Proceedings of Eurasia Business Research Conference

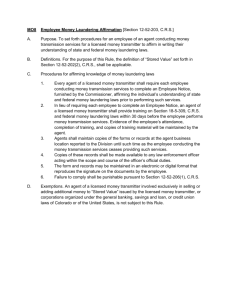

advertisement

Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Study the Phenomenon of Money Laundering Through Banks from the Viewpoint of Islamic Thought: A Reference to the Phenomenon of Banks Corruption Faouzi Abderezag The phenomenon of money laundering, a manifestation of organized crime, which generally include financial and administrative corruption in the economic institutions of public and private sector as well as government departments, this phenomenon has been exacerbated in recent years depending on the political, economic globalization and information and communications technology, has brought the phenomenon of money laundering, the attention of public opinion Governments and the international community to the need to combat this scourge which run mainly with humanitarian and moral concepts and religious, and increased the speed and spread of the phenomenon of globalization penetration of the political, economic and capital's control of political decision and the sovereignty of States over their territory because the world has become a small village in terms of information and common gateway, even grudgingly respect Fighting crime or money laundering dirty money laundering dirty because of their adverse impact on the national economy and global market instability, especially the financial market. Widespread this phenomenon with greater progress and means of information technology through the provision of sophisticated computational methods, and took the money laundering widen exploitation of the results of the technological revolution, and so we find that banks are a safety valve and an Assistant polarization in the implementation of money laundering and laundered at Accordingly, the show as if no money is legitimate suspicion It is noteworthy that no man is an indivisible whole, and the focus is on the element and the omission of other elements because the irregularities arising from drug crimes, kidnapping, piracy, environmental crimes and trafficking in arms and ammunition as well as bribery, embezzlement, fraud and dishonesty are all elements that are fighting religion and Islamic law and because justice stemming from the Islamic Established principles of Islamic jurisprudence do not fluctuate fancies and Amalgams, one of the consequences of the crime of money laundering highlights destabilize the national economy and international economic projects successful strike and increasing affluence obscenity without any effort, with the consequent waste of funds and corruption of moral, social and economic service to the enemies of the Islamic religion. The entire Islamic community, which suffers from poverty, family disintegration and waste energy producing and marginalization of scientific inefficiency rare sense embody the Zionist principle "the end justifies the means," came in the holy Koran, and Al-cow "does not consume your wealth and your false statements to the rulers to consume a team of people's money You know the price and "verse187. Money laundering through the channel banks and take advantage of the secret operation client accounts, are not practical, honest and legitimate because it is based on the value of legal legitimacy of the funds being laundering from the manipulation of terms, any sense of the word money to make white thing, so it requires set things straight and warned that legal This process is one of the activities contrary to the concepts of human and moral, religious, economic, and hence do not even get any ambiguity wrong for the intentional laundering money, it was better to use bleach illicit funds, and will sometimes use the term bleaching and sometimes washing the term to explain that to them the same meaning. The study indicates the problem of money laundering in banks with reference to the phenomenon of corruption as a catalyst for the spread of this scourge and examination as required by Islamic law, the study also shows ways to combat corruption before it occurred after the fact through a so-called policy of preventive and curative in Islamic jurisprudence, and this is what distinguishes Islamic law as other laws and bilateral agreements and international money laundering, Globalization is based primarily on information disguise, especially if the Islamic countries concerned and so it is the duty of Islamic banks and institutions and strict adherence to the full legitimacy in the transactions of the premises history, the history of the Arab Islamic civilization. The teaching of history and have not studied in the Arab-Muslim world on the basis of understanding the past as they were aimed for absolute glorification of the past has become a means of psychological endurance and a tool for mobilizing political and moral of colonization against the mark as he says Abdul Hamid bin Addis, on the basis that the best of our past Past, so why not be our future better than the future? So to be abandoned taboos agreed to be identical to the banks of the religion of God and in accordance with its name, and as long as it revolves around the issue of terminology and concepts we propose to deal with the matter according to the following frameworks: Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 1 - The general framework of the problem: in terms of definitions and terminology and characteristics, causes and dimensions. 2 - Show the relationship between money laundering, tax and offenders. 3 - A money laundering activities parallel legal and illegal. 4 - Stages of money laundering operations: deposit, employment, camouflage. 6 - Means and methods of money laundering domestically and internationally. 7 -The impact on the macro economy. 8 - How money laundering and influence policy. 9 - The means and methods of money laundering globally. 10 - Mechanisms for detecting money laundering. 11 - To address the phenomenon through the effective functioning of banks. 12 - How to deal with money laundering on a global level. 13 - Corruption as a manifestation of money laundering in the balance of Shariah. _____________________________________________________________ Dr Faouzi Abderezag, Sétif University, Faculty of Economics, Algeria.