-Mean Square Error of Approximation (RMSEA) is 0.006 and the Comparative Fit Index (CFI) is 0.999. 4.3 Structural Equation Model (SEM) Results In order to investigate the relationship between five factors (market-seeking. efficiencyseeking, government policies, culture dimension and business networks) and FDI location, CFA was utilised to assess SEM model fit. SEM is used to investigate all variables in the proposed framework and to confirm the hypotheses. Table 2 summaries the results of the hypotheses test, standard errors (SE), the critical ratio (CR) and the probability (p). The „p‟ value indicates statistical significance at levels of 0.001 and 0.05 respectively. The direction and importance of the relationships is determined by the magnitude of β weights. 7 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 Table 2: Summary of Hypotheses Tests (H1-H4) Hypothe sis No. Relationship Marketseeking Efficiency<--H2 FDI seeking Government <--H3 FDI policies Culture <--H4a FDI dimension Business <--H4b FDI networks Note: *** p<0.001; * p<0.05 H1 FDI <--- Estimate SE CR P Accepted/ Rejected .385 .103 3.744 *** Accepted .027 .114 .242 .809 Rejected .313 .134 2.339 * Accepted -.131 .076 -1.719 .086 Rejected .171 .121 1.409 .159 Rejected β .367 .025 .271 -.138 .146 The output would answer the research hypotheses by considering the result for the causal model. As predicted in Hypothesis 1, market-seeking motivation positively influences on FDI location (β=0.367, CR=3.744, p<0.001). In contrast to Hypothesis 2, no support was found. Efficiency-seeking is no significantly related to FDI location in the Vietnamese services industry (β=0.025, CR=0.242, p>0.05). In accord with Hypothesis 3, government policies factor has a significant impact on FDI inflows to the Vietnamese services industry (β=0.271, CR=2.339, p<0.05). Contrary to market-seeking (Hypothesis 1) and government policies (Hypothesis 3), culture dimension (Hypothesis 4a) and business networks (Hypothesis 4b) are not a significant factor in determining FDI location (β=-0.138, CR=-1.719, p>0.05 and β=0.146, CR=1.409, p>0.05, respectively). Overall, given the number of potential factors that could affect FDI location in Vietnamese services industry, the model explains a considerable amount of the observed variance in FDI location (37.2%). 5. Summary and Conclusions This study investigated the MNCs‟ motivations to invest in the Vietnamese services industry. Based on the earlier empirical and theoretical literature, the authors developed new hypotheses and constructs for a questionnaire survey, aimed at studying the motivation of MNCs to invest in Vietnam. Results from this study offer new knowledge and insights into factors that motivate MNC‟s to invest into the services industry in Vietnam and findings can be summarised as follows: Firstly, as expected, the result confirmed the Eclectic paradigm that market-seeking factor is the major determinant of investments. The market-seeking factor was supported in this study. This result is in line with many previous studies, such as Asiedu (2006) and Vijayakumar, Sridharan and Rao (2010). This study indicated that MNCs have been making increasing investments into the Vietnamese services industry to exploit marketseeking (to secure entry into new markets). Secondly, although efficiency-seeking factor has been frequently cited by many scholars as one of the major determinants of FDI, results do not support the hypothesis in this study. This is in line with the Nunnenkamp and Spatz‟s (2002) study in which they found that non-traditional determinants, such as efficiency-seeking factor, are not important to 8 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 proceeding globalisation. They also emphasised traditional determinants (for example, market seeking) which are seen as dominant factors shaping the distribution of FDI. Thirdly, the study‟s findings coincide with previous studies, such as De Mooij & Ederveen (2003) and Margalioth (2003), which found that government policy plays an important role in the business decisions of investors. Therefore, it could be argued that the Vietnamese government should implement new policies and „tweak‟ existing policies to encourage and protect foreign investors, maintain the nation‟s political stability and enhance labourers‟ skill levels. Furthermore, the findings of this study rejected the significant influence of constructs (culture dimension and business network) on FDI location. Many studies have suggested that the culture dimension factor is negatively or positively related to FDI location (Asiedu, 2002, Gast and Herrmann, 2008, Li and Guisinger, 1992, Hong and Chen, 2001). However, in the case of the Vietnamese services industry, the relationship was not statistically significant. In the Vietnamese context, this result discrepancy can probably be explained because of the fact that MNCs have been investing in the Vietnamese services industry for different reasons. For example, firms which make investments mainly to take advantage of market potential or investment incentives, do not highly consider countries culturally close to Vietnam as viable alternatives for investments. In conclusion, the findings of this study make a significant contribution to the literature which lacks detailed studies that examine the motivation of MNCs to invest in the Vietnamese services industry at the firm level. References ASIEDU, E. 2002. On the Determinants of Foreign Direct Investment to Developing Countries: Is Africa Different? World Development, 30, 107-119. ASIEDU, E. 2006. Foreign Direct Investment in Africa: The Role of Natural Resources, Market Size, Government Policy, Institutions and Political Instability. The World Economy, 29, 63-77. BINH, N. N. & HAUGHTON, J. 2002. Trade Liberalization and Foreign Direct Investment in Vietnam. ASEAN Economic Bulletin, 19, 302-318. BLONIGEN, B. A. & PIGER, J. 2011. Determinants of Foreign Direct Investment. National Bureau of Economic Research, Inc, NBER Working Papers: 16704. CHANDPRAPALERT, A. 2000. The determinants of U.S. direct investment in Thailand: a survey of managerial perspectives. Multinational Business Review (St. Louis University), 8, 82. CHANDPRAPALERT, A. 2001. The Determinants of US Direct Investment in Thailand: A Survey on Managerial Perspective. PhD, UMI Dissertation Services. DE MOOIJ, R. A. & EDERVEEN, S. 2003. Taxation and Foreign Direct Investment: A Synthesis of Empirical Research. International Tax and Public Finance, 10, 673693. DINH, T. T. B. 2009. Investment behavior by foreign firms in transition economies. PhD, University of Trento. DU, J., LU, Y. & TAO, Z. 2011. Institutions and FDI location choice: The role of cultural distances. Journal of Asian Economics, Forcoming. 9 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 FIA. 2013. The situation of foreign investment in Vietnam as of end of month 12 / 2012 [Online]. Ha Noi: Foreign investment agency - Ministry of planning and investment. Available: http://fia.mpi.gov.vn/News.aspx?ctl=newsdetail&p=2.39&aID=1439 [Accessed 28 February 2013]. FORNELL, C. & LARCKER, D. F. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research (JMR), 18, 39-50. GAST, M. & HERRMANN, R. 2008. Determinants of foreign direct investment of OECD countries 1991-2001. International Economic Journal, 22, 509-524. GUISO, L., SAPIENZA, P. & ZINGALES, L. 2009. Cultural biases in economic exchange? Quarterly Journal of Economics, 124, 1095-1131. HAIR, J. F., BLACK, W. C., BABIN, B. J. & ANDERSON, R. E. 2010. Multivariate data analysis : a global perspective London Pearson Education HONG, M. & CHEN, L. S. 2001. Quantitative and Dynamic Analysis of the OLI Variables Determining FDI in China. Review of Urban and Regional Development Studies, 13, 163-172. KANG, S. J. & LEE, H. S. 2007. The determinants of location choice of South Korean FDI in China. Japan and the World Economy, 19, 441-460. LEI, H.-S. & CHEN, Y.-S. 2011. The right tree for the right bird: Location choice decision of Taiwanese firms‟ FDI in China and Vietnam. International Business Review, 20, 338-352. LI, J. & GUISINGER, S. 1992. The globalization of service multinationals in the `triad' regions: Japan, Western Europe And North America. Journal of International Business Studies, 23, 675-696. MARGALIOTH, Y. Y. 2003. Tax competition, foreign direct investment, and growth: using the tax system to promote developing countries. . Virginia Tax Review, 23. MIRZA, H. & GIROUD, A. 2004. Regional Integration and Benefits from Foreign Direct Investment in ASEAN Economies: The Case of Viet Nam. Asian Development Review, 21, 66-98. NUNNENKAMP, P. & SPATZ, J. 2002. Determinants of FDI in Developing Countries: Has Globalization Changed the Rules of the Game? Transnational Corporations, 11, 134. PARCON, H. 2008. Labor Market Flexibility as a Determinant of FDI Inflows. University of Hawaii at Manoa, Department of Economics, Working Papers: 200807. PHAM, T. H. H. 2012. Determinants of FDI into China and Vietnam: A comparative study. Document de Travail, working paper, EA 4272, 1-23. SALEH, A. S. & HARVIE, C. 2010. The impact of networking on business performance: A case study of Malaysian SMEs. Academy of Taiwan Business Management Review, 6, 74-85. SANDHU, M. S. 2007. Foreign Direct Investment (FDI) in the Malaysian Services Sector. Doctor in Business Administration, Charles Sturt University. SENIK, Z. C., SCOTT-LADD, B., ENTREKIN, L. & ADHAM, K. A. 2011. Networking and internationalization of SMEs in emerging economies. Journal of International Entrepreneurship, 9, 259-281. SETHI, D., GUISINGER, S., FORD, D. L. & PHELAN, S. E. 2002. Seeking greener pastures: a theoretical and empirical investigation into the changing trend of foreign direct investment flows in response to institutional and strategic factors. International Business Review, 11, 685-705. 10 Proceedings of 3rd Global Accounting, Finance and Economics Conference 5 - 7 May, 2013, Rydges Melbourne, Australia, ISBN: 978-1-922069-23-8 SETHI, D. D., GUISINGER, S. E. S., PHELAN, S. E. S. & BERG, D. M. D. 2003. Trends in foreign direct investment flows: a theoretical and empirical analysis. Journal of International Business Studies, 34, 315-326. SIEGEL, J. I., LICHT, A. N. & SCHWARTZ, S. H. 2011. Egalitarianism and international investment. Journal of Financial Economics, Forcomming. TATOGLU, E. & GLAISTER, K. W. 1998. Determinants of Foreign Direct Investment in Turkey. Thunderbird International Business Review, 40, 279-314. TUOMI, K. L. 2009. Fundamentals, tax incentives and foreign direct investment. Doctor of philosophy Doctor of philosophy, American University VERNON, R. 1966. International Investment and International Trade in the Product Cycle. The Quarterly Journal of Economics, 80, 167-189. VIJAYAKUMAR, N., SRIDHARAN, P. & RAO, K. C. S. 2010. Determinants of FDI in BRICS Countries: A panel analysis. International Journal of Business Science & Applied Management, 5, 1-13. WELCH, D. E., WELCH, L. S., YOUNG, L. C. & WILKINSON, I. F. 1997. The Importance of Networks in Export Promotion: Policy Issues. Journal of International Marketing, 6, 66-82. ZULKIFFLI, S. N. A. 2011. The Effect of Corporate Competitive Capabilities and Supply. Chain Operational Capabilities on Malaysian SMEs. Doctor of Philosophy, University of Wollongong. 11

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)