Payment and Negotiation for the Next Generation Grid and Web

advertisement

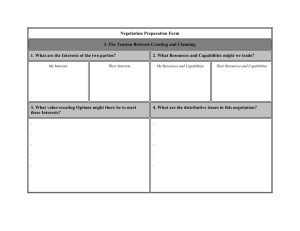

Payment and Negotiation for the Next Generation Grid and Web Jeremy Cohen, John Darlington, William Lee London e-Science Centre, Imperial College London, South Kensington Campus, London SW7 2AZ, UK Email: lesc-staff@doc.ic.ac.uk Abstract. We present a proposal for a next-generation Internet based on chargeable Web Services and Utility Computing realised by a series of open but interacting markets. We demonstrate through the UK e-Science project “A Market for Computational Services” the development of some of the fundamental building blocks to enable such a computational marketplace for the Grid. This paper describes the motivation behind this restructuring of the Internet and Web-based activities as a series of markets and how Grid Computing technologies can contribute towards this goal. The paper details the work undertaken at the London e-Science Centre to build a framework to create and support negotiable and chargeable Web Services. 1 Introduction Computational Grids consist of large numbers of resources that may be distributed over a wide area and owned by many organisations. Given that these resources – including computational and storage resources as well as instruments – may be highly expensive to own and operate, it is an unsustainable vision that organisations will share their resources altruistically or simply allow trusted parties to utilise their excess capacities when utilisation is low. There is a clear need to charge and account for service access and the supporting mechanisms to transfer funds between entities. The UK e-Science/DTI funded project “A Market for Computational Services” [9] set out to investigate and develop mechanisms to support markets in computational Grids. This included research on negotiation and brokering of Grid services along with the development of accounting and payment mechanisms for services. These aspects would be demonstrated through a set of e-Science exemplars. In this paper we present the services produced at the London eScience Centre, in co-operation with a Glasgowbased IT consultancy firm, Real Time Engineering Ltd, to develop a negotiation and payment framework for Web Services. Grid computing is a potentially revolutionary technology in that it could make high-end resources accessible to a much wider community. However its development and deployment will be hampered unless a proper economic model, addressing the supply and use of such services can be developed. The adoption, by the e-Science community of standard Web Services, for both its middleware and application framework, had radical implications for the Markets for Computational Services project. It changed the emphasis of the project from providing accounting and charging mechanisms for Grid Services in an academic context to exploring the creation of a new public market in chargeable Web Services and utility computing. In this arena, chargeable Web Services would form the basis for the Next Generation Internet [5]. The application and adoption of e-Science and Grid computing technologies on the public web would provide new opportunities, whereby the creativity and inventiveness that has been demonstrated on the current Web could be applied to the creation and making of even more complex and useful computational services. Section 2 sets out the case for a market in Web-based services. We examine the stakeholders and conditions for the development of such a market. Section 3 details the negotiation framework that has been developed. Following negotiation, consumers need to pay for their services. The architecture and API of the payment service are introduced in Section 4 with the Web interface and user-view of the service being detailed in Section 5. 2 A Market in Services As computational Grids are being developed, the Grid community has been moving increasingly towards standardised Web Services tech- nologies to support a service-oriented architec- each entity has only a single area in which to ture of Grid Computing with enhanced inter- concentrate (see Figure 1). operability and simplicity. The Computational Markets project initially utilised Grid technologies such as OGSI but subsequently recognised the advantages of in shifting to an interoperable and vendor-supported subset of Web Service standards. In tandem with this technological shift, increasing emphasis has been put on outsourcing and managed services within business. Utility computing providers and services are appearing such as the Sun Grid [12] and HP’s Utility Rendering Service [7]. Businesses are realising that the cost, both in terms of the hardware and the maintenance, of managing their own computing resources may be reduced by buying in capacity on resources that are hosted and managed elsewhere. The cost and risk of operating large-scale computing centres can be amortised among a varied portfolio of clients. Resources are depreciating increasingly rapidly and utility computing can provide for transparent technology refresh as well as simplicity. Add to this the use of managed services and applications, avoiding the costs of internal sofware management, and the cost of computing can be reduced dramatically. Existing Grid middleware provides limited support for the dynamic deployment of applications securely across organisational boundaries. These have resulted in more efficient utilisation of computational power. The lower overall costs presented by the use of managed services in utility computing environments lead us to predict the development of an open, composable market in services that we refer to as the Next Generation Internet [5]. Figure 2 depicts the stake-holders in such a market. To support this, we have been working to prototype a framework that will support negotiation and payment for access to remote use-on-demand, pay-per-use services. The decoupling of processes into clearly defined elements brings about specialisation within the market. Software providers can specialise in producing software services. They can divert resources that would have have been used for managing hardware and networking to aid faster and more advanced development. In turn, hardware providers can specialise in developing, operating and maintaining their hardware resources in order to provide a more reliable and efficient execution environment for use by the software providers. The process of specialisation should in turn drive increased innovation since Fig. 1. Drivers in a Service-oriented market Services may take the form of general execution provision, offering a service-based frontend for the execution of traditional HPC applications. These applications generally utilise large amounts of CPU time but with a relatively small job count. A pay-per-use, use-ondemand model for services also suits low value, high-throughput services. These are the services that would not normally have access to expensive HPC resources. They are accessed by many different users in different locations and their throughput may be erratic. Obtaining a dedicated large-scale resource would generally be too expensive for the service provider since the resource may be idle for a large proportion of the time. However, when a large number of requests are received at once, the service provider may be unable to service the demand, users receive poor quality of service and the service provider’s reputation may be damaged. Using a managed service model, the provider can pull in resources when required in order to service demand and pay only for the time that is used on those resources. The creation of services and their deployment onto remote resources can be achieved using existing tools. One of the major barriers to a service economy is the asymmetric information flow between the sellers and the buyers. Buyers cannot reliably assess the value of the goods being offered and the quality of the goods traded are forced down (the Lemons Hypothesis). There is, therefore, a clear need and hence a market opportunity, especially in the Internet economy, for brokers to intervene to act as intermediaries between users and services. Such brokers, by their reputation and longevity, could organise and safeguard payments and provide a level of trust for the market to operate efficiently. Another barrier to a service economy is the issue of payment. There are two sides to this problem. How the price of a service is determined and how payment is actually made. We introduce the concept of a chargeable service, a service that, in addition to its general functionality, has a wrapper that manages charging for its usage. Chargeable services may provide straightforward functionality at a fixed price. In the case of more complex services, for example, an SME wanting to carry out some 3D rendering, the array of options for service operation may be substantial and a personalised quote would be most appropriate to ensure that both the provider and consumer know what they are getting and what it will cost. Auctioning and online exchange are popular price formation models because of their simplicity and well-known economic characteristics. parameters of a complex managed service provision. In a highly competitive market, where many services claim to offer the same product, a consumer may want to survey the offers from all available providers in order to select the best one. To this end, the negotiation interface is seen as both something end-users may choose to interact with directly, as well as a connector through which brokers will communicate with services in order to find the best deal for their clients. The Southampton e-Science Centre and Swansea University have produced a chargeable Meshing Service, based on work from the GEODISE project [6], as an exemplar for the negotiation and payment framework. The Meshing Service is a complex, computationally intensive service used for generating 2D meshes for use in engineering design and optimisation. It has several negotiable parameters that affect the amount of compute time required for its generation and the quality of the mesh produced. 3.1 Negotiation API The negotiation API provides server and clientside tools to make an existing J2EE Web Service negotiable. We utilise Web Service standards including Web Service Description Language (WSDL) for describing services and the Simple Object Access Protocol (SOAP) over HTTP or HTTPS for transmission of messages between services and their clients. Fig. 2. Stake-holders in a Internet service market Server-side The NegotiationPortType is an additional port added to a service interface to signal to potential users that the service is negotiable. The NegotiationPortType and the accompanying protocol allows the client to hold a conversation with the negotiable service. A client wishing to obtain a quote from a negotiable service would initiate a negotiation session with the service by passing a set of requirements in the constraints document. The constraints document describes a set of terms and their relationships, for example: In the remaining sections of the paper, we will focus on a one-to-one negotiation model for service access and the incorporation of payment urn:economic:Price = 3.54 and urn:image:Quality > 45 and that accounts for service usage. urn:economic:Bundle <= 5 3 Negotiation Negotiation is a practical mechanism to enable providers and users to agree on the operating Terms are identified by the URNs. A set of common terms have been defined in the markets toolkit to convey economic parameters, such as Fig. 3. Negotiation client GUI price, number of invocations, bundling and quality of service parameters. It is envisaged that domain-specific terms would be defined in a shared ontology, standardised by experts in the particular application domain. The Negotiable Service replies with a set of refined constraints taking into account the posted requirements. The client might refine the constraints further by continuing the ongoing conversation with the service. The client might eventually abandon the offers or commit to the agreed terms proposed by the service. The client would then be issued with an electronically signed token that will be used as a ticket of entry along with payment confirmation when the service operation is invoked before the expiry time. ified to ensure that when the service is invoked, it takes into account the negotiated parameters for service use. The Negotiation engine API provides a series of assertion statements that can be instrumented into the service code to ensure agreed constraints are not violated at run-time (e.g. number of iterations in an optimisation loop). Client-side Client-side use of the negotiation API is significantly simpler than enabling a service for negotiation. The negotiation client API manages the session with a negotiable service and the security support in contacting and storing the secured token. From the API, a service’s negotiable parameters and their descriptions can be accessed and proposals can be made for accessing the service. As part of the offer acceptance, the Payment Service is contacted to ensure that the user has the means to pay the agreed charge and a payment authorisation token is generated (see Section 4.1). The Markets Toolkit allows service providers to augment an existing J2EE compliant Web Service implementation with negotiation capability. A configuration file, defining the set of negotiable terms and the negotiation strategy, is fed into the negotiation engine API. This represents the service provider’s private constraints on how pricing is calculated. The existing framework adopts a simple constraints optimisation module, which optimises on the service conA negotiation client GUI (see Figure 3) has straints while attempting to satisfy the client been produced to allow manual negotiation with requirements. services. This has been used in the demonstraOnce the negotiation parameters are speci- tions of the prototype framework and example fied, the code of the service itself must be mod- services. 4 Payment Service The Payment Service is a J2EE compliant Web Service that allows payments to be made, programatically, between entities that are known to the service. The ability to make programmatic payments means that complex HPC computations and brokering operations can take place without user interaction, provided the user has given their permission for this. In addition to the Payment Web Service and client-side API for making payments, we provide a web interface similar to an online banking service. This enables users to register for accounts, view their account statement and credit money to their account. An important aim of this work has been to allow the transfer of real money rather than simply using virtual funds. The service has been linked to PayPal [10] using PayPal’s Web Services API. Users can credit real funds from their PayPal account into their account in the Payment Service and, when accessing chargeable services, payment is remitted to the PayPal account of the service provider. 4.1 Payment Service Architecture Payment Protocol The Payment protocol that is being used for this service was originally presented in [4]. Payment is managed using tokens. A payment token is generated following a request from one party to make a payment to another. This request may be generated from the negotiation framework, alternatively it may be a direct request through the Payment API. A set of authorisation/authentication tests are carried out on the payment authorisation request. If these tests are successful, a unique token is generated representing the specific payment that the user has requested. Within a given time limit – determined when the token is generated – the token may be submitted to the Payment Service with a request to complete payment. If the requirements of this request are accepted, the transfer of funds takes place. Figure 4 shows the interactions involved in the negotiation, authentication and completion of a payment. Following the negotiation process to agree a price, the payment is carried out as follows: 1. The client creates an XML document that details the requested transaction. This includes the source account (this must belong to the client), the destination account, the payment amount and a description of the transaction. This message is signed using the client’s private key. The client creates a secure connection with the Payment Service and sends the authorisation request. 2. The Payment Service evaluates the client’s request. It first checks the signature on the message. If the signature is valid, it checks that the source account belongs to the person who signed the message. This check ensures that, unless a private key has been compromised, no user within the system can request the transfer of money from an account they do not own. If either the source or destination account does not exist, an error is generated. The service then checks that the source account has sufficient funds for the requested payment. If this check is successful, a unique transaction identifier is generated and an XML response document is created. The Payment Service signs this document in case the client wishes to check that it has genuinely been communicating with the Payment Service. This response document is the token that can be presented to the Payment service to complete the payment at a later time. The token contains an expiry time, after which any attempt to complete the payment will fail. This expiry time may be specified by the client in the original request. 3. The user eventually may wish to make use of the Web Service for which they have obtained an authorisation token. They present this token to the Web Service in the SOAP header, along with a request to invoke it. The Web Service then generates a payment completion request document that wraps the authorisation token and is specific to the payment model being used (see Section 4.2). The Web Service creates a secure connection to the Payment Service and passes it the completion document in a signed request. The Payment Service will try and make the transfer of funds and return a response to the Web Service detailing the transaction result. If the transaction is successful, the Web Service can return its results to the end-user. The digital signatures on the message ensure that the source and destination accounts and amount stored within the token are secure. If this information is altered, the digital signature verification will fail and the Payment Service will refuse to transfer the funds. Fig. 4. Interaction diagram for payment negotiation, authentication and completion procedure Implementation The implementation of the Payment Service has been created using J2EE 1.4 compliant Web Services hosted on the Sun Application Server Platform Edition 8. We have used existing standards where possible and have paid particular attention to security and crossplatform interoperability. All code has been written in Java. Security is an important issue in any distributed system, but particularly those where transfer of money is involved. In order to secure the payment service, all users are identified by an X.509 certificate. All communications with the Payment Web Service are encrypted using SSL connections with mutual authentication, with the user’s X.509 certificate identifying them. For negotiation, either transport or message-level security may be used. We have produced example services that demonstrate both forms of security and have used a Java WS-Security implementation to provide message-level security. We are currently using the Pointbase database that is provided as part of Sun’s J2EE Server to provide persistence for account information. The service implementation is compatible with other JDBC compliant databases, such as Oracle. To ease the Interaction with the relational database, the Enterprise Java Beans (EJBs) abstraction has been adopted. 4.2 Payment Models The Payment Service currently supports three different payment models in order to provide flexibility for service providers. Various other models may be appropriate in different situations and the service may be modified in future to support other payment models. The models currently supported are: – Standard Payment: The payment is authorised for a fixed amount and a token representing this amount is produced. When payment is to be completed, the token is presented to the Payment Service and the authorised amount is transferred between the source and destination accounts. A token may only be presented to the Payment Service once. – Variable Usage Payment: This payment model is particularly suited to the purchase of execution time. The exact amount of time required on a resource may be difficult to judge prior to the computation taking place. Payment Authorisation can be made for an amount that represents a cap on the maximum amount that can be spent. Once the final amount is determined, the payment can be completed. The authorisation token is presented to the Payment Service along with the final amount that is to be paid. Providing this amount is less than or equal to the authorisation amount, the funds are transferred. Once the token has been presented it has been used and is invalid. This is the case even if the funds transferred are less than the original authorisation amount. – Partial Payment: The partial payment model allows a payment to be authorised for a particular amount but to be completed in several stages. This is the one model of payment where a token may be presented multiple times. This model is useful for users purchasing multiple invocations of a fixed price service. Unlike a pre-pay scenario, where consumers pay up front a given sum, this method allows a token to be generated that will allow a given amount of money to be transferred within a given time period. The token can be presented multiple times, each time specifying the amount to transfer. The token becomes invalid when all the authorised funds attached to that token have been transferred, or when the validity window is passed. transfers to other accounts registered with the Payment Service. The account statement lists all transactions along with their unique transaction identifier, the transaction date and time and amount (see Figure 5). 6 Further Work Integration with real-world payment systems has been investigated in the development of the prototype but is acknowledged to be a complex issue. The integration with PayPal has allowed transfer of real funds but integration with a system such as WorldPay, allowing direct credit or debit card payments, would be valuable. Simplification of the framework to allow services to be automatically wrapped for negotiation and charging would help adoption of such a system. The aim would be to develop a utility that can take existing Web Services, a set of negotiable parameters and domain of values and then wrap the service automatically. 7 Related Work Groups investigating problems related to the economics of computational Grids include Rajkumar Buyya, University of Melbourne [3, 1] and the IBM Zurich Research Laboratory [8]. Although there is much work surrounding this area, there is little that has been focussed to5 Payment Service Interface wards the practical issues relating to payment for Grid Services. We therefore feel that our The Payment Service Web Interface provides work and that of our partners within the Market a browser-based interface for users to register for Computational Services project is of particand manage their accounts with the Payment ular value to the field of Grid Economics. Service. When accessing the interface, a user must have their certificate embedded in their browser – they are identified using SSL Mutual 8 Conclusion Authentication. To obtain an account with the service, a user visits the payment interface us- With computational Grids becoming more coming their browser. From their certificate Distin- mon and their power becoming increasingly guished Name (DN) they are identified and, if clear to both software and hardware providers, they are not already registered, a registration the prospect of an open Grid market in services page is displayed. The user enters their regis- is becoming more realistic. With Grids traverstration details which are stored in the database ing organisations and providing the means for and a new account is generated. On subsequent resource owners to recoup some of the cost of visits to the payment interface, users are pre- expensive equipment, a secure way to automatsented with a list of all the accounts they hold ically transfer funds between entities is imporand can select an account to view the account tant. management page. We have demonstrated a framework for supThe account management page displays a porting some of these needs, along with invesstatement for the account and enables users tigations into service negotiation and pricing to to credit money into the account from the ac- support a market in distributed services. Our count holder’s PayPal account and make manual work has provided a base upon which other Fig. 5. Payment Service Web Interface account statement project partners have been able to build exemplar services to demonstrate the power of a managed Web Service environment, as well as other fundamental building blocks, such as resource usage and accounting services. Developments in the e-Science programme have helped to erode many of the differences and divisions that have separated various sectors and disciplines. Many of the products and mechanisms of the e-Science programme have potential applications in the public domain. Complex e-Science or HPC methods, suitably encapsulated, could become consumer-oriented commercial services. We envisage virtual service providers will make use of third-party services to provide value-added products that might include highly complex methods requiring large computational resources. These are currently out-of-reach for most small to medium sized organisations who cannot afford to maintain such an IT infrastructure. Advances in Grid computing technologies and innovative charging models could produce a radical change in the provisioning and use of information technology across academia, business and society. 9 2. 3. 4. 5. 6. 7. Acknowledgements 8. We would like to thank the UK e-Science Core Programme and the DTI who have funded the “A Market for Computational Services” project. References 1. R. Buyya, D. Abramson, J. Giddy, and H. Stockinger. Economic models for resource management and scheduling in grid computing. Special Issue on Grid Computing Environ- 9. 10. 11. 12. ments, The Journal of Concurrency and Computation: Practice and Experience (CCPE), 14(13-15):1507–1542, December 2002. R. Buyya, D. Abramson, and S. Venugopal. The grid economy. In Manish Parashar and Craig Lee, editors, Special Issue on Grid Computing, Proceedings of the IEEE, volume 93, pages 698– 714. IEEE Press, New York, USA, March 2005. Rajkumar Buyya. Economic-based Distributed Resource Management and Scheduling for Grid Computing. PhD thesis, Monash University, Melbourne, Australia, April 2002. J. Cohen, W. Lee, A. Mayer, and S. Newhouse. Making the Grid Pay - Economic Web Services. In Building Service Based Grids Workshop, GGF11, Honolulu, Hawaii, USA, June 2004. J. Darlington, J. Cohen, and W. Lee. An architecture for a next-generation internet based on web services and utility computing. Technical report, London e-Science Centre, Imperial College London, London, UK, 2005. Grid Enabled Optimisation and Design Search for Engineering (GEODISE) Project. http: //www.geodise.org/. Hewlett-Packard Development Company, L.P. Servicing the animation industry: Hp’s utility rendering service provides on-demand computing resources. http://www.hpl.hp.com/se3d/ whitepaper-urs.pdf, 2004. Chris Kenyon. IBM Zurich Research Laboratory: Grid Economics. http://www.zurich. ibm.com/grideconomics/. London e-Science Centre. A Market for Computational Services. http://www.lesc.ic.ac. uk/markets/. PayPal (Europe) Ltd. Paypal. http://www. paypal.co.uk. Spring Framework. http://www. springframework.org/. Sun Microsystems, Inc. Sun grid. http://www. sun.com/service/sungrid/overview.jsp.