The Great Depression 1929 - 1933

advertisement

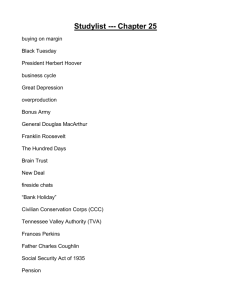

The Great Depression 1929 - 1933 The Stock Market Crash and the Great Depression http://www.youtube.com/watch?v=aPtbekTh 2qo Today’s Lecture Herbert Hoover: 31st President of the United States Lead up to the Crash The Wall Street Crash Why did the Stock Market Crash? The Great Depression - Causes - Effects Rural America Farming Crisis Conclusion Herbert Hoover Part of the intellectual elite; Engineer; Self-made millionaire. Made his political name during WWI organising food relief for Belgium. Progressive sympathiser who intended to follow in the footsteps of T. Roosevelt Defeated Democratic Governor of New York, Albert E. Smith, in a landslide in November 1928. Was the first President to use a telephone in the Oval Office, but the last to dress for dinner every evening with his wife March 1929: Herbert Hoover sworn in as President. Herbert Hoover “We want to see a nation built of home owners and farm owners. We want to see their savings protected. We want to see them in steady jobs. We want to see more and more of them insured against death and accident, unemployment and old age. We want them all secure”. “We have not yet reached the goal, but given a chance to go forward with the policies of the last eight years and we shall soon, with the help of God, be within sight of the day when poverty will be banished from the nation” – Hoover’s acceptance speech for the Republican Nomination, 1928. - Hoover repeated these words in a speech delivered at Madison Square Garden in October 1932, the depths of the depression. “Little had been done by the Federal government in the fields of reform or progress during the 14 years before my time. By 1929 many things were already 14 years overdue. I... had high hopes that I might lead in performing the task”. Herbert Hoover Devoted his presidency to a variety of social, economic and environmental reforms. Feared a ‘welfare-dependent state’ and believed in private plans for social relief . Promoted indirect relief through public works projects and loans to states over direct federal relief to the unemployed He continued with this belief even through the worst years of the Great Depression. Smoot Hawley Tariff Act (1930) His programs failed, and the number of unemployed in the USA rose from 7 million in 1931 to 11 million when he left office. Lead up to the Crash The decade had been characterised by investment fever, and ventures became increasingly risky as people tried to make a ‘quick buck’. March 1929 - stocks plunged, but on this occasion they rallied back. Business began to slow down in mid summer. Stock market was abused by insider trading and margin trading. Kolster Radio scam. It’s 1929 and All’s Well… The Hoover Economic Committee issued a report in May 1929 which claimed “that there seems to be no limit to the US consumer to consume”. "I know of nothing fundamentally wrong with the stock market or with the underlying business and credit structure” - the President of NY's National City Bank (1929) September 1929: Stock Market reaches an all time high: The contract to build the Empire State Building is awarded The Crash October 24th 1929: Black Thursday. 12,894,650 shares were sold, with a loss of over $9bn October 29th 1929: Black Tuesday - 13,000,000 shares are sold off in a wave of panic By mid- November the stock market had lost 1/3 of its value. General Electric’s share price dropped from $403 per share to just $168. Standard Oil’s shares fell from $83 to $48 Why did the Stock Market Crash? “A reaction from an orgy of reckless speculation” – Alexander Dana Noyes (Financial writer, NY Times). By 1929, commercial bankers were loaning more money for stock market and real estate investments than for commercial ventures. Easy access to credit in the 1920s left the American Economy in a very precarious position Business activity steadily subsided in the late 1920s, but the stock market continued to rise “it seemed as though Wall Street were by way of devouring all the money of the entire world” – John Kenneth Galbraith - Investors were, more often than not, big corporations and banks, rather than individual investors – less than 2.5% of Americans actually owned stock. The crash had little direct immediate effect on the majority. The Great Depression: Causes Overconfidence in the stock market, overuse of credit and the subsequent Wall Street Crash Downturns in both the housing and automobile market. A decade of agricultural stagnation Distribution of income Untrustworthy banking system International situation. - War reparations, international economic ties and Britain’s abandonment of the Gold Standard The Great Depression Hoover’s short term fixes: - “I am convinced we have passed the worst and with continued effort we shall rapidly recover” – Spring 1930 An agreement was reached with industrialists that wage rates would be maintained – “The first shock must fall on profits, not on wages”. - This was intended to ensure the well being of the workforce, and that purchasing power remained high. Government money was used to attempt to revitalise the construction industry, thereby creating jobs and stabilising the economy. This belief that the depression would not be severe prevented Hoover from taking more serious action to combat the downturn The Great Depression: Effects 12,830,000 unemployed by 1933, almost 25% - up from 3.2% in 1929 and 8.7% in 1930 - Worse for women and African Americans – in Pittsburgh, blacks made up 8% of the population but 40% of the unemployed. Those who kept their jobs often did so with shorter hours and/or reduced pay - In September 1931 US Steel became the first Corporation to break the 1929 pact with Hoover. 50% of America’s ‘work power’ went unutilised The Great Depression: Effects Unemployment created bread lines, Hoovervilles, Hoover flags and ‘depression pork’. Birth-rate dropped to the lowest in American history, but the suicide rate rose to the highest. Those who had houses, food and clothing often did not have enough for everyone and difficult choices had to be made. African Americans’ experience. The effect on women. Many remained untouched. Rural America “The vast obscurity beyond the city” –F. Scott Fitzgerald 44% of American’s were considered to be rural at the start of the 1930s Most had no indoor plumbing and almost none had electricity More than 1 in 5 working Americans worked on the land The farming economy was in trouble before the Depression. Boom in US farming economy during WWI. Farming Crisis 1920s saw plummeting prices and high unemployment Agricultural Marketing Act, 1929 - Government agreed to purchase surplus crops The Federal government established co-ops between farmers that were intended to prevent overproduction of crops The government could not sustain the program after the depression intensified Conclusion Hoover signed the Relief and Reconstruction Act on July 21st, 1932. This Act allowed $1.5 Bn for ‘self-liquidating’ public works and $300 million in loans to the States for relief purposes. Democratic opposition, Franklin Delano Roosevelt, declared that “relief must be extended by the government, not as a matter of charity, but as a matter of social duty”. FDR won the 1932 election in a landslide and began to put in to motion the programs which, collectively, would be known as the ‘New Deal’ Next Week… The New Deal The Government Response