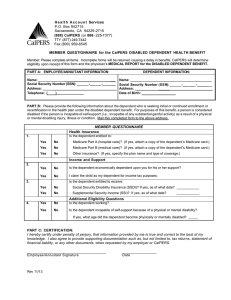

Service Credit Purchase Options A Guide to Your CalPERS

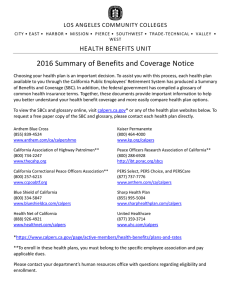

advertisement