International Journal of Application or Innovation in Engineering & Management... Web Site: www.ijaiem.org Email: Volume 5, Issue 3, March 2016

advertisement

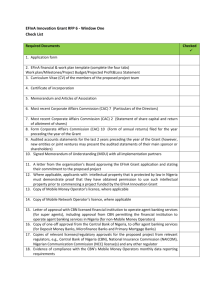

International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 E-payments Adoption and Customers’ Service delivery in Nigerian Deposits Money Banks Oladejo, Morufu. O Department of Management and Accounting, Faculty of Management Sciences Ladoke Akintola University of Technology, Ogbomoso, Oyo State, Nigeria ABSTRACT The use of e-payment is expected to improve financial transaction in Nigeria and serve as a pointer to digital economy. This has thus become a subject of debate among the accountants and practitioners. This paper remains pertinent by exploring the influence of e-payments adoption on customer’s service delivery in Nigeria Deposits Money Banks (DMBs). Data were collected through a structured questionnaire administered on ten quoted DMBs and financial statements of the sampled banks to elicit information on adopted e-payments and combined effect on service delivery measured by customers’ deposits between 2005 and 2012. Data were analyzed using panel logistic regression regressing performance measured by customers deposits on the four identified e-payments by the central banks of Nigeria (ATM, INTERNET, POS and Mobile Banking). The overall result from data analysis shows that when bank adopt e-payment systems, their performance level measured by customer deposits changes. The result of the Regression analysis produced coefficient of determination (R2) 0.9678 supported by high value of Adjusted (R2) significant at 0.9643. The result further indicates that increase in bank size does not necessarily determine the volume of money deposits by customers. With exception of mobile transactions, the result indicates that high volume of ATM transactions is an evidence of high customer deposits. It is therefore suggested as a matter of policy, that bankers must sustain continuous public awareness and consumer education on the invariability of e-payments usage to endear customers to payment technology usage and facilitate attainment of cashless economy. Key words: E-payments Adoption, Customer Deposits, Deposits Money banks, Service Delivery, Nigeria. 1.INTRODUCTION The recent cashless policy of the Nigerian government has been a subject of concern to accountants and players in commerce. The central banks of Nigeria (CBN) strategic plan on payment system is designed to ensure that a larger proportion of currency in circulation is captured within the banking system, thereby enhancing the efficacy of monetary policy operations and economic stabilization measures. The position central bank of Nigeria (CBN Report 2012) that cash related transactions represent over 99% of customers activity in Nigerian banks requires further empirical investigation. According to Umeano (2012) the direct cost of cash was enormous and increasing and that Nigeria is a cash-based economy with retail and commercial payments primarily made in cash. The benefits of e-payments system have been described in the literature to include optimal tax revenue collection by government, increased economic growth and increased financial inclusion while consumers will enjoy faster, easier payments. Also, benefits to corporations and banks are better access to capital, increased efficiency of payment process and accounting, reduced revenue leakages and more efficient treasury management; efficiency, reduced cost and increased banking penetration (Oladejo and Akanbi, 2012; Simeh, 2012; Umeano, 2012). According to Ommachonu, (2012) the central banks of Nigerian e-payments policy is expected to reduce cost of cash management by banks. Thus most banks in Nigeria were reported to have established platforms for e-payments services as observed Ayo, Ekong, , Fatudimu, and Adebiyi, (2007), Oladejo, (2014) including the old generation banks. This according to Popoola (2010) has been as a result of exodus of customers to the New Generation banks that are technology inclined. Customers' taste and desire have begun to raise the stakes of expectation of exceptional services. In Nigeria, electronic banking became prominent after the Central Bank of Nigeria banking reformation exercise in June 2004, which was geared towards reducing the number of banks in the country and making the emerging banks much stronger and reliable (Soludo 2007). Coupled with huge investment on technology and widely adopted telecommunication networks, the banks offer a wide range of e-banking services for effective and efficient of banking services (Adesina, Ayo and Ekong, 2008). The banking sector reform that compelled increased capitalization on deposits money banks in Nigeria resulted in consolidation of banks since 2005. This has made the post consolidated banks strived for improved customers service delivery through technology adoption strategy. The strive for improved customers service delivery by banks could be traced to increasing demand for better services by the customers who would like to transact their banking transactions at any time and convenient location. The usefulness of any particular payments product to an individual is an increasing function of the number of individuals who already use and accept it in executing transactions as averred Abrazhevic, (2004). According to Volume 5, Issue 3, March 2016 Page 130 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 Ezeoha, (2005) developments in Nigeria, such as the introduction of mobile telephone in 2001, improved access to personal computers and internet service facilities have also added to the growth of electronic banking in the country. Evidence from the literature shows that end user adoption of such sensitive technology as money-circulating payment systems is the critical key aspect of the whole part of payment systems’ establishment (Chau and Lau, 2003; Abrazhevich 2004; Al Sukar and Hassan. 2005; Sumanjeet, 2008; Adesina and Ayo, 2010; Oladejo and Ojo, 2010)). This is further corroborated by Kondabagil, (2007) that any decision to adopt E-banking is normally influenced by a number of factors which include customer service enhancement and competitive costs, all of which motivate banks to assess their electronic commerce strategies. Other factors that influence e-payment adoption by banks as identified in the literature are banks size, intensity of branches, customer demand for e-payments, gross earnings, percentage of internet usage, education level of customers, cost of human resources and e-payment trading. The extent to which customers service delivery is influenced by banks adoption variables and identified e-payment systems like Automated teller machine (ATM), Internet banking, point of sales (POS) and mobile banking requires further empirical study 1.2 Statement of the problem The existence of empirical studies measuring combined effect of banks specific adoption variables (like bank size, cost of human capital, intensity of branches) and four e-payment systems like Automated teller machine (ATM), Internet banking, point of sales (POS) and mobile banking on customers service delivery is questionable in the Nigerian context as at the time of this study. However, a bank that adopts electronic banking must develop different methods of conducting business, methods which may introduce new risks to the bank. It is therefore important for Accountants, bankers, policymakers and other players in commerce to understand how electronic transactions in commercial banks influence customers service delivery. The combined effect of all e-payments instrument on performance of the adopting banks measured by customers deposits is worthy of exploration. 1.3 Objectives of the Study Examine the relationship between e-payments systems and customers deposits in Nigeria Deposits money banks (DMBs) Assess the influence of e-payment adoption on customers deposits in Nigeria Deposits money banks (DMBs) 1.4 Hypotheses of the Study HO: E-payment adoption does not significantly influence customer deposits in Nigeria Deposits Money Banks (DMBs) 2.LITERATURE REVIEW 2.1 Concept of Banks Performance and E-Payment Adoption Al-Refaee (2012) averred that commercial banks are considered the most important activities in the economic system wheel in every community, due to the fact that the returns of the economic activity in the community are as much as the banking contribution in the economic activity. Banks must have tough foundation in the globalization world and that can be done by developing the accounting information systems through the e-commerce. For example the financial performance of banks in 2007 showed significant jumps in all key performance metrics from 2006. For instance net interest income and profit before tax rose by 202 % and 288 % respectively showing the resulting effect of the banking reforms as banks were able to make use of their larger balance sheet (CBN Supervision Report 2007). Understanding the link between internet banking and performance according to Khrawish, and Al-Sa'di (2011) is an empirical issue. Commonly used measures of bank performances are the level of profits and growth in customers deposits. Banks profitability can be measured by the return on bank's assets (ROA), a ratio of bank's net income to its total assets. Another good measure of banks profitability is the ratio of net income to equity (ROE) rather than assets since banks with higher equity ratio should also have a higher return on assets and finally the margin of interest. The Key Performance Indicator (KPI) database includes important indicators regarding financial institutions. Growth, earnings and capital aspects are part of the Key Performance Indicators. A performance indicator or key performance indicator (KPI) is an industry jargon for a type of performance measurement. KPIs are commonly used by an organization to evaluate its success or the success of a particular activity in which it is engaged. Performance indicators differ from business drivers and aims (or goals). A school might consider the failure rate of its students as a key performance indicator which might help the school understand its position in the educational community, whereas a business might consider the percentage of income from returning customers as a potential KPI. Bank KPIs include key performance indicators as Investment return metric like Return on operating capital Return on Equity, Return on capital employed, Cost metrics like Overhead cost ratio, Cost to Income, Cost to assets ratio, Income metrics like Gross profit, Interest spread, Non-interest income level, Fee income level, Interest margin metrics Operating margin. Interest margin, Profit margin, Risk metrics like value at risk, Capital adequacy ratio, Company assets metrics like Reserve requirement, Return on average assets, Non-performing assets. 2.2 Appraisal of e-payments system According to Nupur, (2010) the growth of electronic banking in a country depends on many factors, such as success of internet access, new online banking features, household growth of internet usage, legal and regulatory framework. e- Volume 5, Issue 3, March 2016 Page 131 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 banking can offer speedier, quicker and dependable services to the customers for which they may be relatively satisfied than that of manual system of banking. It is believed that banks providing e-payment services like Automated teller machine (ATM) Internet banking or the likes to their customers will be mostly patronised. This is because e-banking system not only generates latest viable returns, it can get its better dealings with customers. It can be inferred from the theory of consumer behavior that customers prefer functioning product or service that are easily accessible and satisfy their need. The study of Karimzadeh, (2011) determined economical prospects of e-banking and found a significant growth in the progress of payment system in Iran. Also Rasolinezhad (2009) findings suggest that ATM banking has the highest performance in Iran among others in consonance with the findings of Agboola, 2006 and Ayo et al 2008 that ATM and internet banking were growing in Nigeria. Among e-payment products as concluded Karimzadeh, (2011) the ATMs are the most widely accepted and highly utilized delivery channel in Iran but ATMs are not up to date and mostly out of service . Gao and Owolabi (2008) investigated the factors that influence the consumer adoption of internet banking in Nigeria. The results showed that the currently relevant factors determining the adoption of internet banking in Nigeria include the level of awareness or attention, the accessibility to computers and the internet, convenience, privacy, costs, and the availability of knowledge and support concerning internet banking. This view corroborates earlier empirical findings from the studies of Cho and Park, (2001), Chen, (2002), Cummingham et al (2005). In the United States, there are 10 million payment terminals; over 60% currently dial-up terminals (Sumanjeet 2009). Also, AlGhamdi et al (2012) observed that the global e-commerce spending is worth about US$10 trillion at present, compared to US$0.27 trillion in 2000. The U.S.A accounts for the largest share (about 79%) of the current total, followed by Europe. By comparison, the Middle East and African region has a very small share (around 3%). Epayments greatly increase payment efficiency by reducing transaction costs and enabling trade in goods and services of very low value. They may also increase the convenience of making payments by enabling them to be made swiftly and remotely from various devices connected to global networks. The major components of e-payment system are money transfer applications, network infrastructures, and rules & procedures governing the use of the system. Electronic payment is a payment carried out electronically. Some proposed electronic payment systems as observed Sumanjeet (2009) are simply electronic version of existing payment systems such as cheques and credit cards, while, others are based on the digital currency technology and have the potential for definitive impact on today’s financial and monetary system. Electronic payment system has accelerated the money circulation speed, and has brought the enormous convenience for the modern trade activity (Weibing, 2011). Typically, this involves the use of computer networks such as the Internet and digital stored value systems in form of cards made up of silicon chips. The system allows bills to be paid directly from bank accounts, without being present at the bank with physical cash, and without the need of writing and mailing cheques. It is card for card. According to Nowadays, Taddesse, and Kidan (2005) societies have well recognized information and knowledge as invaluable resources. The growth of the Internet and World Wide Web (WWW) has made electronic commerce (e-commerce) possible. E-Commerce in its simplest sense is trading electronically. It offers consumers and merchants convenience and speed. The success and growth of e-commerce, however, depends on efficient electronic payment (e-payment) system. With this trend, Moertini, Athuri,. Kemit and Saputro (2011) believed that conducting transactions electronically has been becoming necessity and way of life of Indonesians. 2.3 Economic relevance of e-payments system The emergence of e-commerce has created new financial needs that in many cases cannot be effectively fulfilled by the traditional payment systems (Sumanjeet 2009). From the study of Briggs and Brooks (2011) an Electronic Payment System (EPS) is a form of inter-organizational information system (IOS) for monetary exchange, linking many organizations and individual use. According to Ozuru, Chikwe and Uduma, (2010), Electronic payment transactions in the United State exceeded cheque payments for the first time in 2003. From 2000 to 2003, the volume of electronic payment transactions grew from 30.6 billion to 44.5 billion, while the volume of cheque declined from 41.9 to 36.7 billion over the same period. For instance, in North America in the online B2C world, 90 percent of all online consumer purchases are made with general – purpose credit cards. The same is true for the overwhelming majority of online purchase in Nigeria. Similar trends are occurring in Nigeria today as averred Agboola ( 2006) that all banks in Nigeria have one form of e- banking product or the other, all of which is geared towards delighting customers and with the ultimate objectives by each of the banks to gain competitive advantage and market share. According to Taddesse, and Kidan (2005), the major benefits of e-commerce which is the platform for e-payment systems include the following among other things. Improved response time: communication and flow of information become quick and cost efficient. 24/7 World round the clock availability of goods and services. Communicating, making order, buying, selling, and paying occurs 24 hours a day, 7 days a week and 365 days a year. Extended market reach and revenue potential, and a wide range of choices and convenience for the customer. Geographic barriers or boundaries are removed. A merchant can reach a customer who is physically too far away. The customer on the other hand, can make purchases from a merchant who would otherwise not have been accessible to him. Volume 5, Issue 3, March 2016 Page 132 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 Improved competitive positioning: The benefits of e-commerce are not limited to large entities. Small and medium enterprises (SMEs) are also equal participants in the virtual environment. Reduced costs for the business firm and reduced price for the consumer. However literature suggests that people are not willing to use any technology based payment system for fear of loss of money to theft of fraud (Berger, 2003; Karimzadeh, 2011; Barriya nad Singh, (2012). This view is common to most developing and emerging economies of the world. For instance the study of Karimzadeh, (2011) in Iran highlighted various reasons why the Iranians are averse to use electronic payment system as follows which may not be at variance with Nigerian situations as follows: Suppliers/ sellers are not trusted by people as they do not provide satisfactory information about themselves Lack of appropriate legal framework. Low internet connection speed and high prices of connecting to the internet. Although new ISPs (internet service providers) are being introduced every day and broad band connections like ADSL with up to 2 Mb/sec speed are available in recent years, still there are lots of people that only have access to low speed internet connection at high prices which makes the electronically transactions vulnerable Absence of technical knowledge among traders, businessmen and user and non-user customers. Disproportion between New and traditional banking functions. Disintegrate between organizational and Information Technology infrastructures Law cooperation between different responsible sectors in electronic payment. Lack of infrastructure and weak telecommunication. In Iran, there seem to be inadequate information and telecommunication technology infrastructures. Inadequate information and telecommunication technology infrastructures can negatively impact the adoption and diffusion of electronic transactions. Lack of awareness, penetration of Internet and e-banking products in rural area Minimum level of English language is required. Another impeding factor that may throw a big blow to the electronic banking system in Iran is the language barrier Lack of adequate experts in e-banking context. An inadequate number of well-trained technicians are also a factor. Maintenance and management of websites problems. Given the important role that well functioning payment systems has on monetary policy, financial stability and overall economic activity, the Central Bank of Nigeria (CBN) has put in place set of national system initiatives (CBN 2003). In setting out the objectives of the National Payment System (NPS), the goal is to ensure that the system is available without interruption, meet as possible all users need and operate at minimum risk and reasonable cost. The Government of Nigeria further promoted electronic banking with the CBN release on August 2003. This recognizes that electronic banking and payments services are still at the early stages of development in Nigeria. Arising from the three major roles of the CBN in the areas of monetary policy, financial system stability and payments system oversight, the CBN Technical Committee on E-Banking has produced a report, which anticipates the likely impact of the movement towards electronic banking and payments on the achievement of CBN’s core objectives. Following from the findings and recommendations of the Committee, four categories of guidelines have been developed as follows: Information and Communications Technology (ICT) standards, to address issues relating to technology solutions deployed, and ensure that they meet the needs of consumers, the economy and international best practice in the areas of communication, hardware, software and security. Monetary Policy, to address issues relating to how increased usage of Internet banking and electronic payments delivery channels would affect the achievement of CBN’s monetary policy objectives. Legal guidelines to address issues on banking regulations and consumer rights protection. Regulatory and Supervisory, to address issues that, though peculiar to payments system in general, may be amplified by the use of electronic media.has been becoming necessity and way of life of Indonesians. 2.4 E-payments system and customers service delivery Sathye (1999) with respect to adoption of internet banking by Australian consumers found that two factors such as “security concern” and “difficulty in use” are important reasons why customers do not want to use the service. On the other hand, Jayawardhena & Foley (2000) suggested that the features of internet banking websites, such as: the speed to download; content; design; interactivity; navigation; and security are critical to enhancing customer satisfaction. In addition, Zeithaml et al (2002) have uncovered several quality dimensions related to online systems –ease of navigation, flexibility, efficiency, site aesthetic and security. Recently, Gefen et al (2003) have empirically found that two technological aspects of the web site interface, namely perceived ease of use and perceived usefulness significantly affect customer repurchase intentions. Another rationale for customer use of the internet is convenience. Customers would often prefer to complete their transactions at one site. In this wise customers in e-commerce platform wish to pay their bills electronically and automatically, view and print their monthly bank statements, and purchase stocks, insurance, and other financial offerings with utmost ease. It thus Volume 5, Issue 3, March 2016 Page 133 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 becomes strategic for companies with wide product lines to be able to attract large number of customers to their sites. This is because the provision of a wide range of products and diverse features in the format required by customers is a key to gaining customer satisfaction that enhances organisational performance. Hamidinava and Madhoushi (2005) conducted research to evaluate the features of e-payment system in Iranian bank users view, using questionaire design and ANOVA for pre observation test and Kruskal wallis test, the empirical results showed that the first main factors of e-payment in the view of Iranian users are socio economical index, followed by security index, legal index and then the technical index as having the most effects developing e-payment system. Mashour and Zaatreh (2008) investigates the investment of information systems at Jordan banks and report the results of an empirical study that evaluates the contribution of IS in the effective of banks operations. The research measures the factors which determine information systems effectiveness at Jordan main banks. These variables are presumably system decision performance system usage and user satisfaction among others that are considered the most effective variables in bank performance. Singhal and Padhmanabhan (2005) explored the major factor responsible for internet banking based on respondents’ perception on various internet applications. Primary data was collected by structured survey. The survey was created online and link sent to the respondents from India using convenience sampling. The study concluded that out of total respondents more than 50% agreed that internet banking is convenient and flexible ways of banking and it also have various transaction related benefits. In Nigeria, Adesina et al (2008) focussed on determining the level of users’ acceptance of electronic banking service and investigating the factors that determine users’ behavioural intention to use electronic banking system in Nigeria. The survey instrument employed involved design and administration of total of 200 survey questionnaire within the Lagos metropolis and its environs. The result of the research showed that banks customers who are of e-banking system use it because it’s convenient, easy to use, saves time and meet their transaction needs. Furthermore in the study by Chiemeka, Evwiekpaefe and Chete (2006) some twelve Nigerian banks have introduced online banking systems. The study reveals that customers were able to get up to date information through the online banking system. Moreover, the study shows that the internet banking system is at a basic level and recommends that bank managers need to improve on security levels and increase confidentiality, effective communication integrity and availability. The study of Agboola (2006) revealed that most banks are discouraging cash and most banks are being automated, reducing the volumes of cash transaction. This serves as pointer to the imperative of e-payments adoption and their influence on performance. Noteberg, Christiaanse and Wallage (2000) assessed the impact of third party-provided electronic commerce assurance on consumers' likelihood to purchase products and services online and found third-party assurance significantly increased purchasing likelihood and reduced consumers' concerns about privacy and transaction integrity. Jayawardhena and Foley (2000) reported that Internet banking renders location and time irrelevant, empowers customers with greater control of their accounts and that banks achieve cost and efficiency gains in a large number of operational areas. Empirical conclusion of Brooks and Briggs (2011) that the technological payment infrastructure in Nigeria was modern and of comparable standard calls for more studies. Oghenerukeybe (2009) concurs that the internet is the medium for an escalating amount of business and other sensitive transactions, including online banking and ecommerce. E-payments system also includes point of sales (POS) and mobile banking. 3. METHODOLOGY This study was to cover all the existing commercial banks in Nigeria after the banks consolidation exercise of 2005. Out of the twenty commercial banks existing as at 2013 fifteen of them were quoted on the Nigeria Stock Exchange out of which ten purposively selected for the purpose of the study. The reason for purpose choice of the sampled commercial banks is based on their quotation on the Stock Exchange and consistent records of performance during the period of study. The annual reports of sampled banks covering 2005 to 2013 were analyzed to achieve the objectives of the study. Data were analysed using panel logistics to describe the pattern of performance expected of banks that adopt and those that are yet to adopt all the identified four e-payment systems. This explained the adoption impact on banks specific performance indices represented by customers deposits. Panel data can control for individual heterogeneity due to hidden factors, which if neglected in time series or cross-section estimations leads to biased results (Baltagi 1995). Using Panel logistic regression and least square the e-payments transaction decision by banks was represented by both adoption decisions of four e-payments system (ATM, WEB (internet), POS and Mobile) by banks and volumes of bank’s transaction of each of the four e-payment system highlighted by Central Bank of Nigeria (CBN) reports. YPt = f (ATM, WEB, POS, MOB) ........................................................... (3.1) Where YPt = Banks performance measured by customers deposits ATM = ATM usage by customers WEB = Web (Internet) banking usage by customers POS = Point of sales usage by customers MOB = Mobile banking usage by customers Volume 5, Issue 3, March 2016 Page 134 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 4.RESULTS AND DISCUSSIONS 4.1 Influence of e-payments adoption on customers service delivery of Sampled Banks This study The result of analysis of the influence of e-payments adoption on customers service delivery measured by customers deposits in sampled banks were displayed in Table 4.1. According to the Table 4.1, bank size was found to be negative but significantly related to performance of banks measured by customer deposits at 1% level. The result indicates that increasing in bank size does not necessarily determine the volume of money deposits by customers. Cost of human capital was however found to be positive but not significantly related to performance of banks. The result implies that increase in personnel costs is required to mobilise more people to deposits in banks hence increasing the volume of deposits in banks. Banks with a widespread network of branches and close contacts with customers are relatively less stimulated to invest in the provision of on-line financial services, as they can rely upon their brick-and mortar infrastructure to maintain strong relationships with the local market and thereby improve their performance level in terms of profit. This is captured by the negative relationship between the intensity of branching and the measure of performance. With exception of mobile transactions, the result indicates that high volume of ATM transactions is an indication of high customer deposits. The variable is found to be positive and significantly related to customer deposits alongside volume of POS. This is in line with the finding of Ayo and Ukpere, 2010 that the automatic teller machine (ATM) is the most widely used e-Payment instrument in Nigeria and responsible for about 89% (in volume) of all e-Payment instruments since 2006 to 2008. This is because some customers have at least two ATM cards depending on the number of accounts operated by them and they represent the active users of the ATM cards. Cost of human capital is however found to be positive but not significantly related to performance of banks measured by customers’ deposits. Banks with a widespread network of branches and close contacts with customers are relatively less stimulated to invest in the provision of on-line financial services, as they can rely upon their brick-and mortar infrastructure to maintain strong relationships with the local market and thereby improve their performance level in terms of profit. This is captured by the negative relationship between the intensity of branching and the measure of performance Table 4.1 Influence of e-payment adoption on customer deposits Variable Coefficient Std. error z-statistics Prob. Bank size -.9764925 .1748573 -5.58 0.000*** .0006769 .0002971 2.28 0.028** Intensity of branching .1872646 .9303018 0.20 0.840 Volume of POS .0002503 .0000986 2.54 0.011** Mobile 1.98e-07 2.51e-07 0.79 0.430 ATM .0021379 .001102 1.94 0.052** WEB -.0000299 .0000205 -1.46 0.144 10.07432 1.420378 7.09 0.000*** Cost of human capital Constant Wald chi2 = 129.69 Prob > chi2 = 0.0000 Source: Data analysis, 2014 The above findings are at variance with the studies of Hamidinava and Madhoushi (2005) main factors of e-payment in the view of Iranian users were socio economical index, followed by security index, legal index and then the technical index as having the most effects developing e-payment system. It however tallies with the findings of Mashour and Zaatreh (2008) that found the user satisfaction in term of customers demand for e-payment among others as the most effective variables in bank performance. It corroborates the earlier study of Negrín, Ocampo and Santos (2011), Barriya and Singh, (2012) that banks with better internet infrastructure and higher income clients have superior adoption rates than banks that have decided to keep on running business mainly through their branches. Volume 5, Issue 3, March 2016 Page 135 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 5. CONCLUSION The overall conclusion revealed that when banks adopt e-payments their performance measured by customers deposits changes. Another important finding of the study is that increase in bank size does not necessarily determine the volume of money deposits by customers. Increase in personnel costs is required to mobilize more people to deposits in banks hence increasing the volume of deposits in banks. With exception of mobile transactions, the result indicates that high volume of ATM transactions is an indication of high customer deposits in the sampled banks. Recommendation In the light of the above the following suggestions may be found useful for bankers Bankers should see investment in e-payment system as customers attraction strategy as this would make for increased patronage of such banking services. Continuous public awareness and consumer education on the invariability of e-payments usage to endear customers to payment technology usage and facilitate attainment of cashless economy. References [1] The Abrazhevich, D. (2004). Electronic payment systems. A user centered perspective And interaction Unpublished PHD. Thesis Schouten school for user –system interaction research. design. [2] A. A Adesina, . & C. K Ayo,. (2010), An empirical investigation of the level of users’ acceptance of E-banking in Nigeria. Journal of Internet Banking and Commerce, 15(1) [3] A. A Agboola, (2006); “Electronic payment systems and Tele banking Services in Nigeria”; Journal of Internet Banking and commerce Dec. 2006, Vol. 11 no3 htt://www.arraydev.com/commerce/jibc1). [4] K, Ahmed,(2011), Online Service Quality and Customer Satisfaction: A case studyof BankIslamMalaysiaBerhad,Online\athttp://mpra.ub.uni-muenchen.de/30782/MPRA Paper No.30782, posted 22. September 2011 05:20 UTC [5] R. J, AlGhamdi, N, A. Nguyen & S. Drew (2012), Factors Influencing e-commerce adoption by retailers in Saudi Arabia: a Quantitative Analysis, International Journal of Electronic Commerce Studies Vol.3, No.1, pp.83-100, 2012 [6] K. M, AL-Refaee , (2012), The Effect Of E-Commerce on the Development of the Accounting Information Systems in the Islamic Banks American Journal of Applied Sciences 9 (9): 1479-1490, 2012 ISSN 1546-9239 © 2012 Science Publication [7] A. Al- Sukkar, & H. Hassan, (2005), “Toward a model for the acceptance of internet banking in developing countries” Information Technology for Development, 11(4), 381- 398 [8] C. K, Ayo, U.O, Ekong, I.T, Fatudimu, and A. Adebiyi, A (2007); “M-Commerce implementation in Nigeria: Trends and Issues”. Journal of Internet banking and Commerce; .August, 2007, Vol 12 No 2, [9] C. K Ayo, (2006); “The Prospects of E-Commerce implementation in Nigeria, ” Journal of Internet Banking and Commerce, December 2006, Vol. 11, No 3. [10] Central Bank of Nigeria (CBN) Report, 2003 [11] Central Bank of Nigeria (CBN) Report, 2011 [12] Central Bank of Nigeria (CBN) Report, 2012 [13] P.S, Barriya and Singh. P (2012)” Mobile Banking in India: Barriers in Adoption and Service Preferences” Journal of management, ISSN: 2278-6120.Vol.5,pp.1-7,June 2012. [14] A.N, Berger, (2003); “The economic effects of Technological progress: Evidence from the Banking Industry” Journal of Money, Credit, Banking volume 35(2), 141-176 [15] A, Briggs and L. Brooks (2011); Electronic payment systems development in a developing country: the role of institutional arrangements; The Electronic Journal on Information Systems in Developing Countries. EJISDC (2011) 49, 3, 1-16http://www.ejisdc.org P Y K, Chau, , and Lau, V S K (2003);An Empirical Investigation of the Determinants of Users Acceptance of Internet Banking; Journal of Organisational Computing and elelectronic commerce; Vol 13, No 2, pp 123-145 [16] I, Chen, (2002), ‘IT-based services and service quality in consumer banking’ International Journal of Service Industry Management, Vol.13. No. 1, pp 69-96 Volume 5, Issue 3, March 2016 Page 136 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 [17] S. C, Chiemeka, , Evwiekpaefe, A. E. and Chete, F. O. (2006) “The Adoption of Internet Banking in Nigeria: An empirical investigation”, Journal of Internet Banking and Commerce,!! (3): http://www.arraydev.com/commerce/jibc [18] N, Cho,. & Park, S. (2001), ‘Development of electronic commerce user-consumer satisfaction index ecusi) for internet shopping’ Industrial Management & Data Systems, Vol. 101. No. 8, pp 400-405 [19] L, Cunningham, Gerlach, J. and Harper, M. (2005), 'Perceived risk and e-banking service An analysis from the perspective of the consumer', Journal of Financial Services Marketing, Vol. 10, No. 2, pp. 165–178. [20] A. E, Ezeoha, (2005). Regulating Internet Banking in Nigeria, Problem and Challenges- Part1, Journal of Internet Banking and Commerce 10(3), retrieved from http://www.arraydev.com/commerce/jibc/2005 [21] P, Gao, & Owolabi, P (2008), Consumer adoption of internet banking in Nigeria; International Journal of Electronic Finance archive; Volume 2 Issue 3, October 2008; Pages 284-299; http://dl.acm.org [22] F. H, Hamidinava, and Madhoushi, M (2010), Evaluating The Features Of Electronic Payment Systems In Iranian Bank Users’ View, International Review Of Business Research Papers Volume 6. Number 6. December 2010 Pp.78 – 94 [23] C, Jayawardhena, and Foley, P. (2000), Changes in the banking sector: the case of Internet banking in the UK. Internet Research: Electronic Networking Applications and Policy, 101, pp. 19-30. [24] M, Karimzadeh (2011), Economical prospects and challenges of electronic banking in Iran; Indian Journal of research, Anvikshiki (2011), 5(3): 60-67; www.academia.eduKern, S (2001) “Electronic money - the payment instrument of the future?” E-Economics, No. 12, Deutsche Bank Research, 2001. [25] H.A, Khrawish, Al-Sa'di, N. M (2011), The Impact of E-Banking on Bank Profitability: Evidence from Jordan; Middle Eastern Finance and Economics; Issue 13 EuroJournals Publishing, Inc. 2011 http://www.eurojournals.com/MEFE.htm [26] J, Kondabagil, (2007). Risk Management in electronic banking concepts and best practices, John Wiley and Sons (Asia) Pte Ltd., Singapore, 2007. [27] Mashour and Zaatreh (2008): journal of internet banking and commerce: a frame work for evaluating the effectiveness of information systems at Jordan banks. An empirical study. Vol 13 no 1 [28] Moertini, V S, Athuri, A.A. Kemit, , H.M and N Saputro (2011); The development of Electronic Payment System for Universities in Indonesia: on resolving key success factors; International Journal of Computer Science & Information Technology (IJCSIT), Vol 3, No 2, April 2011 [29] J, Negrín, D, Ocampo and Santos, A (2011), Recent innovations in inter-bank electronic payment Oghenerukeybe, Egwali A. (2009) Customers Perception of Security Indicators in Online Banking Sites in Nigeria, Journal of Internet Banking and Commerce, 14 (1): http: //www.arraydev.com / commerce / jibe / (accessed 16.6.10) [30] J, Nupur, ( 2010). “E-Banking and Customers’ Satisfaction in Bangladesh: An Analysis”. International Review of Business Research Papers. Vol. 6. September. pp. 145-156 [31] M. O, Oladejo, and T,A Akanbi, (2012); Bankers perceptions of electronic banking in Nigeria: A Review of Post Consolidation Experience; Research Journal of Finance and Accounting www.iiste.org ISSN 22221697 (Paper) ISSN 2222-2847 (Online) Vol 3, No 2, 2012 [32] M. O, Oladejo, & O. O, Ojo, (2010): Customers perceptions of the impact of GSM on service delivery in the Nigerian banks; Journal of Management and Enterprises Development, Vol.7,No. 4, pp 109-117 [33] M. O, Oladejo, (2014), An Assessment of E-Accounting Practices in the Nigerian Deposits Money Banks; International Journal of Computer Science & Technology (IJCST); VOL5.2-3, Apr to June, 2014 [34] J, Ommachonu, (2012); Enhancing Cashless economy through mobile banking; Business Day News, Monday, 13 February 2012. [35] H.N Ozuru, Chikwe, J. E., & Idika Uduma (2010); The use of traditional payments and electronic payment systems in Nigeria: A discourse Proceedings of the 11 Annual Conference ©2010 IAABD [36] A, Parasuraman, Zeithaml, A. & Malhotra. A. 2005. “E-S-QUALA Multiple-Item Scale for Assessing”. Electronic Service QualityJournal of Service Research, Vol. 7. pp.1-21 Volume 5, Issue 3, March 2016 Page 137 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 5, Issue 3, March 2016 ISSN 2319 - 4847 [37] S. O Popoola, (2010), Management Perceptions of Internet - based Banking Services in Nigerian Commercial Banks; African Research & Documentation ; http://www.faqs.org [38] E, Rasolinezhad, (2009), Evaluating electronic banking systems in developing nations through Analytic Hierarchy Process model: a case study; International Journal of Electronic Finance; Volume 3 Issue 4, October 2009, Pages 325-338 [39] M, Sathye, (1999), "Adoption of Internet banking by Australian consumers: an empirical investigation", International Journal of Bank Marketing, Vol. 17 No.7, pp.324-34. [40] C, Simeh, C (2012), “As Nigeria goes cashless” from the discourse at the 17th seminar organised for finance correspondents and business editors by the Central Bank of Nigeria (CBN) in Akure, Ondo state; from July 18-20, 2012 [41] S, Sumanjeet, (2008), “Factors Affecting the Online Shoppers’ Satisfaction: A Study of Indian Online Customers”, The South East Asian Journal of Management, Vol. 11, No. 1, pp 3-11. [42] S, Sumanjeet, (2009); emergence of payment systems in the age of electronic commerce: the state of art Global Journal of International Business Research Vol. 2. No. 2. 2009. [43] W, Taddesse, & Kidan T .G (2005), E-Payment: Challenges and Opportunities in Ethiopia United Nations Economic Commission For Africa, E-payment Study Report, October 2005 [44] C. C, Soludo . (2007): Macroeconomic, Monetary and Financial Sector Development in Nigeria (CBN website: www.cenbank.org). [45] Umeano, (2012); “As Nigeria goes cashless” from the discourse at the 17th seminar organised for finance correspondents and business editors by the Central Bank of Nigeria (CBN) in Akure, Ondo state; from July 18-20, 2012 [46] P, Weibing, (2011). Research on Money Laundering Crime under Electronic Payment Background , Journal of Computers, Vol.6, No.1, January, 2011. Pp 147 - 154 [47] S, Zokaee, S.B Ebrahimi, and M Ghazizadeh (2012), Electronic Payment Systems Evaluation: A Case Study in Iran; Information Management and Business Review Vol. 4, No. 3, pp. 120-127 AUTHOR Morufu Oladehinde Oladejo received the BSc, and MSc. degrees in Accounting and MBA from Olabisi Onabanjo University Ago Iwoye in 1995, 2000 and 2008 respectively. He received Ph.d in Financial Management from Ladoke Akintola University of Technology in 2014. He became Associate of both the Institute of Charttered Accountants of Nigeria (ICAN) and Chartered Institute of Taxation of Nigeria (CITN) in 2001 and 2005 respectively. He is also examiner and assessor to both Institutes. He is currently lecturing in the department of Management and Accounting, Faculty of Management Sciences Ladoke Akintola University of Technology, Ogbomoso Nigeria. His research area is in Accounting, Finance and Information CommunicationTechnology. Volume 5, Issue 3, March 2016 Page 138