@ Research Smith 10

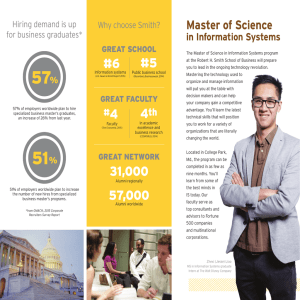

advertisement

Research@Smith MARCH 2009 • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • NO VOL 10 1 • • • • • • • • • • • • • • • • • • • • • • • • •••••••••••••••• •••••• • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • Corporate Governance 2 Encouraging good corporate behavior 4 Entrepreneurship Exploring the reasons for a new venture’s initial network position 6 Accounting The affect of earnings surprises on information asymmetry Research@Smith VOL NO 10 1 Research@Smith summarizes research conducted by the faculty of the Robert H. Smith School of Business at the University of Maryland. Research@Smith is published three times a year by the Robert H. Smith School of Business, University of Maryland; 3570 Van Munching Hall, College Park, MD 20742. www.rhsmith.umd.edu Dean G. Anandalingam Director of Research Michael Ball Editor Rebecca Winner Design Lori Newman Research@Smith is published three times a year by the Robert H. Smith School of Business, University of Maryland; 3570 Van Munching Hall, College Park, MD 20742. www.rhsmith.umd.edu We’d like to put Research@Smith directly into the hands of faculty and administrators who are interested in learning about the latest research conducted by Smith School faculty. To request a copy of this publication or make an address correction, contact Rebecca Winner via e-mail, editor@rhsmith.umd.edu, or phone, 301.405.9465. Visit the Smith Research Network: www.rhsmith.umd.edu/smithresearch/ Research@Smith MARCH 2009 Coming Forward VOL NO 10 1 page 2 Research by Ken G. Smith and Kathryn M. Bartol Industry norms are more effective than sanctions in encouraging good corporate behavior. Causes and Consequences of Initial Network Positions page 4 Research by Benjamin Hallen Who you know matters, but only within the first year of the new venture’s life. Earnings Surprises and Information Asymmetry page 6 Research by Stephen Brown New evidence shows how earnings surprises affect a stock’s investment visibility and trading activity. Doctoral Program page 8 Faculty Awards and Honors, Conferences, Wellman Teaching Award, CHIDS Research Briefing page 10 Featured Researchers page 11 Smith Faculty on the Finance Crisis page 12 Coming Industry norms are more effective than sanctions in encouraging good corporate behavior. forward C EOs are under immense pressure to deliver Bartol and Smith examined 919 firm restatement on earnings performance, a pressure which only announcements from 845 firms between 1994- intensifies in difficult economic times. So it is not 2001, taken from a report issued by the U.S. surprising that so many CEOs—up to 74 percent in General Accounting Office (GAO). The publicly- one study—believe it is acceptable to manipulate traded, relatively large firms were selected from the their earnings reports to achieve performance goals. Execucomp database, which includes more than Manipulation of corporate earnings through income 2,500 past and present members of the S&P 1,500. smoothing, earnings management, or explicitly Firms in the database restated their earnings due to fraudulent behavior is more common than many accounting irregularities that included aggressive would like to admit, but it is easy to understand. It is accounting practices, intentional misuse of facts, and hard to be honest when the alternative is to lay off fraud. One hundred seventy of these restatements workers or close the doors. were considered to be voluntary. Restatements due to innocent mistakes, human error or discontinued When discrepancies between report and reality operations were excluded from the sample. become apparent, some public firms restate their reported financial earnings voluntarily. Others are Firms were more likely to voluntarily restate earnings forced to restate by a law-enforcement body like the when their peers, industry leaders, and network Securities and Exchange Commission (SEC). Voluntary associates have also voluntarily come forward to disclosure of wrongdoing creates an initially negative restate earnings. Coming forward voluntarily can response from stakeholders, often reflected in a mitigate punishment and lessen the damage to a decline of the firm’s market value. It can generate civil firm’s reputation, a process that everyone in the lawsuits and result in the loss of income or position industry can observe. Seeing peers, industry leaders for corporate executives. What would motivate a and other members of their network weather the firm to voluntarily restate its earnings despite the initial negative impact and emerge stronger and negative impact? healthier for it encourages other firms to also brave the initial negative consequences that accompany a Recent research by Ken G. Smith, Dean’s Chaired voluntary disclosure of wrongdoing. Professor of Business Strategy, and Kay Bartol, Robert 2 H. Smith Professor of Management and Organization, Network connections also play an important role. indicates that social forces may be more effective than Indirect connections such as personnel exchange, regulation in compelling firms to do right. In other board interlocks, membership in trade associations, words, good behavior is catching. and shared auditors may communicate norms and march 2009 : VOLUME 10 : NUMBER 1 Research by Ken Smith and Kay Bartol values through a social context. When network Smith and Bartol found that formal regulatory members voluntarily restated earnings, it increased forces actually discourage voluntary the likelihood that a firm in the network would follow suit. restatements, a result the authors found surprising and counter-intuitive. Some argue for additional or more stringent “These companies—the Enrons of the world—may oversight, controlling firm behavior through stricter feel immune to the negative consequences of regulation and control. But Smith and Bartol found restatement because of their history of success and that formal regulatory forces actually discourage their status in the industry,” says Smith. So neither voluntary restatements, a result the authors found the fear of punishment nor the effect of peer pressure surprising and counter-intuitive. seems to influence the behavior of the biggest and most influential firms. “If you were speeding on the freeway and saw other cars being pulled over, you’d slow down,” “Our finding that network connections influence says Smith. But seeing other firms being prosecuted firm behavior suggests that it may be possible to for wrongdoing doesn’t seem to inspire firms to identify better connected firms in an industry and amend their behavior or come forward to restate elicit their aid in encouraging more positive corporate their earnings. It may be that CEOs believe that citizenship,” says Bartol. “Such a direction is enforcement agencies have the wherewithal to warranted because strong regulatory sanctions do not prosecute only a certain number of wrongdoers. seem to work and may even be counterproductive.” CEOs may be gambling on the chance that their firm will not be among the small number caught “Coming Forward: The effect of social and regulatory and prosecuted. forces on the voluntary restatement of earnings subsequent to wrongdoing” was published in The authors also found that the higher the status Organization Science. For more information about of a firm, the less it feels pressure to conform to this research, contact ksmith@rhsmith.umd.edu or industry norms or social regulatory forces. kbartol@rhsmith.umd.edu. RESEARCH@SMITH 3 Causes and consequences of initial network positions Who you know matters, but only within the first year of the new venture’s life. E ntrepreneurs begin their ventures lacking As you might expect, new ventures are more likely to a lot of things—employees, funding, customers, form a relationship with a potential partner if they are technology, among others. A large part of success is already connected through the founder’s network of the ability to get these things, and that depends in relationships. But Hallen found that the entrepreneurs large part on the entrepreneur’s ability to network only benefit from founder ties for a short period with people and organizations that can provide after founding. So who you know does matter, but them with everything from further connections to only within the first year of the new venture’s life. equipment to good advice. Network ties—alliances, Entrepreneurs need to leverage their founder ties soon board interlocks, equity investments between after they begin their venture, finds Hallen. organizations, and the like—can play an important role in the success of a new venture, influencing That leads to a tricky trade-off. Initial network the venture’s ability to acquire capital and industry position has a long-term effect on a venture’s ability information, share resources and capabilities, or to pursue other investors, because investors of similar benefit from their peers’ relationships with buyers status tend to invest in the same projects. A high- and suppliers. status investor—one who provides better benefits, introductions and advice—is unlikely to be attracted Benjamin Hallen, assistant professor of strategy, to a project that already has a circle of lower-status explored the mechanisms by which entrepreneurs investors. This places entrepreneurs, who are often create this crucial initial set of network ties in a desperate for an initial inflow of cash, in a difficult recent paper. Hallen examined 92 U.S. Internet position, because while lower status investors can security ventures from the VentureXpert database provide needed funding, they also limit the circles founded between 2000-02, and their investment from which future investors might come. ties with professional investors who provided capital and advice in exchange for equity in the new firm. “Some entrepreneurs actually end up bringing in Drawing data from new ventures in the same industry more money, but they may be endangering their allowed the authors to more accurately compare venture’s chances of getting a high status investor,” founder human capital and accomplishments in says Hallen. each firm. Hallen used each venture’s original Web pages to find background on founder’s educational Entrepreneurs should think carefully, then, about the background, previous accomplishments, previous ties they form. The strong consequences of initial ties work relationships, and skill sets. suggest that a venture’s initial round of investments is a unique opportunity. Even though low-status 4 march 2009 : VOLUME 10 : NUMBER 1 Research by Ben Hallen investors may be willing to invest at a higher rate, Entrepreneurs, who are often desperate for those relationships will make it more difficult to an initial inflow of cash, find themselves in a attract higher-status investors later on. Hallen also found that well-connected entrepreneurs difficult position—because while lower status investors can provide needed funding, they with high human capital—great resumes and skills— also limit the circles from which future investors will benefit from pursuing high status investors might come. immediately. But entrepreneurs without great connections and less human capital will be better That’s because pursuing investors outside of your served by waiting to pursue high-status investors until network may raise questions about why people in the they have some significant accomplishments under entrepreneur’s network aren’t funding the venture. their belts. At that point, they will become more “The implication is that if you can’t get funding from attractive to the high-status investors they seek, people you already know, your venture probably isn’t and can hope to jump into a higher status circle worth funding,” says Hallen. of investors. “The Causes and Consequences of Initial Network However, Hallen cautions, once an entrepreneur has Positions of New Organizations: From Whom Do gotten out a product and has some distinguished Entrepreneurs Receive Investments” is forthcoming accomplishments, he or she should be careful about from Administration Science Quarterly. For more the investors with whom they choose to work, information about this research, please contact because an entrepreneur’s current network has bhallen@rhsmith.umd.edu. significant influence over what future investors the entrepreneur can pursue. RESEARCH@SMITH 5 Earnings surprises and information New evidence shows how earnings surprises affect a stock’s investment visibility and trading activity. I asymmetry nformation asymmetry is one of the factors that information or who trade for liquidity reasons. This drives the spread between the buying and selling latter group includes both individual investors and price of a stock and pushes up the cost of capital certain professional investors such as index funds, that for firms, so there is real economic significance to maintain balanced portfolios. understanding what drives the activity of privately informed investors and uninformed investors. Meeting They found that information asymmetry decreased or beating analyst’s earnings forecasts has also in the quarter following a positive earnings surprise, become important, not just to firms but to investors when a firm beat earnings forecasts, and increased whose behavior is driven by them. But while it is clear during the quarter following a negative earnings that earnings benchmarks are important to investors, surprise, when firms failed to meet an earnings and that earnings surprises have a short-term effect forecast. on investor’s pricing associations and short-term trading reactions, little has been known about how Earnings surprises attract media attention, and that earnings surprises affected a stock’s investment extra attention raises awareness of the firms in the visibility and trading activity over the long term. minds of investors. When the surprise is positive, there is increased trading activity in the stock. Brown Stephen Brown, assistant professor of accounting expects this is because newly-aware investors believe and information assurance, examined the effect of that a firm that beat its earnings forecasts represent earnings surprises on information asymmetry between an attractive buying opportunity. informed and uninformed investors. With co-authors Stephen A. Hillegeist, INSEAD, and Kin Lo, University There are thousands of stocks for investors to of British Columbia, Brown conducted time-series choose from, so publicity and media attention tests of the association between earnings surprises brings a stock to the awareness and attention of and the change in information asymmetry before and uninformed investors. Good attention in the form of after the earnings announcement. beating earnings expectations result in a decrease in information asymmetry. Why? Brown and his co-authors considered the trading 6 activity level of informed investors, those with some “Beating expectations stop the private information kind of private knowledge that would influence events from occurring,” says Brown. “Firms that are their trading decisions, and uninformed investors, doing well are generally happy to share that good i.e. those who rely solely on publicly available news. You always hear about people getting engaged MARCH 2009 : VOLUME 10 : NUMBER 1 Research by Stephen Brown before they actually get married, but you rarely hear While it is commonly held belief that investors about people getting divorced until it has already place importance on earnings benchmarks, this happened. We humans are eager to share good news and reluctant to share bad news.” study is valuable because it provides evidence for what investors actually do, rather than what The increase in uninformed trading provides additional executives believe investors do. camouflage for informed trading, because it is harder A company that doesn’t meet its earnings forecasts for the market maker to tell that any particular trade is in a big way, particularly when that follows a string based on private information. After a positive surprise, of positive earnings surprises, is more likely to cause the level of informed trading appears to increase greater media attention, which will then cause commensurately with the level of uninformed trading greater asymmetry. on those days when informed traders have private information. However, there are fewer such days on These changes in information asymmetry persisted for which they have such information and so the overall at least a year following the initial earnings surprise, level of information asymmetry is reduced. whether it was positive or negative. Negative earnings surprises cause a reduction in the While it is commonly held belief that investors place level of trading by both uninformed and informed importance on earnings benchmarks, this study traders, despite the fact that the surprise may garner is valuable because it provides evidence for what just as much media attention. This may be because investors actually do, rather than what executives uninformed investors, particularly individual investors, believe investors do. aren’t in a position to sell the stock short. However, the reduction in trading by uninformed investors “The effect of earnings surprises on information is disproportionately greater than the reduction asymmetry,” is forthcoming from the Journal of in trading by the informed and the overall level of Accounting and Economics. For more information information asymmetry increases. about this research, contact sbrown@rhsmith.umd.edu. RESEARCH@SMITH 7 Preparing a new generation of scholars Last year, the Smith School committed $12 million Since writing is an important skill for scholars, the in additional resources to its PhD program. The school recently offered a writing workshop for program is also benefiting from new leadership: doctoral students led by Roland Rust, Distinguished Debra Shapiro, Clarice Smith Professor of University Professor and David Bruce Smith Chair in Management and Organization, became director of Marketing; Ken G. Smith, Dean’s Chaired Professor the Smith School’s PhD program July 1, 2008. of Business Strategy; Ritu Agarwal, Robert H. Smith Dean’s Chair of Information Systems; and Shapiro, all One of Shapiro’s key concerns is the quality of of whom are current or former editors or associate doctoral students’ job placement. Over the past five editors of top journals in their fields. More than a years, 99 percent of Smith’s PhD students have been third of all Smith’s PhD students attended, and the successfully placed immediately after they graduate— workshop was so well-received that Shapiro intends about 95 percent as tenure track assistant professors to provide a “Part 2.” This followup workshop will at an accredited university, and the rest as researchers provide students with specific feedback on papers in either private or government organizations. they bring to the workshop to improve their readiness for submission. Shapiro would like to see all doctoral students with at least one or two top-ranked academic journal Shapiro is also working to build an increasingly publications in order to distinguish themselves on the connected intellectual community that supports and job market, as a tangible demonstration of scholarly encourages cross-functional research. In the Smith expertise. “Top placements will give our students School’s informal environment, students spend a access to resources such as research assistants; lot of time working with faculty one-on-one, and funding to support research, including summer there is a significant amount of joint research going money and ample travel funds; computer resources on. But much of it is concentrated within academic like software, relatively low teaching loads, and disciplines. Shapiro recently began an intranet relatively high compensation. That in turn will allow community that she hopes will ease the ability of them to continue doing high quality scholarship as students and faculty to gather across as well as well as great teaching. In order to get such resource- within discipline-based areas around shared research rich jobs, students need to produce research output interests; indeed, Shapiro believes it may assist while they are here,” says Shapiro. students and faculty in discovering that they have research interests in common. To learn more about the Smith School’s doctoral program, visit http://www.rhsmith.umd.edu/doctoral/. 8 MARCH 2009 : VOLUME 10 : NUMBER 1 This year’s graduating doctoral Peggy Tseng’s dissertation Lori Kiyatkin’s dissertation students have research that spans a studies performance schedules explores health promotion and variety of academic areas. of a live performance event and health care cost management to their impacts on ticket sales. She demonstrate the significant positive Yun Liu’s dissertation consists decomposes the spatial effect into organizational performance of three essays that look at geographic effect and temporal implications of employee health the influence of networks and effect, examines heterogeneity and an organizational culture of connectedness on Chief Executive across markets, and investigates wellness, exploring the crucial Officer (CEO) labor market word of mouth effect. impact of employee health on outcomes, constructing measures organizations and the potential role that capture multiple aspects Yingjie Lan’s dissertation of organizations as agents of social of connectedness and then test examines how to make revenue health promotion. whether, how, and to what management decisions when direction they affect the hiring information about demand is Francine Espinoza’s dissertation of CEOs, CEO replacement, and limited. Lan has developed revenue investigates how consumers’ compensation paid to CEOs. management methods whose only goals and motivations influence requirement consists of upper and compliance with a product Chaodong Han’s dissertation lower limits on demand within recommendation or willingness to examines how globalization— various customer (price) classes. pay for a product, illuminating the particularly global sourcing, Read more about Lan’s research interplay of intrinsic and extrinsic exports, and operations in with Smith faculty Michael Ball and motivations that affect consumers foreign markets—may have Itir Karaesman at Research@Smith while bringing implications for affected inventory and financial Online. advertising and selling. performance, from both firm and industry perspectives, enhancing Andrew Hall’s dissertation applies the understanding of inventory Markov decision process and goal management in a global context programming to individual and and helps management with institutional decisions in military decision making on both inventory manpower planning; he also management and addresses gradient estimation in global strategy. stochastic simulation of a new class of exotic options. RESEARCH@SMITH 9 Faculty Awards and Honors Michel Wedel, Pepsico Professor of Conferences Consumer Science, received the Werner Doron Avramov, associate professor Pommerehne Prize for best paper in the The Center for Complexity in of finance, received a Q-group award for Journal of Cultural Economics, 2004-2005. Business (CCB) will hold its inaugural his paper, “Credit Ratings and the Cross conference on April 24, 2009. Speakers Russell Wermers, associate professor of include Josh Epstein, director of the Center finance, received the Banque Privee Espirito on Social and Economic Dynamics, The Hui Lao, associate professor of Santo and Swiss Finance Institute Award, Brookings Institute; Kathleen Eisenhardt, management and organization, received awarded at the Swiss Finance Institute Stanford University; Doyne Farmer, Santa the 2009 Distinguished Early Career annual meeting in Geneva. Fe Institute; Brian Uzzi, Northwestern Section of Stock Returns.” Contributions Award from the Society of University; Smith School faculty Bill Rand, Industrial and Organizational Psychology the center’s research director and assistant (SIOP) in recognition of her research. Editorial Appointments “The Transformation Age,” a book authored Chrysanthos Dellarocas, associate Distinguished University Professor, and by Henry Lucas, Smith Professor of professor of information systems, is senior executive director of the center. Information Systems, and turned into a editor of Information Systems Research. professor of marketing; and Roland Rust, David Bruce Smith Chair in Marketing, PBS documentary, received the Golden The CCB was launched in 2008 to focus Eagle Trophy from CINE recognizing Wolfgang Jank, associate professor of on the application of complex systems excellence in broadcasting. management science and statistics, joined research to business problems. The center’s the editorial boards of Management Science focus includes applications of complex Dilip Madan, professor of finance, gave and the Journal of the American Statistical systems methods, such as agent-based the keynote address at the Third Annual Association. He was elected program simulation, to analyze and solve problems Hedge Fund Conference at Imperial chair for the marketing section of the joint that arise when a large number of College in London. statistical meetings 2010. entities—consumers, employees, traders, A recent paper in the Journal of Finance Rachelle Sampson, assistant professor the limits of traditional management tools by Vojislav Maksimovic, Dean’s Chair of business, logistics and public policy, like game theory, operations research, Professor of Finance, and Gordon Phillips, was appointed to the editorial board of statistical analysis, controlled experiments, Bank of America Professor, “The Industry Organization Science. qualitative methods, and the like. The firms, etc.—interact in ways that stretch Life-Cycle, Acquisitions and Investment: center is interdisciplinary and draws on the Does Firm Organization Matter?” is a expertise of faculty from across the Smith finalist for the Brattle Best Paper prize. School and the University of Maryland, including decision, operations and Louiqa Raschid, professor of information information technologies; marketing; and systems, has been named a Distinguished computer science. Scientist by the ACM (the Association for Computing Machinery) in recognition The center’s leadership team includes of her individual contributions to both director Chrysanthos Dellarocas, the practical and theoretical aspects of associate professor of decision, operations computing and information technology. and information technologies; executive The new ACM Distinguished Members director Roland Rust, David Bruce include computer scientists and Smith Chair in Marketing, Distinguished engineers from some of the world’s University Professor, and executive director leading corporations, research labs, of the Center for Excellence in Service; and and universities. research director and assistant professor of marketing William Rand. For more information, contact ccb@rhsmith.umd.edu. 10 MARCH 2009 : VOLUME 10 : NUMBER 1 Before returning to the classroom in 2001, Stephen Brown, assistant professor of Wellman served as the assistant dean of accounting and information assurance, the MBA/MS programs at the Smith School received his PhD from Northwestern from 1990-2001. During his tenure, he was University. He is a Chartered Accountant part of an ambitious effort to enhance the and prior to entering academia, worked reputation of the MBA program. for Arthur Andersen in both the audit and tax divisions. His research focuses on $25 Billion Wasted By Poor Communication in Health Care System the causes and effects of disclosures by management on the capital market. Benjamin L. Hallen, assistant professor Inefficiences caused by poor of strategy, received his PhD from Stanford communication in the national health care University. His research focuses on how system wastes about $25 billion per year of entrepreneurs may form network ties caregiver time and resources, according to with potential resource providers and Smith Professor Named University’s a research briefing published by the Smith partners. He studies this question in the Outstanding Faculty Educator School’s Center for Health Information and context of entrepreneurs raising equity Decision Systems (CHIDS). The briefing is investments from venture capital and University of Maryland students and based on research by Ritu Agarwal, corporate investors, with a particular focus their parents selected Mark Wellman, Robert H. Smith Dean’s Chair of on identifying strategies that entrepreneurs Tyser Teaching Fellow, for the University Information Systems and director of may use when they are unknown within of Maryland’s 2008 Outstanding Faculty CHIDS; Daniel Z. Sands, senior medical an industry and lack prior network ties Educator Award. The award is presented infomatics director, Cisco Internet Business to investors. each year by the Maryland Parents Solutions Group and assistant clinical Association to honor a faculty member professor of medicine, Harvard Medical Ken G. Smith, Dean’s Chaired Professor who demonstrates a deep commitment School; and Jorge Diaz-Schneider. of Business Strategy, received his PhD from to providing an exemplary education University of Washington. His research experience for students. Wellman is a To read more about this research focuses on the areas of competition, faculty member in the Smith School’s or learn more about CHIDS, visit competitive advantage, and strategic department of management and www.rhsmith.umd.edu/chids. decision-making. He was editor of the organization and serves as director of Academy of Management Review from the Business, Society & Economy program for the university’s College Park 1996-99, elected a fellow of the Featured Researchers Scholars program. Academy of Management in 1998 and from 2006-07 served as President of the Kathryn M. Bartol, Robert H. Academy of Management. He co-authored Wellman teaches in the areas of global Smith Professor of Management and two books: The Dynamics of Competitive strategy and organizational change. He has Organization, received her PhD from Strategy (Sage Publishing, 1992); and received numerous awards for teaching, Michigan State University. She is the past Strategy as Action: Competitive Dynamics including the Allen J. Krowe Teaching dean of the fellows of the Academy of and Competitive Advantage (Oxford Excellence Award for his outstanding Management, as well as a past president Publishing, 2005) and co-edited the contribution to business education. His of the Academy of Management. Her International Handbook of Organizational approach includes innovative classroom research focuses on knowledge sharing; Teamwork and Cooperative Working activities, such as a mountain-climbing networks and influence; leadership and (Wiley & Sons, 2003), and Great Minds in simulation as a lesson in teamwork and empowerment; virtual teams and vital Management (Oxford Publishing, 2005). decision making. In his role within the work relationships; information technology College Park Scholars program, Wellman and organizations; and rewards, retention, has organized several co-curricular and creativity. activities, including a trip to Walt Disney World’s Disney Institute last May to learn about the Disney approach to business and management. RESEARCH@SMITH 11 Smith Faculty on the Smith School faculty have been Finance Crisis Here ’ s a sampl i ng of thei r opi n ions : actively involved in advising key players and proposing potential Alexander Triantis Albert “Pete” Kyle solutions to the finance crisis. Albert Professor and Department Chair Smith Chair Professor of Finance “Pete” Kyle, Smith Chair Professor of Finance of Finance, worked as an expert “The trend recently, before the for the SEC in conjunction with the “One of the questions that emerges last year or so, has been toward OIG report on the collapse of Bear from all this is what will happen to deregulation. What you’re going Stearns, briefing congressional staffers financial engineering? I’ve heard to see in the next two or three for Henry Waxman’s Committee on people say that the whole structured years is that the government will be Government Oversight. Kyle and mortgage market will be wiped out; extremely, heavily involved in the Haluk Unal, professor of finance, no one will do these packages of financial markets. Fannie Mae and held a briefing session for members securitized loans anymore. That would Freddie Mac will continue to be big of the Senate and House Committees be unfortunate. Financial engineering problems and government will have on Banking, reporters from in some cases is a way to get around stakes in banks it will need to decide BusinessWeek, Dow Jones and U.S. taxes and accounting, and that’s not what to do with. After two or three News & World Report, and Department helpful from a societal aspect. But years of active involvement, I can see of Justice officials, at the Smith financial engineering can create a the focus shifting toward how to get School’s downtown Washington, way for people to manage their risks government regulation into balance.” D.C., campus in the Reagan Building. and tailor their risk return, and I don’t Lemma Senbet, William E. Mayer want to get rid of that.“ Chair Professor of Finance, and N.R. N. R. Prabhala Prabhala, associate professor of Associate Professor of Finance finance, were invited by Maryland Lemma Senbet Congressman John Sarbanes to brief William E. Mayer Chair Professor “This crisis is not entirely about credit his chief of staff and the legislative of Finance or liquidity, but about consumer staff of the federal Oversight and confidence in the residential home Government Reform Committee on “We need to be sure compensation market. Some kind of direct relief to issues relating to the execution of the design is providing executives with homeowners, or to buyers of homes, Paulson economic rescue plan. They incentives to perform, as opposed to such as a tax break or perhaps direct and many other Smith finance faculty incentives to manipulate performance. subsidies of closing costs, might have provided expert commentary Research and development has a long- stimulate interest in buying homes. to numerous press outlets and news term influence on a company, but it Of course that assumes that home programs, including ABC, CNN, the does not have a short-term affect on prices are depressed below their Washington Post, Forbes magazine, profits, so there may be an incentive actual value.” Bloomberg, and NPR. to delay R&D in favor of short-term profit…that is why we need to look at how compensation is structured.” Read more about Smith School thought leadership at our Web site. 12 MARCH 2009 : VOLUME 10 : NUMBER 1 University of Maryland The University of Maryland, College Park, is one of the nation’s top 20 public research universities. In 2007, the University of Maryland received approximately $407 million in sponsored research and outreach activities. The university is located on a 1,250-acre suburban campus, eight miles outside Washington, D.C., and 35 miles from Baltimore. Robert H. Smith School of Business The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 13 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and part-time MBA, executive MBA, MS, PhD, and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations on three continents—North America, Europe and Asia. More information about the Robert H. Smith School of Business can be found at www.rhsmith.umd.edu. In this issue • Why some companies come forward • Networking advice for new ventures • Earnings surprises and information asymmetry • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • No Time to Read? Download this issue’s featured research articles in audio or video format directly to your iPod or other mobile device, and watch or listen to it at your convenience. These audio and video clips can also be accessed via the Web. To subscribe to Smith Podcasts or learn more visit www.rhsmith.umd.edu/podcast. A lso A va i lable i n Mandarin Chinese The featured research articles from this issue of Research@Smith are available in Mandarin Chinese. Go to: www.rhsmith-umd.cn/bi to learn more. 本期Research@Smith (史密斯调研)专题文章的中 文已经可以以播客或音频形式下载收听. 更多史密斯播客请访问 www.rhsmith-umd.cn/bi • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •••••••••••••••••••• • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • Nonprofit Org. U.S. Postage PAID Permit No. 1 Baltimore, MD 3570 Van Munching Hall University of Maryland College Park, MD 20742-1815 Address Service Requested