Accounting Transactions Exercise: Caren Smith, M.D.

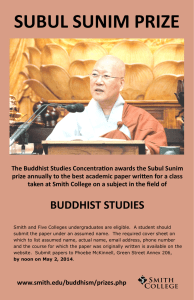

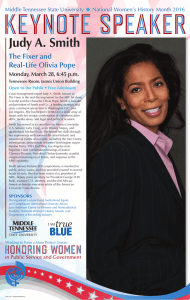

advertisement

Accounting and the Business Environment Chapter 1 Exercises Business Transactions In-Class Exercise (Form groups and work exercise): Exercise No. Page E1-29 45 Affect of Transactions on the Accounting Equation (Set up equation format, as reflected on the next chart, to complete the exercise) Business Transactions Exercise Page E1-29 45 Affect of Transactions on the Accounting Equation (Also prepare an Income Statement, Statement of Owner’s Equity, and Balance Sheet) Business Transactions Caren Smith opened a medical practice. During July, the first month of operation, the business, titled Caren Smith, M.D., experienced the following events: July 6. Smith contributed $55,000 in the business by opening a bank account in the name of C. Smith, M.D. The corporation issued common stock to Smith. 9. Paid $46,000 cash for land. 12. Purchased medical supplies for $1,800 on account. 15. Officially opened for business. 20. Paid cash expenses: employees salaries, $1,600; office rent, $900; utilities, $100. 31. Earned service revenue for the month, $8,000, receiving cash. 31 Paid $1,100 on account. Record transactions on the equation form. Business Transactions $61,100 $61,100 Business Transactions Income Statement Business Transactions $ 8,000 Business Transactions Statement of Retained Earnings Business Transactions Business Transactions Balance Sheet Business Transactions Business Transactions End of Exercise