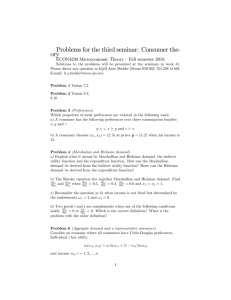

Customer-Focused Investment Advice: Constructing Preferences for Outcomes by Dan Goldstein

advertisement

BeFi Web Seminar for January 30, 2008 Customer-Focused Investment Advice: Constructing Preferences for Outcomes © BeFi Forum 2007 by Dan Goldstein London Business School Customer-Focused Investment Advice: Constructing preferences for outcomes Dan Goldstein BeFi Webinar 30 Jan 2008 1 Collaborators William F. Sharpe Eric J. Johnson 2 Central question How do retirement investors think about risk and return? 3 To investigate, I present a research technique to measure, model, & analyze risk-return tradeoffs. I consider the two models of risk preference: Constant Relative Risk Aversion, and a lossaverse (reference dependent) variants. 4 Central question 2 Part I: Background 5 Domain: Investing for retirement • $3.7 trillion in IRAs • $2.9 trillion in 401(k)s • Magnitude of decision 6 The market solution: Risk tolerance questionnaires How stable are your current and future income sources? A.Very unstable B.Unstable C.Stable D.Very Stable E. I Have Tenure 7 The $6,600,000,000,000 question $$$$ ? % Stocks Uncertainty ? % ? Covariances ? ? ? Interest Rates ? Bonds ? Inflation Rates ? ? % $ Money Market Probability Distribution Of Wealth 8 Rapid choices • Assume • choice between 1 and 10 funds • Allocations in units of 5% of contribution • 16 levels of contribution $1,000 to $16,000 = 160 million ways to complete the form 9 The $6,600,000,000,000 question $$$$ ? % Stocks Uncertainty ? % ? Covariances ? ? ? Interest Rates ? Bonds ? Inflation Rates ? ? % $ Money Market Probability Distribution Of Wealth 10 Central question 2 Part II: Questions 11 Central question Investment advice and economic models often prescribe strategies resulting in lognormal distributions of wealth. In the following experiments, people with Constant Relative Risk Averse (CRRA) utility should prefer lognormal distributions of wealth. People with loss-averse (reference dependent) preferences should prefer distributions that deviate predictably from lognormality. How many people want lognormal distributions? 12 How to find out $ ? 13 Aims of research Question Answer 1. How can we measure preferences for risk and return? ? 2. What are people’s preferences and how can we represent them? ? 3. How well do Constant Relative Risk Aversion and lossaversion describe the data? ? 14 Question 1 and answer 1: How can we measure distribution risk preferences? Income levels (% of pre-retirement income) Cost 100 moveable people, one of which represents the user (experienced frequency representation of probability) Typical level of retirement income (Perceived loss point) Minimum level 15 16 Riskless alternative 17 18 State prices The investor has a budget B and wishes to obtain a probability distribution that will maximize his or her expected utility without exceeding the budget. Each one of the 100 people represents a different state of the world, ranging from the best markets to the worst markets. The cost of obtaining $1 in the ith state of the world is the state price si (Arrow, Debreu, Dybvig) The participant must choose wealth levels wi such that w s i i i 19 =B Assignment of state prices to markers Cost This marker has the lowest state price (smallest influence on the meter) This marker has the highest state price (biggest influence on the meter) 20 Inferring attributes of utility functions from distributions Given outcome wealth levels and state prices si and budget wi B We assume that a person building a p • u (w) distribution is maximizing N subject to the cost constraint w s i i =B i =1 Maximizing the Lagrangian p • u ( w) k ( w'•s B) results in the family of equations u ' ( wi ) = Ksi In other words, the slope of the utility curve at a wealth level is proportional to the weight of the marker assigned to that wealth level 21 Estimating loss aversion Marginal utility is the slope of the utility function. The ratio of slopes at the loss point gives loss aversion parameter u'(w) for losses = u'(w) for gains Perceived loss Perceived gain 22 Q2: What are people’s preferences? 23 Q2: What are people’s preferences? Do preferences conform with maximization of a CRRA utility function? Or do preferences exhibit loss aversion? 24 Design 141 Participants • Age 30 – 60 μ=42 =7 • Income μ=$56,700 =$32,600 • Net worth μ=$112K, saved toward retirement μ=$30,000 • 74% married, 16% single, 10% divorced/widowed Method • Training: Participants made distribution and saw outcome • Created two probability distributions of desired wealth in retirement • Answered 50 question survey • Actual industry risk tolerance quiz • Psychological risk-taking scale • Demographics • Follow up one year later 25 Q3: How well do CRRA and Loss Averse utility functions capture preferences? CRRA x (1 ) u ( x) = 1 has been estimated to range from 1 to 10 Prospect Theory x for x > 0 v( x) = ( ) for x < 0 x Perceived loss has been estimated to be 2.25 26 Perceived gain Central question 2 Part III: Results 27 Results of Q2: What are people’s preferences? 40 35 30 25 20 15 10 5 Percentage of pre-retirement income 28 5 19 5 18 5 17 5 16 5 15 5 14 5 13 5 12 5 11 5 10 95 85 75 65 55 45 35 0 25 Average number of markers 45 Results of Q3: Two different types of people HighR2 60 50 40 30 20 10 95 10 5 11 5 12 5 13 5 14 5 15 5 16 5 17 5 18 5 19 5 85 75 65 55 45 35 0 25 Average number of markers Low R2 Percentage of pre-retirement income 29 30 31 Eight Validations Within And Between Years 32 Eight Validations Within And Between Years Risk of chosen portfolio DB CRRA Coefficient 20-60% of explained variance Psych Risk Scale Industry Risk Scale Age Income Gender 33 Demographics Correlation w/ Risk Aversion Age Income Gender 34 Test re-test reliability Pearson Within Y1 .70 Within Y2 .80 Between Years .58 >$25K Saved .78 35 Conclusions Question Answer How can we measure Distribution Builder, a validated market research risk return preferences technique to measure, model, and analyze riskfor complex distributions? return preferences How can we describe preferences? Roughly lognormal with some participants massing probability at a reference point. Can we model these preferences? CRRA fits half the participants well, while a loss averse value function describes the other half. 36 The end (This talk is over.) 37 PRESENTED BY Shlomo Benartzi Co-Founder, BeFi Associate Professor Co-chair of the Behavioral Decision Making Group The Anderson School at UCLA Warren Cormier © BeFi Forum 2007 Co-Founder, BeFi President, Boston Research Group