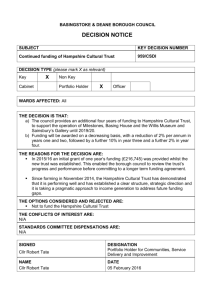

The Impact of Welfare Reform and Public Sector Spending Reductions on Low

advertisement