abc Accounting Consolidated Balance Sheets [ADVANCED HIGHER]

advertisement

![abc Accounting Consolidated Balance Sheets [ADVANCED HIGHER]](http://s2.studylib.net/store/data/013060807_1-80e5b9b7e87689b0571b4665a3a254bc-768x994.png)

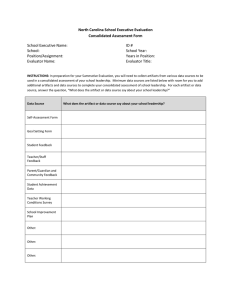

Accounting Consolidated Balance Sheets [ADVANCED HIGHER] Brian Bennie abc Acknowledgement Learning and Teaching Scotland gratefully acknowledge this contribution to the National Qualifications support programme for Accounting. First published 2005 © Learning and Teaching Scotland 2005 This publication may be reproduced in whole or in part for educational purposes by educational establishments in Scotland provided that no profit accrues at any stage. ISBN 1 84399 078 4 © Learning and Teaching Scotland CONTENTS Introduction 4 Section 1: Where control is obtained by buying all of the ordinary shares at balance-sheet value 5 Section 2: Where control is obtained by buying all of the ordinary shares where the subsidiary has reserves 9 Section 3: Where control is obtained by buying all of the ordinary shares at above or below balance-sheet value 13 Section 4: Where control is obtained but not all of the ordinary shares are purchased 17 Section 5: Preparing consolidated balance sheets at a date after purchase Post-acquisition profits Unrealised profits Current accounts 21 21 24 28 Section 6: Writing off goodwill 37 Solutions 47 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 3 CONSOLIDATED BALANCE SHEETS INTRODUCTION When one undertaking (the parent), has gained control of another (the subsidiary), a Consolidated Balance Sheet shows how the group as a whole relates to the outside world, and gives the shareholders in the parent an overall view of the performance of their investment. These notes describe the following possible situations under which control of a subsidiary may be obtained and show how to prepare a consolidated balance sheet at time of purchase in each case: 1. Buying all of the ordinary shares at balance-sheet value. 2. Buying all of the ordinary shares where the subsidiary has reserves. 3. Buying all of the ordinary shares at above or below balance-sheet value. 4. Buying a majority of the ordinary shares. The notes then explain the procedures to be followed and show how to prepare a consolidated balance sheet at the end of subsequent years taking into account: 5. Post-acquisition profits, inter-company dealings, unrealised profits. 6. Writing down of goodwill. All worked examples assume that the parent undertaking is X plc, and that the subsidiary is Y plc. So as not to obscure the principles involved: • Worked examples and answers use a simplified balance sheet layout and many of the headings, dates and groupings required by the Companies Acts, etc. are not used. It could be appropriate, however, for students to use the detailed layout and headings covered in the section of the Advanced Higher course dealing with ‘Final Accounts and Balance Sheets of a plc’ when completing questions 16 onwards and in examinations. • Worked examples use relatively small numbers, not the millions which may be involved in real-life examples. 4 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 1 Where control is obtained by buying all of the ordinary shares at balance-sheet value Example 1 Summarised Balance Sheets prior to purchase Bank Other assets Liabilities £1 Ordinary Shares X plc £ 400 800 1,200 200 1,000 Y plc £ 100 200 300 50 250 1,000 250 X then purchased all of the ordinary shares in Y for £250, paying by cheque. • In the new balance sheet of X, the Bank balance goes down and this is replaced by a new asset ‘Investment in Y plc’. • There is no effect on the balance sheet of Y (the money is paid directly to the shareholders, not to Y). The two balance sheets now appear as: Balance Sheets of …. X plc £ Investment in Y plc 250 Bank 150 800 Other assets 1,200 Liabilities 200 1,000 £1 Ordinary Shares 1,000 Y plc £ 100 200 300 50 250 250 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 5 CONSOLIDATED BALANCE SHEETS To consolidate the balance sheets, it is not simply a case of adding both sets of figures together, although this will in fact happen to many items. It is necessary first of all to eliminate any instances of the same item being included in both balance sheets. Thus the investment in Y, held as an asset by X, which is exactly the same thing as the capital of Y, does not appear in the consolidated balance sheet. Showing all three balance sheets together: £ 250 V 150 800 1,200 200 1,000 Investment in Y Bank Other assets Liabilities £1 Ordinary Shares 1,000 Y plc Consolidated Balance Sheet £ £ 100 200 300 50 250 V X plc 250 Bank Other assets Liabilities £1 Ordinary Shares 250 1,000 1,250 250 1,000 1,000 The same principle of elimination will also apply to: • existing loans between the companies • trading debts between the companies It should be noted that the ordinary share capital of the subsidiary will never appear as an item in the consolidated balance sheet – the ordinary share capital of the group is the same as the ordinary share capital of the parent. 6 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Example 2 (dealing with trading debts between the companies) The following are the balance sheets of X and Y prior to purchase: Bank Debtor Y Other assets Creditors £1 Ordinary Shares X £ 600 100 1,200 1,900 400 1,500 1,500 Bank Other assets Creditors Creditor X £1 Ordinary Shares Y £ 200 600 800 200 100 500 500 X purchases the entire ordinary share capital of Y for £500 paying by cheque. Showing all three balance sheets together: Creditors Creditor X £1 Ordinary Shares Y plc £ Consolidated Balance Sheet £ 200 Bank Other assets 1,500 600 800 200 100 500 1,500 500 £1 Ordinary Shares V Investment in Y Bank Debtor Y Other assets X plc £ 500 100 100 V 1,200 1,900 400 Liabilities 300 1,800 2,100 600 1,500 1,500 Note that the debtor/creditor has been eliminated and does not appear in the consolidated balance sheet. A similar elimination would take place for any loans between the companies. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 7 8 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 2 Where control is obtained by buying all of the ordinary shares where the subsidiary has reserves In addition to paying for the ordinary shares, a purchaser of a company will also pay for any reserves, as these belong to the ordinary shareholders. Once the business is purchased, the new owner will own the shares and the reserves. Example 3 The following are the balance sheets of X and Y prior to purchase: X £ 800 1,400 2,200 Bank Other Assets Bank Other Assets Y £ 300 700 1,000 Creditors 400 1,800 Creditors 400 600 £1 Ordinary Shares Profit and Loss 1,200 600 1,800 £1 Ordinary Shares Profit and Loss 500 100 600 X purchases the entire ordinary share capital of Y for £600 by cheque. Consolidated Balance Sheet of X and Y Bank (800–600+300) Other Assets Creditors £ 500 2,100 2,600 800 1,800 £1 Ordinary Shares 1,200 600 Consolidated Reserves* 1,800 Notice that the reserves of the subsidiary on consolidation are treated exactly the same as its ordinary capital – i.e. they do not appear in the consolidated balance sheet. * This may simply be called ‘profit and loss’, or ‘consolidated profit and loss’. On consolidation, it has the same value as the profit and loss balance of the parent, but as these notes progress, it will be seen that in future years this will include other items. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 9 CONSOLIDATED BALANCE SHEETS Question 1 Big plc has total assets of £4,000 and this is represented by ordinary share capital of the same value. Small plc has total assets of £400 and this is also represented by ordinary share capital of the same value. Big purchased the entire capital of Small at balance sheet value paying by cheque. Prepare the consolidated balance sheet. Question 2 Great plc had the following assets and liabilities: Bank Other Assets Liabilities £ 400 1,300 200 £1 Ordinary Shares 1,500 On the same date, the balance sheet of Small plc showed the following: Bank Other Assets £ 50 200 £1 Ordinary Shares 250 Great purchased the entire capital of Small at balance sheet value paying by cheque. Prepare the consolidated balance sheet. 10 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 3 Large plc has total assets of £40,000 (including £1,000 owing to it by Little plc). It has £5,000 of liabilities and is financed entirely by £1 ordinary shares. Little plc has total assets of £5,000 and £1,500 of liabilities. It is financed entirely by £1 ordinary shares. Large purchased the entire share capital of Little, paying by cheque. Prepare the consolidated balance sheet. Question 4 The following figures are from the summarised balance sheets of Major plc and Minor plc as at 3 May year 1. Buildings Equipment Major £ 10,000 20,000 Minor £ 2,000 1,000 Stocks Debtors Bank 30,000 20,000 30,000 2,000 2,000 800 Creditors 12,000 3,800 98,000 4,000 98,000 3,000 1,000 4,000 Financed by £1 Ordinary Shares Share Premium On the above date, Major purchased the entire capital of Minor for £4,000 paying by cheque. Included in the debtors and creditors figures is £500 owing by Minor to Major. Prepare the consolidated balance sheet as at 3 May year 1. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 11 CONSOLIDATED BALANCE SHEETS Question 5 The following are the Balance Sheets of Town plc and Village plc as at 1 March year 1. Property Machinery Town £ 40,000 30,000 Village £ 5,000 4,000 Stocks Debtors Bank Loan to Village 20,000 30,000 30,000 5,000 5,000 8,000 1,000 Creditors Loan from Town 20,000 135,000 5,000 5,000 13,000 110,000 25,000 135,000 10,000 3,000 13,000 Financed by £1 Ordinary Shares Profit and Loss On the above date: Included in the debtors and creditors figures is £1,000 owing by Town to Village. On 1 March year 1, Town purchased the entire capital of Village at balance sheet value of £13,000, paying by cheque. Prepare the consolidated balance sheet at 1 March year 1. 12 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 3 Where control is obtained by buying all of the ordinary shares at above or below balance-sheet value • Where the amount paid exceeds the balance-sheet value, goodwill is created. • Where the amount paid is less than the balance-sheet value, goodwill with a negative value is created. Thus if the subsidiary has £10,000 £1 ordinary shares and reserves of £4,000 and the business is purchased for £15,000, goodwill of £1,000 is created; if it is purchased for £12,000, negative goodwill of £2,000 is created. Example 4 The following are the Balance Sheets of X and Y prior to purchase. Bank Other Assets X £ 1,000 1,400 2,400 Y £ Bank Other Assets 200 600 800 Creditors 600 1,800 Creditors 300 500 £1 Ordinary Shares Profit and Loss 1,400 400 1,800 £1 Ordinary Shares Profit and Loss 400 100 500 X purchases the entire Ordinary Share Capital of Y for £550 by cheque. Goodwill is therefore valued at £50 (550–(400+100) ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 13 CONSOLIDATED BALANCE SHEETS Consolidated Balance Sheet of X and Y after purchase £ 50 650 2,000 2,700 900 1,800 Goodwill Bank Other Assets Creditors Ordinary Shares Consolidated Reserves 1,400 400 1,800 Question 6 The following are the summarised Balance Sheets of Glasgow plc and Dundee plc prior to purchase on 8 September year 1. Fixed Assets Current Assets Current Liabilities Ordinary Shares Profit and Loss G £ 50,000 25,000 75,000 10,000 65,000 D £ 10,000 6,000 16,000 3,000 13,000 50,000 15,000 65,000 11,000 2,000 13,000 Notes The balance sheets include £1,000 owing by Glasgow to Dundee for goods supplied. Glasgow purchased all of the ordinary share capital of Dundee for £15,000. Prepare the consolidated balance sheet immediately after purchase. 14 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 7 The following are the Balance Sheets of Tay plc and Don plc prior to purchase on 9 May year 1. Buildings Equipment Tay £ 50,000 90,000 Don £ 20,000 10,000 Stocks Debtors Loan to Don Bank 15,000 20,000 5,000 10,000 5,000 4,000 Bank Loan from Tay £1 Ordinary Shares Profit and Loss 3,000 5,000 190,000 31,000 170,000 20,000 190,000 30,000 1,000 31,000 Notes Tay purchases all of the ordinary share capital of Don, paying £28,000 by cheque. Prepare the consolidated balance sheet immediately after purchase. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 15 16 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 4 Where control is obtained but not all of the ordinary shares are purchased Where more than 50%, but less than 100%, of the subsidiary’s ordinary shares are purchased, it follows that some of the ordinary shares will remain in the hands of the original owners. Thus the subsidiary is not wholly owned and the consolidated balance sheet must show this. The ‘top part’ of the balance sheet treats all of the assets and liabilities of the subsidiary as if they were fully owned by the parent. No attempt is made to split items such as machinery or stocks into the amount owned by the parent, and the amount owned by the other shareholders. Instead, all of these items are included at full value, since although they are not fully owned, they are fully under the control of the parent. The ‘capital and reserves’ section of the balance sheet however includes a value for MINORITY INTEREST, i.e. the share of the subsidiary which the parent undertaking does not own and is therefore still owned by the other shareholders of the subsidiary. As before, the ordinary share capital and the reserves of the subsidiary do not appear in the consolidated balance sheet. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 17 CONSOLIDATED BALANCE SHEETS Example 5 Y has 40,000 £1 ordinary shares and reserves of £10,000. X purchases 30,000 shares in Y, paying £42,000 by cheque. Y has a value of X owns 75% of Y Minority Interest owns 25% of Y £50,000 £37,500 £12,500 Minority Interest appears in the ‘financed by’ section of the consolidated balance sheet. It should be shown separately from the other items in this section. The price paid for the business is not relevant to the calculation of Minority Interest. Goodwill, however, will be purchase price less value of Y purchased, i.e. £42,000 less £37,500. Example 6 The following are the summarised balance sheets of X plc and Y plc prior to purchase. Buildings Equipment X £ 40,000 25,000 Y £ 10,000 20,000 Stock Debtors Bank 15,000 10,000 30,000 6,000 3,000 4,000 Creditors 12,000 108,000 3,000 40,000 £1 Ordinary Shares Profit and Loss 100,000 8,000 108,000 36,000 4,000 40,000 X purchased 60% of the ordinary shares of Y for £29,000 paying by cheque. X owns 60% of 40,000 = Minority Interest owns 40% of £40,000 = £24,000 £16,000 Y paid £29,000 for its share of £24,000 – therefore goodwill is £5,000. 18 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Consolidated Balance Sheet £ 5,000 50,000 45,000 100000 Goodwill Buildings Equipment Stock Debtors Bank 21,000 13,000 5,000 39,000 15,000 Creditors Financed by: £1 Ordinary Shares Consolidated Reserves Minority Interest 24,000 124,000 100,000 8,000 108,000 16,000 124,000 Question 8 (a) Calculate Minority Interest and Goodwill in each of the following examples. A B C Total number of £1 ordinary shares 40,000 100,000 50,000 Profit and loss balance (£) 10,000 20,000 5,000 Number of shares purchased 24,000 60,000 40,000 Purchase Price (£) 32,000 78,000 47,000 Minority Interest Goodwill ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 19 CONSOLIDATED BALANCE SHEETS The following are the summarised balance sheets of Parent plc and Child plc prior to purchase on 3 October year 1. Buildings Equipment Parent £ 40,000 60,000 Child £ 20,000 20,000 Stocks Debtors Bank 25,000 20,000 10,000 5,000 4,000 Bank Creditors £1 Ordinary Shares Profit and Loss 14,000 141,000 2,000 2,000 45,000 120,000 21,000 141,000 30,000 15,000 45,000 The share capital of Child consists of £1 ordinary shares. Parent purchases 24,000 of these paying £40,000 by cheque. Parent partly finances this by the issue of 25,000 £1 ordinary shares at a premium of £0.20 per share Included in the balance sheets above is £1,000 owing by Child to Parent for goods purchased. (b) Prepare the Consolidated Balance Sheet on 3 October year 1. (c) Explain how your answer would have been different if the purchase price had been £30,000. 20 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 5 Preparing consolidated balance sheets at a date after purchase So far, the consolidated balance sheet has been drawn up immediately upon the purchase being made. However the situation is ongoing, and it will be necessary to prepare a consolidated balance sheet at the end of each financial year. Goodwill will still be calculated at time of purchase and included in the balance sheet at these values. (See later regarding the writing down of goodwill.) However, there are three new considerations. (i) Post-acquisition profits Any profits made by the subsidiary company after purchase must be shared between the parent and minority interest. This profit will be found by comparing the reserves (profit and loss balances) of the subsidiary at the date of consolidation and at the end of the year in question. Any increase will be treated as a profit, part of which will be added to the consolidated reserves, and part added to the minority interest. This profit is known as ‘POST-ACQUISITION PROFITS’ and will be shared out in proportion to ordinary share ownership. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 21 CONSOLIDATED BALANCE SHEETS Example 7 On 30 September year 1, Y plc has 1,000 £1 ordinary shares and a profit and loss balance of £400. On that date X purchases 60% of these shares for £900. On 31 December of that year, the balance sheet of Y shows a profit and loss balance of £500. On purchase goodwill is valued: Price paid Value taken over (60% of £1,400) Goodwill £900 £840 £60 On purchase minority interest may be calculated: Value of Y £1,400 Value taken over £840 Minority interest (i.e. 40% of £1,400) £560 On preparing consolidated balance sheet at year end: Reserves at purchase £400 Reserves at balance sheet date £500 Post-acquisition profits £100 Which are shared by adding to: Consolidated reserves Minority interest £60 £40 Minority Interest therefore equals £600 (560+40) In most examples it will not be necessary to find minority interest in this way. It can be found simply by taking the closing balance sheet of the subsidiary and applying the minority interest percentage to the total of ordinary capital plus reserves at that date. In the above example: Ordinary shares Reserves at end of year £1,000 500 £1,500 40% of £1,500 = £600 22 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS You should now be aware of the different treatments applied to the reserves of a subsidiary. Any reserves which are in existence at the time of consolidation are included in the initial calculation of goodwill and of minority interest. Changes in the profit and loss balance over the years are included in the calculation of consolidated reserves and of minority interest. In neither case do the reserves appear as separate items in the consolidated balance sheet. Question 9 Complete the table below for each of the four illustrations. DATA (i) (ii) (ii) (iv) 5,000 10,000 25,000 50,000 £1,000 £2,000 £5,000 £5,000 22,500 30,000 At date of purchase £1 Ordinary Shares in subsidiary Reserves in subsidiary Number of ordinary shares purchased 4,000 Price paid 7,500 £5,500 £9,000 £26,000 £37,000 Goodwill At year end Reserves in subsidiary £1,500 £3,000 £6,000 £4,000 Total post-acquisition profits Value added to consolidated reserves Value added to minority interest Final Minority Interest* * Remember that this can be calculated in 2 ways: • Minority Interest at time of purchase plus amount added since purchase, or • Minority Interest % multiplied by value of subsidiary ordinary shares plus reserves at end ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 23 CONSOLIDATED BALANCE SHEETS (ii) Unrealised profits It is an established accounting principle that profit is recognised at point of sale. Assume X buys goods for £100 and sells them to Y for £150. This gives X a profit of £50. If, however, the goods have not yet been sold by Y, from the point of view of the group no goods have actually been sold – and therefore no profit has yet been made by the group. There is also a difference in stock valuation. The goods will have been entered into the books of Y at a cost price of £150, but as far as the group is concerned the cost price is only £100. Therefore, looking at the individual accounts of the two companies results in a profit of £50 and a closing stock of £150, whereas from the group perspective there is no profit and the closing stock is worth only £100. Profits generated in this way are referred to as ‘unrealised profits’ and this must be taken into account when preparing the consolidated balance sheet. It might be worthwhile to recap on paragraph 1, page 4 of these notes, which said: ‘When one company (the parent), gains control of another (the subsidiary), a Consolidated Balance Sheet shows how the group as a whole relates to the outside world.’ It follows then that the group figures, and not the individual company ones, must be shown in the consolidated balance sheet Where goods have been traded between the two companies, when preparing a consolidated balance sheet, any unrealised profits on these goods must be deducted from • consolidated reserves and • consolidated stocks 24 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS A more likely situation is where X has sold goods to Y and at balance sheet date some of them have been sold on. It is then necessary to calculate the amount of over-recorded profit on the ones that have NOT yet been sold. Example 8 X purchases goods at a cost of £1,000. These are sold to Y for £1,500. At balance sheet date, Y has sold 60% of these goods for £1,200. PROFITS SHOWN BY INDIVIDUAL COMPANIES X will record: Sales Purchases Profit Y will record: Sales Purchases Less stock Profit Total profit £1,500 £1,000 £500 £1,200 £1500 £600 £900 £300 £800 PROFITS SHOWN BY GROUP AS A WHOLE Goods costing £600 have been sold for £1,200 = total profit £600 Therefore on consolidation, profit is over-recorded by £200. From the perspective of the group, the closing stock ought to be valued at cost to the group, i.e. £400, not £600. Therefore, on consolidation, closing stock is over-recorded by £200. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 25 CONSOLIDATED BALANCE SHEETS Method: It is not necessary to go through the above process, simply: • Calculate profit made by X as if all goods were sold. £500 • Apply percentage unsold by Y to this figure. 40% • Reduce profits and closing stock by answer. £200 Beware: • The selling price and any profit made by Y is not relevant – this profit has been made and does not require to be adjusted. • Questions may give you the amount sold, or the amount unsold. Question 10 (a) Calculate the adjustment required to consolidated profits and closing stock in each of the following four cases: (i) (ii) (iii) (iv) Cost of goods produced by X £100 £200 £400 £500 Price charged to Y £200 £300 £600 £650 % sold by Y 40% 60% 80% 30% Reduction required in recorded profit Reduction required in stocks (b) At the end of the financial year stocks held by Peter plc and Paul plc were £40,000 and £20,000 respectively and consolidated reserves amounted to £75,000. However, towards the end of the year goods costing £6,000 were sold by Peter to Paul at a mark-up of 25%. At the end of the year 30% of these goods were unsold. Calculate the figures to appear in the year-end balance sheet for (i) (ii) 26 consolidated reserves closing stock ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS (c) At the end of the financial year stocks held by Grand and Petit were £10,000 and £3,000 respectively. However 1,000 units of brand Z had been produced by Grand at a cost of 60p per unit and sold to Petit at a price of 80p per unit. To date, Petit had sold 700 of these for £1.10 each. (i) Calculate the profit recorded by Grand Petit Group (and show unrealised profit) (ii) Calculate the value of the group closing stock. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 27 CONSOLIDATED BALANCE SHEETS (iii) Current accounts Adjustment must be made for any funds in transfer between the companies. In some cases, the two companies operate CURRENT or TRANSFER ACCOUNTS which record transactions between them. Any payments made just before balance sheet date are likely to be recorded in the current account of the paying company, but not yet in the account of the receiving one. To prepare the consolidated balance sheet, assume that any payments recorded by one company have been received by the other. Example 9 On 28 December Y owes X £500 – this is recorded in current accounts in both companies. If balance sheets were to be prepared on that date, Y would have a current liability, X a current asset, and nothing would appear in the consolidated balance sheet. If, however, Y then repays X £200, the transaction would immediately affect the bank and current account in the books of Y, but would probably not reach X by the year end. Extract from balance sheets: Bank Current (asset) Current (liability) Before repayment X Y 4,000 800 500 500 After repayment X Y 4,000 600 500 300 To consolidate, it is necessary to eliminate the current accounts and adjust the total bank balance. Thus the consolidated balance sheet will show only the bank figure of £4,800 (not £4,600). The ‘missing £200’ belongs to the group – it has to be included in its balance sheet. 28 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 11 On 1 July year 1, the balance sheet of Valley plc contained the following: Debtors Stocks Debentures £1 Ordinary Shares Profit and Loss (a) £ 5,000 4,000 10,000 30,000 6,000 If, on the above date, ordinary shares in Valley were purchased by Glen plc, calculate the goodwill (if any) in each of the following possible situations: (i) 20,000 £1 shares were purchased for £25,000 (ii) 22,500 £1 shares were purchased for £30,000 (iii) 18,000 £1 shares were purchased for £23,000 (iv) 5,000 £1 shares were purchased for £7,000 (b) Calculate the value of the minority interest in each of the above situations. (c) During years 4 to 6 goods were sold by Glen to Valley. Calculate the adjustment required to consolidated profits in each of the following possible situations: (i) Year 4 – Goods costing £3,000 were sold for £5,000 and 80% of these are unsold by Valley (ii) Year 5 – Goods costing £2,000 were sold at a mark-up of 25% and 60% of these are unsold by Valley (iii) Year 6 – Goods costing £4,200 were sold at a gross profit of 25% on sales. Valley had sold 60% of these for £6,000. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 29 CONSOLIDATED BALANCE SHEETS (d) At the end of years 2 to 4, the profit and loss balances of Valley were as shown below. Calculate the adjustment required to consolidated reserves in each year for option (i) in (a) above. (i) Year 2 (ii) Year 3 (iii) Year 4 30 £7,200 £5,700 £9,000 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 12 On 1 September year 1, the balance sheet of Foggie plc contained 40,000 £1 ordinary shares and a profit and loss balance of £10,000. When Turra plc gained control of Foggie plc on the above date, goodwill was calculated to be £5,000. (a) Calculate the purchase price in each of the following possible situations: (i) 25,000 ordinary shares were purchased (ii) 30,000 ordinary shares were purchased (iii) 35,000 ordinary shares were purchased (b) If on 31 December year 2, the profit and loss balance of Foggie was £12,000, calculate the minority interest in each of the above situations. (c) Turra manufactures products at a cost of £2 per unit. During year 4, 5,000 units were sold to Foggie: Calculate the unrealised profits under each of the following possible arrangements: (i) Mark-up on cost was 20%, 3,000 units were sold by Foggie. (ii) Selling price to Foggie was £3, and these were then resold to customers for £5. 800 units were unsold. (iii) Goods were sold at a price to allow Turra a gross profit ratio of 50%. Foggie has 2,500 units in stock. (d) The balance sheet of Foggie on 31 December year 6 included the following which were financed by ordinary shares and reserves Fixed Assets: Current Assets: Current Liabilities Debentures £ 50,000 20,000 5,000 5,000 Calculate the minority interest in each of the possibilities in (a) above. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 31 CONSOLIDATED BALANCE SHEETS Question 13 On 1 July year 1 Grant plc purchased 1,275 ordinary shares in Baker plc, paying £5,300 by cheque. At the time of purchase, Baker’s profit and loss account balance was £1,000 and share premium was £500. During the year Grant sold goods to Baker to the value of £900 being cost plus 25%. An estimated 65% of these were unsold at the end of the year. A cheque for £300 sent to clear a current account balance was in transit at balance sheet date. The following are the balance sheets of Grant plc and Baker plc: Balance Sheets as at 31 December year 1 £ Fixed Assets Buildings Investment in Baker plc Current Assets Stocks Debtors Current Account Bank £ 17,000 5,300 22,300 1,200 1,500 300 50 3,050 Current Liabilities Creditors 5,600 Long-term Loans Capital and Reserves £1 Ordinary Shares Share Premium Revaluation Reserve Profit and Loss 32 Grant £ Baker £ 4,900 800 260 400 1,460 –2,550 19,750 6,000 13,750 6,500 600 4,500 2,150 13,750 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 800 660 5,560 1,300 4,260 1,500 500 2,260 4,260 CONSOLIDATED BALANCE SHEETS (a) Calculate: (i) (ii) (iii) (iv) (v) (b) Goodwill Post-acquisition profits Unrealised profits in stock holdings Minority Interest at 31 December Consolidated Reserves at 31 December Prepare the consolidated balance sheet as at 31 December year 1. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 33 CONSOLIDATED BALANCE SHEETS Question 14 On 1 July year 1 Dawson plc purchased 80% of the ordinary shares of Smith plc, paying £7,000 by cheque. At the time of purchase, Smith’s profit and loss account balance was £1,200. During the year Dawson produced goods at a cost of £800 which were then sold to Smith at cost plus 25%. An estimated 40% of these goods were unsold by Smith at the end of year 1. There is a cheque in transit between the companies. The following are the balance sheets of Dawson plc and Smith plc: Balance Sheets as at 31 December year 1 Fixed Assets Buildings Investment in Smith plc Current Assets Stocks Debtors Current Bank £ 3,000 2,200 300 4,000 9,500 Current Liabilities Creditors Current Revaluation Reserve Profit and Loss 4,000 3,000 6,000 400 4,600 7,000 39,000 2,000 37,000 Capital and Reserves £1 Ordinary Shares £ Smith £ 6,000 3,000 1,200 2,500 Long-term Loans 34 Dawson £ 25,000 7,000 32,000 600 200 3,800 9,800 2,700 7,100 30,000 5,000 7,000 37,000 2,100 7,100 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS (a) Calculate: (i) (ii) (iii) (iv) (b) Goodwill Post-acquisition profits Unrealised profits in stock holdings Consolidated reserves at 31 December year 1. Prepare the consolidated balance sheet as at 31 December year 1. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 35 CONSOLIDATED BALANCE SHEETS Question 15 On 1 July year 1 Strachan plc purchased 3,000 £1 ordinary shares of Mackenzie plc, paying £1.50 per share by cheque. At the time of purchase, Mackenzie’ profit and loss account balance was £1,200 and share premium was £400. During the year goods were traded between the companies at a profit of £100. An estimated 75% of these are unsold at the end of the year. Balance Sheets as at 31 December year 1 Fixed Assets Buildings Equipment Investment in Mackenzie plc Current Assets Stocks Debtors Bank £ 5,000 3,400 3,000 11,400 Current Liabilities Creditors 2,500 Debentures Capital and Reserves £1 Ordinary Shares Share Premium Revaluation Reserve Profit and Loss (a) 36 £ 4,800 3,000 1,200 4,200 8,900 44,500 1,500 43,000 1,000 32,000 4,000 2,000 5,000 Mackenzie £ 4,000 800 3,200 8,000 1,000 7,000 5,000 400 11,000 43,000 1,600 2,000 7,000 Calculate: (i) (ii) (b) Strachan £ 30,000 1,100 4,500 35,600 Goodwill Shares of post-acquisition profits Prepare the consolidated balance sheet as at 31 December year 1. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SECTION 6 Writing off goodwill FRS 10 states that positive purchased goodwill should be capitalised and, unless it has an indefinite life, it should be amortised over its useful life by the straight-line method. The consequence of this is that the value of goodwill calculated on purchase will gradually be reduced over a number of years. The ‘balancing entry’ will be to reduce consolidated reserves by a similar amount. Thus, if goodwill on consolidation is calculated to be £3,000 and this is to be amortised over 10 years, £300 will be deducted from the goodwill figure and from consolidated reserves each year. In the first year, depending upon the date of acquisition and company policy, a full year’s charge may be made, or a proportion or none at all. The answer to question 15 should have included: Goodwill £540 Consolidated Reserves £5,165 If the figures had related to year 3, and goodwill had to be written down by a full 10% each for each of the 3 years, the balance sheet would then have shown: Goodwill Consolidated Reserves £378 i.e. down 3 times 54 £5,003 i.e. down 3 times 54 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 37 CONSOLIDATED BALANCE SHEETS Summary In any consolidation question you are likely to be required to do the following: 38 1. Calculate GOODWILL at time of purchase, i.e. purchase price less (percentage of ordinary shares purchased times subsidiary’s ordinary shares and reserves). 2. ELIMINATE common items, e.g. investment held by parent and ordinary shares and reserves of subsidiary, current or transfer accounts, loans. 3. Calculate POST-ACQUISITION PROFITS – increase in subsidiary’s reserves since purchase has to be shared and relevant amount added to consolidated reserves (and depending upon method used, also added to minority interest if already calculated). 4. Calculate UNREALISED PROFITS – ‘profits’ on unsold goods deducted from consolidated reserves and stock values. 5. Write down GOODWILL based on straight-line method – also reduce consolidated reserves. 6. Calculate CONSOLIDATED RESERVES taking into account the above changes. 7. Calculate MINORITY INTEREST – i.e. relevant percentage of ordinary shares and reserves in subsidiary’s balance sheet. 8. Complete CONSOLIDATED BALANCE SHEET. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 16 On 1 January year 1 Tay plc purchased 9,000 £1 ordinary shares in Don plc for a total of £14,200. On that date the reserves of Don included a profit and loss of £2,800. During December of year 3 Tay sold goods to Don. These had cost £600 to produce and were sold at a price allowing Tay a gross profit of 25% on sales. Only 40% of these goods had been sold by Don by 31 December year 3. During the last week of year 3, a cheque for £300 had been sent by Don to Tay, but this had not been received by Tay by the end of the year. Goodwill is to be written down by 10% (straight line) for each year. Balance Sheets on 31 December year 3 £ Fixed Assets Buildings Machinery Investment in Don plc Current Assets Stocks Debtors Current Account Bank Tay £ 40,000 25,000 14,200 79,200 5,000 4,000 400 1,000 10,400 Current Liabilities Creditors Current Account £ 2,500 10,000 12,000 22,000 1,000 500 100 1,600 7,900 800 100 87,100 15,000 72,100 Long-term Loans Capital and Reserves £1 Ordinary Shares Share Premium Revaluation Reserve Profit and Loss 55,000 6,000 5,400 5,700 Don £ 700 22,700 6,000 16,700 12,000 1,800 17,100 72,100 2,900 4,700 16,700 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 39 CONSOLIDATED BALANCE SHEETS (a) Calculate: (i) Goodwill (ii) Shares of post-acquisition profits (iii) Unrealised profits in stock holding (b) 40 Prepare the consolidated balance sheet as at 31 December year 3. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 17 A gained control of B in September year 1, purchasing 3,500 £1 ordinary shares for £6,050. On that date B’s share premium and profit and loss balance amounted to £1,200. (a) Calculate goodwill at that date. During year 3 A sold goods to B for £2,000 at a mark-up of 25% on cost. On 31 December of that year 65% of these goods are unsold. In addition on that date there is a cheque for £100 in transit. Company policy is to depreciate goodwill by 10% per annum (straight line) for each complete year of ownership. (b) Prepare the consolidated balance sheet as at 31 December year 3. Balance Sheets as at 31 December year 3 £ Fixed Assets Buildings Investment in B plc A £ 18,000 6,050 24,050 Current Assets Stocks Debtors Current Account Bank 1,200 1,900 100 2,350 5,550 Current Liabilities Creditors 4,600 Long-term Loans Capital and Reserves £1 Ordinary Shares Share Premium Revaluation Reserve Profit and Loss 4,900 4,900 900 450 200 1,550 950 25,000 3,000 22,000 550 15,000 2,500 3,000 1,500 B £ £ 1,000 5,900 500 5,400 4,000 1,000 7,000 22,000 400 1,400 5,400 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 41 CONSOLIDATED BALANCE SHEETS Question 18 On 1 April year 1, Central plc purchased 5,000 £1 ordinary shares in Belt plc for £1.50 per share. At that date, Belt’s balance sheet contained: 10% Debentures £1 Ordinary Shares Share Premium Profit and Loss £ 6,000 8,000 600 1,400 On 31 December year 4, the Balance Sheets were: £ Buildings Investment in Belt plc Stocks Debtors Bank Current Central £ 40,000 7,500 47,500 £ 2,500 3,000 1,000 1,200 7,700 Current Creditors 3,000 Belt £ 5,400 2,500 500 8,400 4,700 52,200 900 2,100 3,000 Debentures £1 Ordinary Shares Share Premium Profit and Loss 42 10,000 12,200 £ 10,000 5,400 15,400 52,200 6,000 9,400 30,000 8,000 22,200 52,200 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 600 800 1,400 9,400 CONSOLIDATED BALANCE SHEETS Goodwill is to be written down on a monthly basis at a rate of 8% per annum. During the course of the month of December, goods costing £1,000 were sold by Central to Belt at a mark-up of 40%. 30% of these goods remain unsold. There is money in transit at the end of the year. Prepare the Consolidated Balance Sheet at the end of year 4. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 43 CONSOLIDATED BALANCE SHEETS Question 19 1. Primary became a plc in year 1 when it issued 200,000 25p ordinary shares to the public at a premium of 10p per share. 2. On 28 April year 3, Academy plc gained control of Primary Plc by purchasing 160,000 ordinary shares for £65,000. 3. The purchase of Primary was mainly financed by the issue of 40,000 £1 ordinary shares in Academy for £1.40 each. 4. On the date of purchase, the Profit and Loss balance of Primary was calculated to be £5,000. (a) Select the information from above and calculate as at 28 April, year 3: (i) (ii) Goodwill Minority Interest On 31 December year 6, the individual balance sheets of Academy and Primary include: Stocks Profit and Loss Academy £ 5,000 7,000 Primary £ 3,000 6,000 Stocks held by Primary include 500 units which were purchased from Academy for £5 per unit. (cost plus 25%) Goodwill has been written down so that it is now 75% of its value on creation. (b) From the above information calculate as at 31 December year 6. (i) (ii) (iii) (iv) 44 Goodwill Minority Interest Consolidated Stock Consolidated Reserves ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 20 Explain the meaning, significance and treatment of each of the following terms. (a) (b) (c) (d) Goodwill Minority Interest Consolidated Reserves Post-Acquisition Profits ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 45 CONSOLIDATED BALANCE SHEETS Question 21 On 27 November year 1, High plc purchased 20,000 50p ordinary shares in Low plc. At that date, Low’s balance sheet contained: £ 15,000 3,000 Ordinary Shares Profit and Loss On 31 December year 3, the Balance Sheets were: £ £ Buildings Machinery Investment in Low plc Stocks Debtors Bank Current Creditors High £ Low £ 30,000 3,000 14,500 47,500 10,000 6,200 3,500 2,000 1,000 2,200 8,700 3,000 16,200 3,400 1,500 1,500 6,400 5,700 53,200 1,000 5,400 21,600 Debentures 1,000 52,200 3,000 18,600 Ordinary Shares 30,000 15,000 22,200 52,200 3,600 18,600 Share Premium Profit and Loss 5,000 17,200 Goodwill is to be written down at 10% per annum. During the course of the month of December, goods costing £600 were sold by High to Low at a mark-up of 30%. 80% of these goods have been sold. There is money in transit at the end of the year. Prepare the Consolidated Balance Sheet at the end of year 3. 46 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS SOLUTIONS Solutions – showing essential information only Question 1 Consolidated Balance Sheet of Big and Small Total Assets 4,000 Capital 4,000 Question 2 Consolidated Balance Sheet of Great and Small Bank Other Assets 200 1,500 1,700 200 1,500 Liabilities Ordinary Share Capital (400–250+50) 1,500 Question 3 Consolidated Balance Sheet of Little and Large Total Assets 40,500 (40000–1000–3500+5000) Total Liabilities 5,500 35,000 (5000–1000+1500) Ordinary Share Capital 35,000 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 47 CONSOLIDATED BALANCE SHEETS Question 4 Consolidated Balance Sheet of Major and Minor as at 3 May year 1 Buildings Equipment 12,000 21,000 Stocks Debtors Bank 32,000 21,500 26,800 80,300 15,300 Creditors 33,000 65,000 98,000 Ordinary Share Capital 98,000 Question 5 Consolidated Balance Sheet of Town and Village as at 1 May year 1 Property Machinery 45,000 34,000 79,000 Stocks Debtors Bank 25,000 37,000 18,000 80,000 Creditors 24,000 (30000+1000–13000) 56,000 135,000 Ordinary Share Capital Consolidated Reserves 48 110,000 25,000 135,000 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 6 Consolidated Balance Sheet of Glasgow and Dundee as at 8 September year 1. Goodwill Other Fixed Assets Current Assets Current Liabilities 2,000 60,000 15,000 12,000 £1 Ordinary Shares Consolidated Reserves 62,000 (25000+6000–15000–1000) 3,000 65,000 50,000 15,000 65,000 Question 7 Consolidated Balance Sheet of Tay and Don as at 9 May year 1 Goodwill Buildings Equipment –3,000 70,000 100,000 Stocks Debtors 20,000 24,000 44,000 21,000 Bank £1 Ordinary Shares Consolidated Reserves (28000–31000) 167,000 23,000 190,000 (10000–3000–28000) 170,000 20,000 190,000 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 49 CONSOLIDATED BALANCE SHEETS Question 8 (a) A C Total number of £1 ordinary shares 40,000 100,000 50,000 Profit and loss balance (£) 10,000 20,000 5,000 Number of shares purchased 24,000 60,000 40,000 Purchase Price (£) 32,000 78,000 47,000 Minority Interest £20,000 £48,000 £11,000 Goodwill (b) B £2,000 £6,000 £3,000 Consolidated Balance Sheet of Parent and Child as at 3 October year 1. Goodwill Buildings Equipment 4,000 60,000 80,000 144,000 Stocks Debtors 30,000 23,000 53,000 Creditors Bank 15,000 2,000 17,000 Ordinary Share Capital Share Premium Consolidated Reserves Minority Interest 36,000 180,000 145,000 5,000 21,000 171,000 9,000 180,000 Goodwill = 40000 – 80% × 45000 Minority Interest = 20% × 45000 (c) 50 If purchase price was £10,000 less, then Goodwill would be a negative of £6,000. Bank balance would have been £10,000 higher. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 9 DATA (i) (ii) (ii) (iv) 5,000 10,000 25,000 50,000 £1,000 £2,000 £5,000 £5,000 4,000 7,500 22,500 30,000 Price paid £5,500 £9,000 £26,000 £37,000 Goodwill £700 nil £1,000** £4,000 At date of purchase £1 Ordinary Shares in subsidiary Reserves in subsidiary Number of ordinary shares purchased At year end Reserves in subsidiary £1500 £3000 £6000 £4000 Total post acquisition profits £500 £1,000 Value added to consolidated reserves £400 £750 £900 £-600 Value added to minority interest £100 £250 £100 –£400 £1,000 –£1,000 Final Minority Interest* £1,300 £3,250 £3,100 £21,600 * 20% of 25% of 10% of 40% of £6,500 £13,000 £31,000 £54,000 ** Note that this is negative. ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 51 CONSOLIDATED BALANCE SHEETS Question 10 (a) (i) (iii) (iv) Cost of goods sold by X £100 £200 £400 £500 Selling price to Y £200 £300 £600 £650 % sold by Y 40% 60% 80% 30% Reduction required in recorded profit £60 £40 £40 £105 Reduction required in stocks £60 £40 £40 £105 (b) (i) (ii) consolidated reserves closing stock (c) (i) Grand 1,000 × 20p = Petit 700 × 30p = Group 700 × 50p = Unrealised profit 300 × 20p = Closing stock (ii) 52 (ii) £74,550 £59,550 £200 £210 £350 £60 £12,940 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 11 (a) (b) (c) (d) Goodwill (i) 25000 – (2/3 × 36000) = (ii) 30000 – (3/4 × 36000) = (iii) 23000 – (3/5 × 36000) = (iv) not applicable, less than 50% £1,000 £3,000 £1,400 of shares purchased Minority Interest (i) 1/3 × 36000 = (ii) 1/4 × 36000 = (iii) 2/5 × 36000 = £12,000 £9,000 £14,400 Unrealised profits (i) 2000 × 80% = (ii) 500 × 60% = (iii) 1400 × 40% = £1,600 £300 £560 Post-acquisition profits (i) (7200 – 6000) × 2/3 = (ii) (5700 – 6000) × 2/3 = (iii) (9000 – 6000) × 2/3 = £800 –£200 £2,000 Question 12 (a) (b) (c) (d) Purchase Price (i) 31250 + 5000 = (ii) 37500 + 5000 = (iii) 43750 + 5000 = £36,250 £42,500 £48,750 Minority Interest (i) 15/40 × 52000 = (ii) 10/40 × 52000 = (iii) 5/40 × 52000 = £19,500 £13,000 £6,500 Unrealised profits (i) (20% × £2) × 2000 = (ii) £1 × 800 = (iii) £2 × 2500 = Minority Interest (i) 15/40 × 60000 = (ii) 10/40 × 60000 = (iii) 5/40 × 60000 = £800 £800 £5,000 £22,500 £15,000 £7,500 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 53 CONSOLIDATED BALANCE SHEETS Question 13 (a) Goodwill 5300 – (85% of 3000) = £2,750 (i) Post-Acquisition Profits = 2260 – 1000 = £1,260 (ii) Unrealised Profit 900 × 20% = 180 × 65% = (iii) Minority Interest 15% of 4,260 = £117 £639 (iv) Consolidated Reserves 2150 + (85% × 1260) – 117 = £3,104 (b) Consolidated Balance Sheet as at 31 December year 1. Goodwill Buildings 2,750 21,900 Stocks Debtors Bank 1,883 1,760 750 4,393 6,400 Creditors Long-term Loan Share Capital Share Premium Revaluation Reserve Consolidated Reserves -2,007 22,643 7,300 15,343 6,500 600 4,500 3,104 Minority Interest 54 24,650 8,204 14,704 639 15,343 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 14 (a) (i) Goodwill = 7000 – (80% × 6200) = (ii) Post-acquisition Profits = 2100–1200 = £900 (split 720/180) £2,040 (iii) Unrealised Profits = 40% × (800 × 25%) = £80 (iv) Consolidated Reserves = 3000 + (80% × 900) – 80 = £3,640 (b) Consolidated Balance Sheet at 31 December year 1 Goodwill Buildings 2,040 31,000 Stocks Debtors Bank 5,920 3,400 4,500 13,820 3,100 Creditors Long-term Loan Share Capital Revaluation Reserve Consolidated Reserves Minority Interest 33,040 10,720 43,760 4,700 39,060 30,000 4,000 3,640 7,640 37,640 1,420 39,060 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 55 CONSOLIDATED BALANCE SHEETS Question 15 (a) (b) (i) Goodwill = 4500 – (6600 × 3/5) = £540 (ii) Post-acquisition profits 1600–1200 = £400, divided consolidated reserves 240, minority interest 160 Consolidated Balance Sheet at 31 December year 1 Goodwill Buildings Equipment 540 34,000 1,900 36,640 Stocks Debtors Bank 7,925 4,600 3,000 15,525 3,500 Creditors Long-term Loan Share Capital Share Premium Revaluation Reserve Consolidated Reserves 32,000 4,000 2,000 5,165 Minority Interest 56 12,025 48,465 2,500 45,965 11,165 43,165 2,800 45,965 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 16 (a) (i) (ii) Goodwill = 14200 – (3/4 × 16600) = £1,750 Less 3 × 175 = £525 Post-acquisition profits = £1,225 £100 split 75/25 (iii) Unrealised profits cost 600, selling price 800, profit 200, unsold 60% = (b) £120 Consolidated Balance Sheet as at 31 December year 3 Goodwill Buildings Machinery 1,225 50,000 37,000 Stocks Debtors Bank 5,880 4,500 1,400 11,780 3,300 Creditors Long Term Loan Share Capital Share Premium Revaluation Reserve Consolidated Reserves Minority Interest 88,225 8,480 96,705 21,000 75,705 55,000 6,000 5,400 5,130 16,530 71,530 4,175 75,705 Working Consolidated reserves = 5700 + 75 – 120 – 525 = Minority interest ¼ × 16700 = £5,130 £4,175 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 57 CONSOLIDATED BALANCE SHEETS Question 17 (a) Goodwill = 6050 – (7/8 × 5200) = 1500 – 300 = £1,200 (b) Consolidated balance sheet as at 31 December year 3 Goodwill Buildings 1,200 22,900 Stocks Debtors Bank 1,840 2,350 2,650 6,840 5,150 Creditors Long-term Loan Share Capital Share Premium Revaluation Reserve Consolidated Reserves 24,100 1,690 25,790 3,500 22,290 15,000 2,500 3,000 1,115 Minority Interest 6,115 21,615 675 22,290 Working Minority interest = 5400 × 1/8 = £675 Unrealised profits = cost 1600, selling 2000, profit 400 × 65% = £260 Post-acquisition profits = Consolidated Reserves 1500 +175 –260 – 300 = 58 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland £200 split 175/25 £1,115 CONSOLIDATED BALANCE SHEETS Question 18 Consolidated Balance Sheet of Central and Belt as at 31 December year 4 £ £ 875 50,000 50,875 Goodwill Buildings Stocks Debtors Bank 7,780 5,500 1,800 15,080 5,100 Creditors 9,980 60,855 6,000 54,855 Debentures Ordinary Share Capital Share Premium Consolidated Reserves 30,000 10,000 11,330 21,330 51,330 Minority Interest 3,525 54,855 Working Goodwill = 7500 – (5/8 × 10000) = Written down by 30% = Final value Consolidated reserves 12200 – 375 – 375 – 120 = Minority Interest 9400 × 3/8 = 1250 375 £875 £11,330 £3,525 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 59 CONSOLIDATED BALANCE SHEETS Question 19 (a) (b) (i) Goodwill = 65,000 – 80% × (50,000 + 20,000 + 5,000) = £5,000 (ii) Minority Interest = 20% × (50,000 + 20,000 + 5,000) = £15,000 (i) Goodwill = 75% × 5,000 = (ii) Minority Interest = 15000 + 20% × (6000 – 5000) = (iii) Consolidated Stock = 8000 – 500 = £3,750 £15,200 £7,500 (iv) Consolidated Reserves = 7000+(80% × 6000 – 5000)– (25% × 5000) – (500 × 1) = £6,050 60 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland CONSOLIDATED BALANCE SHEETS Question 20 Goodwill • The purchase price less appropriate proportion of ordinary shares plus reserves • Calculated on consolidation • Appears in the balance sheet as a fixed asset • May be written down over a number of years Minority Interest • The value of that part of the group not under the control of the parent • Calculated by applying the percentage of ordinary shares not purchased to the total of ordinary shares plus reserves • Appears separately from other parts of the ‘capital and reserves’ section of the balance sheet Consolidated Balance Sheet • A statement showing an overall view of the group as a whole, as opposed to its individual parts • Contains the totals for many items but must eliminate common items such as current accounts • Does not show the capital or reserves of the subsidiary Post-Acquisition Profits • Profits made by subsidiary after purchase • Belong to group and to minority interest in proportion to share of ordinary shares Unrealised Profits • Arises where goods have been sold by, e.g. parent to subsidiary and not all of these goods have been sold by subsidiary • Profits counted by parent on unsold goods by subsidiary must be discounted • Consolidated reserves and stock values must be reduced ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland 61 CONSOLIDATED BALANCE SHEETS Question 21 Balance Sheet as at 31 December year 3 Goodwill Buildings Machinery 2,000 40,000 9,200 51,200 Stocks Debtors Bank 6,864 3,500 4,700 15,064 4,000 Creditors Debentures Ordinary Shares Share Premium Consolidated Reserves 11,064 62,264 4,000 58,264 30,000 5,000 17,064 Minority Interest 22,064 52,064 6,200 58,264 Goodwill = 14,500 – 2/3 × 18,000 = 2,500 Less 10% for 2 years = Unrealised Profits = 180 × 20% = 62 ACCOUNTING (ADVANCED HIGHER) © Learning and Teaching Scotland £2,000 £36