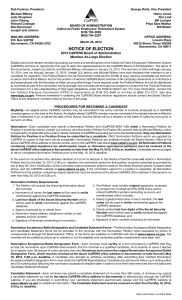

GASB Pension Changes CAJPA 201

advertisement

GASB PENSION CHANGES Planning For Retirement In A World Of Alternative Realities Jeffrey C. Chang What Are We Talking About? • Potential for huge impact on public agency financials – expect greater balance sheet volatility • New burdens on plans • A reality disconnect between plan liabilities and plan funding In Plain English • CalSTRS Fact Sheet: Under the proposed standards…NPL placed on a medium sized school's balance sheet more than doubled their liability and showed a negative fund balance In Plain English • Center for Retirement Research (CRR): The funded ratio for a significant sample of state and local plans will decline in 2010* from 77% to 53% *(The latest year for which data was available) Effects Vary Significantly For Some It's Quite Scary • CRR study: Based on proposed GASBrequired assumptions, approximately 30 of the nation's largest public retirement systems "could" run out of money to pay benefits within 25 years Implications Of New Liabilities You need to examine potential impacts of increased liabilities: – All lending/credit arrangements – Contractual covenants – LOCs; current ratios – Impairment of general assets used to pool/share risk – Impact on borrowing costs Plans' Response • Most observers say the new GASBproscribed discount rates will not be widely adopted by plans' administrative boards • But it is anticipated that a large number of plans will eventually move toward the use of shorter amortization periods Anything We Learn From The Private Sector's Experience? • 1975 – 2006: Private sector DBPs declined from over 100,000 plans to fewer than 30,000 • 1975: 75% of workers in DBPS • 2005: > 75% in DCPs instead • Decline greatest in small plans • Decline amongst collectively bargained plans much slower Why Public Sector Probably Won't See The Same Trend • Until the law is clarified, employer's right to freeze or reduce benefits appears to be severely limited • CalPERS doesn't help matters – and presents another obstacle • Many public agencies must deal with wellorganized and litigious unions Impairment Of Contract Doctrine • Federal and State Constitutions prohibit "impairment of contract" • California courts have said State constitution creates a "vested right" of public employees with respect to their pension benefits • This right arises at the time of employment Impairment Of Contract Doctrine The Billion $ Question Do employee's rights under the constitution prevent a public agency from reducing future, unearned benefits? Impairment Of Contract Doctrine • Current majority view: You cannot change a formula for actives without at least replacing it with something "comparable" • The minority view: Future, unaccrued benefits can be modified or eliminated No Help From CalPERS • CalPERS, an independent system with its own rules and no clear oversight • Even if there is no impairment, CalPERS rules may not allow it • In 2011, CalPERS tightened its contract termination rules – much more expensive to leave Must Deal With Unions • JPAs with unions must also deal with MMB Act issues • Often, unions negotiate benefit concessions that can't be provided on the tax basis they believe Your Options Depend on whether you: 1. Have union employees 2. Are in CalPERS (or a large multipleemployer plan) 3. Are willing to take on risk of litigation 4. Have a governing board with the political will to make tough choices The Principal Options? In CalPERS 1. Increase employees' contributions or cost-share 2. Create new benefits tiers 3. Seek re-amortization of employer contributions 4. Terminate contract (subject to new rules) The Principal Options? Not in CalPERS (e.g., single employer DBP): 1. Employer can negotiate with unions to modify, freeze or terminate pension benefits 2. Unions that won't agree to a modification or reduction, may agree to to increased employee contribution Potential Wildcards? 1. Municipal bankruptcy – Although Vallejo and Stockton declared, not clear whether Chapter 9 trumps vested rights – Interesting issue about funding of CalPERS while in bankruptcy 2. Pension reform Potential Wildcards? 3. Local pension reform initiatives (San Diego and San Jose) 4. Positive clarification of case law