Proceedings of Annual Tokyo Business Research Conference

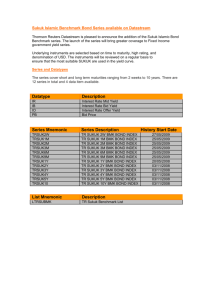

advertisement

Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 Analysis of Financial Faktors of Sukuk Issuance by Public Companies Compared With Bonds Issuance and Issuance Using Ijarah and Mudarabah Contract Tettet Fitrijanti and Prima Yusi Sari There are not so many researches on the Islamic banking product named sukuk (Islamic bonds). In Indonesia, 31 out of 300 public companies have issued sukuk. This research is trying to find out any financial factors that caused those 31 companies for issuing sukuk, instead of conventional bonds. Those financial factors are either internal / fundamental or macro economical. Indonesian’s public companies had issued sukuk using Ijarah or Mudarabah contract. Ijarah contract is a lease agreement, while Mudarabah is a contract whereby one party is the investor and the other party the manager. This research other question is whether there is any financial factors that influence the selection of Ijarah or Mudarabah contract. The research was made in 25 public companies out of 31 companies issuer of sukuk in Indonesia, the reason why the other 6 companies are not part of the study is that, those companies do not present a complete public financial report. Using the independent comparison test and logit regression analysis, the research found out that the main objective of issuing sukuk is to absorb the available funds for solving conventional debt. Although the financial risk of the company before the issuance of sukuk is higher, at the same time the profitability of the company issuing the sukuk is also higher than the issuer. The sukuk was seen as a debt instrument rather than equity instruments, with any kind of contract (Aqad). A company issued sukuk not because of his financial situation but as an financial alternative in form of debt instead of equity, thus sukuk is seen as a debt, with any kind of the contracts or Aqad. There were other considerations than inflation and fluctuations in stock returns in the selection process of sukuk as financing instruments by companies that have higher probability of choosing Mudarabah rather than Ijarah contract, those companies have high profitability, high financial risk, high market value, and in the economic condition of low inflation and low risk in form of fluctuations in their stock returns. 1. Research Background The issuance of sukuk is one of the funding strategy that give a positive value for both companies and countries, by encouraging the development of the company and the development of the country, including in Indonesia. Development of Sukuk in Indonesia is driven by the private sector initiation. Initiated by the Mudarabah sukuk issuance in 2002 by the company named Indosat with a value of 175 billion, the development of corporate sukuk in Indonesia is generally an initiation of the underwriters, instead of corporate sukuk issuer itself. This happened due to a lack of understanding of the strengths and weaknesses of sukuk (Ascarya, 2007). ____________________________________________ Dr. Tettet Fitrijanti, MSi, Ak, CA, SAS, Accounting & Finance Lecturer, Padjadjaran University, Bandung, Indonesia, Email: tfitry@yahoo.com, tettet.fitrijanti@fe.unpad.ac.id Prima Yusi Sari, ME, Ak, CA, Accounting & Finance Lecturer, Padjadjaran University, Bandung, Indonesia, Email: primayusi@yahoo.com, prima.sari@fe.unpad.ac.id Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 The development of sukuk issuance in Indonesia from 2002 to 2008 was growing faster with the highest level of sukuk emissions noticed in 2009 with 14 emission sukuk with a value of Rp2.32 trillion, and then declined until it reaches its lowest level in 2011 in which there is only one emission sukuk with a value Rp 100 billion (Bapepam-LK, 2012). Table 1: Corporate Sukuk in Indonesia Year 2002 – 2012 Published Data Year Number of Value of Emissions (in billions Emissions of Rp) 2002 1 175,0 2003 5 565,,0 2004 7 684,0 2005 3 585,0 2006 1 273,0 2007 4 892,0 2008 14 2.324,0 2009 8 1.517,0 2010 4 800,4 2011 1 100,0 August 2012 4 1.475,0 Total 52 9.390,4 This study therefore aims to find out if there is any difference in the financial condition of the issuer of sukuk by the company issuing the bond, what are the internal factors that cause companies to sukuk issuance, and what are the factors that led to the company issuing sukuk to choose Mudarabah instead of Ijarah contract. 2. Theoretical Framework The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) found that the sukuk certificates value are presented after the close of registration, the receipt of the value of the certificate is used according to the plan, as well as parts and ownership of tangible assets, goods, or services, or capital of a particular project or capital of an investment in a particular activity. As described in the Decision of the Chairman of the Capital Market Supervisory Agency and Financial Institution No. KEP-181 / BL / 2009 on issuance of Islamic securities, Sukuk as Islamic securities in the form of a certificate or proof of ownership of the same value, represent a certain part (integral or not divided (syuyu / Undivided share) for (a) certain intangible assets (ayyan maujudat); (b) the value of benefits on tangible assets (manafiul ayyan) specified either already exist or will exist; (c) services (al khadamat) that already exist and will exist; (d) the assets of particular projects (maujudat masyru 'muayyan); or (e) investment activities that have been determined (nasyath ististmarin khashah). Excess sukuk namely: (a) Can reach a broader investor, especially for investors who are concerned about the aspects of Sharia, (b) to diversify the portfolio as a source of funds, (c) the offer is still relatively low, with a high level of demand, (d) In general, sukuk has a low price or at least as compared to conventional bonds. While some of the weaknesses of sukuk, among others, are; (a) The structure is more complicated because it requires the assets to came in (the underlying asset), (b) Tax and legal Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 uncertainty, (c) Does not have an official benchmark, because the government has not issued sukuk (Ascarya, 2007). AIMS sukuk are divided into four groups based on asset or project that became the basis of the transaction, those groups are as follows: 1) Sukuk that represent ownership in tangible assets (mostly in the form of sale and lease back transactions or direct lease); 2) Sukuk representing expediency or services (based on a sub-lease or sale transaction services / sale of service); 3) Sukuk that represent part of the equity in a particular business or portfolio investment (based on Musharaka or Mudarabah contract); 4) Sukuk that represent the items received or receivable in the future (based on Murabahah, Salam, or istishna). Referring to the Decision of the Chairman of the Capital Market Supervisory Agency and Financial Institution (Bapepam-LK) No. KEP-430 / BL / 2012 on the Akad Agreement Used In The issuance of Islamic securities in the capital market: The sukuk contract are: 1. Ijarah: An agreement (contract) between the lessor / providers (mu'jir) and the tenant / service user (musta'jir) to transfer rights (benefit) on an object that can be Ijarah benefits of goods and / or services within a certain time with the payment of rent and / or wages (ujrah) without being followed by the transfer of ownership of the object of Ijarah itself. 2. Istishna: An agreement (contract) between the buyer / purchaser (mustashni ') and the manufacturer / seller (shani') to create objects Istishna purchased by the buyer / purchaser (mustashni ') with the criteria, requirements, and specifications have been agreed by both parties. 3. Kafalah: An agreement (contract) between the insurer (kafiil / guarantor) and a guaranteed party (makfuul 'anhu / ashiil / person who owes) to guarantee the obligations of which are guaranteed to other parties (makfuul lahu / person indebted). 4. Mudarabah (Qiradh): An agreement (contract) cooperation between the owners of capital (sahib al-mal) and the manager of the business (mudharib) by way of capital owners (sahib al-mal) submit capital and business manager (mudharib) manages the capital in a business. 5. Musharakah: An agreement (contract) cooperation between two or more parties (syarik) by way of capital to include both in the form of money or other assets to conduct business. 6. Wakalah: An agreement (contract) between the authorizer (muwakkil) and the recipient of the (vice) by means of the authorizing party (muwakkil) provides power to the authorized representative (representative) to perform certain actions or deeds. Akads that are internationally known and has been getting "endorsement" of the Accounting and Audting Organization for Islamic Financial Institutions (AAOIFI), are among others: 1. Ijarah, where one party acting alone or through a representative, to sell or lease the rights to the benefits of an asset to another party based on the price and the agreed period without being followed by the transfer of ownership of the asset itself. Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 The Sukuk Ijarah contract is divided into 2 parts, muntahiya bittamliek (sale and lease back) and ijara headlease and sublease 2. Mudarabah, whereby one party provides capital (rab al maal) and other parties providing labor and expertise (mudharib), the advantage of such cooperation will be divided based on a pre-agreed ratio. Losses incurred will be borne solely by the capital yangmenyediakan. 3. Musharaka, in which two or more parties working together combining the capital to build a new project, developing an existing project, or fund operations. Gains and losses are shared according to the amount of the capital participation of each party. 4. Istishna, where the parties agreed to the sale and purchase in order to finance a project or item. As for the price, delivery time, and the specification of goods / project determined in advance by agreement. (Directorate of Islamic Financing Policy, 2008). When referring to the National Fatwa Council of Sharia Islamic Bonds, the covenants that can be used for the issuance of Islamic bonds are: Mudarabah (muqaradah) / Qardh, Musharaka, Murabahah, Salam, Istisna, and Ijarah (DSN, 2006). 1. Mudarabah Agreement or Muqaradah (Trust Financing, Investment Trust). Mudarabah is a business cooperation agreement between the two parties with the first providing capital, while others become managers. The National Fatwa Council of Sharia bonds mentioned that Mudarabah Sharia Bonds is an Islamic Bonds based on Mudarabah with regard to the substance MUI Fatwa National Sharia Board 7 / DSNMUI / IV / 2000 on the Mudarabah financing. 2. Ijarah Agreement (Operational Lease) Ijarah is a contract based on one party buying equipment needed and rent it to a particular client. Holders of Ijarah Securities as the owner, is fully responsible for everything that happens on their property. In the National Sharia Board Fatwa No. 41 / DSN-MUI / III / 2004 on Sharia Ijarah Bonds stated that the Sharia, Ijarah Bonds are bonds that are based on the Ijarah contract agreement for the transfer of rights (benefits) for an item within a certain time with rent payments (ujrah), without being followed by the transfer of ownership of the goods themselves. Coupled with due regard to the substance of the National Sharia Board MUI Fatwa No. 09 / DSN-MUI / IV / 2000 on ijara financing. 3. Musharaka Agreement (Partnership, Project Financing Participation). Musharaka Securities contracts are based on an almost resembles Securities than Mudarabah. The main difference is the intermediary would be a group of people who became Musharaka bondholders in a combined partnership, in Mudarabah capital resources are hold only from one side. In the National Sharia Board Fatwa No. 08 / DSN-MUI / IV / 2000 on Musharaka financing mentioned that Musharaka financing is financing based on the cooperation agreement between two or more parties for a specific business, where each party contributes to the funds providing, and where the benefits and risks will be shared in accordance with the agreement. 4. Salam Agreement (In-Front Payment Sale) Salam is a sale of a commodity, where the quality and quantity of the goods that will be given to the buyer at a specified time in the future at current prices are determined in advance. In the National Sharia Board Fatwa No.05 / DSN-MUI / IV / 2000 regarding the sale and purchase greetings mentioned that the sale of goods by Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 means of ordering and payment of the price in advance with certain conditions is called with greetings. 5. Istisna Agreement (Purchase by order or manufacture) Istisna is a contract that is used to sell manufactured goods. In the National Sharia Board Fatwa No. 06 / DSN-MUI / IV / 2000 regarding the sale and purchase Istisna, it is mentioned that buying and selling is the sale and purchase agreement in the form of reservations of certain items with certain criteria and conditions agreed between the buyer (buyer, mustashni) and sellers (maker, shani). 6. Murabahah Agreement (Deferred Payment Sale) Murabahah is sale contract, of goods at the original price with an agreed advantage added. In the National Sharia Board Fatwa No. 04 / DSN- MUI / IV / 2000 on Murabahah, it is mentioned that the first customer to buy the necessary goods in the name of the first party itself, and this purchase should be valid and usury free. Then the customer pays the agreed price of the goods in a certain period of time agreed upon. Among all companies that go public, there are only a few one that issue sukuk, not bonds. Which lead to ask the question, what are the factors that affect the issuance of sukuk, both macro and micro factors. There are several types of contract in the issuance of sukuk in Indonesia, sukuk is presently more use in the form of Ijarah and Mudarabah contract, therefor the interest to find out why companies chose Ijarah or Mudarabah contract. One Previous research on the effect of the issuance of sukuk on the issuing company's fundamentals and capital market reaction, was made by Selim Cakir and Faezeh Raei (2007) who concluded that the value at risk is smaller than Eurobond sukuk and sukuk returns are relatively smaller. Nafiah Afaf (2008) concluded that the issuance of the bonds causes an increase in the leverage of the company. Mujahid & Tettet (2010) concluded that the value of corporate sukuk issuance has no significant effect on cumulative abnormal stock return. Other finding in the Mujahid & Tettet (2010) research is that, Sukuk Company does not have a significant effect on the market reaction to cumulative abnormal stock return. Contract based Sharia sukuk are different compared to other funding instruments, namely bonds or stocks. In sukuk contract, agreed funding are recognized as a debt, such as Ijarah contract, or the nature of the contract is recognized as capital but has matured as a debt, such as Mudarabah contract. There are two types of factors in Islamic transactions, emotional and rational factors. The characteristics of rational factors in Islamic transactions are the use of financial considerations, if the contract is projected to be more profitable than conventional, and vice versa. If there is a consistent difference in the financial situation of the company issuing sukuk compared with bonds, the companies allegedly issuing sukuk choose more to improve the financial situation, not an excuse adherence to sharia. Financial reasons include differences in financial circumstances as indicated by differences in key financial ratios such as ROA, ROE, DER, and other ratios. As a complementary analysis, or control of variables, we tested the effect of macroeconomic factors on the selection of the type of financial instrument, such as inflation. The same thinking is also applied to the analysis of the factors causing companies to choose the type of contract in the issuance of sukuk, between Mudarabah and Ijarah. Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 3. The Research Method The data used in this study were obtained from a variety of sources with the following details: ROA Value obtained using the formula ROE Value obtained using the formula Debt to Equity ratio Value obtained using the formula Debt to Asset ratio Value obtained using the formula Market to Book value Value obtained using the formula Stock Price fluctuations Fluctuations in the value of stock prices obtained from the standard deviation of daily stock price amount for 1 year. Inflation Inflation rate is obtained using the formula , 4. Population and Sample The population in this study is the 31 companies that issue sukuk in Indonesia, namely: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. PT Indosat Tbk PT Mitra Adiperkasa Tbk PT Adhi Karya (Persero) Tbk PT Matahari Putra Prima Tbk PT Perusahaan Listrik Negara (Persero) PT Ricky Putra Globalindo Tbk PT Apexindo Pratama Duta Tbk PT Humpus Intermoda Transportasi Tbk PT Berlina Tbk PT CSM Corporatama PT Citra Sari Makmur PT Sona Topas Tourism & Industry Tbk PT Bank Mandiri Syariah PT Cilliandra Perkasa PT Bank Syariah Muamalat Indonesia Tbk Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. PT Bank Bukopin Tbk PT Berlian Laju Tanker Tbk PT Mayora Indah Tbk PT Sumarecon Agung Tbk PT Metrodata Elektronic Tbk PT Aneka Gas Industry Tbk PT Salim Ivomas Pratama PT Pupuk Kalimantan Timur (Persero) PT Titan Petrokimia Nusantara PT Tiga Pilar Sejahtera Food Tbk PT Adira Dinamika Multi Finance Tbk PT Sumberdaya Sewatama Tbk PT Bank Muamalat Indonesia Tbk PT Bank Pembangunan Daerah Sumatera Barat (Bank Nagari) PT Bank Pembangunan Daerah Sulawesi Selatan PT PTPN VII From the population above, we selected 25 companies as a sample, because there are six companies that the data are not available for all variables. Those six companies are: 1. 2. 3. 4. 5. 6. PT Adira Dinamika Multi Finance Tbk PT Bank Pembangunan Daerah Sulawesi Selatan PT Bank Mandiri Syariah PT Cilliandra Perkasa PT CSM Corporatama PT PTPN VII The analysis of the differences between companies that issue sukuk and those issuing bonds, is made using different test, T test or Mann Whitney U test. The Analysis of the causal factors (internal) company issuing sukuk is made using logit regression with the pooled data. Finally the analysis of the factors causing a company issuing sukuk to choose Mudarabah or Ijarah is made using logit regression. Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 5. Research Findings 5.1. Analysis of Financial Situation of a Company before Sukuk and Bonds issuance Table 2: Independent Samples Test Results - Difference in Financial Situation of a Company before Sukuk and Bonds issuance: Debt To Asset Average Debt To Asset 7134.5 (Rank Sum) Before Issuance of Sukuk Average Debt To Asset 5906.5 (Rank Sum) Prior to Issuance p-value 0.0958 Inference There is a significant difference Debt To Asset before the issuance of sukuk and before the issuance of bonds. The company Debt To Asset before the issuance of sukuk on average is larger than the Debt To Asset of the company before the issuance of bonds The results showed that companies issue sukuk when their Debt To Asset is high relative to their financial condition prior to the issuance of bonds, and statistically significant. Thus it can be presumed that such sukuk issuance is for the company to absorb the available funds beyond conventional debt that has been obtained as shown in the balance as a high debt to assets. Table 3. Independent Samples Test Results - Difference in Financial Situation of a Company before Sukuk and Bonds issuance: Debt To Equity Average Debt To Equity 6725.5 (Rank Sum) Before Issuance of Sukuk Average Debt To Equity 6315.5 (Rank Sum) Prior to Issuance p-value 0.777 Inference There is no significant differences between, Debt To Equity before Sukuk issuance and before bonds issuance. The Company Debt To Equity before the issuance of Sukuk in average is greater than the Debt To Equity of the company before the issuance of bonds The results showed that the companies issue sukuk when their Debt To Equity is high relative to the financial condition prior to the issuance of bonds, but the difference was not statistically significant. Although not statistically significant, but the debt to equity sukuk issuer are higher than the bonds issuer, consistent with the results of the analysis of the differences in debt to asset. Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 Table 4. Independent Samples Test Results - Difference in Financial Situation of a Company before Sukuk and Bonds issuance: Return on Assets Average Return on Assets Prior 6720 (Rank Sum) to Issuance of Sukuk Average Return on Assets Prior 6321 (Rank Sum) to Issuance p-value 0.7920 Inference There is no significant difference in return on assets before the issuance of sukuk and before the issuance of bonds Return on assets of the company before the issuance of sukuk on average higher than the return on assets of the company before the issuance of bonds The results showed that companies issue sukuk when its return on assets is relatively high compared to the financial circumstances before the issuance of the bonds, but the difference was not statistically significant. Although not statistically significant, but ROA of sukuk issuer is higher than the ROA of bonds issuer, so it was concluded that although the financial risks of sukuk issuer is higher, but at the same time the company issuing the sukuk is also more profitable than corporate bond issuers. Table 5. Independent Samples Test Results - Difference in Financial Situation of a Company before Sukuk and Bonds issuance: Return on Equity Average Return on Issuance of Sukuk Average Return on Issuance p-value Inference Equity Prior to 6361.5 (Rank Sum) Equity Prior to 6679.5 (Rank Sum) 0.3429 There is no significant difference in the return on equity before the issuance of sukuk and before the issuance bonds The Return on Equity of the company before the issuance of sukuk on average is smaller than the return on equity of the company before the issuance of bonds The results showed that companies issue sukuk when its return on equity is low relative to the financial condition prior to the issuance of bonds, but the difference was not statistically significant. Although not statistically significant, but ROE of sukuk issuer is lower than ROE of bond issuer, so it was concluded that when the financial risks of sukuk issuer is higher, at the same time the performance of the company's equity Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 management of the sukuk issuers are also lower than the company issuing bonds. The results of this study can be considered as an indication that sukuk is seen as a debt instrument rather than equity instrument, for any kind of contract. 5.2. Analysis of a Company (Internal) Factors That Cause the Issuance of Sukuk Table 6. Logit Test Results Debt to Equity and ROE Constant 0.3545965 Debt To Equity Coefficient 0.1713596 Return On Equity 0.0322672 Coefficient Probability > chi2 0.3778 Pseudo R2 0.0229 Number of Observations 62 Table 7. Logit Test Results Debt to Asset & ROA Constant Debt To Asset Coefficient Return On Asset Coefficient Probability > chi2 Pseudo R2 Number of Observations -0.382 0.114 -2.384 0,5691 0,0133 62 Based on the results of the logit analysis it can be concluded that the Debt To Equity ratio, the ROE as well as ROA are not the variable that cause companies to issue bonds or sukuk. Thus it can be presumed that companies issued sukuk not because of the financial situation which is different from companies that issued bonds. When the variable market-to-book value is added to the regression equation, then obtained the following results are obtained: Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 Table 8 Logit Test Results Debt to Equity, ROE and Market to Book Value Constant Coefficient Debt To Equity Coefficient Return On Equity Coefficient Market to Book Value Probability > chi2 Pseudo R2 Number of Observations 0.0327958 0.1658241 -0.1634761 0.4235076* 0.1410 0.0643 62 *: significant Based on the above regression equation, we concluded that if the market to book value increases, then the selection of sukuk by the company as debt instruments decreased compared with bonds. The results of this study is consistent and logic, companies issuing sukuk as an alternative to equities, as bonds, sukuk thus might be seen by the company as debt, whatever kind of contract it is. 5.3. Analysis of the Financial Factors that cause a Company to Choose between Sukuk Mudarabah or Sukuk Ijarah. Table 9 Sukuk Scheme Difference between Mudarabah and Ijarah Iteration Iteration Iteration Iteration Iteration Iteration Iteration 0: 1: 2: 3: 4: 5: 6: log log log log log log log likelihood likelihood likelihood likelihood likelihood likelihood likelihood = = = = = = = -7.9219874 -6.0323548 -5.4384587 -5.3145179 -5.3132587 -5.313258 -5.313258 Logistic regression Log likelihood = Number of obs LR chi2(5) Prob > chi2 Pseudo R2 -5.313258 ijarah Coef. roe debt_to_eq~y inflasi pergerakan~r book_value _cons -12.10283 -.129127 .0137275 .0109682 -2.283965 3.561127 Std. Err. 15.93216 .5930658 .2267577 .0093281 2.195114 2.856717 z -0.76 -0.22 0.06 1.18 -1.04 1.25 P>|z| 0.447 0.828 0.952 0.240 0.298 0.213 = = = = 17 5.22 0.3899 0.3293 [95% Conf. Interval] -43.32928 -1.291515 -.4307095 -.0073146 -6.58631 -2.037935 19.12363 1.033261 .4581644 .029251 2.018379 9.16019 Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 From the regression results, can be concluded that the probability of companies issuing sukuk Ijarah compared to Mudarabah decrease when the ROE of the companies is high, decrease when D / E of companies is high, decreases also when M / B of companies is high, declined when companies stock returns is high, rise up when the inflation rate is high, and rise up when the fluctuations of stock return sis high. Eventhough the overall model was not significant, but the effect of variable X on Y is 0.3293%. And the results of this study indicate that companies that have a higher probability of choosing Mudarabah contract rather than ijara contract tends to be a company that have a high ROE, D / E, high M / B, high stocks return, but low inflation rate and low fluctuations in stock returns. 6. Conclusion There are not so many researches on the sukuk (Islamic bonds). In Indonesia, 31 companies out of 300 public companies have issued sukuk. This research was conducted to find out any financial factors that caused those 31 companies to issue sukuk, instead of conventional bonds. Those causal factors are either internal / fundamentals or macro. Indonesia's public companies have issued Sukuk Ijarah or sukuk Mudarabah. Ijarah is a lease agreement, while the Mudarabah contract is a contract whereby one party is the investors and the other parties as the manager. This research other question was whether there is any financial factors that influence the selection of Ijarah or Mudarabah contract. The sample of this study was 25 public companies out of the population of 31 companies issuer of sukuk in Indonesia, using independent comparison test and logit regression analysis, this research concluded : Differences in Corporate Financial Analysis before Issuing Bonds and Sukuk (Based on the independent samples t- test) - Debt to Asset before issuing sukuk is higher relative to the financial condition prior to the issuance of bonds and statistically significant, so the objective of issuing sukuk is to absorb the available funds out of conventional debt. - Debt to Equity before issuing sukuk is higher relative to the financial condition prior to the issuance of bonds. Although not statistically significant, this result is consistent with Debt to asset. - Company that issued sukuk had relatively higher Return on Assets than their financial circumstances before the issuance of bonds. Although not statistically significant, but it can be presumed that the financial risk of companies before the issuance of sukuk is higher, at the same time the profitability of those companies issuing sukuk is also higher than the issuer. - Company that issued Sukuk had a relatively lower Return on Equity compared to their financial circumstances before the issuance of bonds. Although not statistically significant, but it can be presumed that not only the financial risk of the company before the issuance of sukuk is higher, but the performance of the equity management of the company issuer sukuk is also lower than the one issuer of bonds. Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 It is also an indication that the sukuk was seen as a debt instrument rather than equity instruments, in any kind of the contract (aqad). Analysis of the internal factors that lead a Company to issue Sukuk or Bonds and the Macro Factors (Based on Logit Regression Analysis) - Debt to Equity, ROE and ROA are not variables that cause companies to issue sukuk, so it can be presumed that the company issuing sukuk not because of the financial situation, in comparison to bond issuance reasons. - If the market value to book value before issuing sukuk increased, the probability of selection of sukuk by the company as debt instruments decreased compared to probability to issuance of bonds, so it presumed that company issue sukuk as an financing alternative in form of debt instead of equity, thus sukuk is seen as a debt, in any kind of the contract. - Macroeconomic variables such as inflation and fluctuations in stock returns are not significantly affecting the company in choosing between issuing sukuk or bonds. This means that there were other considerations in selection process of sukuk as financing instruments. Analysis of Financial & Macro Factors in Choosing between Contract/Aqad Mudarabah and Ijarah (Based on Logit Regression Analysis) - Probability of companies issuing sukuk with Ijarah ccontract/aqad compare with Mudarabah contract/aqad decreased as ROE was high, Deb/Equity high either, as well as a high Market/Book and stock returns. - Probability of companies issuing sukuk with Ijarah contract/aqad in compare with Mudarabah contract/aqad increase as inflation rate was high, and fluctuations in stock returns were high. - Although the overall model was not significant, but the effect of variable X on Y was 0.3293% - These results indicated that companies, whose probability of choosing Mudarabah rather than Ijarah contract is higher, tend to also had high profitability, high financial risk, high market value, in the economic condition of low inflation and low risk in form of fluctuations in their stock returns. 7. References Ascarya dan Diana Yumanita, 2007, Comparing The Development Islamic Financial/Bond Market in Malaysia and Indonesia, IRTI Publications (2008) : Saudi Arabia. Badan Pengawas Pasar Modal dan Lembaga Keuangan. 2012. Statistik Pasar Modal September 2012. Pada http://www.bapepam.go.id/pasar_modal/publikasi_pm/ Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 statistik_pm/2012/2012_IX_4.pdf. diakses pada 23 Juni 2013 Dewan Syariah Nasional – Majelis Ulama Indonesia. Kumpulan Fatwa. Terkait Surat Berharga Syariah Negara. Edisi ketiga tahun 2012 Direktorat Kebijakan Pembiayaan Syariah, 2008, Mengenal Instrumen Investasi dan Pembiayaan berbasis Syariah, Depkeu: Jakarta Himpunan Fatwa Dewan Syariah Nasional, 2004, Cet. Kedua Mohammed AL-Bashir (January, 2008). Sukuk market: innovations and challenges. Mujahid & Tettet F, 2010, Reaksi Investor Terhadap Penerbitan Sukuk, Jurnal Bisnis & Manajemen Peraturan Bapepam dan LK Nomor IX.A.14 tentang Akad-akad yang Digunakan Dalam Penerbitan Efek Syariah Sakti, Ali. 2011. Peran Lembaga Keuangan Syariah dalam Pengembangan Ilmu Syariah, Hukum dan Ekonomi, Jurnal Online.