Document 13141890

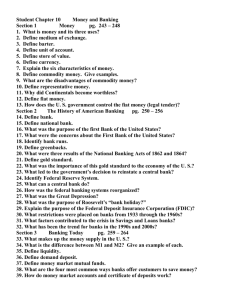

advertisement