S M I

advertisement

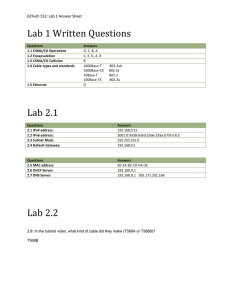

STUDENT MANAGED INVESTMENT FUND [Transportation: Bulk Shipping] This report is published for educational and investment purposes only by students enrolled in American University’s Student Managed Investment Fund. Date: September 22, 2011 Diana Shipping Inc. Ticker: DSX Price: $7.66 Recommendation: Buy 5-Year Price Target: $24.72 ___________________________________________________________ Safety Ratings Earnings/Share Mar Jun Sept Dec Year P/E Ratio Moody’s No Bonds Outstanding 2006 $0.26 $0.28 $0.32 $0.37 $1.23 12.39 2007 $0.40 $0.41 $0.44 $0.49 $1.74 17.13 Standard & Poor’s No Bonds Outstanding 2008 $0.71 $0.76 $0.77 $0.72 $2.96 4.15 2009 $0.47 $0.39 $0.36 $0.34 $1.56 9.00 Fitch No Bonds Outstanding 2010 $0.36 $0.42 $0.42 $0.40 $1.60 7.28 2011 $0.41 $0.34 $0.314 $0.263 $1.327 ___________________________________________________________ Source: Yahoo Finance Investment Rationale (As of September 22, 2011) Highlights (As of September 22, 2011) Diana Shipping is the owner of 24 dry bulk cargo ships, which it leases to various companies in the shipping industry on a medium-to-long-term basis. DSX has some of the lowest leverage and highest profit margins in the dry bulk sector. Company is committed to continuing sustainable growth and is positioned accordingly. Growth in the developing world is fueling an increasing need for long-distance bulk hauling, which is currently being overshadowed by a glut of ships on the market. This will provide long-term support for growth in the shipping industry. Key Statistics Exchange NYSE The bulk shipping industry has been decimated by an oversupply of ships, which has driven many companies to the edge of bankruptcy. Diana Shipping is positioned not only to weather the storm in the dry bulk shipping industry, but to benefit from it. Available cash will enable DSX to purchase ships from insolvent competitors at bargain prices, positioning it for significant appreciation as the sector recovers over the next 5 years. Low P/B and P/E multiples make the company a long-term value. DCF valuation shows that the intrinsic value of the company is approximately double its current price. Current P/E (Yahoo Finance) 5.61 1.55 Current Price (Sept. 22, 2011) $7.66 Beta (09/21/2011) 52 Week High (Nov. 09, 2010) $13.71 Shares Outstanding 52 Week Low (Sept. 22, 2011) $7.42 Market Cap (Sept. 22, 2011) Prior Year EPS $1.60 Projected 12 M Dividend Yield Forward P/E (Yahoo Finance) 9.34 Fiscal year ends 82.573M $632.51M 0.00% Dec. 31 September 22, 2011 Diana Shipping Inc. Business Description Diana Shipping Inc. (DSX) is a ship holding company providing global transportation services. The company is incorporated in the Marshall Islands and headquartered in Athens, Greece. Diana Shipping owns a fleet of 24 dry bulk carriers consisting of 15 Panamaxclass vessels, 1 Post-Panamax vessel and 8 Capesize vessels. An additional 2 Newcastlemax ships are under construction and are scheduled for delivery in mid-2012 (See Appendix for fleet details). As of Dec. 31 2010, the average vessel age was 5.4 years. These dry bulk carriers are used to haul bulk agricultural products (corn, rice, soybeans, etc.), or raw minerals (iron ore, coal, etc.) over long distances. Operations Diana Shipping provides ships to companies looking to lease rather than purchase dry bulk carriers. In addition to providing the ships, Diana also provides crews and maintenance. Leases typically have a duration of 1-5 years. Diana Shipping’s lease portfolio is well diversified and includes BHP Billiton, Cargill International, Hyundai Merchant Marine Co., Hanjin Shipping Co. and Morgan-Stanley Capital Group Inc among others. During 2010, no single lessee accounted for more than 18% of revenue. Fleet utilization rates have consistently been above 97%, contributing to one of the industry’s highest operating and profit margins; 46.87% and 45.49%, respectively. Profits are significantly lower than they were during the pre-recession shipping boom, but they have begun to recover from their 2009 low. This recovery in income is primarily attributable to a number of long-term leases locked in at high, pre-recession rates and stabilizing lease rates as measured by the Baltic Dry Index (see industry overview). However, rates declined again in early 2011 as the industry sought to process another wave of new ships entering the market and fallout from the Japanese tsunami and Australian flooding reduced shipping demand. Should rates remain at this depressed level, the company will be less profitable than analysts are forecasting in the year ahead. However, unlike many of its peers, Diana Shipping is positioned to continue grow and remain in the black. Management Based on public statements, management appears to be focused foremost on keeping a strong balance sheet, which will be key to preserving shareholder wealth during this period of shipping industry volatility. Simeon Palios, chairman and CEO, has also repeatedly stressed the importance of sustainable strategic growth. A solid balance sheet plays into this goal, by increasing the company’s access to capital markets and decreasing its cost of borrowing. Name Simeon Palios Anastasios Margaronis Andreas Michalopoulos Ioannis Zafirakis Maria Dede Boris Nachamkin Konstantinos Psaltis Apostolos Kontoyannis William Lawes Analyst: John Stefos Age Since 69 55 39 39 38 77 72 62 67 2005 2005 2006 2008 2005 2005 2005 2005 2005 Current Position Chairman of the Board, Chief Executive Officer President, Director Chief Financial Officer, Treasurer Executive Vice President, Secretary, Director Chief Accounting Officer Director Director Independent Director Independent Director AU SMIF Page 2 September 22, 2011 Diana Shipping Inc. Industry Overview and Competitive Positioning Dry Bulk Shipping The transportation industry, and the shipping industry in particular, tends to be highly cyclical. Increased demand during expansions leads to increased purchases of capital assets. Ships are unique in the transportation industry because of the time it takes between placing an order and the new ship entering the market. Often, by the time new ships hit the waves, the expansion-driven demand that drove their construction has given way to recession. Between 2005 and mid-2008 this cycle was exacerbated by exploding demand for Iron ore, coal, grain and other bulk commodities in India and China. Chartering rates also exploded, resulting in thousands of new dry bulk haulers being ordered. As these new ships began to be delivered, the 2008-2009 global recession hit. Charter rates (as measured by the Baltic Dry Index) plunged to less than one tenth of their previous level. Ships ordered before the recession are still being delivered, creating an oversupply of available ships which, in turn, has placed continued downward pressure on leasing prices. Impact of the 2008-2009 Recession on the Baltic Dry Index Source: http://www.shareswatch.com.au/blog/stockmarket/the-all-ordinaries-the-baltic-dry-index-and-other-charts-to-watch/ The Baltic Dry Index is a common aggregate measure of daily charter rates of different types of bulk shipping vessels. Outlook The dry bulk shipping sector has not yet stabilized, nor is it likely to do so in the next 18-24 months. This sector remains plagued by oversupply with total fleet growth this year expected around 14%, down from 16% last year. 1 In spite of rapidly growing demand for raw material imports in India and China, new ship construction has outpaced the growing demand for bulk commodity imports. With glut of ships on the leasing market, low leasing prices, and high steel prices, an increasing number of older ships are been scrapped. It will take an additional 18-24 months for scrapping and import growth to soak up this oversupply.1 In the short-term, the ongoing supply-side crisis in the dry bulk shipping sector will continue to lead to volatility in the Baltic Dry Index and equity prices. However, in the medium term, new deliveries are expected to drop sharply between 2013 and 2014 leading to stabilization. Once stabilization occurs, the industry looks to be a solid growth opportunity thanks in large part to ongoing demand for raw materials, which are fueling industrialization in India and China. Growth in shipping demand will also increase as manufacturing begins to recover in Europe and the United States. Industry Players There are no dominant players in the dry bulk industry. Rather, the industry is fragmented with many small public and private companies below $500 million in market capitalization. Typical companies are under 10 years old, own between 10 and 30 ships, and are highly leveraged. These companies were profitable before the recession, but many are struggling to remain so today. With leasing rates unlikely to substantially increase within the next 18 to 24 months, it is likely that the industry will undergo a period of 1 Saul, Jonathan and Randy Fabi. Growth Fears Add to Dry Bulk Shipping Crisis. August 4, 2011 < http://uk.reuters.com/article/2011/08/04/uk-shipping-drybulkeconomy-idUKTRE77348X20110804>. Analyst: John Stefos AU SMIF Page 3 September 22, 2011 Diana Shipping Inc. consolidation with a substantial number of bankruptcies (see the Comparables section for more information on industry players). Diana Shipping’s large cash position will enable it to acquire new ships at bargain prices over the next two years, resulting in substantially higher profits as this cyclical industry recovers in the second half of the decade. Impact of 2008-2009 Recession on Dry Bulk Vessel Prices Source: http://seekingalpha.com/article/232661-our-dry-bulk-shipping-projections-sink-or-swim Competitive Position within Industry Diana Shipping has some of the highest liquidity, and margins in the sector as well as some of the lowest leverage ratios. It also has the advantage of being insulated from spot market price swings by its longer-term leases. DSX is a moderately sized company by industry standards. Some of its competitors are larger, such as Dry Ships Inc. (DRYS), which owns a total of 35 dry bulk haulers. However, size does not seem to be a significant advantage in this sector, as no single company is large enough to have pricing power, and the value of economies of scale is limited. The shipping industry is highly fragmented with yahoo finance recognizing 111 different competitors with each company controlling a very small portion of the overall market. Two Year Equity Performance DSX and Competitors Source: Yahoo Finance Analyst: John Stefos AU SMIF Page 4 September 22, 2011 Diana Shipping Inc. Comparables Company Name Mkt. Cap Revenue (ttm) Profit Margin (ttm) P/E (ttm) P/S (ttm) ROA Debt/Equity Total Cash Total Cash/Revenue Diana Shipping (DSX) $632.51M $279.04M 45.49% 5.61 2.66 5.44% 30.15% 375.61M 134.61% Dry Ships (DRYS) $1.24B $872.78M 7.71% 16.19 1.45 2.61% 98.95% 367.67M 42.13% Navios Maritime Holdings Inc. (NM) $359.97M $707.23M 11.40% 5.05 0.51 3.11% 129.28% 342.35M 48.41% Eagle Bulk Shipping Inc. (EGLE) $116.51M $308.28M 1.30% 32.00 0.38 1.61% 174.08% 51.13M 16.59% Excel Maritime Carriers (EXM) $196.97M $401.14M 23.58% 2.05 0.50 1.50% 62.87% 59.73M 14.89% Macroeconomic Drivers within the Industry Raw Material / Commodity Demand The demand for imported raw materials and agricultural goods is what fundamentally drives the dry bulk shipping sector. Demand for raw material and commodity inputs, such as such as Iron ore, coal, and timber, is driven by consumption of manufactured goods, which is dependent on overall economic health. Increasing demand from the US, Europe, China, India, and developing nations would help to soak up the excess supply of ships and push leasing prices higher. Conversely, a recession or significant slowdown in China or India in the near term would cause demand for such raw materials to decline dramatically. This would, in turn, decrease demand for shipping extending the oversupply problem. Imports / Exports The bulk shipping industry concentrates on long-distance hauling and international shipping. The industry would be adversely affected if large importers of raw materials, such as China and India, were to develop domestic sources of such materials large enough to meet their growing demand. Japanese Tsunami and Australian Flooding The flooding in eastern Australia shut down mine operations earlier this year resulting in a temporary slowdown in the supply of materials carried by bulk shippers. The Japanese tsunami reduced Japanese industrial output, which reduced demand for materials and commodities. These natural disasters and their impact on dry bulk shipping demand have contributed to the recent decline in the Baltic Dry Index. Macro Trends Globalization and industrialization in the developing world drive the dry bulk shipping sector. As long as these trends continue to grow, the sector will continue to grow. Between 2014 and 2015, the demand for bulk shipping, fueled by these macro trends, will likely catch up to the current oversupply of ships. Once this occurs, the cyclical dry bulk shipping sector appears poised for healthy expansion driven by the growing demand for commodities and raw materials in the developing world. Investment Summary Diana Shipping Inc. offers an opportunity to benefit from the near-term instability of the dry bulk shipping sector as leasing prices begin to recover in 2014 and beyond. Diana’s superior cash and leverage will enable it to expand by exploiting opportunities as they arise. DSX is positioned to take advantage of declining ship prices driven by highly leveraged competitors’ efforts to raise cash by scrapping or selling ships. This was demonstrated by Diana Shipping’s recent purchase of a Panamax vessel for less than $30 million. Such vessels were selling for nearly $100 million dollars three years ago. Before the recession, Diana Shipping was trading around $30 per share with a fleet of 19 ships, 5 smaller than its fleet is today. Recovering shipping rates and a newly acquired, larger fleet will enable DSX to return to this level or beyond in the second half of the decade. Thanks to its strong balance sheet, Diana Shipping will be poised to ride the next upswing of this cyclical industry delivering higher returns for its shareholders. Analyst: John Stefos AU SMIF Page 5 September 22, 2011 Diana Shipping Inc. Valuation Discounted Cash Flow The model that I developed to find Diana Shipping’s intrinsic value is based on several assumptions. 1) Leasing rates will not decline further (rates are at the lowest they have ever been except for a short period in 2009 and have been driven down temporarily by flooding in Australia and a decrease in Japanese demand for raw materials resulting from the tsunami) 2) Diana Shipping’s customers will not default on their contracts. 3) China and India will not have recessions or dramatic slowdowns within the next 5 years. 4) After the glut of ships works its way through the market in 2012 and 2013, Diana’s leasing rates will gradually return to the average between their 2008 high and their current low. 5) Beginning in 2014, Diana Shipping will acquire 3 new ships per year (2 Panamax and 1 Capesize). I consider this growth scenario to be extremely conservative. Diana acquired 3 new ships in 2010 alone and currently has enough cash to purchase 12 Panamax ships without accessing any credit. 6) 4% Terminal Growth Rate 7) A required equity rate of return of 15.91% per year (CAPM inputs: Beta = 1.55, Market Return = 11% per year, Risk Free Rate = 2.08%) Estimated EPS 2012 $0.67 2013 $0.407 2014 $1.39 2015 2016 $1.93 $2.54 Horizon Value = $22.18 Intrinsic Value = $14.66 2-Year Target = $19.30 5-Year Target = $24.72 Risks to DCF Intrinsic Value and Price Target This valuation should be viewed in the context of the ongoing volatility of the dry bulk shipping sector. Equity prices of the entire sector are likely to continue to reflect investor worries about bankruptcies in the near term. The shares of Diana Shipping Inc. are also likely to face substantial volatility. As mentioned in the assumptions section above, this model is based on continuing robust demand for raw materials and commodities in the developing world. A significant decline in this demand over the next 18-24 months would reduce demand for shipping. This would, in turn, push back the recovery in lease rates, which this model assumes will begin in 2014. Ratio Analysis The turbulence in the dry bulk sector precludes meaningful multiples valuation. However, comparing Diana Shipping Inc.’s current multiples with its historical averages could help to contextualize its current valuation. Fear seems to be playing a central role in the current disposition of the sector with solid companies, like DSX, trading at extremely low multiples. Comparing the company’s current price with its price calculated using the company’s average 5-year P/E helps to show the value of the stock in a more stable environment. This analysis helps to verify the intrinsic value estimate generated using the DCF model. EPS (ttm) 5-Year Average P/E $1.57 9.99 EPS (forward 12 month) $1.01 5-Year Average P/E 9.99 Expected Price in Stable Environment $15.68 Expected Price in Stable Environment $10.13 Financial Analysis Dupont Analysis Return on Equity 0.1095 Net Income / Sales 0.4549 Sales/Assets 0.1807 Assets/Equity 1.3319 Breaking down the company’s ROE using a DuPont Analysis shows that low leverage and low assets turnover ratios seem to be holding down ROE. However, low asset turnover is typical in the shipping industry and the company’s low leverage is one of its strongest qualities. In fact, this ROE is high for the dry bulk shipping sector. Competitors ROEs are as follows: DRYS - 0.0214, NM 0.0673, EGLE - 0.0061, EXM - 0.0565 Analyst: John Stefos AU SMIF Page 6 September 22, 2011 Diana Shipping Inc. Earnings Earnings have recovered somewhat since they bottomed in 2009. However, earnings are likely to decline over the short term as the new ships continue to enter the market. Over the last several years, the company has opted to keep these earnings on its balance sheet rather than pay dividends. This is reflected in the book value of each DSX share, which is currently $14.30 according to yahoo finance. Cash Flow Diana Shipping has strong cash flows. The company has a profit margin of approximately 45% and pays no dividends, so that income remains available for use. In addition, of the company’s expenses, 37% are depreciation and amortization requiring no outlay of cash. Capital Structure and Balance Sheet Maintaining a strong balance sheet is one of management’s often repeated priorities. The strength of Diana Shipping’s balance sheet is one of the principal characteristics that sets this company apart from others in the sector. The company has a current ratio of 12.48 and has enough cash on its balance sheet to increase its fleet size by approximately 50% without ever accessing its available lines of credit. Its current capital structure is composed of approximately 76% equity and 24% debt. The debt is all from direct bank loans including an $82.6 million line of credit with the export-import bank of China opened last year. The company has no bonds outstanding. While others in the dry bulk sector may be facing tough times, Diana’s strong balance sheet will not only protect it from bankruptcy, but also enable it to grow. Major Shareholders Top Institutional Holders Shares % Out SEIZERT CAPITAL PARTNERS LLC 4,528,561 5.56 49,633,028 Jun 30, 2011 DREMAN VALUE MANAGEMENT, L.L.C. 3,167,071 3.89 34,711,098 Jun 30, 2011 DEUTSCHE BANK AKTIENGESELLSCHAFT 2,449,264 3.01 26,843,933 Jun 30, 2011 WELLS FARGO & COMPANY 1,884,380 2.31 20,652,804 Jun 30, 2011 MORGAN STANLEY 1,675,954 2.06 18,368,455 Jun 30, 2011 OHIO-PUBLIC EMPLOYEES RETIREMENT SYSTEM (PERS) 1,643,255 2.02 18,010,074 Jun 30, 2011 Argyll Research, LLC 1,535,000 1.89 16,823,600 Jun 30, 2011 American Century Companies, Inc. 1,532,583 1.88 16,797,109 Jun 30, 2011 HBK INVESTMENTS, L.P. 1,527,193 1.88 16,738,035 Jun 30, 2011 Ameriprise Financial, Inc. 1,400,339 1.72 15,347,715 Jun 30, 2011 Top Mutual Fund Holders Value* Reported Shares % Out DWS Dreman Small Cap Value Fd 2,425,884 2.98 26,587,688 Jun 30, 2011 Value* Reported AMERICAN CENTURY SMALL CAP VALUE FUND 1,225,000 1.50 13,426,000 Jun 30, 2011 Advisors Inner Circle Fund-Cambiar Small Cap Fund 794,000 0.98 8,940,440 Apr 30, 2011 PAX WORLD BALANCED FUND, INC. 767,522 0.94 9,087,460 Mar 31, 2011 ROYCE OPPORTUNITY FUND 702,700 0.86 7,701,592 Jun 30, 2011 MFS INTERNATIONAL NEW DISCOVERY FUND 625,000 0.77 7,400,000 Mar 31, 2011 RiverSource Equity Ser-Columbia Mid Cap Growth Opportunitiy 478,918 0.59 5,967,318 Feb 28, 2011 ING VARIABLE PRODUCTS-ING SMALL COMPANY PORTFOLIO 298,494 0.37 3,271,494 Jun 30, 2011 MARSHALL MID-CAP VALUE FUND 254,900 0.31 2,793,704 Jun 30, 2011 OPPENHEIMER MAIN STREET SMALL & MID CAP FUND 253,807 0.31 3,005,074 Mar 31, 2011 Source: Yahoo Finance Analyst: John Stefos AU SMIF Page 7 September 22, 2011 Diana Shipping Inc. Investment Risks Commodity Risk Fluctuations in commodity prices could affect the demand for the shipping services that Diana Shipping Inc. provides. However, DSX is not directly exposed to such fluctuations Exchange Rate Risk Diana Shipping’s functional currency is the U.S. dollar. However, it is involved in transactions using various foreign currencies throughout its operations. Interest Rate Risk The company is exposed to interest rate risk as some of its debt instruments have variable rates. Market Risk Diana Shipping is in a highly specialized sector. Its price performance is more a function of the fundamentals of that sector than of overall market trends and risks. Credit Risk As of September 2011, the company had no outstanding public debt, but it did have several outstanding loans. The firm’s cost of debt is relatively low for a firm of its size, which is a reflection of its exceptionally strong balance sheet. Source: Company Fillings, and Bloomberg Figure 1: Income Statement Period Ending Total Revenue Cost of Revenue Gross Profit Operating Expenses Research Development Selling General and Administrative Non Recurring Others Dec 31, 2010 275,448 64,977 Dec 31, 2009 239,342 53,334 Dec 31, 2008 337,391 54,902 210,471 186,008 25,347 53,083 17,464 44,686 - - - 133,639 124,336 225,837 Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest 1,041 133,082 5,213 127,869 910 924 124,782 3,284 121,498 - 1,234 227,071 5,372 221,699 - Net Income From Continuing Ops 128,779 121,498 221,699 - - - Net Income Preferred Stock And Other Adjustments 128,779 - 121,498 - 221,699 - Net Income Applicable To Common Shares Source: Yahoo Finance 128,779 121,498 221,699 Total Operating Expenses Operating Income or Loss Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items Analyst: John Stefos AU SMIF 282,489 13,831 (438) 43,259 Page 8 September 22, 2011 Diana Shipping Inc. Figure 2: Cash Flow Statement Period Ending Net Income Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments To Net Income Changes In Accounts Receivables Changes In Liabilities Changes In Inventories Changes In Other Operating Activities Total Cash Flow From Operating Activities Investing Activities, Cash Flows Provided By or Used In Capital Expenditures Investments Other Cash flows from Investing Activities Dec 31, 2010 128,779 Dec 31, 2009 121,498 Dec 31, 2008 221,699 53,175 8,204 (284) (8,416) (1,237) (1,019) 44,574 4,015 1,463 (4,027) 315 (15,935) 43,221 240 176 (2,988) (1,044) (153) 178,292 151,903 261,151 (259,689) 7,690 (314) (65,225) (7,690) (166) (109,568) 906 Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends Paid Sale Purchase of Stock Net Borrowings Other Cash Flows from Financing Activities (252,313) (73,081) (108,662) 35,337 102,680 - 98,523 43,510 - (247,001) 119 139,700 - Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes 136,997 - 141,583 - (107,182) - 62,976 220,405 45,307 Change In Cash and Cash Equivalents Currency in USD. Source: Yahoo Finance Analyst: John Stefos AU SMIF Page 9 September 22, 2011 Diana Shipping Inc. Figure 3: Balance Sheet Period Ending Assets Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Dec 31, 2010 Dec 31, 2009 Dec 31, 2008 345,414 467 4,068 4,700 282,438 7,690 183 2,831 4,014 62,033 1,646 3,146 1,729 Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges 354,649 1,217,972 8,409 4,359 297,156 1,009,173 11,457 2,639 68,554 987,766 886 Total Assets Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities 1,585,389 1,320,425 1,057,206 11,367 7,320 13,823 8,711 5,400 18,275 8,033 11,979 Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Negative Goodwill 32,510 377,294 1,428 4,227 38,413 - 32,386 276,268 1,202 11,244 - 20,012 238,094 1,122 22,502 - Total Liabilities Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity 453,872 321,100 281,730 820 222,246 908,467 (16) 815 93,467 904,977 66 751 (28,031) 802,574 182 Total Stockholder Equity 1,131,517 999,325 775,476 Net Tangible Assets 1,131,517 999,325 775,476 Currency in USD. Source: Yahoo Finance Analyst: John Stefos AU SMIF Page 10 September 22, 2011 Diana Shipping Inc. Appendix: Vessel Leases Vessel BUILT Sister Ships * DWT Gross Rate (USD Per Day) Com* * Charterer Delivery Date to Charterer Redelivery Date to Owners*** Notes Panamax Vessels 1 CORONIS 2006 2 6/Apr/2010 6/Mar/2012 - 21/Jun/2012 C 20,500 5.00% C Transport Panamax Ltd., Isle of Man 4/Mar/2010 4/Dec/2011 - 4/Mar/2012 B 13,250 5.00% Cargill International S.A., Geneva 8/Jul/2011 24/May/2012 - 23/Aug/2012 B 19,750 5.00% J. Aron & Company, New York 24/Sep/2010 24/Aug/2012 - 24/Oct/2012 B 25,000 5.00% Daelim Corporation, Seoul 8/May/2010 8/Apr/2012 - 8/Jun/2012 5.00% Cargill International S.A., Geneva 74,444 73,593 NAIAS 73,546 CLIO 2005 6 Siba Ships Asia Pte. Ltd. ARETHUSA 2006 5 5.00% 74,381 2007 4 24,000 ERATO 2004 3 C 73,691 CALIPSO 23,000 B 13,750 2005 7 1 0 11,750 4,75% 6/Aug/2011 6/Jul/2012 - 6/Oct/2012 B 13,750 5.00% Cargill International S.A., Geneva 23/Feb/2011 23/Jan/2012 - 23/Apr/2012 A 20,500 5.00% Louis Dreyfus Commodities S.A., Geneva 26/Sep/2010 26/Jul/2012 - 26/Nov/2012 18/Apr/2011 18/Mar/2013 - 18/May/2013 75,172 6/Aug/2011 4 A 15,600 5.00% Hyundai Merchant Marine Co., Ltd., Seoul, South Korea A 19,750 5.00% China National Chartering Co. Ltd. (Sinochart), Beijing 17/Sep/2010 17/Aug/2012 - 1/Nov/2012 A 19,500 4.75% Resource Marine Pte., Ltd, Singapore 11/Dec/2010 11/Nov/2013 - 11/Feb/2014 A 34,500 4.75% Cargill International 21/Feb/2008 21/Nov/2012 - 21/Feb/2013 75,106 75,211 TRITON 2001 1 3 73,583 18/Sep/2008 OCEANIS 2001 1 2 73,630 DANAE 2001 1 1 12/Oct/2011 Cargill International S.A., Geneva DIONE 2001 - Hanjin Shipping Co. Ltd., Seoul THETIS 2004 5/Oct/2011 5.00% B 9 20/Jul/2011 2,3 20/Jul/2011 PROTEFS 2004 4/Sep/2010 73,691 59,000 8 1 75,336 ALCYON Analyst: John Stefos AU SMIF Page 11 5 September 22, 2011 Diana Shipping Inc. S.A., Geneva 2001 1 4 75,247 NIREFS A 2001 1 5 21,000 5.00% 16,500 5.00% 75,311 MELITE 2004 76,436 Louis Dreyfus Commodities Suisse S.A. Cargill International S.A., Geneva 12/Feb/2010 28/Dec/2011 - 27/Mar/2012 1/Feb/2011 1/Jan/2013 - 1/Mar/2013 5/Oct/2012 - 4/Jan/2013 - 12/Mar/2013 Post-Panamax Vessels 1 6 ALCMENE 20,250 2010 5.00% Cargill International S.A., Geneva 20/Nov/2010 93,193 Capesize Vessels 1 7 NORFOLK 74,750 3.75% Corus UK Limited 12/Feb/2008 12/Jan/2013 26,500 5.00% Minmetals Logistics Group Co. Ltd., Beijing 1/Mar/2011 1/Feb/2016 55,800 5.00% Refined Success Limited 28/Sep/2007 28/Aug/2012 - 28/Oct/2012 D 30,500 5.00% BHP Billiton Marketing AG 16/Oct/2010 16/Feb/2013 - 16/Jun/2013 D 17,350 5.00% Cargill International S.A., Geneva 30/May/2011 15/Mar/2013 - 14/Aug/2013 52,000 5.00% BHP Billiton Marketing AG 13/Nov/2007 4TC AVG 5.00% BHP Billiton Marketing AG 29/Sep/2011 14,000 5.00% Morgan Stanley Capital Group Inc. 10/Oct/2011 10/Jul/2013 - 10/Nov/2013 8 D 55,000 4.75% Shagang Shipping Co. 3/Nov/2009 3/Oct/2014 - 3/Jan/2015 9 D 48,000 3.75% Nippon Yusen Kaisha, Tokyo (NYK) 3/Mar/2010 3/Jan/2015 - 3/May/2015 2002 164,218 1 8 ALIKI 1/Apr/2016 2005 180,235 1 9 SALT LAKE CITY 2005 171,810 2 0 SIDERIS GS 2006 174,186 2 1 SEMIRIO 2007 174,261 2 2 BOSTON D 2007 177,828 2 3 29/Sep/2011 6,7 10/Oct/2011 HOUSTON 2009 177,729 2 4 NEW YORK 2010 177,773 Analyst: John Stefos AU SMIF Page 12 September 22, 2011 Diana Shipping Inc. Vessels Under Construction 2 5 LOS ANGELES E 18,000 5.00% EDF Trading Limited, London 29/Feb/2012 29/Dec/2015 - 29/Apr/2016 10,11,1 3 E 18,000 5.00% EDF Trading Limited, London 30/Apr/2012 30/Dec/2015 - 30/Jun/2016 10,12,1 3 2012 206,000 2 6 PHILADELPHIA 2012 206,000 * Each dry bulk carrier is a "sister ship", or closely similar, to other dry bulk carriers that have the same letter. ** Total commission percentage paid to third parties. *** Charterers' optional period to redeliver the vessel to owners. Charterers have the right to add the off hire days, if any , and therefore the optional period may be extended. 1 Vessel off-hire for drydocking from July 30, 2011 to August 15, 2011. 2 Period extended for one (1) or two (2) laden legs in charterers' option at US$ 13,750 per day. 3 Estimated date based on latest information received from charterers. Hanjin Shipping Co. Ltd., has agreed to compensate the Owners for the difference between the new rate and the previous rate for the period from August 6, 2011 to August 18, 2011. 4 5 6 Resource Marine Pte., Ltd, Singapore is a guaranteed nominee of Macquarie Bank Limited. Estimated date. 7 Charterer has agreed to pay a daily rate which equals the average of the 4TC Routes for an approximate period of ten (10) days. 8 Morgan Stanley Capital Group Inc. has the option to employ the vessel for a further minimum eleven (11) to a maximum thirteen (13) month period at a gross rate of US$15,000 per day starting twenty-four (24) months after delivery of the vessel to the charterer. 9 Shagang Shipping Co. is a guaranteed nominee of the Jiangsu Shagang Shipping Group Co. 10 Year of delivery and dwt are based on shipbuilding contracts. 11 This newbuilding is also referred to as Hull H1234. 12 This newbuilding is also referred to as Hull H1235. 13 Based on expected date of delivery to owners. Source: http://www.dianashippinginc.com/default.asp?siteID=1&pageid=69&langid=1 Analyst: John Stefos AU SMIF Page 13