Policies and Guidelines for Ministers’ Offices November 2008

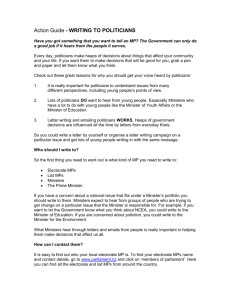

advertisement