Proceedings of 11 Asian Business Research Conference

advertisement

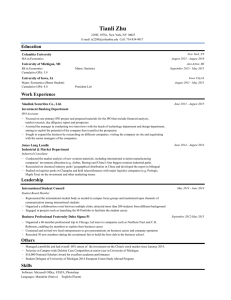

Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 Lingering the IPO Process: An Obstacle to Company’s Growth Mohammad Amzad Hossain* and Md. Mustafizur Rahaman** The initial public offering is widely viewed as the bellwether of market confidence as it accords several benefits to the previously private company that entails enlarging and diversifying the equity base, easier and cheaper access to capital, increasing the exposure, prestige and public image of firm, offering good opportunities for acquisition, attracting and retaining better management and employees through liquid equity participation, creating multiple financing opportunities such as convertible debt, cheaper banks loan etc. All of these beneficial factors in turn are enhancing the popularity of IPO day by day as a sound form of capital formation which is quite evident in the recent capital market of Bangladesh with the increased number of IPO players. As lingering in IPO process makes unnecessary delays in the implementation of the project or redemption of the loans on time, escalates the overall cost of the firm, reduces its viability and thus deters the growth of the industrialization, reform in the IPO process has become inevitable. Throughout our study we have outlined the existing IPO process while exhibiting some possible solutions to expedite it to allow the investor to an inexpensive and easier access to capital. However, this study strongly recommends that simplification in the IPO process has become crucial to stimulate the industrialization and boost up the economy of our country. Key Words- IPO, BSEC, RJSC, DSE, CSE, Book Building Method, Fixed Price Method Field of Research: Finance and Accounting 1. Introduction: Although the number of individual investors participating in the capital markets has grown substantially highlighting the discrepancies in investing opportunities between institutional investors and retail investors, still there are many who even can’t think of having an investment in shares fearing loss due to unfair practice. One of the first trading practices to come under regulatory and shareholder fire was the initial public offering (IPO) process which, according to Christine Hurt (2004), has revealed itself to be undemocratic at best and manipulative at worst. Many researchers focus on many issues to stop this stock market turmoil. Christine Hurt (2004) argues that the root cause of the abuses in the IPO process is the book building method of distributing IPO shares. This discriminatory system of pre-allocating shares to industry players creates an inefficient market for IPO shares that negatively affects both issuers and secondary market investors. Ravi Jagannathan and Ann E. Sherman (2004), on the other hand, suggested retaining the strengths of the basic book building method, and incorporate those features of auctions to make book building more transparent and accessible. ____________________________________________________________ *Mr. Mohammad Amzad Hossain, Former Lecturer, Department of Business Administration, East West University, Bangladesh, Mailing Address- Kha/9,Road-7, Block-E, Section-2, Mirpur, Dhaka-1216, Email: ahmaruf87@gmail.com, Mobile-01672-859485. **Mr. Md. Mustafizur Rahaman, Asst. Professor, Department of Accounting, Bangladesh University of Business and Technology (BUBT), Mailing Address- Bangladesh University of Business and Technology, Mirupur-2, Dhaka-1216, Email: mustafizmamun09@gmail.com, Mobile # 01710-535443. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 Jinliang Li and Jian Zhou (2006) found that the degree of earnings management possesses significant predictive power on IPO failure and IPO firms associated with aggressive earnings management are more likely to delist for performance failure. In their study, Gemma Lee and Ronald W. Masulis (2011) investigates whether financial intermediaries (FIs) participating in the IPO process play a significant role in restraining earnings management (EM). They argued, it is not evident that Venture Capitals (VCs) as a group significantly restrain EM by IPO issuers. However, they uncovered strong evidence that more reputable VCs and IBs are associated with significantly less EM. Although academics have focused on specific aspects of the IPO process that could be improved to eliminate certain market inefficiencies, this paper fills a specific vacuum by arguing that the entirety of the IPO process is much more in need of reform than any of its parts alone. 2. Objectives of the Study: To delineate the specific procedure to be followed by a company to go for IPO while demonstrating the complex inter relationship between the advising, marketing, pricing and trading mechanism of the IPO and to outline the role of the underwriters in the IPO process in Bangladesh. To identify the problems of IPO Process in Bangladesh and therefore make some recommendations to accelerate the IPO process through resolving the conflict of interest between the issuer company and the general investors. 3. Methodology of the Study: The study, descriptive in nature, will allow us to explore the overall IPO process in Bangladesh. The study is mainly based on secondary data which have been collected from different published research papers, Bangladesh Bank guidelines, public issue rules2006, prospectus of different Issuer Companies, guidelines from the underwriters, text books, websites of the different regulatory bodies and various published and unpublished study materials and so on. We have also conducted in depth interview, face to face conversation with distinct personnel including members of the regulatory bodies, secretaries, senior officers, principal officers and some other high officials to collect the primary data. 4. Purpose of the IPO: Basically the purpose of the IPO can be categorized into two subsections. Such as: 1. IPO can be made for raising capital for a new company or 2. It can be undertaken to fulfill the desire of an existing company in the form of expansion of existing facility or installation of new plant facility or it may be used for the redemption of existing loan. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 5. Analyzing the IPO Process in Bangladesh: Basically the overall process of IPO can be subdivided into two broad categories. Such as A. Procedures before obtaining consent from Bangladesh Securities & Exchange Commission B. Procedures after the collection of consent letter from BSEC. A. Procedures before obtaining consent from Bangladesh Securities & Exchange Commission (BSEC): All the procedures to be followed by the company intending to go for IPO can be presented as follows with the help of a diagram: Figure: Procedures to be followed before obtaining Consent Letter from BSEC Approval from the sponsors/ Directors Selecting Professionals Selection of the issue manager Selection of the underwriters Obtaining NOC from the lenders Accomplishing the valuation of the company Selection of the Legal Advisor Audit of the Financial Statements Preparing Credit Rating Report Preparing Draft Prospectus Submission of the IPO Application Consent from BSEC 5.1 Approval from the Sponsors / Directors: At the initial stage of IPO process, the issuer co. must take necessary approval from the sponsors/ directors to go for IPO funding and complete the documentation of the process, necessary declarations, Due Diligence & so on and take necessary information from the sponsors/ directors. 5.2 Electing Appropriate Professionals: The following section describes the choice of some key professionals, facilitate the IPO process: i) Selection of the Issue Manager: The issue manager will be held responsible for the scrutiny and supervision of every tasks regarding IPO which includes directing the preparation of draft prospectus in the Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 prescribed form and as per law, ensuring that all the information included in the prospectus are correct without any material errors and bias, taking the responsibility of distribution of refund warrant money to the investors along with the help of post issue manager, managing liaison among the BSEC, Post Issue Manager, Stock Exchanges, Bankers to the Issue, Underwriters, Investment Bankers and the Issuer Company during the IPO session to accelerate the overall IPO process, providing due diligence certificate etc. ii) Selection of Underwriters: The IPO process in the second step can be characterized with the selection of adept underwriters and completion of underwriting agreement. The underwriters are responsible for the successful floatation of the share and undertake the risk of under subscription of the shares- a very rare scenario in the history of Bangladesh. Rule 14 of the Public Issue Rules, 2006 states the following regarding Underwriters: (i) The issuer making public offering shall appoint underwriter(s), having certificate of registration from the Securities and Exchange Commission or allowed by the Commission to carry out underwriting on a firm commitment basis. iii) Audit the Financial Statements: The issuer co. must have their Financial Statements audited by appropriate auditor duly signed on each page by CEO/ MD & Chief Financial Officer of the Issuer co. and Issue Manager to comply with Rule-3 of Public Issue Rules, 2006. The audited financial statements shall not be older than 120 days from the end of the accounting period for which the financial statement is prepared. After that the issuer co. is supposed to submit 10 (Ten) copies of audited financial statements to BSEC, one copy each to DSE and CSE. 5.3 Accomplishing the valuation of the co. and restructuring: Before going to IPO, the issuer and the issue manager mutually estimates the total value of the firm and decides how many shares to offer to the public market and at what price. The issuer co. may also change its structure for IPO purpose if they feel it necessary. Determination of offering price can be based on two methods. Such as A) Fixed Price Method: Under the Fixed Price Method the issuer company has the discretionary power to set the offering price. Under this method the issuer company must reveal the basis of the determination of offering price in to their prospectus so as to communicate it to the general investors along with detailed descriptions of qualitative and quantitative factors justifying the offering price B) Book Building Method: The book building is a method of offering price discovery for the IPO on the basis of the demand from the institutional investors for the securities to be offered. Under this method the issuer company elects an investment banker or issue manager and then mutually set an indicative price for the bidding. Usually the initial price is determined on the basis of the past performance, expected future earnings of the issuer and Price earnings ratio of the peer group companies of that industry. When the issuer company organizes the road show Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 for IPO with the institutional, investors, it gains the firsthand experience to set the initial price. This initial price also known as indicative price is the basis of electrical bidding where the syndicate or institutional investors divulge how many shares they are willing to buy and at what price. Usually in the auction a 20% Price band is proposed to the institutional investors for bidding (i.e. the investors will be allowed to bid at 20% ups and down of the indicative price) and the final price is fixed by the issuer only after closure of the electronic bidding. This bidding starts with the most expensive price at first and count down until they reach number of shares to be sold. The lowest price at which all the demand for the proposed shares exhaust will be determined as the offering price for the IPO issue and at this price share will be issued to the general investors. 5.4 Selecting the Bankers to the Issue: The issuer co. must obtain letter from the bankers to the issue confirming the opening of separate account for IPO and accepting their appointment, to comply with Rule-18 of Public Issue Rules, 2006. The issuer co. should choose those banks which have online service with goods sense professionalism as the Bankers to the Issue shall be held responsible for depositing and withdrawal of public money. 5.5 Obtaining NOC (No Objection Certificate) from the Lenders: As the collection No Objection Certificate is obligatory to get the IPO consent, the issuer co. must obtain it from all of its lenders stating that the lenders have no objection if the issuer co. intends to change their existing capital structure. 5.6 Preparing Credit Rating Report: Credit rating is compulsory for IPO listing process for those companies who want to issue shares at premium price or who want to issue the right shares. 5.7 Prepare Draft Prospectus: The publication of draft “Prospectus” is critical for IPO process, as it is such a document made for the purpose of communicating the general public about company’s plan to offer the sale of its securities under public issue rules. Before application for IPO, the issuer must submit the draft of the prospectus to the respective regulatory bodies. A prospectus of the issuer company typically includes statutory conditions, due diligence certificates, risk factor analysis, description of different parties involved in IPO, auditor’s report to the Shareholders and application form etc. 5.8 Submitting the Application for IPO: Submission of application for getting the IPO consent must be accompanied with approved version of the prospectus and deposit of Govt. fee of BDT 10,000. In case of discrepancy, BSEC will notify the issuer co. within 28 days of receipt of the application and if the issuer fails to rectify the inconsistencies within 30 days of communication, then the issuer companies will have file a new application.(Rule -17 of the Public Issue Rules, 2006) As per Public Issue Rules 2006; the application must be accompanied with- Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 1. Memorandum and Articles of Association- certified by the Registrar of Joint Stock Companies and Firms (RJSC) and attested by the Managing Director/Chief Executive Officer. 2. Certificate of Incorporation and Certificate of Commencement of Business – certified by the Registrar of Joint Stock Companies and Firms and attested by the Managing Director/ Chief Executive Officer. 3. Extract from the Minutes of Meeting of the Board of Directors for raising paid up capital – photocopy attested by the Managing Director/ CEO. 4. Consent of the Directors to serve, in original, signed by all directors. 5. Land Title Deed with current rent receipts -photocopy attested by the Managing Director/ Chief Executive Officer. 6. If plant & machinery is reconditioned or second-hand – a certificate from SGS or Lloyds agency on its economic life and price competitiveness duly certified by the Chamber of Commerce of the exporting country or the country of origin – all in original. 7. Loan agreements, if any – photocopy attested by the Managing Director/ Chief Executive Officer. 8. Banker’s letter confirming opening of separate bank account for public issue purposes - photocopy attested by the Managing Director/ Chief Executive Officer. 9. Due Diligence Certificate from the Manager to the Issue - in original. 10. Due Diligence Certificate from Underwriter- in original. 11. Due Diligence Certificate from Debenture Trustee, in original, as prescribed by the Commission. 12. Agreement with: (a) Investment Adviser, (b) Issue Manager, (c) Underwriter(s) and (d) Debenture Trustee- photocopies attested by the Managing Director/ Chief Executive Officer. 13. Bankers’ to the issue’s letter accepting their appointment as such – photocopy attested by the Managing Director/CEO. 14. Joint venture agreement if any-attested by the Managing Director/ Chief Executive Officer. 15. Tax Holiday Approval Letter from NBR – attested by the Managing Director/ Chief Executive Officer. 16. Copy of return of allotment and particulars of directors certified by the RJSC and attested by the Managing Director/ Chief Executive Officer. 17. Banker’s certificate/ bank statement showing deposit of an amount equivalent to the paid up capital/ auditor’s certificate in that regard attested by the Managing Director/ Chief Executive Officer. 18. Undertakings of the issuer company and its directors for obtaining CIB Report from Bangladesh Bank – attested by the Managing Director/ Chief Executive Officer. 19. Copies of valid license from the regulatory authority, where applicable – attested by the Managing Director/ Chief Executive Officer. 20. Deed of Trust (in case of debt securities) attested by the Managing Director/ Chief Executive Officer. 21. Credit rating report, if applicable – attested by the Managing Director/ Chief Executive Officer. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 5.9 Consent from BSEC: After the submission of application duly filled by the issuer co., if BSEC find it reliable and free from material error then it will issue the Letter of Consent within 60 days of receipt of the application. In case of correct and fresh application it usually takes 45 days for the issuer to get the IPO consent from BSEC. B. Procedures to be followed after Obtaining the Consent from BSEC: Figure: Procedures to be followed after obtaining consent Submission of Final prospectus Announcement for the investor Submit the printed prospectus Apply for being enlisted Refund Warrant arrangement In case of under subscription Transaction rate Subscription period Approval of listing Agreement with the CDBL 5.10 Submission of Final Prospectus: After collecting necessary approval from the BSEC, initially Issuer Company is required to submit the abridged version of the prospectus to the office of the BSEC usually 10-15 days before to the opening of the subscription for getting the final approval followed by a simultaneous submission of signed copy of prospectus to the Registrar of Joint Stock Company (RJSC) on or before the date of publication of prospectus in newspaper. Simultaneously the issuer company should make a deal with the printers to print the Prospectus, Forms, Refund Warrants, and Letter of Allotment etc. 5.11 Announcement for the Investor: After receiving the consent letter, the approved abridged version of the prospectus shall have to be published by the issuer in four national daily newspapers(in two Bangla and two English), within the stipulated time stated in the consent letter provided by BSEC. Beside this the full version of the prospectus shall have to be posted to the website of the BSEC, Stock Exchanges, Issuer and the Issue Manager. A published newspaper clip of the prospectus shall also be submitted to the BSEC by the issuer within 24 hours of the publication. In addition to this the issuer company will have to submit a diskette containing the vetted copy of prospectus to BSEC, DSE and CSE. Furthermore the issuer will have to post the vetted prospectus to the website of Issuer, BSEC, Issue Manager within three working days of the issuance of Letter of Consent as well. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 5.12 Submit the Printed Prospectus: After printing of the prospectus the Issuer co will have to send 40 copies of printed prospectus to BSEC and the abridged version of the said prospectus as well as the application forms are also required to be submitted by the issuer to Bangladesh Embassies by EMS of postal departments within 5 working days from the date of publication of abridged version of the prospectus in the newspapers. 5.13 Apply for Being Enlisted: To be enlisted the issuer co should apply to the all-Stock Exchanges of Bangladesh in the prescribed form and submit the vetted copy of prospectus to the Stock Exchanges within 7 working days from the date of issuance of the Consent Letter by the BSEC. For the application for being listed in stock exchanges the issuer company has to submit the filled application to the BSEC at first for attestation and then the issuer company need to get its application filed with the Stock Exchanges within the aforesaid stipulated period of time. 5.14 Subscription Period: The subscription list and the sale of the securities will be commenced after the elapse of 25 days from the publication of abridged version of the prospectus and subscription shall remain open for 5 consecutive banking days before closure. For NRB it will be open for closing date plus 9 days so as to reach the application to the issuer company. 5.15 Transaction Rate: To facilitate the application by the NRB, spot buying rate (TT Clean) in US $ and UK pound and Euro of Sonali Bank for subscription of NRB‟s. need to be collected by the issuer company from the Sonali Bank at the opening date of the subscription. 5.16 In Case of Under Subscription: In the situation of under subscription, Issuer shall notify the same to the underwriter to purchase the underwritten shares. Here the time limitation is within 10 days of close of subscription date. The underwriters are liable to make full payment of the underwritten amounts within 15 days of the Issuer’s notice. 5.17 Refund Warrant arrangement: To ensure the refunding of the money to the investors who have not get the share, the issuer co. must have to arrange a separate bank account for refund warrant purpose with the post issue manager along with the assistance of the issue manager which is also known as Mother Accounts for Refund Warrants. 5.18 Approval of Listing: The granting of listing applications depends on the autonomy of the stock exchanges upon satisfaction of their requirement and the stock exchanges shall decide the same within a maximum period of 6 weeks from the closure of subscription lists. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 5.19 Agreement with the CDBL: After getting the approval from the stock exchanges for enlisting, the issuer company must make an agreement with Central Depository of Bangladesh Ltd. (CDBL) as the CDBL maintains online transaction of securities in exchange of some fees. Following the agreement the issuer companies is supposed to take decision on depositing the sponsors share during Lock in Period with custodial bank or with CDBL. 6. Problems of IPO Process in Bangladesh: Firstly, the regulatory bodies and other related parties involved in IPO, responsible for executing the IPO of the companies suffer from serious malfunction due to the existence of bureaucratic system in their administration, causes unnecessary delays in the IPO of the companies. In addition to this, sometimes the personnel working in those offices, due to the lack of proper training facilities and workshop to make continuous professional development, do not possess adequate knowledge and technical expertise regarding capital market which is a major catalyst lingering the IPO process in the country. So the large scale unskilled workforce is causing a serious trouble in IPO, is a major threat for the capital market. Besides, the inefficient management of the companies willing to go for IPO slows down the overall process of IPO phase. However, Lack of automation and high tech technology in the office of the respective authority responsible for expediting the IPO Process is also influential factors. Secondly, rapid and frequent changes in policies made by the govt. for strengthening the capital market, is also a significant factor obstructing the flow of IPO for the Issuer Company as the Issuer Company has to comply with the changing rules & regulation set by the govt. to go for IPO. Recurrent Changes in the management of regulatory bodies involved with IPO can also be held responsible for interrupting the IPO process. Thirdly, sometimes the Issuer Company’s propensity to exert undue influence in setting up of offering price of the IPO share (issuer company normally wants to add more premium to their offering price) necessitates negotiation with the regulatory bodies causes unnecessary encumbrances in the flow of public offering. Fourthly, as an integral part of the IPO, the issuer company has to publish the prospectus to the general mass containing detail information of their IPO and company profile. The preparation of this prospectus is very much complicated in nature as the issuer company has to follow strict rules and regulation to prepare this document. The complexity in the preparation of prospectus, being a conspicuous reason for delay in IPO process, also intensifies from the lack of proper guidance from the Issue Manager and for their inefficient work forces. The determination of offering price, which is an essential part of the prospectus, is also very intricate as it can be done by using different methods having different figures, may be deceptive to the investors. Additionally, Shortage of underwriters, Issue Managers, Post Issue Managers and Bankers to the Issue in the capital market responsible to accelerate the IPO Process and the complexity in their selection, is also an important part obstructing the IPO in the country. Furthermore, the Political instability prevailing in the country hinders the communication phase in various steps of IPO, causes serious problem and the pressure of inflationary economy is also evident in that case enhancing the cost of the overall IPO process. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 Lack of coherence in between the Issuer and Bankers to the issue during collection of IPO proceeds is also apparent in our country as many Bankers to the Issue have not online service yet. Sometimes the Issuer Companies do not intend to come to the market for raising capital through IPO due to the threat of under subscription as our capital market is imperfect in nature where rumor plays a vital role to determine the share price. Inappropriate public perception regarding price of the share and capital market, Influence of rumor in the share price, illiteracy among the general investors, volatility into the share market, existence of gambler and their effect is into the market place, are marked as substantial factor influencing the possibility of under subscription which in turn creates reluctance among the Issue Companies to come into the market and thus lingering the IPO process in the country. However, absence of adequate post issue service institutions responsible for conducting IPO lottery, distributing allotment letters, share certificates and dividend warrants, is also a crucial factor affecting the speed of IPO process. Finally, causes of delaying in IPO may also include lack of preparation for IPO from the part of the issuer co., effect of ulterior motive of media and effect of yellow journalism, complexity in the listing procedure and so on. 7. Recommendations: The following measures can be enumerated as guidelines to increase the efficiency of IPO process: Number of Post Issue Management Service Institutions, post issue managers, underwriters, brokerage house, and bankers to issue should be enhanced to accommodate the increased no. of IPO players. Bureaucracy, being a curse for our country, should be reduced to a reasonable extent to shorten the IPO processing time. Automation in the file processing, e filing system, e governance and de layering in the organizational structure with rigid accountability can reduce the impact the bureaucracy. The offices of the DSE, CSE, BSEC, RJSC and other regulatory and legislative bodies, responsible for the execution of IPO, may be equipped with high tech and sophisticated technologies to ensure the automated work environment. As rapid changes in policies and management structure cut down the speed of the IPO process, the Govt. and other bodies responsible for setting up of policies and practices for the capital market, should be visionary in that regard. IPO is a sensitive issue as it involves huge public money. So a proper mechanism should be set to ensure the ethical practice in every aspect of IPO. Proper training and moral persuasion can be utilized to ensure this. During IPO session the officers of all related parties should form a team to perform the processing of the IPO on group wise which will certainly expedite the execution of IPO and will improve the efficiency. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 The regulatory bodies and other offices involved with the execution of IPO can arrange rigorous training program on “How to prepare for& Carry out the IPO Process” from time to time so as to enhance the excellency in that particular area. Rigorous research initiative can also be deployed. The regulatory bodies such as Bangladesh Securities and Exchange Commission should provide sufficient guideline and should be very much strict and rigid regarding setting up of offering price of the share so as to reduce the Issuer Company’s propensity to negotiate with the offering price repeatedly. The regulatory bodies should increase their span of monitoring and supervision over the capital market and should set proper polices to make the market perfectly efficient in order to lessen the volatility of the share market and to restore the confidence of the investor which will certainly accelerate the IPO processing in Bangladesh. The publication of the prospectus, being a major part of the IPO, should be made easier to the issuer companies. The BSEC can provide a precise format including proper guidelines of preparing the prospectus to the issuer companies so as to facilitate their issuance of prospectus. Moreover, as prospectus is a public document, proper care should be taken for the publication of it by both the Issuer Companies and the managers to the issue. All the bankers to the issue should initiate online service for their clients. This will obviously help the issuer company to collect IPO proceeds from the potential investors more easily and rapidly. The formalities needed to list the issuer companies in the capital market should be minimized to reasonable extent and should be made less complicated in order to encourage the IPO funding more and more. Planning is crucial to a successful IPO. The issuer company should grow the company's business with an eye to the public marketplace. The issuer should also obtain audited financial statements using IPO-accepted accounting principles, clean up the company's act, establish antitakeover defenses, develop good corporate governance, create insider bail-out opportunities and take advantage of IPO windows. 8. Conclusion: Although the IPO process may include Significant costs or it requires to disclose confidential financial and business information or consumes meaningful time, effort and attention of senior management, the advantages of IPO obviously outweigh the drawbacks of IPO which signifies the importance of the study of IPO process in Bangladesh and suggesting ways to improve it. The recommendations and suggestions for expediting the IPO process in Bangladesh outlined throughout these papers in one side will certainly help the issuer companies to raise equity capital more cheaply and quickly, on the other hand this paper will certainly provide a rigid guideline to the regulatory bodies, underwriters, Bankers to the Issue, Issue Managers and other relevant parties involved in IPO process to make necessary reforms. Proceedings of 11th Asian Business Research Conference 26-27 December, 2014, BIAM Foundation, Dhaka, Bangladesh, ISBN: 978-1-922069-68-9 References: Black, B.S. and R. J. Gilson, 1998, Venture capital and the structure of capital markets: Banks versus stock markets, Journal of Financial Economics 47, pp.243-277. Brau, J., B. Francis, and N. Kohers, 2003, The choice of IPO versus takeover: Empirical evidence, Journal of Business 76, pp.583-612. Chemmanur, T. J. and P. Fulghieri, 1999, A Theory of the going-public decision, Review of Financial Studies 12, pp.249-279. Christine Hurt, 2004, Moral Hazard and the Initial Public Offering, Cardozo Law Review, Vol. 25, Winter. Gemma Lee and Ronald W. Masulis (2011), Do more reputable financial institutions reduce earnings management by IPO issuers? Journal of Corporate Finance. 03/2011; 17(4):982-1000. http://bangladeshiiponews.blogspot.com/2012/04/basic-idea-for-ipo-process.html electronically accessed on July 20, 2014 http://www.dsebd.org/ipo-archive-2013.php electronically accessed on August 25, 2014 http://www.dsebd.org/ipo-archive-2014.php electronically accessed on September 18, 2014 http://www.thefinancialexpress-bd.com/index.php electronically accessed on July 24, 2014 http://www.sec.gov.bd/ electronically accessed on October 11, 2014 Jagannathan, Ravi and Ann Sherman, 2004, “Why Do IPO Auctions Fail?” Jinliang Li and Jian Zhou (2006), Earnings Management and Delisting Risk of Initial Public Offerings Maksimovic, V. and P. Pichler, 2001, Technological innovation and initial public offerings, Review of Financial Studies 14, pp.459-494. Mello, A. S. and J. E. Parsons, 2000, Hedging and liquidity, Review of Financial Studies 13, pp.127-153. Modigliani, F. and M. Miller, 1963, corporate income taxes and the cost of capital: A correction, American Economic Review 53, pp.433-43. Myers, S. C., 1984, The capital structure puzzle, Journal of Finance 39, pp.575-592. Myers, S. C. and N. S. Majluf, 1984, Corporate financing and investment decisions when firms have information that investors do not have, Journal of Financial Economics 13, pp.187-221.