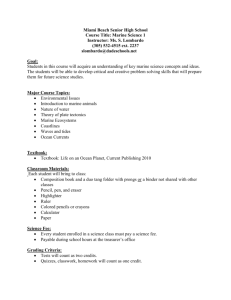

Marine industries global market analysis Marine Foresight Series No.1

advertisement