development microeconomics development macroeconomics

advertisement

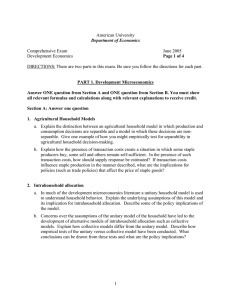

AMERICAN UNIVERSITY Department of Economics Comprehensive Examination- Development Economics June 2013 Directions Answer two (2) questions from each of the two parts—development microeconomics and development macroeconomics—for a total of four (4) questions. Be sure to keep the time constraint in mind and pace yourself so that you have time to complete all questions thoroughly. Read the questions carefully and make sure to answer what is asked. Use diagrams and equations if helpful but be sure to label them. Answers are judged on clarity of exposition, command of the relevant literature, and accuracy and depth of technical detail. 1 PART 1. Development Microeconomics Answer two of the four questions from this part. 1. Agricultural households a) Explain the distinction between an agricultural household model in which production and consumption decisions are separable and a model in which these decisions are nonseparable. Describe how you would empirically test for separability in agricultural household decision-making. Does the rejection of global non-separability necessarily imply that no households are non-separable? Explain. b) Explain how the presence of transaction costs create a situation in which some staple producers buy, some sell and others remain self-sufficient. In the presence of such transaction costs, how should supply response be estimated? If transaction costs influence staple production in the manner described, what are the implications for policies that affect the price of staple goods? 2. Intrahousehold allocation a) In much of the development microeconomics literature a unitary household model is used to understand household behavior. Explain the underlying assumptions of this model and the implications of the model for intrahousehold allocation, specifically addressing the implication of the model for the division of labor and allocation of goods within a household. Assuming the unitary model is correct, what are some of the policy implications of the model? b) Concerns over the assumptions of the unitary model of the household have led to the development of alternative models of intrahousehold allocation such as Pareto-efficient and non-Pareto efficient collective models. Provide some studies and evidence that challenge the unitary model assumptions. Explain how Pareto-efficient collective models differ from the unitary model. Describe how empirical tests have been conducted to test the validity of the unitary model and to test whether household allocation is Pareto efficient. In general, what conclusions and policy implications can be drawn from these tests? 2 3. Fertility a) What factors does the theory of household fertility decision making indicate are important in determining the fertility rate? Considering this theory, suppose a conditional cash transfer (CCT) program is put into place that targets poor households who have children. The program grants a significant transfer provided that recipients meet co-responsibilities including: (i) pregnant women receiving prenatal care; (ii) children under the age of five having regular health checkups and receiving vaccines and nutritional supplements as needed; and (iii) children from ages 6-14 enrolling in and attending school at least 85% of the time. Failure to meet these conditions results in being removed from the program. Given the theory of household fertility decision making, discuss the likely impacts of this CCT program on fertility. How would go about empirically assessing if the program has an impact on fertility? b) Consider a country that had a significant decline in fertility rates over a 20 year period. Suppose that during this period the government actively promoted contraceptive use through a national network of public health clinics and that the program was phased in over a ten year period. Considering the theory of household fertility decision making, how might you empirically test the factors that influenced fertility decline over the period in question, including the role of the government program? In your answer, be sure to clearly identify the factors that are likely to matter and how each could be empirically analyzed. 4. Credit and risk a) Describe how informational asymmetries limit credit transactions in rural areas of developing countries. Discuss the impact this has on the functioning of rural credit markets. What institutional innovations have microfinance institutions used to overcome these problems? Discuss the reasons why these appear to work (in the sense they have been successful at avoiding high levels of default). Describe the difficulties in identifying the impact of microfinance program on consumption and asset accumulation. Given these difficulties, describe how you would go about determining if such a program improved borrower welfare. b) Although markets for credit and insurance are imperfect, rural households in developing countries employ a variety of ex post mechanisms to cope with risk and smooth consumption. Describe these mechanisms. Explain how you might test whether these mechanisms bring about a Pareto-efficient allocation of consumption risk at the community level (where community can be defined as a village, ethnic group, network, etc.). In general, what does the empirical evidence suggest about the ability of households within a community to smooth consumption? What are some of the reasons why these results might emerge? 3 PART 2. Development Macroeconomics Answer two of the three questions from this part. 5. Growth models. a) The standard Solow growth model frames growth of output in terms of stocks of productive inputs and productivity growth. Explain the model’s basic assumptions and key behavioral questions, write the expression for output per capita in the steady-state, and explain its intuition. b) Explain why the equilibrium is stable. c) Using the Solow growth model, show the combined effect of an increase in the population growth rate and a decrease in the savings rate on the equilibrium capital to output ratio and steady-state growth of output. d) Explain how Acemoglu et al use the pattern of colonial conquest and settlement as a means to test the role of institutions in growth. e) In an econometric setting, you are asked to present five variables that could determine growth. Indicate what variables these are and describe an approach to assessing the effect of these different variables on growth. Make sure to define your variables, explain expected results, and discuss any potential econometric complications. 6. Fiscal sustainability. a) What is the difference between the concepts of overall budget balance and primary balance and explain when is one a more useful concept to use and when the other? b) Provide an expression for the primary balance that stabilizes the debt ratio at the current level and explain how the assumptions used in deriving this result. c) At what level of indebtedness for a country does default become a serious concern? d) How do volatility in revenues, ability to adjust expenditures, and volatility of other macroeconomic variables affect the analysis of likelihood of default? e) Based on recent developments in the world economy and your knowledge of the various countries surveyed during the course, name two countries that are facing difficulty with fiscal sustainability and two that are not. 4 7. Monetary and exchange regimes and real exchange rates. You are asked to provide advice to two medium-sized developing countries on the monetary and exchange rate regimes that they should adopt. a) Country 1: The country has a moderate level of money to GDP (say 30 percent), the government has a chronic deficit and at times asks the central bank to finance its domestic borrowing. The country exports cocoa and other agricultural commodities, and at the moment growth is about 2 percent and inflation 5 percent. i. What would you recommend for a monetary regime, a reserve or broad money based regime or inflation targeting? Explain your reasoning. ii. What would you recommend for an exchange rate regime? Explain your reasoning. b) Country 2: The country has a higher level of money to GDP (say 60 percent), the government’s treasury bill market is well developed and banks lend to each other in an interbank market. The country exports light manufactured products, and at the moment growth is about 3 percent and inflation 4 percent. i. What would you recommend for a monetary regime, a reserve or broad money based regime or inflation targeting? Explain your reasoning. ii. What would you recommend for an exchange rate regime? Explain your reasoning. c) Turning to the real exchange rate analysis for each of these two countries: i. Contrast nominal and real exchange rates and explain the law of one price. ii. Provide two different methodologies to explain how you would assess whether the real exchange rate is properly valued and if they provided different results, explain how you would choose between them. 5