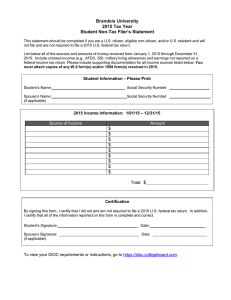

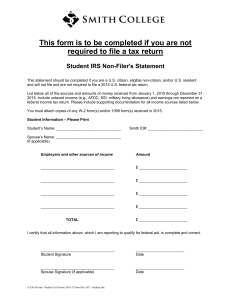

2014 Tax Year Student Non-Tax Filer’s Statement

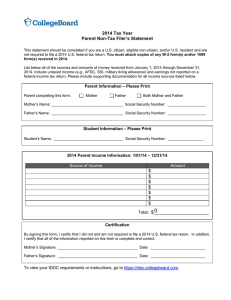

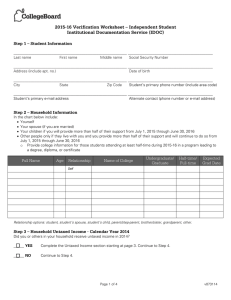

advertisement

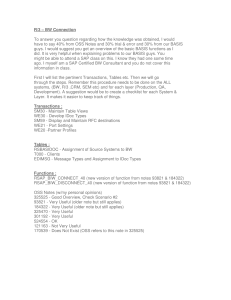

2014 Tax Year Student Non-Tax Filer’s Statement This statement should be completed if you are a U.S. citizen, eligible non-citizen, and/or U.S. resident and will not file and are not required to file a 2014 U.S. federal tax return. List below all of the sources and amounts of money received from January 1, 2014 through December 31, 2014. Include untaxed income (e.g., AFDC, SSI, military living allowance) and earnings not reported on a federal income tax return. Please include supporting documentation for all income sources listed below. You must attach copies of any W-2 form(s) and/or 1099 form(s) received in 2014. Student Information – Please Print Student’s Name: ___________________________________ Social Security Number: ___________________ Spouse’s Name: ___________________________________ Social Security Number: ___________________ (if applicable) 2014 Income Information: 1/01/14 – 12/31/14 Source of Income Amount $ $ $ $ $ $ $ $ $ 0 Total: $___________________________ Certification By signing this form, I certify that I did not and am not required to file a 2014 U.S. federal tax return. In addition, I certify that all of the information reported on this form is complete and correct. Student’s Signature: ______________________________________ Date: __________________________ Spouse’s Signature: ______________________________________ Date: __________________________ (if applicable) To view your IDOC requirements or instructions, go to https://idoc.collegeboard.com. V073114