a. THE Jayne Elizabeth Zanglein*

advertisement

FROM WALL STREET WALK TO WALL STREET TALK:

THE CHANGING FACE OF CORPORATE GOVERNANCE

Jayne Elizabeth Zanglein*

TABLE OF CONTENTS

I.

INTRODUCTION

II.

THE FIDUCIARY DUTY TO VOTE PRoXIES.•......................... .48

A.

Exclusive Benefit Rule

.49

a.

Prudence Rule

C.

Plan Documents Rule

1.

1.

D.

ill.

45

51

Analysis of Economic Impact

:

Investment Policy Statements and

Proxy Voting Guidelines

52

57

.59

Delegation ofDuty to Vote

63

1.

2.

3.

4.

63

64

65

68

Directed Trustees and Named Fiduciaries

Investment Managers

Disclaimers

Participant-Directed Voting

SHAREHOLDER ACTMSM

A.

Relational Investing, In General

B.

The 1998 Proxy Season

1.

The Leadership Role of Union and

Public Funds

2.

Binding Shareholder Proposals

:

3.

Focus Lists, Chronic Under-performers,

and Key Votes

4.

AFL-CIO Key Votes Project..

C.

AFL-CIO Model Guidelines for

Delegated Proxy Voting Responsibility

IV.

PROXY REGULATION REFORM BY THE SEC

A.

Proxy Rules, In General

B.

Cracker Barrel

C.

Discretionary Voting

*

Professor of Law, Texas Tech University School of Law.

43

HeinOnline -- 11 DePaul Bus. L.J. 43 1998-1999

68

68

73

73

79

80.

85

87

97

97

104

105

44

DEPAUL BUSINESS LAW JOURNAL

V.

CORPORATE GOVERNANCE STANDARDS

A.

B.

C.

D.

VI.

[Vol. 11:43

Council ofInstitutional Investors

CalPERS

Voting Proxies ofForeign Corporations

OECD and Other Groups

107

107

112

117

119

122

CONCLUSION

HeinOnline -- 11 DePaul Bus. L.J. 44 1998-1999

1998]

WALL STREET WALK

45

I. INTRODUCTION!

The choice of a common stock is a continuing process.

Certainly there is just as much reason to exercise care andjudgment

in being a shareholder as in becoming one. 2

Pursuing increased shareholder value is less a matter of

pulling out of a company aryl more an exercise in working within.

The Wall Street walk has given way to the Wall Street talk. The

bigger the investment fund, the bigger the incentive to continually

ensure that corporate governance standards enhance shareholder

investment. 3

Pension funds are financial giants whose slightest move can

shake the stock market. Pension funds cm:rently have assets of $5.7

trillion, nearly half of the $12 trillion held by all institutional

investors. 4 Pension funds internally manage 58.8% of their assets. s

Collectively, all institutional investors, including pension funds,

control about sixty percent of the stock of the one thousand largest

U.S. public corporations. 6 Pension funds alone, hold 25.8% oftotal

U.S. equity outstanding.? The twenty-five largest institutional

investors control nearly twenty percent of all outstanding stock! and

1. I have previously addressed these issues in Jayne Zanglein, High Perfornulnce

Investing: Harnessing the Power of Pension Funds to Promote Economic Growth and

Workplace Integrity, 11 LAB. LAW 9 (1995), Jayne Zanglein, Who's Minding Your

Business?, 10 HOFSTRA LAB. L. J. 23 (1992), Jayne Zanglein, Pensions, Proxies and

Power, 7 LAB. LAW 771 (1992); and JAYNE ZANGLEIN, SOLELY IN OURlNTEREST (1992).

2. B. GRAHAM AND D. DODD, SECURITY ANALYSIS 508 (1934).

3. CalPERS Press Release, Wall Street Walk Being Replaced with Wall Street

Talk (July 9, 1998), <http://www.caIpers.ca.gov/whatshap/news/releases

Irecentlpr19980709c.htm> .

4. U. S. Institutional Investors Sharply Step Up Asset Holdings, PR NEWSWIRE

(June 11, 1998).

5. Id.

6. Institutional Investors-Especially the Top 25-Are Gaining More Power and

Control Over the Largest U.S. Companies, PR NEWSWIRE (Aug. 20, 1998) [hereinafter

Institutional Investors-Especially the Top 25]. Forty percent of the top 1,000 companies

had institutional ownership in excess of seventy percent. Ten years ago, only eleven

percent of these companies were more than seventY percent controlled by institutions. Id.

(paraphrasing Carolyn Kay Brancato).

.

7. U.S. Institutional Investors Sharply Step Up Asset Holdings, supra note 4.

8. See generally Institutional Investors-Especially the Top 25, supra note 6.

HeinOnline -- 11 DePaul Bus. L.J. 45 1998-1999

DEPAUL BUSINESS LAW JOURNAL

46

[Vol. 11:43

more than seventy percent of the one thousand largest corporations. 9

For example, institutional owners own more than ninety-five

percent of Federated Department Stores,10 eighty percent of

Chiquita Brands, Storage Technology and Owens-Corning

Fiberglass, and more than seventy-five percent of Deere, Gannett,

Hercules, Whirlpool, Xerox, Armstrong World Industries, and

.

Pitney Bowes. ll

Wh~n institutional investors first approached underperforming corporations in the early 1990s, the basic corporate

attitude was, "Go away ... if you don't like the stock, sell it.."12

But large pension fund investors like the California Public

Employees Retirement System ("CalPERS") could not sell off the

stock ofunder-perfotming companies without lowering the stock's

market price. 13 Unable to do the "Wall Street Walk," large pension

funds opted for "Wall Street Talk. "

At first, the funds were unsuccessful. Richard Koppes,

formerly general counsel to CalPERS reminesces: "We couldn't get

anyone to pay attention to us. ,,14 Corporate officers were clearly

hostile to overtures made by pension fund executives. One CEO

replied to a letter from CalPERS: "What is truly alarming is the

substance and tone of your letter, which demonstrates a remarkable

lack of understanding of our industry, our company, our

performance, and our prospects. ,,15 The CEO refused to meet with

CalPERS, noting that the fund only held 0.5 percent of the

9.

10.

Id.

Share/wlder Resolutions Winning Majority Votes in 1998, XV IRRC CORP. Gov.

BULL. 6 (Apr.-June 1998).

11. The Top 100 U.S. Companies Ranked by Stock Market Value, Bus. WK., 1992

Special Bonus Issue, at 118.

12. Michael Yabara, Money Talks, 15 CAL. LAW. 50, 54 (Feb. 1995) (quoting Dale

Hanson, then CEO of CaiPERS).

13. Because of their size, many pension funds cannot sell corporate stock without

"disrupting trading and lowering share prices." Robert B. Reich, A Moral Workout for Big

Money, N.Y. TIMES, Sept. 11, 1994, at C9. See also Leslie Wayne, Seeking Investment

with Principle, N.Y. TIMES, Aug. 10, 1993, at Cl (quoting Assistant Secretary of Labor

Olena Berg as saying: "Given the size of funds, it doesn't make sense to try to beat the

market for a quarter ... when you are the market, as funds are, you can't beat it. The

goal should be an overall lifting of the economic boats by investing in ways that are

economically productive and create more and better jobs. "

14. Yabara, supra note 12, at 53.

15. Id. at 54.

HeinOnline -- 11 DePaul Bus. L.J. 46 1998-1999

1998]

WALL STREET WALK

47

company's stock. I6 .

Five years later, John M. Nash, CEO of the National

Association of Corporate Directors complimented CalPERS:.

"CalPERS has accomplished more in 5 years than we did in 17, by

virtue of $80 billion dollars. Money talks. ,,17 Now, "Wall Street

Talk" has become more effective than the "Wall Street Walk."

In order to prepare to talk with CEOs of under-performing

companies, pension fund executives need to closely monitor the

governance of the corporations whose stock they hold. In recent

years, at the urging of the Department of Labor, pension funds have

become more actively involved in monitoring corporate

performance and communicating with corporate officials, either

informally, or through the proxy process. The Department of Labor

has encouraged pension funds to exercise their shareholder rights.

In July 1994, the Department issued an interpretive bulletin on

voting proxies, monitoring corporate performance, and

communicating with management. 18

In its interpretive bulletin, the Department emphasized that

in voting proxies, a fiduciary should "consider those factors that

may affect the value of the plan's investment and not subordinate the

interests of the participants and beneficiaries in their retirement

income to unrelated objectives. ,,19 The fiduciary must also act

solely in the interest of the plan participants and beneficiaries and

its vote cannot be influenced by its relationship with the plan

sponsor. 20

The interpretive bulletin consolidates the Department's

position, as stated in previous advisory opinions,21 that plan

fiduciaries have a duty to vote proxies appurtenant to shares of stock

16. ld.

17. ld. at 55.

18. Interpretive Bulletins Relating to the ERISA of 1974, 59 Fed. Reg. 38,860,

38,863 (1994), (codified at 29 C.F.R. pt. 2509.94-2 (1994» [hereinafter Interpretive

Bulletins].

19. ld.

20. ld.

21. See Letter from Department to Helmulth Fandl, Chairman of the Retirement

Board of Avon Products (Feb. 23, 1988), reprinted in 15 Pens. & Ben. Rep. (BNA) 391

(F~b. 29, 1988) [hereinafter Avon Letter]; Letter from Department to Robert A.G. Monks

of Institutional Shareholder Services, Inc. (Jan. 23, 1990), reprinted in 17 Pens. & Ben.

Rep. (BNA) 244, 245 (Jan. 29, 1990) (Monks Letter).

HeinOnline -- 11 DePaul Bus. L.J. 47 1998-1999

48

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

held as plan assets. 22 The bulletin clarifies that a named fiduciary

who appoints an investment manager may require the investment

manager to vote proxies according to investment policy guidelines·

adopted by the named fiduciary. 23 The bulletin also encourages

active monitoring of corporate management by plan fiduciaries. 24

The first part of this article will focus on ERISA's fiduciary

rules as they relate to the voting of proxies held by pension plans

and the Department of Labor's position on proxy voting, as

enunciated in advisory opinions and Interpretive Bulletin 94-2. The

second section will describe recent trends in institutional proxy

voting as exhibited during the 1998 proxy season. The third section

will describe the Securities and Exchange Commission's recent

amendments to the Rules on Shareholder Proposals which became

effective in June 1998. The final section will discuss the

proliferation of national and international Corporate Governance

Standards by pension funds and other institutional investors.

II. THE FIDUCIARY DUTY TO VOTE PROXIES

The Department of Labor has ruled that the exercise of

voting rights which have an economic impact on the value of stock

held by a plan, is a fiduciary act governed by the Employee

Retirement Income Security Act ("ERISA").25 Proxy voting rights

are plan assets which must be voted in accordance with ERISA's

fiduciary duties. 26 According to the Department, "the fiduciary act

of managing plan assets which are shares of corporate stock . . .

include[s] the voting of proxies appurtenant to those shares of

stock. ,,27 Thus, when exercising voting rights, fiduciaries must

comply with ERISA Section 404(a)(1)(A), (B), and (D).28

22.

23.

24.

25.

26.

27.

28.

Interpretive Bulletins, supra note 18.

[d.

[d.

AvonLetter, supra note 21, at 391.

[d.

[d.

Interpretive Bulletins, supra note 18.

HeinOnline -- 11 DePaul Bus. L.J. 48 1998-1999

1998]

WALL STREET WALK

49

A. Exclusive Benefit Rule

ERISA Section 404(a)(l)(A) establishes the exclusive benefit

rule. This rule requires fiduciaries to act solely in the interest of

plan participants and beneficiaries and for the exclusive purpose of

providing plan benefits and defraying reasonable .expenses of plan

administration. 30 Fiduciaries must act "with an eye single to the

interests of the participants and beneficiaries ,,31 and may not place

themselves in a position where they are required to compromise

their duty of undivided loyalty to plan participants. 32

Although the Department of Labor has stated that the

exclusive benefit rule prohibits "a fiduciary from subordinating the

interests of participants and beneficiaries in their retirement income

to unrelated objectives, ,,33 the Department has never taken the

position that incidental benefits are prohibited under all

circumstances. 34 More than a decade ago, the Department indicated

that although Section 404(a) "does not exclude the provision of

incidental benefits to others, the protection of retirement income is,

and should continue to be, the overriding social objective governing

the investment of plan assets. ,,35 More recently, the Department

stated that "pension plan investments must be based upon what is in

the economic interest of the plan as a separate and distinct legal

29

29. ERISA §404(a)(I)(A); 29 U.S.C. §l104(a)(I)(A) (1998).

30. Id.

31. Donovan v. Bierwirth, 680 F.2d 263,271 (2d Cir. 1982).

32. Id.

33. AvonLetter, supra note 21, at 393 n. 4.

34. Address by Dennis Kass, Assistant Secretary of Labor, Pension and Welfare

Benefits Administration, U. S. Department of Labor, Current Developments at the

Department ofLabor, at the Annual Conference in Las Vegas, Nev., sponsored by the Int'l

Found. of Employee Benefit Plans (Nov. 1986), reprinted in INT'L FOUND. OF EMPLOYEE

BENEFIT PLANS, EMPLOYEE BENEFITS ANNUAL 235, 236 (1987). Dennis Kass, then

Assistant Secretary of Labor explained: "There is nothing in ERISA, however, requiring

that an investment decision be wholly uninfluenced by the desire to achieve social or

incidental objectives if the investment, when judged solely on the basis of its economic

value to the plan, is equal or superior to alternative investments otherwise available." Id.

35. Ian Lanoff, The Social Investment of Private Pension Plan Assets: May It Be

DoneLawfully Under ERISA?, 31 LAB. L.J. 387, 389 (1980). However, Lanoffcautioned

that "[t]o introduce other social objectives may be to dilute this primary objective." Id.

Later, Lanoff commented, "[I]t may not be consistent with ERISA standards to pursue .

. . [social goals], with plan assets, except as incidental to the fundamental ERISA purpose

of assuring retirement income." Id. at 391.

HeinOnline -- 11 DePaul Bus. L.J. 49 1998-1999

50

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

entity established for the purpose of providing retirement income,

[and] that other considerations can be considered provided that they

are incidental and do not compromise the required investment

decision. ,,36

In an advisory opinion issued in May 1998, the Department

of Labor stated that "the fiduciary standards . . . do not preclude

consideration of collateral benefits, such as those offered by a

'socially responsib~e' fund, in a fiduciary's evaluation of a particular

investment opportunity. ,>37 The Department continued: "However,

the existence of such collateral benefits may be decisive only if the

fiduciary determines that the investment offering the collateral

benefits is expected to provide an investment return commensurate

to alternative investments having similar risks. ,,38

This duty to act solely in the interest of plan participants and

beneficiaries applies to proxy voting. 39 Fiduciaries must cast their

votes so as to "maximize the economic value of plan holdings."4O

The duty to maximize does not mandate short-term maximization of

profits. The Department of Labor has said that "[p]lan fiduciaries

are not required to take the 'quick buck' if they believe, based on an

appropriate and objective analysis, the plan can achieve a higher

economic value by holding the shares.... ,,41

Various factors must be considered by plan fiduciaries who

are deciding whether to take the "quick buck" or wait for long":term

share appreciation. For example, in the context of tender offers, the

Department has observed that

36. Pension Investments: Hearing Before the New York State Pension Investment

Task Force, 190 - 91 (Mar. 3, 1989) (testimony of David Walker, Assistant Secretary for

Pension and Welfare Benefits, U.S. Department of Labor).

37. Letter from Department of Labor to William M. Tartikoff, Senior Vice President

and General Counsel, Calvert Group Limited (May 28, 1998), reprinted in 25 Pens. &

Ben. Rep. (BNA) 1328 (June 8, 1998) [hereinafter Calvert Letter].

38. Id.

39. Avon Letter, supra note 21, at 393.

40. Address by William Brock, Secretary of Labor, before the Ass'n of Private

Pension and Welfare Plans (Apr. 30, 1986), quoted in KRiKORIAN, FiDUCIARY STANDARDS

IN PENSION AND TRUST MANAGEMENT FuND 224 (1989).

41. Opening Statements by M. Peter McPherson, Deputy Secretary of the Treasury

and David Walker, Assistant Secretary, Pension and Welfare Benefits Administration,

Department of Labor, at the Pension Briefing on ERISA and Takeovers, at 2 (Jan. 30,

1989) (statement by David Walker) [hereinafter Opening Statements].

HeinOnline -- 11 DePaul Bus. L.J. 50 1998-1999

1998]

WALL STREET WALK

51

it would be appropriate to weigh a tender offer

against the underlying intrinsic value of the target

company, and the likelihood of that value being

realized by current management or by possible

subsequent tender offer. It would also be proper to

weigh the long-term value of the company against

the value presented by the tender offer and the ability

to "invest the proceeds elsewhere. In making these

determinations, the long-term business plan of the

target company's management would be relevant. 42

This balancing test is equally applicable to decisions regarding

proxy issues. Long-term growth can be favored over short-term

gains if the fiduciaries' decision is in the economic best interest of

plan participants. 43

B:

Prudence Rule

ERISA Section 404(a)(I)(B) requires fiduciaries to act with

"the care, skill, prudence, and diligence under the circumstances

then prevailing that a prudent man acting in a like capacity and

familiar with such matters would use in the conduct of an enterprise

of a like character and with like aims.,,44 Courts have interpreted

the prudence rule as imposing "an extremely high standard of

conduct, ,,45 "the highest mown to the law.,,46 Prudence is an

"objective standard which can be consistently applied ill. all cases. ,,47

Courts have defined prudence as a procedural test which requires

fiduciaries to conduct an "intensive and scrupulous" investigation. 48

42. Joint Department of LaborlDepartment of Treasury Statement of Pension

Investments (Jan. 31, 1989), reprinted in 16 Pens. & Ben. Rep. (BNA) 215 (Feb. 6, 1989)

[hereinafter Joint Statement).

43. Of course, the prudence rule of ERISA § 404(a)(1)(B) also must be satisfied.

44: ERISA § 404(a)(1)(B); 29 U.S.C. § t"104(a)(1)(B) (1998).

45. Marshall v. Mercer, 4 Employee Benefits Cas. (BNA) 1523, 1532 (N.D. Tex.

1983).

46. Donovan v. Bierwirth, 680 F.2d 263,272 n. 8 (2d Cir. 1982), cert. denied, 459

U.S. 1069 (1982).

47. Freund v. Marshall &. llsley Bank, 485 F. Supp. 629, 635 (W.D. Wis. 1979).

48. Donovan V. Bierwirth, 538 F. Supp. 463, 470 (B.D.N.Y. 1981), afj'd as

modified, 680 F.2d 263 (2d Cir.), and cert. denied, 459 U.S. 1069 (1982).

HeinOnline -- 11 DePaul Bus. L.J. 51 1998-1999

52

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

Courts will not focus on the success or failure of the investment to

determine if an investment is prudent. Instead, they will examine

the methodology employed by the fiduciaries. 49

The fiduciary also must apply procedural due diligence when

voting on a proxy issue. A fiduciary must carefully analyze the

issues involved. A fiduciary who "fails to vote, or casts a vote

without considering the impact of the question, or votes blindly with

management" will violate the prudence rule. 50

In other contexts, courts have held that a fiduciary who lacks

"the education, experience and skill required to make a decision

concerning the investment of a plan's assets, ... has an affirmative

duty to seek independent counsel in making the decision. ,,51 The

failure of an inexperienced fiduciary to seek expert advice is a

violation of the prudence rule. 52 It appears that if a fiduciary lacks

the expertise to analyze a proxy issue, the fiduciary must seek

professional guidance to satisfy the prudence rule.

1. Analysis of Economic Impact

In its interpretive bulletin, the Department also addressed

institutional shareholder activism. The Department noted that

"where proxy voting decisions may have an effect on the value of

a plan's underlying investment, plan fiduciaries should make proxy

voting decisions with a view to enhancing the value of the shares of

stock, taking into account the period over which the plan expects to

hold such shares. ,,53 The Department also endorsed the monitoring

or influencing of corporate management where the fiduciary expects

that the acts of monitoring or influencing corporate management

either alone, or in conjunction with other shareholders, are likely to

49. Donovan v. Walton, 609 F.Supp. 1221, 1222, 1228 (S.D. Fla. 1985), ajf'd,794

F.2d 586 (11th Cir. 1986).

50. Ball Signals Continued Commitment to Proxy Voting Issues at Department, 17

Pens. & Ben. Rep. (BNA) 207 (Jan. 29, 1980) (statement of David George Ball, then

Assistant Secretary of Labor for Pension and Welfare Benefits Administration).

51. Katsaros v. Cody, 568 F.Supp. 360, 367 (B.D.N.Y. 1983), a!f'd in pertinent

part, 744 F.2d 270 (2d Cir. 1984), cert. denied sub nom. Cody v. Donovan, 469 U.S.

1072 (1984). See also Letter from U.S. DepaJ,tment of Labor to Charles R. Smith (Nov.

23, 1984), reprinted in 12 Pens. & Ben. Rep. 52 (BNA) (Jan. 7, 1985).

52. Katsaros, 568 F. Supp. at 367.

53. Interpretive Bulletins, supra note 18.

HeinOnline -- 11 DePaul Bus. L.J. 52 1998-1999

1998]

WALL STREET WALK

53

enhance the value of plan-held stock.54 The Department suggested

that shareholder activism is appropriate where a stock portfolio such

as an index fund is being held on a long term basis or where the

. plan cannot easily dispose of the stock without affecting the stock's

value. 55 The Department further suggested that shareholder

communication might be proper on issues such as board

Independence, candidates' qualifications, executive compensation,

board policies on mergers and acquisitions, the company's longterm business plans, the extent of debt financing, the company's

investment in work force training and other workplace practices,

and fInancial and non-financial measures of corporate

performance. 56

Monitoring and communication can· be

accomplished through correspondence, meetings with management,

and exercising legal shareholder rights. 57

These duties apply only to voting rights which, when

exercised, will have an economic impact on the value of stock held

by the plan. 58 The Department of Labor has identifIed several

shareholder proposals which are likely to have an economic effect

on shares held by the plan. One such issue is a proposed change in

the company's state of incorporation. 59 Because a change in the

state of incorporation may affect the rights of shareholders to

participate in the corporate decision-making process, the proposal

may have an impact on the value of plan-owned stock. 60

The Department of Labor also has stated that poison pills

have an economic impact on the value of shares held by a plan. 61

The Department's conclusion is supported by a 1986 study, in

which the SEC's Office of Chief Economist balanced management's

enhanced negotiating power which results from the adoption of a

54.

55.

56.

57.

58.

59.

60.

Id.

Id.

Id.

Interpretive Bulletins, supra note 18.

Avon Letter, supra note 21, at 393.

Id.

Id.

61. Id. A poison pill is a "strategic move by a takeover-target company to make its

stock less attractive to an acquirer." DOWNES & GOODMAN, BARRON'S FINANCE AND

INvESTMENT HANDBOOK 393 (1987) [hereinafter DOWNES & GOODMAN]. The strategy

usually has such a severe economic impact that it is as if the acquirer swallowed a "poison

pill." Id.

HeinOnline -- 11 DePaul Bus. L.J. 53 1998-1999

54

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

poison pill against possible costs where entrenched management

uses a poison pill to prevent a lucrative buyout. 62 The SEC Chief

Economist found that on average, when a company adopts a "poison

pill [plan] in the midst of takeover speculation" the company's stock

declines 2.4 percent net of market. 63 The Chief Economist

concluded "that the market considers the typical poison pill to be

significantly harmful to shareholder welfare when takeover

speculation is present.,,64 Therefore, a shareholder proposal to

redeem a poison pill plan may increase shareholder value because

it will make takeover attempts easier and will prevent management

entrenchment. 65

Although the Department of Labor has not formally

addressed greenmail or shark repellents, such issues affect the value

of shares held by pension plans, and therefore, fiduciaries must vote

on such issues. The SEC Chief Economist has analyzed the impact

of greenmail on stock prices. 66 In a 1984 report, the Chief

Economist concluded that "non-participating shareholders suffer

substantial and statistically significant share price declines upon the

announcement of [greenmail]. ,,67 The average decline in stock price

was 5.2 percent. 68 The Chief Economist said that the "evidence

does not support the general view that the [troublemaking minority

shareholders] are destructive corporate raiders, or that the

repurchases are valuable investments because the target's stock is

undervalued. ,,69 The Chief Economist concluded that generally,

62. OFFICE OF THE CHIEF EcONOMIST, SECURmES AND EXCHANGE COMMISSION,

THE EFFECTS OF POISON PILLS ON THE WEALTH OF TARGET SHAREHOLDERS 2 (Oct. 23,

1986), reprinted in Corporate Takeovers(Part 2): Hearings Before the House Subcomm.

on Telecommunications, Consumer Protection and Finance ofthe Comm. on Energy and

Commerce, 99th Cong., 1st Sess. 690, 697-703 (1985) [hereinafter Corporate Takeovers

(Part 2)].

63. [d. at 2, 13.

64. [d. at 13.

65. See Avon Letter, supra note 21, at 393 (stating that a proposal to rescind a poison

pill involves a fiduciary act of plan management).

66. OFFICE OF THE CHIEF EcONOMIST, SECURmES AND EXCHANGE COMMISSION,

THE IMPACT OF TARGETED SHARE REpURCHASES (GREENMAIL) ON STOCK PRICES (1984),

reprinted in Corporate Takeovers (Part 2), supra note 62, at 581 [hereinafter Greenmai[J.

Greenmail is the payment to a raider by a target company to buy back shares at a premium

in return for the raider's agreement not to further pursue the target. [d.

67. Greenmail, supra note 66, at 2.

68. [d. at 13.

69. [d. at 14.

HeinOnline -- 11 DePaul Bus. L.J. 54 1998-1999

1998]

WALL STREET WALK

55

greenmail is not in the best interest of shareholders. 7o

In a 1985 study, the SEC Chief Economist analyzed the

effects of antitakeover amendments ("shark repellents") on stock

prices.71 The Chief Economist found an average net-of-market stock

return of negative 1.31 percent for all types of antitakeover

amendments. 72 When the statistics are broken down by category,

the effect of certain shark repellents on stock prices becomes

apparent.

The average stock decline after adoption of a

supermajority provision73 was 1.25 percent, while enactment of a

supermajority provision with a board override caused a decline of

4.86 percent. 74 Classified board amendments75 resulted in a net-ofmarket return of negative 2.42 and the authorization of blank-check

preferred stock resulted in a negative 2.84 return. 76

One study concluded that "on average, a firm taken at

random from the market has approximately a 4.9 percent chance of

becorirlng a takeover target in a given year and that, if such a bid

should occur, the expected premium is approximately 45 percent

greater than previous market values. ,m

The adoption of

70. Id. at 15.

71. OFFICE OF THE CHIEF EcONOMIST, SECURITIES AND EXCHANGE COMMISSION,

SHARK REPELLENTS AND STOCK PRICES: THE EFFECTS OF ANmAKEOVER AMENDMENTS

- SINCE 1980 (1985), reprinted in Corporate Takeovers (Part 2), supra note 62, at 604

[hereinafter SHARK REPELLENTS AND STOCK PRICES].

72. Corporate Takeovers (Part 2), supra note 62, at 604, Table 4.

73. Supermajority provisions require "a substantial majority (usually 67% to 90%)

of stockholders [to] approve important transactions, such as mergers." DOWNES &"

GOODMAN, supra note 61, at 485.

74. Corporate Takeovers (Part 2), supra note 62, at 604, Table 4.

75. Classified board provisions "classify (or stagger) the board into (usually three)

groups so that only a fraction of all directors are elected each year. Classification makes

it more difficult to change the composition of the incumbent board, therefore making it

more difficult for any insurgent shareholder or group to gain control of the firm." SHARK

REPELLENTS AND STOCK PRICES, supra note 71, at 10.

76. Id. at 32. The SEC notes that:

[A]uthorization to issue blankcheck preferred stock allows the board

of directors to establish voting, dividend, conversion and other rights

for preferred stock that the company may issue...• [T]his device also

allows the board to discourage hostile bidders by issuing to friendly

parties preferred stock with special voting rights and/or by creating a

"poison pill" security.

Id. at 11.

77. Pound, The Effects ofAntitakeover Amendments on Takeover Activity: Some

HeinOnline -- 11 DePaul Bus. L.J. 55 1998-1999

56

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

antitakeover amendments creates a loss of approximately five to

seven percent of annual expected returns. 78 The study found that

supermajority and classified board amendments, "increase the

bargaining power of management in the event of a control bid, to

the detriment of shareholder wealth. These amendments appear to

reduce the frequency of takeover bids significantly while not

improving the expected value of shareholder gains in those takeover

contests that do occur. ,,79

However, it appears that the

implementation of a fair price provision80 does not adversely affect

stock prices. 81

The Department of Labor has not announced specifically

whether voting on dual stock recapitalization plans and golden

parachutes proposals are acts of fiduciary duties. However, these

proposals have an effect on the value of plan-owned shares and

would involve fiduciary decisions. In a 1987 report, the SEC Chief

Economist found "significant and negative abnormal stock returns

at the announcement of the dual class recapitalization.,,82 The

adoption of lucrative golden parachutes also may affect share

values.

The Department has noted however, that ministerial or

routine issues such as the uncontested appointment of accountants

do not involve acts of fiduciary duty. 83 For example, absent

, extraordinary circumstances, fiduciaries are not required to vote on

uncontested appointments of accountants. 84

Direct Evidence, 30 J.LAW & EcON. 353, 361 (1987) (footnotes omitted) [hereinafter

Effects ofAntitakeover Amendments]. See also Pound, Shareholder Activism and Share

Values: The Causes and Consequences of Countersolicitations Against Management

Antitakeover Proposals, 32 J. LAW & EcON. 357, 366 (1989).

78. Pound, Effects ofAntitakeover Amendments, supra note 77, at 362.

79. [d. at 367.

80. Fair price provisions usually provide that a supermajority amendment will be

waived if an equal price is paid for all shares of a target's stock in a merger.

81. [d. at 367. The SEC Office of the Chief Economist also has concluded that the

adoption of fair price provisions has a statistically insignificant impact on the value of

shares. See also SHARK REPELLENTS AND STOCK PRICES, supra note 71, at 30.

82. OFFICE OF THE CHIEF EcONOMIST, SECURmES AND EXCHANGE COMMISSION,

UPDATE - THE EFFECfS OF DUAL-CLASS RECAPITALIZATIONS ON SHAREHOLDER WEALTH:

INCLUDING EVIDENCE FROM 1986 AND 1987 8 (July 16, 1987).

83. Klevan, Fiduciary Duty and Proxy Voting, 7 ANN. REv. BANKING L. 229, 232

(1988).

84. [d.

HeinOnline -- 11 DePaul Bus. L.J. 56 1998-1999

1998]

WALL STREET WALK

57

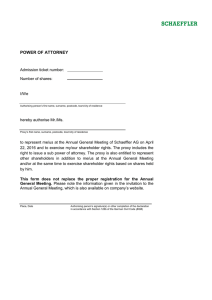

Summary of Research on Proxy Issues Which Have an

Economic Impact on Plan-Held Assets8S

6:.

,. ProxyAssne'il" '

••• : ' 0

,Economic, b.npaet~¥; .lif

"

Change in Company's

State of Incorporation

Implementation of Poison

Pill

Redemption of Poison Pill

'~

".

-.

SourceH':'

~'!;!;~

"!"

~,.. i'r~_.

CF

Avon Letter (198&)

-2.4%

SEC Office of Chief

Economist (986)

SEC Office of Chief

Economist (1986)

SEC Office of Chief

Economist (1984)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1985)

SEC Office of Chief

Economist (1987)

-5.2%

Anti-takeover amendments

On average, -1.31 %

Supermajority Provisions

-1.25%

Supermajority Provision

with a board override

Classified Board

Amendments

Authorization of Blankcheck Preferred Stock

Fair Price Provision

-4.86%

Dual Class

Recapitalization

.., .$,- 4.

Some

Positive

Greenmail

:"

. ~~'-~~':~~_~~":.

,

-2.42%

-2.84%

No impact

Negative

L

c. Plan Documents Rule

ERISA section 404(a)(1)(D) requires fiduciaries to act "in

accordance with the documents and instruments governing the plan

insofar as such documents are consistent with [ERISA]. ,,86 Under

this rule, plan fiduciaries must vote in accordance with any voting

policies adopted by the board of trustees or named fiduciary. frJ The

85. But see Bernard S. Black, Does Shareholder Activism Improve Company

Performance?, 19 CORP. BD. 1 (Mar. 13, 1998); Paul G. Barr, Study: Activism Has No

Impact, PENS. & INV. (Sept. 30, 1996) <http://www.pioniine.comlhtml/news/piI996

/960930-61-Q1.html. >.

86. 29 U.S.C. §1104(a)(I)(D) (1998).

87. But see Central Trust Co. v. American Avents Corp., 11 Employee Benefits Cas.

(BNA) 1850 (S.D. Ohio, 1989) (the court held that an ESOP trustee did not violate its

fiduciary duty when it ignored a plan provision that required the plan's participants to vote

on tender offers. The court found that the trustee's decision to accept the tender offer was

HeinOnline -- 11 DePaul Bus. L.J. 57 1998-1999

58

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

Department has interpreted section 404(a)(1)(D) to require records

to be maintained with respect to the voting of proxies, the voting

procedure followed by the investment manager, and individual

votes. 88 Proxies received by the investment manager must be

matched with the plan's holdings on the record dates and voted in

accordance with the plan's voting procedure. 89

In an advisory letter to Avon Products, Inc., the Department

of Labor stated that the prudence rule requires fiduciaries to develop

proxy voting guidelines and to record voting decisions. 90 The

Department said that "with respect to proxy voting, . . . an

investment manager or other responsible fiduciary [must] keep

accurate records as to the voting of proxies. ,,91 This is especially

important since the plan document rule requires fiduciaries to act

"in accordance with the documents and instruments governing the

plan insofar as such documents and instruments are consistent with

[ERISA]."92 This rule requires investment managers to vote in

accordance with voting policies adopted by the fiduciaries or board

of trustees unless such policies are contrary to ERISA.

In the Monks Letter, the Department also described the

information that a plan fiduciary must review. in carrying out its

responsibility to monitor the activities of the investment manager

relating to proxy voting. Records must be kept on the voting of

proxies, the voting procedure pursuant to which the investment

manager votes the proxies, and individual votes. This information

is necessary for the fiduciaries to monitor the investment manager

to ensure that he is "fulfilling his fiduciary obligations in a manner

which justified the continuation of the management appointment. ,,93

based on its conclusion that accepting the offer would be in the economic interest of the

plan participants).

88. Monks Letter, supra note 21, at 244-46.

89. Id. at 245.

90. Avon Letter, supra note 21, at 395.

91. Id.

92. ERISA §404(a)(l)(D), 29 U.S.C. §1104(a)(I)(D) (1998).

93. Monks Letter, supra note 21, at 246. A 1989 survey by the Department found

that almost 40% of investment managers surveyed did not keep proxy voting records. Joel

Chernoff, Washington Working to Change System, PENS. & INV. AGE, Apr. 16, 1990, at

19.

HeinOnline -- 11 DePaul Bus. L.J. 58 1998-1999

1998]

WALL STREET WALK

59

1. Investment Policy Statements and Proxy Voting Guidelines

Interpretive Bulletin 94-2 also addr~ssed the role of

investment policy statements in governing the conduct of investment

managers.94 The Department stated that a named fiduciary has

authority under ERISA section 402(c)(3)95 to appoint an investment

manager. Inherent in this authority is the fiduciary's power to issue

investment policy statements which will govern the conduct of

investment managers. 96 Investment policy statements are plan

documents97 and investment managers are required to follow a

policy statement to the extent the document i~ consistent with

ERISA.98

The Department took care to distinguish investment policy

statements from directions given by a named fiduciary to a trustee

under ERISA section 403(a)(1).99 The Department considers an

investment policy statement to be general guidelines. Examples

include the

identification of acceptable classes or types of

investments, limitations on investment categories as

a percentage of the plan's portfolio, or generally

applicable guidelines regarding voting positions in

proxy contests (for example, criteria regarding the

support of or opposition to recurring issues, such as

94. For a description of investment policy statements and sample guidelines see

supra note 1, at ch. 15, and app. C. The Department

defines an investment policy statement as a "written statement that provides the fiduciaries

who are responsible for plan investments with guidelines or general instructions concerning

various types of categories of investment management decisions, which may include proxy

voting decisions." Interpretive Bulletins, supra note 18. The term does not include

specific directions given to an investment manager with respect to the purchase or sale of

a specific security at a designated time or the voting of a particular proxy. Id.

95. 29 U.S.C. § l102(c)(3) (1998).

96. Interpretive Bulletins, supra note 18.

97. Id.

98. Id. The Department states that "a trustee to whom a statement of investment

policy applies would be required to comply with such policy unless, for example, it would

be imprudent to do so in a given instance." Id.

99. ERISA § 403(a)(I) (1998). Section 403(a)(I) provides that if a plan expressly

provides that the trustee is subject to the direction of a named fiduciary who is not a

trustee, the trustee shall be subject to proper directions which are made in accordance with

the terms of the plan which are not contrary to ERISA. Id.

ZANGLEIN, SOLELY IN OURlNTERESI',

HeinOnline -- 11 DePaul Bus. L.J. 59 1998-1999

60

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

proposals to create classified boards of directors or

to provide for cumulative voting for board

members). 100

The Department does not consider specific instructions as to the

purchase or sale of a specific security at a designated time or

instructions to vote certain proxies in a specific manner to be

investment policy statements. 10l

Although ERISA does not require investment policy

statements to be adopted by fiduciaries, the Department "believes

that such statements serve a legitimate purpose in many plans by

helping to assure that investments are made in a rational manner and

are designed to further the purposes of the plan." 102 The

Department has noted that proxy voting guidelines may be

particularly helpful where a fund employs numerous investment

managers because the guidelines might prevent investment managers

from taking conflicting positions on the same proxy issue. 103 This

occurs quite frequently. Last year, the AFL-CIO conducted a

survey that found that investment managers often vote contrary to

the trustees' proxy voting guidelines, but also take conflicting

positions on the same proxy issues. 104

The Department has observed that managers of pooled

accounts who are governed by multiple proxy voting guidelines

must, to the extent possible, comply with each policy. 105 Where the

policies conflict, the investment manager should vote the proxies "to

reflect each policy in proportion to the respective plan's interest in

the pooled account." 106 If an investment manager cannot feasibly

100. Interpretive Bulletins, supra note 18.

lO1.Id.

102.Id.

103.Id.

104. Interpretive Bulletins, supra note 18. See discussion of the AFL-CIO survey on

10 key votes, infra note 250 and accompanying text.

105. Interpretive Bulletins, supra note 18.

106. Id. A 1992 survey found that 88% of investment managers surveyed have

sufficient staff and resources to vote proxies according to proxy voting guidelines of

individual pension fund clients. Who's Minding Your Business?, supra note I, at 96-97.

Six percent of investment managers do not have sufficient resources to provide

individualized proxy voting, and 6% said they would do it only under certain circumstances

and for certain types of fund. Id.

HeinOnline -- 11 DePaul Bus. L.J. 60 1998-1999

1998]

WALL STREET WALK

61

vote proxies according to each individual proxy voting guideline,

then the manager may require all clients to agree to the manager's

master proxy voting guidelines. 107

In 1989, the Department of Labor conducted a proxy

survey.l08 The Department found that seven percent ofpension fund

investment managers had no written proxy guidelines and almost

twelve percent maintained a policy of voting with management. 109

Only eighty-three percent of the managers who had written proxy

guidelines actually followed those guidelines. 110 In a report on its

findings, the Department warned investment managers to maintain

proxy voting procedures and "adequate record keeping to document

the proxy voting process. ,,111 The Department cautioned investment

managers against voting only on non-controversial issues. 112 In a

1991 investigation of bank trust departments, the Department found

"pockets of non-compliance." 113 Some banks did not maintain

permanent proxy voting records or did not vote on de minimis

amounts of stock, and some abstained on social responsibility issues

and poison pills. 114

In public speeches after the Avon Letter was issued, David

Walker, then Assistant Secretary of Labor, urged investment

managers and other fiduciaries who vote proxies to establish a

general policy on recurrent voting issues. lIS Large pension funds

107. Interpretive Bulletins, supra note 18. The master policy then would become the

plan document and the manager would be required to follow the document.

108. U.S. DEP'TOFLABOR, PROXY PROJEcr REpORT (1989).

109.Id. at 6.

110.Id.

l11.Id. at 9.

112. U.S. DEP'TOFLABOR, PROn:PROJEcrREpORT, supra note 108, at 8.

113. Corporate Governance: DOL Announces Preliminary Results of Bank Trust

Department Investigation, 18 Pens. & Ben. Rep. (BNA) 323 (Feb. 25, 1991).

114.Id.

115. Pension Investments: Public Hearing Before the New York State Pension

Investment Task Force 202 (1989) (testimony of David Walker, Assistant Secretary of

Labor for Pension and Welfare Benefits, U.S. Department of Labor). Walker further

advised trustees to consider the following factors when voting on proxies:

Number one, the nature of the issue and whether or not the issue itself

is likely to have an effect on the underlying value of the stock;

Secondly, what your investment philosophy and strategy is, how long

do you plan to hold this investment and how does that play into the .

issue;

HeinOnline -- 11 DePaul Bus. L.J. 61 1998-1999

62

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

heeded this message. A 1992 survey of large pension funds found

that eighty-nine percent of public funds had proxy voting guidelines

and seventy-seven percent of union funds had adopted voting

guidelines. 116 Ninety-seven percent of investment managers

reported that they had adopted guidelines. ll7 It is doubtful that these

statistics are applicable for smaller funds.

The Department's study of proxy voting policies was

updated in 1996. 118 The updated survey found that one-hundred

percent of the plans surveyed "had clearly delegated authority to

investment managers to vote proxies or had clearly designated

another plan fiduciary to vote proxies. ,,119 One-hundred percent of

the investment managers surveyed had written proxy voting

policies. 120 The depth of the policies varied, ranging from an overly

broad command to vote "in the best interests of the client,"121 to

detailed instructions on how to vote on executive compensation and

poison pills.122 Likewise, all of the investment managers maintained

voting records, but about sixteen percent did not report their voting

decisions to clients and twenty-five percent only reported on proxy

voting on a quarterly or annual basis. 123

The 1996 report discovered some problem areas. Many of

the plans surveyed did not provide their investment managers with

proxy voting guidelines and many did not review their guidelines

with a potential manager during the hiring process. 124 A

"significant number of plans do not routinely monitor investment

And, thirdly, quite candidly, your confidence in management.

Id. at 203.

116. Who's Minding Your Business?, supra note I, at 76.

117.Id.

118. Proxies: PWBA Study of Voting Policies Reveals Progress, Room for

Improvement, 23 Pens. & Ben. Rep. (BNA) 549 (Feb. 26, 1996) (quoting Olena Berg,

assistant Secretary of Labor for the Pension and Welfare Benefits Administration)

[hereinafter Proxies].

119. Id.(quoting OIena Berg, Assistant Secretary of Labor for the Pension and Welfare

Benefits Administration).

120.Id.

121. Proxies, supra note 118, at 549 (quoting Olena Berg, Assistant Secretary of

Labor for the Pension and Welfare Benefits Administration).

122. Proxies, supra note 118, at 549.

123.Id.

124.Id.

HeinOnline -- 11 DePaul Bus. L.J. 62 1998-1999

1998]

WALL STREET WALK

63

managers' voting to insure that proxies are voted in accordance with

the plans' or managers' stated policies. ,,125

D. Delegation ofDuty to Vote

The duty to vote proxies may be imposed on one of four

groups: named fiduciaries, trustees, investment managers, or

participants. ERISA Section 403(a) requires plan assets to be held

in trust by one or more trustees. 126 Trustees have the exclusive

authority and discretion to manage plan assets unless such authority

is delegated to an investment manager, 127 or unless the plan provides

that the trustees are subject to proper direction by a named

fiduciary .128 In Interpretive Bulletin 94-2, the Department reaffirmed

its view that the plan trustee has the exclusive right to vote proxies

unless the trustee is subject to the directions of a named trustee or

the power to manage plan assets has' been delegated to investment

managers. 129

1. Directed Trustees and Named Fiduciaries

ERISA Section 403(a) requires trustees to follow the

directions of the named fiduciary so long as the directions are

properly made in accordance with the terms of the plan and are not

contrary to ERISA. 130 The Department of Labor has stated that "[i]f

the plan expressly reserves to the named fiduciary the authority to

direct the trustee with respect to proxy voting, the trustee must

follow such directions so long as the directions are proper, in

accordance with the terms of the plan, and not contrary to the

125.Id. (quoting Olena Berg, Assistant Secretary of Labor for the Pension and

Welfare Benefits Administration).

126. ERISA § 403(a), 29 U.S.C. §1l03(a) (1998).

127. ERISA § 403(a)(2), 29 U.S.C. § 1l03(a)(2) (1998).

128. ERISA § 403(a)(I), 29 U.S.C. § 1l03(a)(I) (1998). A named fiduciary is a

person designated as a fiduciary in accordance with plan procedures. ERISA § 402(a)(2),

29 U.S.C. § 1l02(a)(2) (1998). Named fiduciaries may be named in plan documents or

may be chosen by the plan sponsor through a procedure which is specified in the plan. Id.;

Avon Letter, supra note 21, at 392.

129. Interpretive Bulletins, supra note 18.

130. ERISA § 403(a)(I), 29 U.S.C. § 1103(a)(I) (1998).

HeinOnline -- 11 DePaul Bus. L.J. 63 1998-1999

64

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

provisions of ERISA. ,,131 A trustee is absolved from liability for

following the proper directions of a named fiduciary. 132 In the

context of participant-directed accounts, a trustee is protected in

following directions of participants if the participants were not

subjected to undue pressure from the employer to vote their shares

in a particular manner. 133 Trustees must analyze the directions

given by the named fiduciary to determine whether the directions

comport with the plan and ERISA. 134 If the trustees blindly follow

improper directions given by the named fiduciary, the trustees may

be held liable for breach of fiduciary duty under ERISA.

2. Investment Managers

A named fiduciary may delegate authority to an investment

manager 135 to manage and control plan assets. 136 In an advisory

letter to Avon Products, Inc., the Department of Labor stated that

if proxy voting authority has been delegated to the investment

manager, then only the investment manager can vote the proxies

unless the named fiduciary has reserved the right to direct the

trustee with respect to proxy voting. 137 A violation will occur if any

person other than the investment manager (or a person under the

supervision of the investment manager) votes the proxies. Once the

named fiduciary delegates its investment authority to the investment

131. Monks Letter, supra note 88, at 244 n.3.

132. ERISA § 405(b)(3)(B), 29 U.S.C. § 1l05(b)(3)(B) (1998).

133. See Letter from U.S. Department of Labor to John Welch (Apr. 30, 1984),

reprinted in 11 Pens. & Ben. Rep. (BNA) 633 (May 7, 1984) [hereinafter Carter Hawley

Hale Letter].

.

134.Id.

135. An investment manager is defined as a fiduciary (other than a trustee or named

fiduciary) who:

(i)

has the power to manage, acquire, or dispose of any asset of a plan;

is registered as an investment adviser under the Investment Advisers

Act of 1940; is a bank, as defined in that Act; or is a qualified insurance

company; and

(iii)

has acknowledged in writing its fiduciary status with respect to the

plan.

(ii)

ERISA § 3(38), 29 U.S.C. § 1002(38) (1998).

136. ERISA § 402(c)(3), 29 U.S.C. § 1l02(c)(3) (1998).

137. Avon Letter, supra note 21, at 3-4; Monks Letter, supra note 88, at 245.

HeinOnline -- 11 DePaul Bus. L.J. 64 1998-1999

1998]

WALL STREET WALK

65

manager, it "no longer has the authority to decide how the

investment manager votes proxies and would be engaging in a

section 404(a)(1)(D) violation in doing so unless, in delegating such

management responsibility to the investment Iilanager, it reserves to

itself the right to vote proxies. ,,138

3. Disclaimers

One year after the Department of Labor issued the Avon

Letter, the Department further delineated its position on proxy

voting in the Monks Letter. In announcing the letter to Robert A.G.

Monks, then president of Institutional Shareholder Services, Inc.,

David George Ball, the head of the Pension and Welfare Benefits

Administration stated, "Privilege bears responsibility." 139 [W]hen

institutional investors don't vote, or vote without paying close

attention to the implications of their vote for the ultimate value of

their holdings, they are hurting not only themselves but also the

beneficiaries of the funds they hol~ in trust. ,,140

. The Department responded to several questions raised by

Monks. The first question was whether an investment manager can

effectively avoid responsibility for voting proxies by including a

disclaimer in the investment management contract. The Department

clarified that "[i]f the plan expressly reserves to the named fiduciary

the authority to direct the trustee with respect to proxy voting, the

trustee must follow such directions so long as the directions are

proper, in accordance with the terms of the plan and not contrary to

the provisions of ERISA. ,,141 The Department noted that "[a]n

ERISA violation will occur if the investment manager is explicitly

or implicitly assigned the authority to vote proxies . . . and the

named fiduciary, trustee, or any person other than the investment

138. Avon Letter, supra note 21, at 4. In the Monks letter, the Department noted that

"[a]n ERISA violation will occur if the investment manager is explicitly or implicitly

assigned the auiliority to vote proxies ... and ilie named.fiduciary, trustee, or any person

oilier ilian ilie investment manager makes the decision how to vote iliose same proxies."

Monks Letter, supra note 88, at 245.

139. Ball Signals Continued Commitment to Proxy Voting Issues at Department, 17

Pens. & Ben. Rep. (BNA) 207 (Jan. 29, 1990).

140.Id.

141. Monks Letter, supra note 88, at 245.

HeinOnline -- 11 DePaul Bus. L.J. 65 1998-1999

66

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

manager makes the decision how to vote those same proxies. ,,142

Even if the investment management agreement provides that the

manager is not required to vote proxies, "a delegation of authority

to the investment manager to vote such proxies will ha~e occurred

and the investment manager must vote the proxies. ,,143 However,

if the trust agreement does not grant the trustees the authority to

delegate the voting of proxies, or if the trust agreement requires any

investment manager who is appointed to assume the duty to vote

proxies, any investment management agreement which provides to

the contrary would be void to the extent inconsistent with plan

documents. l44 If the plan documents prohibit the investment

manager from voting proxies, the trustees have the exclusive

responsibility to vote the proxies. Where the plan requires the

trustees to act subject to the direction of a named fiduciary, then the

trustees must vote the proxies at the direction of the named

fiduciary. 145

Morton Klevan, an official of the Department of Labor

provides the following example of the complexity of proxy

delegation rules:

Assume that there is a chief financial officer,

"CFO," of Company A. She directs Bank X, the

trustee of A's pension plan, to vote in favor of

Company A's proposals, which include super

majority voting provisions and the creation of a new

class of stock for the management group which

carries ten times the votes of regular shares of stock.

Under ERISA, the first question to ask is whether

the plan expressly provides for directed trustees.

The trustees have the exclusive authority to manage

and dispose of plan assets unless the plan provides

for directions by a named fiduciary and they get

142.Id.

143.Id.

144. The Department noted that "[t]he interpretation of any particular plan provision

or investment management contract is, however, inherently factual in nature." Id.

145. K1evan, Fiduciary Duty and Proxy Voting, 7 ANN. REv. BANKING L. 229, 233-34

(1988), reprinted in KRIKORIAN, FIDUCIARY STANDARDS IN PENSION "AND TRUST

MANAGEMENT 230 (1989).

HeinOnline -- 11 DePaul Bus. L.J. 66 1998-1999

1998]

WALL STREET WALl{

67

proper directions from the named fiduciary. It is

then necessary to consider whether the plan

contemplates directions to be given as to these sorts

of issues, and if so, whether the CFO is the person

described in the plan as the one to give the

directions. If not, the directions should be ignored

by the trustee because the plan has not properly

provided direction for the trustees. If the plan

specifies that the trustees should be subject to the

CFO's directions with respect to the voting of

proxies on all issues except routine matters, the

trustees are still not insulated. They must decide

whether these directions . . . may violate Title I of

ERISA, particularly the solely in the interest

provision of section 404(a), the 'exclusive purpose'

provisions of sections 404(a), and the prohibited

transaction provisions of section 406. If the

directions contravene these provisions, the trustees

would be duty bound to ignore them. 146

In his letter to the Department of Labor, Monks also inquired

whether an investment manager has a fiduciary obligation to

reconcile proxies with holdings on a record date. The Department

responded that "the fiduciary who has the authority to vote proxies

has an obligation under ERISA to take reasonable steps under the

particular circumstances to ensure that the proxies for which it is

responsible are received." 147 Reasonableness is determined on the

basis of relevant facts and circumstances. The Department warned

that an investment manager who has made no effort to reconcile

proxies would be acting in violation of ERISA. 148

146.Id.

147. Monks Letter, supra note 88, at 245.

148. A 1992 survey found that 70% of investment managers reconcile proxies, 8%

cannot reconcile, and 22% do not attempt to reconcile. Who's Minding Your Business?,

supra note 1, at 94-95.

HeinOnline -- 11 DePaul Bus. L.J. 67 1998-1999

68

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

4. Participant-Directed Voting

ERISA section 404(c) permits an individual account plan to

allow participants to control the investments in their respective

accounts by passing through to the participants the right to vote on

proxies or respond to tender offers. 149 If the participants exercise

their pass-through voting rights, the named fiduciary may be

relieved of any liability that results from the exercise of control by

the participants. 150 The Department of Labor has issued several

advisory opinion letters concerning pass-through voting

procedures,151 but a detailed discussion of such voting procedures is

beyond the scope of thi~ article. 152

III. SHAREHOLDER ACTIVISM

A. Relational Investing, In General

Interpretive Bulletin 94-2 signals the Department's

encouragement of "relationship investing. ,,153 John Wilcox,

managing director of Georgeson & Company, a proxy solicitation

firm, says: "This adds a regulatory seal of approval to what had

been a maverick activity. . .. [p]ension plans have profoundly

changed Corporate America and this is another part of that

change. ,,154 Olena Berg, former assistant Secretary of Labor,

endorsed this concept, defining "relationship investing" as a longterm approach in which pension fund investors "own larger stakes

in fewer companies, giving them more leverage [to negotiate issues

of concern] with corporate management and the board of

149. See 29 U.S.C. § 1l04(c) (1998).

150. ERISA § 404(c)(2), 29 U.S.C. §1l04(c)(2) (1998).

151. Carter HawLey HaLe Letter, supra note 134, at 633; Labor Department Opinion

Letter on Tender Offers, dated Feb. 23, 1989, 16 Pens. & Ben. Rep. (BNA) 390 (Mar. 6,

1989) [hereinafter Polaroid Letter].

152. For an in-depth analysis of pass-through voting arrangements, see Donald J.

Myers & Michael B. Richman, Pass-Through of Proxy and Tender Decisions C New

Guidance From the NationsBank Case, 25 Pens. & Ben. Rep. (BNA) 775 (Mar. 3D, 1998).

153. Ken Silverstein, Clinton Administration OfficiaL Advocates Relationship Investing;

Pension Funds, PENSION WORLD, July 1994, at 6 [hereinafter Clinton Administration].

154. Leslie Wayne, U.S. Prodding Companies to Activism on Portfolios, N.Y TIMES,

July 29, 1994, at Dl.

HeinOnline -- 11 DePaul Bus. L.J. 68 1998-1999

1998]

WALL STREET WALl(

69

directors. ,,155

Studies have shown that relationship investing works. A

study by Wilshire Associates tracked forty-two companies during

five years that the CalPERS was actively involved in corporate

governance. According to the study, these forty-two companies

"beat the S. & P. 500 by 41 percent - while in the prior five years

the same companies underperformed the S. & P. 500 by 66

percent. ,,156 As Samuel Johnson said, "Depend upon it, sir, when

a man knows he is about to be hanged in a fortnight, it concentrates

his mind wonderfully." The 1990's spin on this phrase was coined

by former Secretary of Labor Robert Reich: "Nothing concentrates

the mind of a corporate executive quite so sharply as a pointed

inquiry from a large investor or outside director. ,,151

A more recent study by Tim Opler and Jonathan Sokobin158

concluded that companies on the Council of Institutional Investors'

focus list of poor performing companies, "experienced

improvements in operating profitability and share returns" in the

post-listing period. 159 The study found that the "focus list firms

under performed the S & P 500 by 72.9% in 48 months before

listing and by 22.4% in the 12 months before the listing." 160 In the

12 months after the listing, "the mean return of the portfolio of

focus list firms" exceeded the S & P by 5.9%, a statistically

significant difference. In the 24 months after the listing, the

portfolio return exceeded the S & P by 9.2%. However, this

difference is not statistically significant. 161 Additionally, the focus

list firms experienced substantial improvements in profitability in

the 24 months after the listing. 162 Some of these returns may be

155. Clinton Administration, supra note 153, at 6.

156.Id. But see Robert C. Pozen, Institutional Investors: The Reluctant Activists,

HARV. Bus. REv., Jan.-Feb. 1994, at 140; Ken Silverstein, Pension Funds Increase

Presence in Corporate Boardrooms, PENSION WORLD, May 1994, at 4.

157. Patrick S. McGurn, DOL Issues New Guidelines on Proxy Voting, Active

Investing, IRRC CORP. Gov. BULL., July-Aug. 1994, at 1,4.

158. Tim C. Opler & Jonathan Sokobin, Does Coordinated Institutional

Sharehalder Activism Work? (May 1998) <http://www.cob.ohiostate.edurfinlfaculty

lopler/ciiweb/textof.htm> .

159.Id.

160.Id.

161.Id.

162. Opler & Sokobin, supra note 158.

HeinOnline -- 11 DePaul Bus. L.J. 69 1998-1999

70

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

attributable to a 12.7% increase in divestitures, and a higher-thanaverage CEO turnover rate. 163

A third study by Diane Del Guercioico and Jennifer

Hawkins found that targets of shareholder proposals by the "largest

and most active funds" such as CalPERS, the New York City funds

and the State of Wisconsin Investment Board ("SWIB") from 1987

through 1993, "experienced 'higher senior management turnover,'

more 'governance events,' such as shareholder lawsuits, and

'responsive corporate policies, such as asset sales, restructurings

and layoffs. ,,,164 The authors concluded that shareholder resolutions

"are a low cost mechanism that can be fruitfully used to further a

number of goals, such as putting pressure on management, signaling

to the market the views of the fund regarding target company

management and building shareholder support for more costly

governance activities such as takeovers. ,,165

Corporations and analysts recognize that pension funds

represent a threat to the autocratic control exercised by most

corporate boards:

"Relational investing" is emerging as a new

"buzzword" for this era of rejuvenated investor

activity. In its mildest form, it incorporates little

more than improved communications between

management and shareholders. At its extreme,

relational investing anticipates that "institutions will

acquire large ownership positions, voluntarily

commit to hold stock for the long term, occupy seats

on boards of directors, participate in corporate

decision making, and act like 'owners' rather than

.

investors. ,,166

163.Id.

164. Diane Del Guercioico & Jennifer Hawkins, The Motivation and Impact of

Pension Fund Activism, J. FIN. EcON.,(forthcoming), quoted in JAMES E. Heard & Patrick

S. McGurn, Corporate Governance Auditfor 1998, INSIGHTS, Dec. 1997, at 3.

165.Id.

166. Karl A. Groskaufmanis, Proxy Reform and the Brave New World of Investor

Relations: Ten Rules of Thumb for the 1990s, INSIGHTS, Dec. 1993, at 18 (quoting John G.

Wilcox, Relational Investing: Can It Really Work?, N.Y.L.J., May 6, 1993, at 5). See

also Richard Koppes & Maureen L. Reilly, An Ounce ofPrevention: Meeting the Fiduciary

Duty to Monitor an Index Fund Through Relationship Investing, 20 J. CORP. L. 413 (1995);

HeinOnline -- 11 DePaul Bus. L.J. 70 1998-1999

1998]

WALL STREET WALK

71

Advocates of relationship investing point to its benefits:

First, it helps solve a problem executives have

complained of for years: short-term investing. By

creating a class of enlightened investors who give

companies patient capital, relationship investing

should free management to focus on the long term.

Over time, that should lift profits, productivity, and

prospects.

And that would boost U.S.

competitiveness.

Second, the very existence of a new breed of active

capitalists fixes another failing of U.S. corporations:

"the imperial CEO, unchecked by a pliant board of

directors.... Investors who actively monitor their

holdings would introduce a badly needed measure of

management accountability. 167

The tactics used by institutional investors are working. 168 In 1993,

John c. Wilcox, Managing the Proxy Process, INSIGHTS, Dec. 1993, at 3; Robert C.

Pozen, supra note 156, at 140; Norma M. Sharara and Anne E. Hoke-Witherspoon, The

Evolution of the 1992 Shareholder Communication Proxy Rules and Their Impact on

Corporate Govemaru:e, 49 Bus. LAW. 327 (1993); Dennis J. Block and Jonathan M. Hoff,

Corporate Governance Reform and Directors' Duty of Care, N.Y.L.J., May 20, 1993, at

5; John Wilcox and Richard Wines, Investor Targeting: A Quantitative Approach to

Reaching Institutions, INSIGHTS, May, 1993, at 14; Judith H. Dobrzynski, Relationship

Investing, Bus. WK., Mar. 15, 1993, at 68; The New Governance Paradigm; CE

Roundtable, CHIEF ExECUTIVE, Apr. 1994, at 40; Mary McCue, Matching Perceptions to

Reality: Communicating Effectively with Shareholders, INSIGHTS, Dec. 1994, at 22; Ethan

Stone, Must We Teach Abstinence? Pensions' Relationship Investments and the Lessons of

Fiduciary Duty, 94 COL. L. REv. 2222 (1994); Robert Kleiman, Kevin Nathan, and Joel

Shulman, Are There Payoffs for "Patient" Corporate Investors?, MERGERS &

ACQUlsmONS, Mar.-Apr. 1994, at 34; Mark J. Roe, The Modem Corporation and Private

Pensions, 41 UCLAL. REv. 75 (1993); JohnH. Matheson and Brent A. Olson, Corporate

Cooperation, Relationship Management, and the TriakJgical Imperative for Corporate Law,

78 MINN. L. REv. 1443 (1994); Bernard S. Black and John C. Coffee, Hail Britannica?:

Institutional Investor Behavior Under Limited Regulation, 92 MICH. L. REv. 1997 (1994);

Edward B. Rock, Controlling the Dark Side ofRelational Investing, 15 CARDOZO L. REv.

987 (1994); Ian Ayres and Peter Cramton, Relational Investing and Agency Theory, 15

CARDOZO L. REv. 1033 (1994); Jill E. Fisch, Relationship Investing: Will it Happen? Will

it Work?, 55 OHIO ST. L.J. 1009 (1994).

167. Dobrzynski, supra note 166, at 68.

168. For a more detailed description of the history of shareholder activism, see

HeinOnline -- 11 DePaul Bus. L.J. 71 1998-1999

72

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

pension fund investors complained to management when James

Robinson III announced his intention to resign as CEO but remain

as chairman of th~ board of American Express. 169 The funds wanted

Robinson to resign from both positions. Less than a week after the

funds complained, Robinson announced his intention to resign from

both positions. 170 Pension funds were also the impetus behind the

firing or resignation of other corporate chieftains including John F.

Akers of International Business Machines, Paul Lego of

Westinghouse Electric Corporation, Kay B. Whitmore of Eastman

Kodak Company, Anthony D'Amato of Borden, Inc., 171 and Robert

Stempl of General Motors Corporation. 172 Nell Minow, co-founder

of LENS, Inc., has dubbed this phenomenon the "Queen of Hearts

theory of activism: 'Off with their heads! ,,,173

This demand for corporate accountability has CEOs

listening. James E. Preston, chairman and CEO of Avon Products,

recalls:

Five years ago when I became chairman and CEO of

Avon Products, I learned an important lesson about

communication. The company had been under

intense scrutiny by a number of shareholder activist

groups because of dismal performance for about a

decade. During my first year, I discovered that open

communication with your larger shareholders and

shareholder rights groups can go a long way toward

weathering the storm. Through the years, we've

built on that lesson. We recently invited between 70

and 80 institutional investors to two meetings, one in

Pensions, Proxies, and Power, supra note 1. See also Gerald F. Davis and Tracy A.

Thompson, A Social Movement Perspective on Corporate Control, 39 ADM. SCIENCE Q.,

Mar. 1994, at 141; Thomas A. Stewart, The King is Dead, FORTUNE, Jan. 11, 1993, at 34.

169. See generally Vidya N. Root, Marking a 'Sea Change' in Corporate Life, the

Boards Bite Back, THE BUFFALO NEWS, Jan. 23, 1994.

170.Id.

171.Id.

172. Nell Minow, Turning Back the Queen ofHearts, THE REcORDER, Mar. 30, 1994,

at 7.

173. Id. Minow notes that studies have shown that stock prices increase significantly

when the CEO is fired. However, she believes that firing the CEO is not always the best

response. [d.

HeinOnline -- 11 DePaul Bus. L.J. 72 1998-1999

1998]

73

WALL STREET WALK

New York and the other in California.

feedback from those meetings was terrific.174

The

B. The 1998 Proxy Season

1. The Leadership Role of Union and Public Funds

[For the first time this year, U.S. shareholder groups got

more than 50% ofthe vote in a majority ofshareholder resolutions.]

That is a major first . .. and companies pay attention . . . they

measure power. Sara Teslik, Executive Director, Council of

Institutional Investors. 175

Union plans and staff retirement funds are becoming a

powerful force. 176 During the 1998 proxy season, multiemployer

funds and staff plans had "between 70 and 100 resolutions either

submitted, under negotiations with the SEC or management, or in

the drafting process. ,,177 One-third of the resolutions that passed

were submitted by union groupS.178 The Teamster filed the most

resolutions, with seventeen proposals, followed by SEIU with eight

proposals, the CWA with six proposals, and the IUOE and HERE

with five and three respectively.179

With assets of $2.8 trillion, public funds have even more

180

Public funds own about 12.5 % of all corporate stock. 181

clout.

The New York City Funds filed twenty-eight shareholder proposals

during the 1998 proxy season,l82 followed by CalPERS' five

174. The New Governance Paradigm; CE Roundtable, supra note 166, at 40.

175. Wall Street Walk Being Replaced with Wall Street Talk: Corporate Governance

Changes Spurred by Increased Voice of Shareholders Worldwide., Bus. WIRE, July 9,

1998.

176. Labor's Growing Shareholder Activism Agenda, PENS. & INv. (Mar. 23, 1998)

< http://www.pionline.comfhtmllnews/pi1998/980323-12-2.html. >.

177. David Moberg, Union Pension Power, THE NATION, June I, 1998, at 15-16.

178. Kenneth A. Bertsch & Virginia Rosenbaum, Shareholders Increase Support for

Resolutions on Board Independence, Annual Election of Directors, XV IRRC CORP. Gov.

BULL. 6 (Apr.-June 1998) [hereinafter Shareholders Increase Support].

179.Id.

180. Moberg, supra note 177, at 15-16.

181.Id.

182. Bertsch & Rosenbaum, supra note 178, at 7. See also Ricki Fulman,

Shareholder Activism: Shareholders Keep Directors Feeling the Heat, PENS. & INv., Feb.

9, 1998, at 19; Heard & McGurn, supra note 164, at 3 (citing a recent study which found

HeinOnline -- 11 DePaul Bus. L.J. 73 1998-1999

74

DEPAUL BUSINESS LAW JOURNAL

[Vol. 11:43

proposals, three sponsored by the State of Wisconsin Investment

Board,183 and two filed by the College Retirement Equity Fund. 184

These figures do not include "stealth" resolutions that are the

subject of quiet negotiations with the company and subsequently