College of Business Administration

advertisement

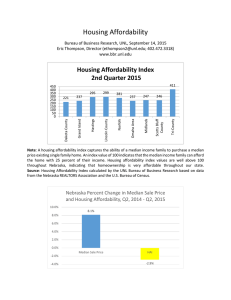

College of Business Administration Economic Conditions for Real Estate in Nebraska Nebraska REALTORS Association Fall Meetings September 8, 2014 Eric Thompson Director, Bureau of Business Research College of Business Administration University of Nebraska-Lincoln ethompson2@unl.edu www.bbr.unl.edu 1 College of Business Administration Summary Prevailing economic conditions suggest a favorable environment for the Nebraska housing market due to above-median and growing incomes low interest rates moderate home prices The housing market offers high affordability throughout Nebraska 2 College of Business Administration Outline The environment for interest rates Economic conditions in Nebraska and implications for jobs and income 6-month leading indicator longer-run economic outlook Housing market performance and affordability 3 College of Business Administration The Environment for Interest Rates Rates to Stay Low: Example of 10-Year Treasury Bond Interest Rate on 10-year Treasury Bonds 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 2014.2 2014.3 2014.4 2015.1 2015.2 2015.3 2015.4 2016.1 2016.2 4 College of Business Administration The Environment for Interest Rates “There has been a change in the natural balance of between savings and investment, leading to a decline in normal real rate of interest.” - Laurence Summers Reasons for this: 1) Reduction in demand for debt financed investment – large ventures (by market value) can be started at little cost 5 College of Business Administration The Environment for Interest Rates 2) Declining population growth – older population which borrows less 3) Rising income inequality- greater concentration of income for top earners raises the propensity to save 4) Decline in the relative price of capital goods – less borrowing 6 College of Business Administration The Environment for Interest Rates 5) Due to taxes, lower pre-tax interest rate in low inflation environment 6) Central banks building reserves, especially in safe dollars – willing to accept low interest rates. I’ll add 7) – higher share of income growth in “saving” nations (china, etc.) – also raises the propensity to save 7 College of Business Administration Economic Conditions in Nebraska Next 6 Months The Nebraska economy is expected to be strong during the 2nd half of 2014 The question is: will the Nebraska economy stay strong as 2015 begins? The Survey of Nebraska business says “yes” The Leading Economic Indictor – Nebraska says “maybe” 8 College of Business Administration Economic Conditions in Nebraska Survey of Nebraska Business from UNL Bureau of Business Research A survey of 500 businesses each month In most months, a 25% to 35% response rate A random selection of businesses 9 College of Business Administration Economic Conditions in Nebraska Survey of Nebraska Business Business Expectations Results from Last 6 Months 2.50% 1.25% 0.45% 0.41% 0.26% Mar 14 Apr 14 May 14 0.64% 0.34% 0.31% 0.00% -1.25% -2.50% Jun 14 Jul 14 Aug 14 10 College of Business Administration Economic Conditions in Nebraska Leading Economic Indicator – Nebraska from the UNL Bureau of Business Research Six components: Business expectation Value of U.S. dollar Single-family home building permits Airline passenger counts Initial claims for unemployment insurance Manufacturing hours 11 College of Business Administration Economic Conditions in Nebraska Leading Economic Indicator - Nebraska Figure 2: Change in LEI - N Last 6 Months 2.50% 2.15% 1.24% 0.95% 1.25% 0.11% 0.14% 0.00% -1.25% -0.75% -2.50% Feb 14 Mar 14 Apr 14 May 14 Jun 14 Jul 14 12 College of Business Administration Economic Conditions in Nebraska Leading Economic Indicator - Nebraska 6-Month Forecast of Nebraska Economcy 1.07% 1.25% 0.89% 110.00 109.50 0.51% 0.75% 109.00 0.37% 108.50 0.25% 108.00 107.50 -0.06% -0.25% -0.02% 107.00 106.50 -0.75% 106.00 105.50 -1.25% 105.00 Jul 14 Aug 14 Sep 14 Oct 14 Index Growth Nov 14 Dec 14 Jan 15 Index Value 13 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast Supportive local conditions for the real estate market: Solid or strong job growth outlook in key industries yields solid income and population growth in Nebraska Strong growth: construction and services Solid growth: retail, manufacturing, transportation 14 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Construction (2% - 2.5%) 55 45 40 35 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 30 2000 1000s of Jobs 50 15 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Services (1.5% - 1.8%) 420 400 360 340 320 300 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 280 2000 1000s of Jobs 380 16 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Retail Trade in 2014 (1%) 115 110 100 95 90 85 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 80 2000 1000s of Jobs 105 17 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Transportation (0.5% - 1.5%) 58 56 52 50 48 46 44 42 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 40 2000 1000s of Jobs 54 18 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Manufacturing (0.3% - 0.7%) 120 115 105 100 95 90 85 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 80 2000 1000s of Jobs 110 19 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for total non-farm jobs 2.0% 1.8% 1.5% 1.5% 1.4% 1.2% 1.0% 1.0% 1.0% 0.5% 0.0% 2014 2015 United States 2016 Nebraska 20 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for income and population Measure Rate of Growth 2014 2015 2016 Personal Income 3.9% 4.3% 4.4% Inflation 2.0% 2.4% 2.8% Population 0.7% 0.6% 0.6% 21 College of Business Administration Economic Conditions in Nebraska Longer-Run Forecast for Agriculture Nebraska agriculture should thrive and maintain most income and wealth gains There will grow international demand for imports from a growing global middle class Nebraska is a highly competitive agriculture region Production cluster yields a cost advantage Ogallala Aquifer yields reliable water supply Climate change may benefit state (relatively) 22 College of Business Administration Global Demand for Agricultural Imports Source: OECD and FAO Secretariats Annual Imports of Coarse Grains (kt) 4,000 3,900 3,800 3,700 3,600 3,500 3,400 3,300 3,200 3,100 3,000 2013 2014 2015 2016 OECD 2017 2018 2019 2020 2021 2022 Developing Countries 23 College of Business Administration Global Demand for Agricultural Imports Source: OECD and FAO Secretariats Annual Imports of Pigmeat (kt) 4,000 3,900 3,800 3,700 3,600 3,500 3,400 3,300 3,200 3,100 3,000 2013 2014 2015 2016 OECD 2017 2018 2019 2020 2021 2022 Developing Countries 24 College of Business Administration Economic Conditions in Nebraska Golden Triangle 25 College of Business Administration Economic Conditions in Nebraska Able to Adapt Well To Climate Change? 26 College of Business Administration Economic Conditions in Nebraska Nebraska Farm Income and Farmland Prices Year 2009 2010 2011 2012 2013 2014 2015 2016 Annual Farm Income $3.1 billion $3.8 billion $7.7 billion $5.8 billion $6.7 billion $5.8 billion $5.6 billion $5.5 billion Average Value of Farm Land Per Acre $1,340 $1,520 $1,940 $2,590 $3,050 Sources: USDA and UNL Department of Agricultural Economics 27 College of Business Administration Housing Market Performance and Affordability Homes sold in Nebraska Statewide trends Housing affordability index Definition Statewide trends Local trends 28 College of Business Administration Housing Market Performance and Affordability Trends in Homes Sold in Nebraska Homes Sold In Nebraska 25,000 20,000 15,000 10,000 5,000 0 2010 2011 2012 2013 Source: Nebraska Realtors Association 29 College of Business Administration Housing Market Performance and Affordability Housing Affordability Index A housing affordability index is one good way to capture conditions in housing market. A housing affordability index reflects: The median price of homes Prevailing interest rates Median income 30 College of Business Administration Housing Market Performance and Affordability Housing Affordability Index A housing affordability index takes a value of 100 when: a median income family can afford to make monthly mortgage payments for a median price home with 25% of their income, assuming a 20% down payment a 30-year fixed rate mortgage 31 College of Business Administration Housing Market Performance and Affordability Housing Affordability Index Nebraska housing is affordable since: 1) incomes are slightly above-median but 2) homes are relatively inexpensive Nebraska 2013 Median Family Income $64,550 U.S. $63,623 (Source: U.S. Census) 2013 Median Sale Price $135,000 $197,400 (Source: Nebraska Realtors Association, National Realtors Association) 32 College of Business Administration Housing Market Performance and Affordability Housing Affordability Index 2010-2013 300 250 200 150 100 50 0 2010 2011 Nebraska HAI 2012 2013 U.S. HAI 33 College of Business Administration Housing Market Performance and Affordability Housing Affordability Index Nebraska Localities June 2014 HAI June 2014 450 402 400 330 350 300 272 307 270 236 250 235 248 240 200 151 150 100 50 United States Tri-County Scotts Bluff County Lincoln/Midlands Omaha Area Norfolk Lincoln County Hastings Grand Island Dakota County 0 34 College of Business Administration Housing Market Performance and Affordability Summary Housing remains affordable due to low interest rates solid and growing family income moderate housing prices A relatively supportive environment for residential real estate in Nebraska in the coming years high housing affordability some population growth 35 College of Business Administration THANK YOU Any Questions? 36