Proceedings of Annual Paris Economics, Finance and Business Conference

advertisement

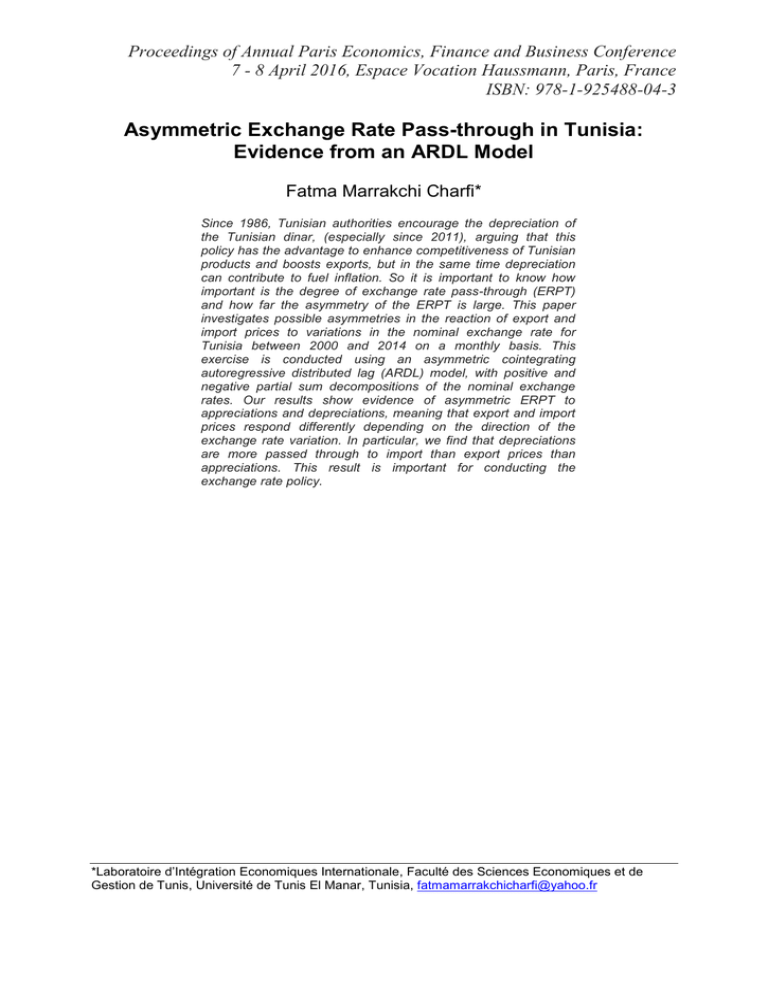

Proceedings of Annual Paris Economics, Finance and Business Conference 7 - 8 April 2016, Espace Vocation Haussmann, Paris, France ISBN: 978-1-925488-04-3 Asymmetric Exchange Rate Pass-through in Tunisia: Evidence from an ARDL Model Fatma Marrakchi Charfi* Since 1986, Tunisian authorities encourage the depreciation of the Tunisian dinar, (especially since 2011), arguing that this policy has the advantage to enhance competitiveness of Tunisian products and boosts exports, but in the same time depreciation can contribute to fuel inflation. So it is important to know how important is the degree of exchange rate pass-through (ERPT) and how far the asymmetry of the ERPT is large. This paper investigates possible asymmetries in the reaction of export and import prices to variations in the nominal exchange rate for Tunisia between 2000 and 2014 on a monthly basis. This exercise is conducted using an asymmetric cointegrating autoregressive distributed lag (ARDL) model, with positive and negative partial sum decompositions of the nominal exchange rates. Our results show evidence of asymmetric ERPT to appreciations and depreciations, meaning that export and import prices respond differently depending on the direction of the exchange rate variation. In particular, we find that depreciations are more passed through to import than export prices than appreciations. This result is important for conducting the exchange rate policy. *Laboratoire d’Intégration Economiques Internationale, Faculté des Sciences Economiques et de Gestion de Tunis, Université de Tunis El Manar, Tunisia, fatmamarrakchicharfi@yahoo.fr