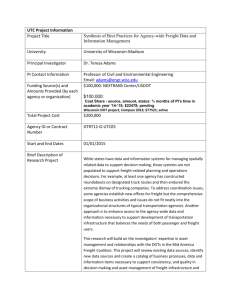

Identification of Massachusetts Freight Issues and Priorities By

advertisement