This form is to be completed if you are not

This form is to be completed if you are not required to file a tax return

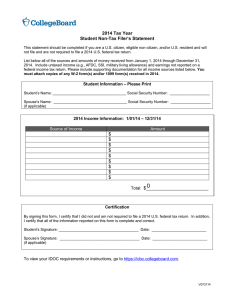

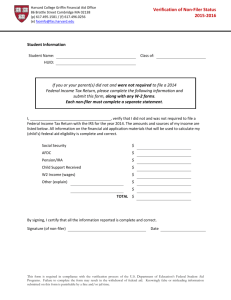

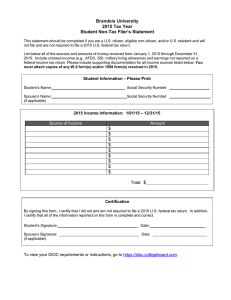

Student IRS Non-Filer's Statement

This statement should be completed if you are a U.S. citizen, eligible non-citizen, and/or U.S. resident and will not file and are not required to file a 2015 U.S. federal tax return.

List below all of the sources and amounts of money received from January 1, 2015 through December 31,

2015. Include untaxed income (e.g., AFDC, SSI, military living allowance) and earnings not reported on a federal income tax return. Please include supporting documentation for all income sources listed below.

You must attach copies of any W-2 form(s) and/or 1099 form(s) received in 2015.

Student Information – Please Print

Student’s Name: _______________________________ Smith ID#: __________________________

Spouse’s Name: _______________________________

(if applicable)

Employers and other sources of income Amount

___________________________________ $ _______________________

___________________________________ $ _______________________

TOTAL $ _______________________

I certify that all information above, which I am reporting to qualify for federal aid, is complete and correct.

___________________________________ _______________________

Student Signature Date

___________________________________ _______________________

Spouse Signature (if applicable) Date

S:\FAO\Forms -Student Use\Forms 2016-17\Non-filer 1617 -Student.doc