BEFORE THE PUBLIC SERVICE COMMISSION OF MARYLAND

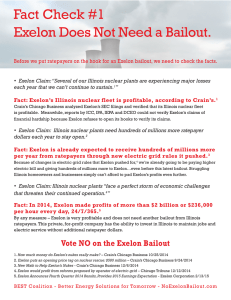

advertisement