Problems for the third seminar: Consumer the- ory

advertisement

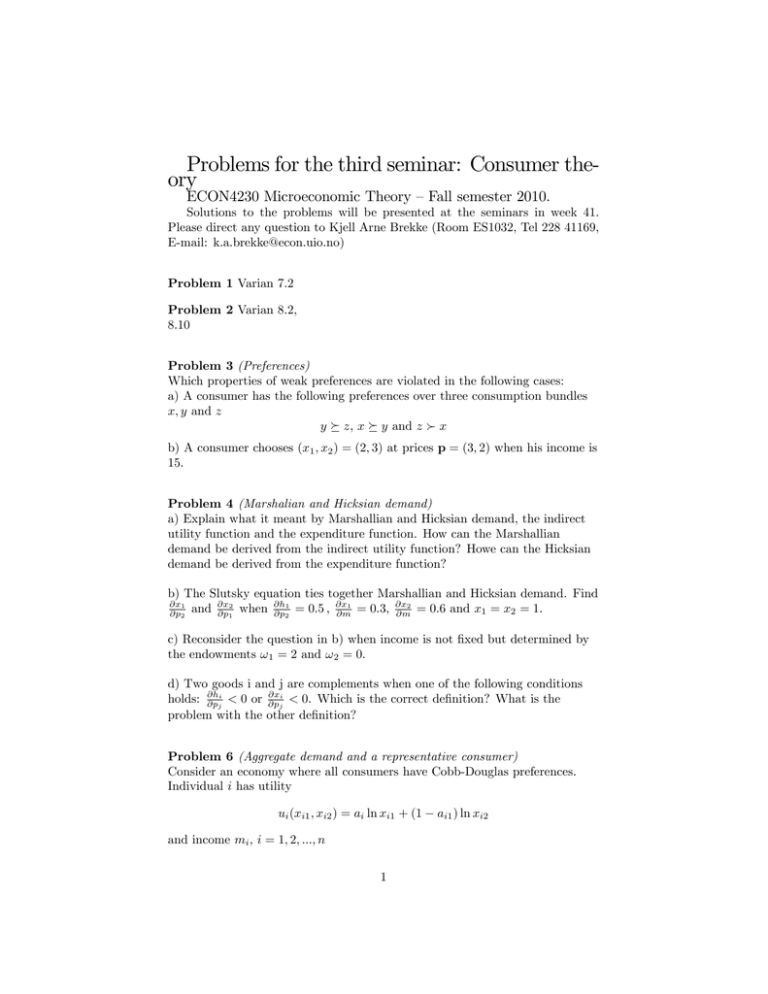

Problems for the third seminar: Consumer theory ECON4230 Microeconomic Theory –Fall semester 2010. Solutions to the problems will be presented at the seminars in week 41. Please direct any question to Kjell Arne Brekke (Room ES1032, Tel 228 41169, E-mail: k.a.brekke@econ.uio.no) Problem 1 Varian 7.2 Problem 2 Varian 8.2, 8.10 Problem 3 (Preferences) Which properties of weak preferences are violated in the following cases: a) A consumer has the following preferences over three consumption bundles x; y and z y z, x y and z x b) A consumer chooses (x1 ; x2 ) = (2; 3) at prices p = (3; 2) when his income is 15. Problem 4 (Marshalian and Hicksian demand) a) Explain what it meant by Marshallian and Hicksian demand, the indirect utility function and the expenditure function. How can the Marshallian demand be derived from the indirect utility function? Howe can the Hicksian demand be derived from the expenditure function? b) The Slutsky equation ties together Marshallian and Hicksian demand. Find @x2 @h1 @x1 @x2 @x1 @p2 and @p1 when @p2 = 0:5 , @m = 0:3, @m = 0:6 and x1 = x2 = 1. c) Reconsider the question in b) when income is not …xed but determined by the endowments ! 1 = 2 and ! 2 = 0. d) Two goods i and j are complements when one of the following conditions @xi @hi < 0 or @p < 0. Which is the correct de…nition? What is the holds: @p j j problem with the other de…nition? Problem 6 (Aggregate demand and a representative consumer) Consider an economy where all consumers have Cobb-Douglas preferences. Individual i has utility ui (xi1 ; xi2 ) = ai ln xi1 + (1 and income mi , i = 1; 2; :::; n 1 ai1 ) ln xi2 a) Under what condition will aggregate demand be a function of prices and aggregate income only? b) Show that under the conditions derived in a), aggregate demand equals the demand of a representative consumer spending the entire aggregate income, and specify the preferences for the representative consumer. Problem 6 (Uncertainty) Consider the lotteries A: 4000 with probability 80% 0 with probability 20% versus B : 3000 with probability 100% 0 with probability 0% 4000 with probability 20% 0 with probability 80% versus D : 3000 with probability 25% 0 with probability 75% and C: In a paper in Econometrica 1979, Kahneman and Tversky reported that a majority prefers B over A but also prefers C over D. a) Show that this behavior violates expected utility theory. (Hint. You may choose u(0) = 0) Problem 7 Risk aversion Suppose a person has an expected utility function ( W1 for > 0 and 1 u(W ) = ln(W ) ( = 1) 6= 1 a) For a given wealth level W , compute the Arrow Pratt measure of risk 00 )W aversion r(W ) and the relative risk aversion u u(W 0 (W ) . Consider next a quadratic utility function u(W ) = (W W )2 b) Is this a reasonable utility function for W > W ? c) Compute the relative and absolute risk aversion. Is risk aversion increasing or decreasing in wealth. 2