Performance Management Accountability Meeting Richard A. Davey,

advertisement

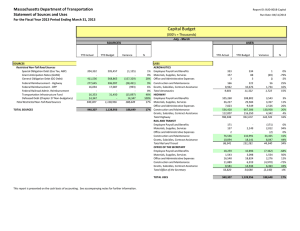

Performance Management Accountability Meeting Data as of October, 2012 Richard A. Davey, Secretary & CEO Office of Performance Management and Innovation Celia J. Blue, Assistant Secretary November 27, 2012 November, 2012 Table of Contents EXECUTIVE SUMMARY.................................................................................................................................................................. 3 MASSDOT GOALS......................................................................................................................................................................... 4 ORGANIZATION-WIDE PERFORMANCE DASHBOARD..................................................................................................................... 5 AERONAUTICS PERFORMANCE DASHBOARD................................................................................................................................. 6 AERONAUTICS – SAFETY............................................................................................................................................................... 7 AERONAUTICS – FISCAL RESPONSIBILITY....................................................................................................................................... 8 HIGHWAY PERFORMANCE DASHBOARD........................................................................................................................................ 9 HIGHWAY – SAFETY....................................................................................................................................................................... 12 HIGHWAY – CUSTOMER SERVICE.................................................................................................................................................. 14 HIGHWAY – EMPLOYEES............................................................................................................................................................... 15 HIGHWAY – FISCAL RESPONSIBILITY.............................................................................................................................................. 16 HIGHWAY – INNOVATION............................................................................................................................................................. 19 RAIL & TRANSIT PERFORMANCE DASHBOARD.............................................................................................................................. 20 RAIL & TRANSIT – SAFETY............................................................................................................................................................. 23 RAIL & TRANSIT – CUSTOMER SERVICE......................................................................................................................................... 24 RAIL & TRANSIT – EMPLOYEES...................................................................................................................................................... 27 RAIL & TRANSIT – FISCAL RESPONSIBILITY..................................................................................................................................... 28 RAIL & TRANSIT – INNOVATION.................................................................................................................................................... 30 RMV PERFORMANCE DASHBOARD............................................................................................................................................... 31 RMV – SAFETY.............................................................................................................................................................................. 33 RMV – CUSTOMER SERVICE.......................................................................................................................................................... 34 RMV – FISCAL RESPONSIBILITY...................................................................................................................................................... MASSDOT – EMPLOYEES............................................................................................................................................................... 2 37 38 November, 2012 Executive Summary MassDOT is currently underway with its Strategic Planning “Refresh “process. The Office of Performance Management and Innovation has been working with the Senior Leadership team to define an expanded set of goals, and metrics for Phase II of MassDOT’s Performance Management development. We will continue our efforts to drive improvements in our data collection, analysis, and reporting. As we build on the areas in which we are performing well, we will strive for improvement in areas that do not meet our expectations of excellence. Through a process of continuous innovation and improvement we will move toward our vision of national leadership in results driven management. Below is a summary of Division highlights contained in this report. • Aeronautics Airport inspections are behind schedule but are projected to meet calendar year-end target. • Highway Bridge health is meeting expectations. IRI measure of pavement conditions exceeds target for FY2011. NHS roadway conditions for FY2011 did not meet PSI expectations. On-time projects need improvement. On-budget projects have improved and are close to expectations. • MBTA/ Rail and Transit On-time performance improving on several lines. Other data not available. • RMV Junior Operator accidents data status changed to “Under Development” as it appears data collection process might be unreliable and needs further review. Branch and call center wait times have improved but are not meeting expectations. Road test wait times have increased. ALARS system upgrade is on schedule. 3 November, 2012 MassDOT Goals Vision: Leading the Nation in Transportation Excellence Mission: Deliver excellent customer service to people who travel in the Commonwealth, and provide our nation’s safest and most reliable transportation system in a way that strengthens our economy and quality of life. We are one transportation organization focused on customer service and safety. MassDOT Goals: (draft) Safety – Work with unwavering commitment to the safety of the public and employees. Minimize risks and injuries through thoughtful design, construction, oversight and employee empowerment. Customer Service – Deliver superb service that both anticipates and responds to customer needs. Move vehicles and people in ways that “give them their time back” by creating system wide efficiencies. Employee Engagement – Maintain a working environment that is diverse, challenging and accommodating; support and encourage employees using clear objectives. Treat our employees as our internal customers and give them the tools necessary to excel at their jobs. Fiscal Responsibility – Invest and manage public funds and other resources wisely. Instill a dedication to thrift across our organization. Innovation – Pursue constant improvement in our work and services. Create an environment where employees are eager to use their talents to find better ways to do business and deliver service. 4 ORGANIZATION-WIDE PERFORMANCE DASHBOARD Data through October 2012 unless otherwise noted Goals Safety Customer service Employees Fiscal responsibility Innovation Performance Key Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Needs Improvement Under development / Data missing Not meeting expectations 5 PERFORMANCE DASHBOARD Aeronautics Division Aeronautics sub-goals Status Trend Measured period Current Prior Target this period Weight Notes Monthly 26 22 30 High Loss of staff delayed airport inspections until May Under development Under development 6/30/2013 Low - On-track On-track High - Monthly -34% -50% Expenses do not exceed budget High Data Represents Q1 of State Fiscal Year 2013 SFY 16.9% Under Development 90.0% High - Under development Under development 6/30/2013 Low - Safety Inspect 36 public-use airports per calendar year Customer service Ensure that construction projects are trending on-time, pilot Employees Stable Participate in "How Can I Help You Today?" training Fiscal responsibility Ensure that operating expenses are at or below operating budget (YTD) Disburse 90% of the airport capital budget by the state fiscal year end Ensure construction projects are trending onbudget, pilot Innovation Under development Performance key Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Needs improvement Not meeting expectations Under development / Data missing 6 November, 2012 Aeronautics – Safety Number of Public-Use Airports Inspected (YTD) 30 Target ≥ 30 26 25 20 15 10 5 0 May * June July August September October 2012 *Staffing changes during the year resulted in airport inspections starting in May 7 November, 2012 Aeronautics – Fiscal Responsibility Operating Seasonally adjusted operating expense budget vs. YTD actual July 2012 - September 2012 (FY 2013) Actual Budgeted Variance $92,000 $140,000 -$48,000 Capital 100% 90% Airport Capital Budget Disbursement Through October 80% 70% 60% 50% 40% 30% 20% 10% 0% 16.9% Data currently unavailable 2012 2013 State Fiscal Year 8 PERFORMANCE DASHBOARD Highway Division Highway sub-goals Safety Status Trend Measured period Current Prior Target This Period Weight Notes Improving Monthly 463 466 ≤ 463 High Accellerated Bridge Program goal: Reduce the number of SD bridges to 450 by 2016 Declining Monthly 81.83 81.88 ≥ 81.98 High - Improving CY 35 30 33 Medium Refers to i nci dents wi thi n Route 128 Declining FFY 63.5% 66.6% > 70% High Data displayed is from FY 2011 Prevent the number of structurally deficient bridges from exceeding 463 Maintain at least a 81.98 system-wide bridge health index* Reduce average incident clearing times by 5% from previous year (Min) Ensure that 70% of pavement on the National Highway System in good or excellent condition (IRI) Customer service Ens ure tha t a t l ea s t 90% of Inters ta te Roa dwa ys a re i n good or excel l ent condi ti on (PSI) Improving FFY 98.1% 95.2% >90% High Data displayed is from FY 2011 Ensure that at least 80% of construction projects are completed on time Declining Monthly 55% 63% ≥ 80% High - Develop a travel speed data collection pilot program on I-93 to inform statewide congestion metrics Monthly Under development Under development Project benchmarks Medium - Performance key Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Needs improvement Not meeting expectations Under development / Data missing 9 PERFORMANCE DASHBOARD Highway Division Highway sub-goals Employees Status Trend Measured period Current Prior Target This Period Weight Notes Monthly 16 Data missing 10% less than previous year High - High - Reduce the number of workplace injuries by at least 10% from the previous year Participate in "How Can I Help You Today?" and "Performance Management Senior Staff" training Stable Monthly On-track On-track Develop an engineering fellowship program Stable Monthly On-track On-track Project benchmarks Medium - Declining SFY -$3,851,173 -$21,315,647 ≤ $0 above budget High 2012 data includes over $3M for Additional Funds for Extra Work orders in response to the Hurricaine Improving Quarterly 68% 63% ≥ 70% High - Improving FFY 132 139 ≤ 120 days Medium - Advertise at least 80% of projects that are planned (STIP) Improving SFY 91.4% 81.0% ≥ 80% High - Fiscal responsibility Ensure that construction projects are on or under budget upon fiscal completion Ensure that projects are trending on budget at construction completion Ensure that the time between advertisements and notice to proceed does not exceed 120 days Complete an on budget and on time trending program (5 mega projects, 12 district projects) Monthly Under development Under development Under development Medium - Ensure that operating expenses are at or below operating budget (YTD) Monthly -42% -57% Expenses do not exceed budget High Data represents Q1 of State Fiscal Year 2013 Maintain forecasted cashflow for construction projects (YTD) Monthly Under development Under development Under development Monthly On-track On-track Project benchmarks High - Seasonally Under development 9,484 -5% from previous year Medium - Innovation Incorporate "Accelerated Bridge Program" best practices into all projects Reduce road salt use per inch by at least 5% from the previous year (tons of salt per inch of snow) Performance key - Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Stable Needs improvement Not meeting expectations Under development / Data missing 10 Highway – Safety Structurally Deficient Bridges 520 510 500 Target ≤ 463 490 480 470 Accelerated Bridge Program goal: reduce the number of SD Bridges to 450 by September, 2016 463 460 100 95 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 May-12 Apr-12 Mar-12 Feb-12 Jan-12 Dec-11 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 450 Apr-11 November, 2012 Bridge Health Index (out of >5,000 bridges) 90 85 80 Target = 81.98 81.88 75 70 65 Bridge Health Index (BHI) is the ratio of the current condition of each element to perfect condition that is expressed as a score from 0 to 100, with a value of 0 indicating all of a particular bridge’s elements are in the worst condition. 60 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 2013 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 11 Highway – Safety November, 2012 100% Percent of NHS Roadways in Good or Excellent Condition - PSI* 90% 80% Target ≥ 70% 70% 60% 64% 30% 67% 40% 69% 50% 2009 2010 2011 20% 10% 0% Federal Fiscal Year 12 Highway – Customer Service 95% 93% 2009 2011 Ensure that at least 70% of construction projects are completed on-time CURRENT PERIOD 90% 80% 2010 Federal Fiscal Year 100% 92% 85% 80% 72% 72% 72% 70% Target ≥ 70% 71% 69% 64% 81% 64% 60% 52% 46% 29 / 36 PROJECTS 33 / 39 PROJECTS 8 / 8 PROJECTS 5 / 7 PROJECTS 11 / 12 PROJECTS 13 / 25 PROJECTS 11 / 16 PROJECTS 41 / 51 PROJECTS 10% 37 / 58 PROJECTS 20% 7 / 11 PROJECTS 30% 23 / 32 PROJECTS 40% 44 / 61 PROJECTS 50% 16 / 35 PROJECTS 100% 98% Percent of Interstate Pavement in Good or Target ≥ 90% Excellent Condition - IRI* 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 44 / 61 PROJECTS November, 2012 0% Q1 Q2 2010 State Fiscal Year 2011 2012 Q3 2013 Q4 13 November, 2012 Highway – Employees Highway Engineering Fellowship Program Timeline 0% Complete 50% Complete 100% Complete 11/1/2012 Highway Engineer Fellowship Program Established 6/13/2013 Program Materials Advertised Applications Available Receive Application Packets Interviews Review Final Candidates Reviews/ Decisions Offers Made 14 Highway – Fiscal Responsibility November, 2012 Construction Projects On or Under Budget at Fiscal Completion ( Additional Funds/Extra Work Orders ) $30 $20 86 Contracts $21 Million Millions $10 15 Contracts $5 Million 56 Contracts $2 Million $0 -$10 87 Contracts $23 Million 88 Contracts $34 Million -$20 28 Contracts $9 Million -$30 174 contracts -$40 143 contracts 43 contracts 2010 2011 2012 State Fiscal Year Contracts Over Budget Contracts Under Budget Ensure that projects are trending on-budget at completion of construction 100% 90% 86% CURRENT PERIOD 80% 74% 72% 68% 63% 60% Target ≥ 70% 57% 53% 53% 52% 75% 73% 69% 70% 60% *A project is considered fiscally complete when the final paperwork and material certification processes are complete 20 / 35 PROJECTS 26 / 36 PROJECTS 29 / 39 PROJECTS 3 / 8 PROJECTS 6 / 7 PROJECTS 38% 9 / 12 PROJECTS 17 / 25 PROJECTS 10 / 16 PROJECTS 37 / 51 PROJECTS 31 / 58 PROJECTS 10% 46 / 77 PROJECTS 20% 17 / 32 PROJECTS 30% 42 / 61 PROJECTS 40% 32 / 61 PROJECTS 50% 0% Q1 Q2 2010 State Fiscal Year 2011 2012 Q3 2013 Q4 15 Highway – Fiscal Responsibility Length of Time between Advertisement and Notice to Proceed 2009 2010 2011 2012 0 141 -80 128 -60 124 -40 111 -20 Days -100 -120 -140 Target ≤ 120 -160 Federal Fiscal Year 100% Through 10/11/2012 Projects Planned (STIP) vs. Project Advertised 90% Target ≥ 80% 50% 91% 60% 81% 70% 71% 80% 80% November, 2012 40% 30% 20% 10% 0% 2009 2010 2011 Federal Fiscal Year 2012 16 November, 2012 Highway – Fiscal Responsibility Operating Expense Budget Seasonally adjusted operating expense budget vs. YTD actual July 2012 - September 2012 (FY 2013) Actual Budgeted Variance $48,238,000 $84,295,000 -$35,158,000 Construction: Budgeted vs. Actual 2011 2012 State Fiscal Year Budgeted Actual * Fiscal year 2013 data is YTD as of 10/24/12 $141 $645 $626 $594 $541 Millions $859 Construction Budget Spent $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 2013 * 17 PERFORMANCE DASHBOARD Rail and Transit Division Rail & Transit sub-goals Safety Status Trend Measured period Current Prior Target this period Weight Notes Yearly Data missing 487 -10% from previous year High Data on graph is displayed monthly 880 928 - High Data represents YTD from January 1st - October 24th Reduce the number of year-to-date MBTA customer injuries by at least 10% from the previous year Reduce the YTD number of MBTA total crime incidents from the previous year Improving Declining Monthly 96.4% 96.6% ≥ 95% High - Improving Monthly 91.7% 91.3% ≥ 95% High - Improving Monthly 95.5% 93.7% ≥ 95% High - Improving Monthly 90.2% 89.7% ≥ 95% High - Improving Monthly Data missing 81% ≥ 95% within 5 days Medium - Monthly Data missing 4.2 Decrease from previous year Medium - Declining Monthly Data missing 2.57 Decrease from previous year Medium - Declining Yearly Data missing 27% Decrease from previous year Medium - Declining Monthly 98.9% 99.1% ≥ 99% High - Improving Monthly 99.4% 98.9% ≥ 99% High - Monthly Under development Under development Under development High - Customer service Ensure that at least 95% of Red Line trips run on time Ensure that at least 95% of Orange Line trips run on time Ensure that at least 95% of Blue Line trips run on time Ensure that at least 95% of Commuter Rail trips run on time Ensure that at least 95% of MBTA customer inquiries are closed within 5 days Reduce the average MBTA response time to customer inquiries from the previous year (Days) Reduce MBTA customer call wait times from the previous year (Mins) Reduce the percentage of MBTA call abandonments from the previous year Maintain at least a 99% level of MBTA escalator availability Maintain at least a 99% level of MBTA elevator availability Increase fare gate up-time for North & South Stations & Back Bay Performance key Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Needs improvement Not meeting expectations Under development / Data missing 18 PERFORMANCE DASHBOARD Rail and Transit Division Rail & Transit sub-goals Employees Status Trend Measured period Current Prior On-track On-track Data missing 470 Data missing 4 Monthly -2.2% -1.2% Target this period Weight Notes High - Medium Data on graph is displayed monthly High - High Data is one month offset High - Participate in "How Can I Help You Today?" and "Performance Management" trainings - 10% from previous year Declining Ensure actual MBTA operating budget is at least 2% below projected operating budget Improving Ensure that MBTA construction projects are completed on-budget Yearly Under development Under development Ensure that non-fare revenues meet or exceed budgeted amounts Monthly Data missing $9,942,122 Data missing Medium Data is one month offset Ensure that Rail and Transit Division's operating expenses are at or below operating budget (YTD) Monthly 0% 0% Expenses do not exceed budget High Data is one month offset Ensure that Rail and Transit Division's State and Federal award's approved funds Yearly (State Fiscal Year) 62% 62% No target this period High No target this period Under development Under development Project Benchmarks Medium - Under development Under development Project Benchmarks Medium - Under development Under development Project Benchmarks Low - Reduce the number of MBTA empl oyee i njuri es res ul ti ng i n l os t ti me by a t l ea s t 10% from the previ ous yea r Reduce the number of YTD assaults on employees Fiscal responsibility Innovation Declining Stable < -2% below budget Install countdown clocks in MBTA stations Pilot the Mobile ticketing on Commuter Rail project Re-develop MBTA Red line on-time performance data in collaboration with MIT Performance key Yearly Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Needs improvement Not meeting expectations Under development / Data missing 19 Rail and Transit – Customer Service MBTA Red Line On-Time Performance 100% 96.4% 90% 80% 70% MBTA Orange Line On-Time Performance 100% 90% 80% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 91.7% November, 2012 0% May June 2011 July 2012 August September May 80% 95.5% 90% 80% 60% 2012 August 60% 50% 40% 40% 30% 30% 20% 20% 10% 10% September Target ≥ 95% 70% 50% 0% July Commuter Rail On-Time Performance 100% 90% 70% June 2011 Target ≥ 95% MBTA Blue Line On-Time Performance 100% April 90.2% April 0% April May June 2011 July 2012 August September Target ≥ 95% April May June 2011 July 2012 August September Target ≥ 95% 20 Rail and Transit – Customer Service November, 2012 10 Average Response Time to MBTA Customer Inquiries 9 8 7 Days 6 5 4 3 2 1 0 June July 2011 August September October 2012 0 May MBTA Customer Call Wait Times 3.5 3 Minutes 2.5 2 1.5 1 0.5 0 May June July 2011 August September October 2012 21 Rail and Transit – Customer Service MBTA Escalator Uptime 100% 98.9% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% April May June 2011 July 2012 August September Target ≥ 99% MBTA Elevator Uptime 100% 90% 99.4% November, 2012 80% 70% 60% 50% 40% 30% 20% 10% 0% April May June 2011 July 2012 August September Target ≥ 99% 22 November, 2012 Rail and Transit – Employees Recordable MBTA Employee Injuries Resulting in Lost Time (YTD) 500 450 400 350 300 250 200 150 100 50 0 431 470 332 May June July 2011 August September October 2012 Recordable MBTA Employee Injuries Resulting in Lost Time 70 60 50 39 38 40 28 30 20 10 0 May June July 2011 August September October 2012 23 Rail and Transit – Fiscal Responsibility MBTA seasonally adjusted operating expense budget vs. YTD actual July 2012 - September 2012 (FY 2013) Actual Budgeted Variance $326,095,069 $333,419,427 -$7,324,358 MBTA 2% Operating Expense Reduction Initiative Year to Date September -6% -2.2% -4% October Data currently unavailable August -1.2% -2% July -2.1% 0% June -1.9% May -2.0% November, 2012 -8% -10% 2011 2012 Target ≥ -2% 24 November, 2012 Rail and Transit – Fiscal Responsibility R&T seasonally adjusted operating expense budget vs. YTD actual* July 2012 - September 2012 (FY 2013) Actual Budgeted Variance $104,792,000 $104,830,000 -$38,000 The majority of this budget is grants, subsidies, and contract assistance ($104,773,000) State and Federal Funds Distributed to Regional Transit Authorities* (YTD) $13,183,206 Federal $6,098,752 $5,980,066 $13,600,000 State $10,406,500 $10,396,336 Funds Approved Funds Awarded Funds Contracted *Does not include the MBTA 25 November, 2012 Rail and Transit – Innovation MBTA Countdown Sign Installation Timeline 8/15/2012 9/1/2012 9/20/2012 10/18/2012 10/25/2012 11/1/2012 11/15/2012 1/31/2013 1st Sign: South Station (Red Line) Sign: Park Street (Red Line) Sign: Downtown Crossing (Red Line) Sign: Broadway (Red Line) Sign: Andrew (Red Line) Sign: Kendall/MIT Orange Line Sign Installation (Except Terminals) 2/1/2013 3/1/2013 Red Line Sign Installation Resumes Blue Line Sign Installation Begins Red Line Sign Installation Temporarily Ends MBTA Mobile Ticketing Timeline Early November 2012 Late November 2012 Early 2013 Mobile Ticketing App Released to Stores South Side Commuter Rail/Boat Launch North Side Launch (Single/10Ride Tickets Only) All Lines Sell Single/10-Ride Digital Tickets Marketing Campaign Expands to Every Route Full Monthly Pass With Charlie Capabilities Launches (Approximate) Marketing Campaign Begins 26 PERFORMANCE DASHBOARD Registry Division Status Trend Measured period Current Prior Target this period Weight Notes Reduce the number of a cci dents ca us ed by Juni or Oera tors res ul ti ng i n ci ta ti ons to bel ow the previ ous yea r Improving Yearly Under development Under development Decrease from previous year High Data represents accidents for August 2012 Inspect each vehicle inspection station at least three times per year Declining Monthly 7,139 7,587 Ins pect ea ch s ta ti on 3X per yea r Low - Keep the statewide average branch wait time below 15 minutes Improving Monthly 26.2 26.6 ≤ 15 Minutes High - Keep the statewide average call center wait time below 10 minutes Improving Monthly 25.18 Min 27.8 Min ≤ 10 Minutes High - Increase the number of online transactions to over the previous year Improving Yearly 372,694 329,472 Increase from previous year Medium - Keep the average wait for road tests below 28 days Declining Monthly 37 36 ≤ 28 Days Low - Yearly Under development Under development 759 Medium - Yearly Under development Under development Decrease from previous year High - On-track On-track Monthly -14% -16% Expenses do not exceed budget High - Monthly Data missing Data missing 134,851 High - Monthly Under Project Under developmen development benchmarks High - Needs improvement Not meeting expectations RMV sub-goals Safety Customer service Reduce the number of customer complaints from previous period Increase the customer compliments from previous year Employees Participate in "How Can I Help You Today?" and "Performance Management Senior Staff" trainings Fiscal responsibility % that operating expenses are below operating budget (YTD) Innovation Increase the number of RMV transactions conducted through industry partners from the previous year Install the new ALARS system Performance key Meeting or exceeding expectations Aeronautics | Highway | Rail & Transit | RMV Stable Under development / Data missing 27 November, 2012 RMV – Safety 8,000 Number of Vehicle Inspection Station Audits (YTD) 7,000 7,139 6,000 5,000 4,000 Target ≥ 4987 3,000 2,000 1,000 0 May June July August 2011 2012 September October 28 RMV – Customer Service Minutes 27.2 26.8 Target ≤ 15 minutes 26.2 20 22.4 25 25.5 Average Branch Wait Times 26.6 30 15 10 5 0 May June July 2011 30 October 25.2 27.8 24.3 21.2 15 September 2012 Target ≤ 10 minutes 21.4 20 August Call Center Wait Times 20.7 25 Minutes November, 2012 10 5 0 May June July 2011 August September October 2012 29 RMV – Customer Service Online vs. Branch Transactions 1,400 1,200 76% 24% 71% 75% 25% 72% 76% 24% 77% 75% 25% 69% 77% 73% 78% 22% 600 79% 71% 800 21% 1,000 Online Transactions 29% 28% Branch Transactions Average Wait for Road Tests 40 23% 31% 0 23% 200 27% 29% 400 Target ≤ 28 days 35 30 37.3 36.5 36.3 37.2 15 36.4 20 35.2 25 Days Thousands November, 2012 May June July August September October 10 5 0 2012 30 RMV – Customer Service / Innovation Transactions Completed at Automated Kiosks 1,200 752 748 655 600 746 800 877 899 1,000 400 200 0 May June July August 2011 September October 2012 Number of RMV Transactions Completed by Industry Partners (1,904 partners in total) 140,000 120,000 June July 129,435 May 116,537 40,000 126,258 60,000 110,962 80,000 116,241 100,000 123,249 November, 2012 20,000 0 August September October 2012 31 November, 2012 RMV – Fiscal Responsibility Seasonally adjusted operating expense budget vs. YTD actual July 2012 - September 2012 (FY 2013) Actual Budgeted Variance $12,725,000 $14,736,000 -$2,011,000 32 November, 2012 MassDOT - Employees "How Can I Help You Today?" Training 5,000 4,000 ( Target : Train 5,000 employees by 6/30/2013) 3,732 3,000 2,000 1,000 Performance Management Senior Staff Trained (YTD) 0 90 77 80 70 60 50 40 30 20 10 5/7/12 5/6/12 5/5/12 5/4/12 5/3/12 5/2/12 5/1/12 4/30/12 4/29/12 4/28/12 4/27/12 4/26/12 4/25/12 4/24/12 4/23/12 4/22/12 4/21/12 4/20/12 0 33