Benefits Committee Meeting March 30, 2012 , 2012

advertisement

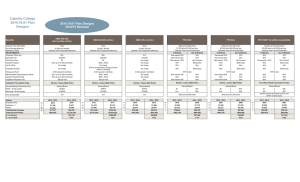

Benefits Committee Meeting March 30,, 2012 Table of Contents/Agenda: Section 1: October 2011 Renewal Overview -Current Rates & Benefits Section 2: October 2012 Renewal Planning - Renewal R l Schedule S h d l - Goals & Objectives Section 3: Options to Consider - Recap R off 2011 Plan Pl Options O ti Section 4: SISC Updates S ti 5: Section 5 N t Steps Next St Exhibits: Health Care Reform - Changes on the Horizon 2 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Medical HMO (SISC) Cabrillo College renewed with Blue Shield (SISC) High Option HMO $10-0: 5.6% Low Option HMO $25-500 Admit; changed Rx from $5/$20 copay to $9/$35: 4.0% Rate guaranteed for 1 year (10/1/2011 – 10/1/2012) Medical PPO (SISC) Cabrillo College renewed with Blue Shield (SISC) High Plan 90-E $10: 4.9% Medium Plan 80-G $10: 4.8% Low Plan HDHP-B: 7.0% Rate guaranteed for 1 year (10/1/2011 – 10/1/2012) Dental PPO (ACSIG) Cabrillo College renewed with Delta Dental Dental PPO: 0.0% Rate guaranteed for 1 year (10/1/2011 – 10/1/2012) CompanionCare (Individual Retiree Plan) Cabrillo College renewed with CompanionCare C CompanionCare: i C -2.3% 2 3% Rate guaranteed for 1 year (10/1/2011 – 10/1/2012) Kaiser Permanente (Individual Retiree Plan) Cabrillo College renewed with Kaiser Permanente Kaiser Permanente : 0 0.0% 0% Rate guaranteed for 1 year (10/1/2011 – 10/1/2012) 3 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Trend Surveys Medical (Actives & Retirees < 65) Fee-for-Service (FFS)/Indemnity Plans High-Deductible Health Plans (HDHPs)** Open-Access Preferred Provide Organizations (PPOs/Point-of-Service (POS) Plans *** PPOs/POS Plans (with PCP GateKeepers) Health Maintenance Organizations (HMO's) Segal Aon Hewitt (Summer 2011) (w/o Rx) w/Rx 10.5% 10.1% 9.8% 9.7% (w/o Rx) 11.7% 10.4% w/Rx 10.9% 9.8% 10.0% 9.5% 9.9% 10.0% 10.4% 9.6% 9.8% 9.2% 10.3% 10.1% 10.0% 9.8% * Trend projections w ere derived by proportionally blending medical trends and freestanding prescription drug trends. ** HDHPs are defined as those plans w here the deductible is at least the minumum health savings account (HSA) level required by the Internal Revenue Service ($1,200 single, $2.400 family in 2012) *** Open-access PPO/POS plans are those that do not require a primary care physician (PCP) gatekeeper referral for specialty services. Year 2006 2007 2008 2009 2010 2011 2012 PPO Renewal / Trend Summary SISC PPO CalPERS PERS Statewide Choice PPO Renewals Renewal * 6.80% 9.43% 7.50% 12.50% 4.80% 9.00% 0.00% 0.00% 11.60% 2.00% 6.7%, 9.89% TBD 1.91% CA PPO Trend 10.00% 11.00% 10.00% 10.00% 11.00% 12.00% 9.80% AVERAGE 6.1% 6.39% 10.54% * CalPERS PERSChoice renewal figures represent overall statewide figure as published by CalPERS 4 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Financial Summary Li off Coverage Line C E ll Enrollees BLUE SHIELD ACTIVE EMPLOYEES HMO High ($10 copay) 78 HMO Low ($25 copay) 293 PPO High ($300 ded) 76 PPO Med ($500 ded) 33 PPO Low ($2,500 ded) 31 BLUE SHIELD RETIREE INCLUDING EARLY RETIREE HMO High ($10 copay) 13 HMO Low ($25 copay) 11 PPO High ($300 ded) 94 PPO Med ($500 ded) 4 PPO Low ($2,500 ded) 2 COMPANIONCARE (INDIVIDUAL RETIREE PLAN) CompanionCare (Individual Retiree Plan) 8 KAISER PERMANENTE (INDIVIDUAL RETIREE PLAN) KP ((Individual Retiree Plan)) 1 DELTA DENTAL Active 521 Retirees 126 MONTHLY TOTAL ANNUAL TOTAL 644 10/1/2010 10/1/2011 $∆ %∆ $215,530 $230,785 $114 563 $114,563 $37,871 $18,200 $227,588 $240,107 $120 128 $120,128 $39,690 $19,467 $12,058 $9,322 $5 565 $5,565 $1,819 $1,267 5.6% 4.0% 4 9% 4.9% 4.8% 7.0% $15,368 $8,902 $69,511 $2,452 $962 $16,196 $9,184 $73,104 $2,580 $1,030 $828 $282 $3,593 $128 $68 5.4% 3.2% 5.2% 5.2% 7.1% $4,807 $4,697 -$110 -2.3% $324 $324 $0 0.0% $64,641 $10,422 $64,641 $10,422 $0 $0 0.0% 0.0% $794,338 $829,158 $34,820 4.4% $9,532,059 $9,949,899 $417,840 4.4% 5 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Current Benefits None High PPO (90-E $10, Rx 5-20 w $100 brand deductible) $300 p/ind; $600 p/fam Medium PPO (80-G $10, Rx 5-20 w $100 brand deductible) $500 p/ind; $1,000 p/fam $1,000 / $2,000 $2,000 / $4,000 $600 / $1,800 $1,000 p/ind; $3,000 per fam MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Inpatient Hospital Lab & X-Ray $10 $10/$30 No charge No charge No charge Outpatient Surgery No charge $25 $25/$30 $0 $500 / Admit No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $100 (waived if admitted) $500 / Admit $500 / Admit $25 per visit Medco Generic/Brand** $ $ $9/$35 $18/$90 N/A Benefits Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family Emergency Room Mental Health Care/Substance Abuse Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply Annual Deductible High HMO $10-0 w/Chiro Low HMO $25-500 w/Chiro None $100 (waived if admitted) No charge No charge $10 Medco Generic/Brand** $ $ $5/$10 $10/$20 N/A Low PPO (HDHP -B w/HSA Compatibility) $2,500 p/ind; $5,000 p/fam $5,000 p/ind or $10,000 per fam In Network $10 $10 Ded waived; 100% 90% 90% Out of Network 50% 50% 50% $600 p/day 50% In Network $10 $10 Ded waived; 100% 80% 80% Out of Network 50% 50% 50% $600 p/day 50% In Network 90% 90% Ded waived; 100% 90% 90% Out of Network 50% 50% 50% $600 p/day 50% 90% $350 p/day 80% $350 p/day 90% $350 p/day $100 copay $100 copay $100 copay 90% 50% 80% 50% 90% 50% 90% 50% 80% 50% 90% 50% 90% 50% 80% 50% 90% 50% Medco Rx plan $5-20 w/$100 brand ded Medco Rx plan $5-20 w/$100 brand ded Rx w/ Blue Shield Contracted Provider Generic/Brand** Generic/Brand** Generic/Brand** $ $5 $ $10 $$5 $ $10 $ $7 $ $14 $20 $50 $20 $50 $25 $14 $100 per individual up to $300 per family $100 per individual up to $300 per family $2,500 medical deductible must be met 6 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Current Rates (Active Employee Rates and Contributions) HIGH HMO ($10-0 w/Chiro) Actives Employee Only Employee +1 Family MONTHLY PREMIUM ANNUAL PREMIUM TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM Employee Contributions Employee Only Employee +1 Family y MONTHLY CONTRIBUTION ANNUAL CONTRIBUTION TOTAL MONTHLY CONTRIBUTION TOTAL ANNUAL CONTRIBUTION 30 17 31 78 10/1/2011 $780 $1,559 $2,149 $116,522 $ , $1,398,264 HIGH PPO (90-E $10, Rx 5-20 w $100 brand) LOW HMO ($25 ($25-$500 $500 w/Chiro) 138 59 96 293 10/1/2011 $644 $1,288 $1,777 $335,456 $ , $4,025,472 42 23 11 76 10/1/2011 $853 $1,514 $2,320 $96,168 $ , $1,154,016 MEDIUM PPO (80-G $10, Rx 5-20 w $100 brand) 14 11 8 33 10/1/2011 $774 $1,373 $2,100 $42,739 $ , $512,868 LOW PPO (HDHP-B w/H.S.A. Compatibility) 25 2 4 31 10/1/2011 $577 $1,030 $1,611 $22,929 $ , $275,148 $613,814 $7,365,768 HIGH HMO ($10-0 w/Chiro) LOW HMO ($25-$500 w/Chiro) HIGH PPO (90-E $10, Rx 5-20 w $100 brand) MEDIUM PPO (80-G $10, Rx 5-20 w $100 brand) LOW PPO (HDHP-B w/H.S.A. Compatibility) 10/1/2011 $136 $271 $372 $ $20,219 $242,628 10/1/2011 $0 $0 $0 $ $0 $0 10/1/2011 $209 $226 $543 $ $19,949 $239,388 10/1/2011 $130 $85 $323 $ $5,339 $64,068 10/1/2011 $0 $0 $0 $ $0 $0 $45,507 $546,084 7 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Current Rates & Benefits (CompanionCare Retiree Plan) S SERVICES C S MEDICARE CompanionCare 2011 Benefits Based on 2011 Medicare Benefits Pays all but first $1132 for 1st 60 days Pays all but first $283 a day for the 61st to 90th day Inpatient Hospital (Part A) Pays $1132 Pays $283 a day Pays all but $566 a day Lifetime y Reserve for 91st to 150th day Pays $566 a day Pays nothing after Lifetime Reserve is used Pays 100% for 1st 20 days Pays all but $141.50 a day for 21st to 100th day Pays nothing after 100th day Pays 100% for 151st day to 515th day Pays nothing Pays $141.50 a day for 21st to 100th day Pays nothing after 100th day Deductible (Part B) $162 Part B deductible per year Pays $162 Basis of Payment (Part B) 80% Medicare Approved (MA) charges after Part B deductible 80% MA charges 20% MA charges including 100% of Medicare Part B deductible 20% MA charges 100% of MA charges Pays nothing Skilled Nursing Facilites (Must be approved by Medicare) Medical Services (Part B) Doctor, x-ray, appliances, & ambulance Lab 20% MA charges up to the Medicare 80% MA Charges up to the annual benefit amount. (Physical & Medicare annual benefit amount p Therapy py Combined)) Speech Pays 1st 3 pints unreplaced blood 80% MA charges after 3 pints and 20% MA charges Pays 80% inpatient hospital, surgery, Not covered anestetist and in hospital visits for medically necessary services for 90 Physical/Speech Therapy (Part B) Blood (Part B) Travel Coverage (when outside the US for less than 6 consecutive months) Rx drug plan enhanced through Medco Health effective 1/1/2012 Outpatient Presrciption Drugs CompanionCare EMPLOYEES Retiree Retiree plus 1 dependent TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM EE 6 2 8 co pay for a 30-day 30 day * Generic: $9 co-pay SISC will automatically enroll supply at a retail pharmacy or $18 copay for a 90-day supply through CompanionCare members into home delivery service Medicare Part D. No additional * Brand: $35 co-pay for a 30-day premium required. SISC plans supply at a retail pharmacy or $90 coare not subject to the pay for a 90-day supply through 'doughnout hole'. home delivery service Renewal $427 $854 $4,270 $51,240 8 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Current Rates & Benefits (Kaiser Retiree Plan) KAISER PERMANENTE INDIVIDUAL RETIREE PLAN SERVICES Hospitalization * Inpatient * Emergency Room $200/Admit $50 co-pay/waived if admitted Skilled Nursing Facility Covered in full for 100 days per benefit period Physician Services/Basic Health Services * Office visits * Consultation, diagnosis, and treatment by a specialist X-Ray Services * Includes routine annual mammography Laboratory Services Annual Physical Examination * Includes pap smears $10 co-pay per visit No charge No charge $10 co-pay co pay per visit $10 co-pay per visit; $5 co-pay per group visit Outpatient Mental Health/20visits Vision Care * Examination for eyeglasses * Glaucoma testing * Standard frame/lenses every 24 months $10 per visit $10 co-pay per visit $150 frame and lens allowance every 24 months Not covered $10 co-pay per visit Dental Care (DeltaCare) Hearing Examination Immunizations * Includes flu injections and all Medicare approved immunizations Ambulance No charge $50/Trip $10 co-pay per visit ( bj t tto medical (subject di l necessity) it ) Manual Manipulation of the Spine Prescription Drugs $10 co-pay per generic/$20 co-pay per brand name up to $100 day supply at Kaiser pharmacies * Prescription drugs related to sexual dysfunction 50% co-insurance; limited to 27 doses in any 100-day period RETIREE UNDER AGE 65 Retiree TOTAL MONTHLY PREMIUM TOTAL ANNUAL PREMIUM 1 Renewal $324 $324 $3,888 9 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 1: October 2011 Renewal Overview Current Rates & Benefits (Dental PPO Plan) ACTIVES RETIREES Dental Benefits In-Network $2,000/Member Calendar Year Maximum Calendar Year Deductible Individual / Family Diagnostic g and Preventive Oral Exam & X-Rays Teeth Cleaning Fluoride Treatment Space Maintainers Bitewings Basic Services & Crowns A l Amalgam/Composite /C it Filli Fillings Periodontics (Gum disease) Endodontics (Root Canal) Extractions & Oral Surgrey Sealants Crown Repair Restorative - Inlays and Crowns Prosthodontics Orthodontics Eligible for Benefit Lifetime Maximum Dental Accident Lifetime Maximum RATE GUARANTEE ACTIVES RATES Employee Only Employee + 1 Dependent E l Employee + 2 or M More D Dependents d t EE 229 126 166 Out-of-Network $2,000/Member Out-of-Network $2,000/Member None None None None 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 70-100% 60% 50% 60% 50% 50% Child(ren) Only $1,000 100% $1,000/Member 100% $1,000/Member 1 Year 1 Year 10/1/2011 $65.92 $130.03 $192 72 $192.72 521 MONTHLY PREMIUM ANNUAL PREMIUM In-Network $2,000/Member Not Covered EE 63 61 2 10/1/2011 $63.76 $115.48 $166 07 $166.07 126 $63,471 $761,652 $11,393 $136,720 10 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 2: October 2012 Renewal Planning Renewal Schedule Coverages Effective Date Release Date 10/1/2012 May 18, 2012 10/1/2012 Mid July 2012 Medical Blue Shield HMO, PPO, H.S.A. Dental Delta Dental PPO 11 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: Options to Consider Recap of October 2011 Plan Options – HMO High Renewal Alternative 1 Alternative 2 None HMO 10 10-0 0 w/Chiro /Chi $5/$20 Rx None HMO 20 20-250 250 w/Chiro /Chi $5/$10 None $1,000 / $2,000 $1,000 / $2,000 $1,500/$3,000 $10 $10/$30** No charge No charge $10 $10/$30** No charge No charge No charge No charge $20 $ $20/$30** No charge No charge $100 performed in an ASC; $150 in a hospital No charge g No charge g $250 / admission $ $100 $100 (waived if admitted) 20%** $10 in your service area; $50 outside your service area $100 $100 (waived if admitted) 20%** $10 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** $100 $100 (waived if admitted) 20%** $20 in your service area; $50 outside your service area $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care No charge $10 (up to 100 visits p/cal yr) No charge $10 (up to 100 visits p/cal yr) $100/day $25 (up to 100 visits p/cal yr) No charge No charge $250 / admission $ $10 $ $10 $20 No charge No charge $250 / admission $10 Medco Generic/Brand** Generic/Brand $5/$10 $10/$20 $10 Medco Generic/Brand** Generic/Brand $5/$20 $10/$50 $20 Medco Generic/Brand** Generic/Brand $5/$10 $10/$20 5.6% 4.3% -2.7% Pl Plans Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL y Office Visit Physician Specialist Visit Preventive Care Lab & X-Ray Outpatient Surgery Hospitalization I Inpatient ti t Ambulance Emergency Room Durable Medical Equipment Urgent Care Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox Inpatient hospital facility Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply % ∆ to Current Cabrillo College – March 30, 2012 High HMO $10-0 w/Chiro Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution 12 Section 3: Options to Consider Recap of October 2011 Plan Options – HMO Low None Alternative 1 HMO $25-500 w/Chiro $7/$25 Rx None New Low HMO Plan effective 10/1/2011 HMO $25-500 w/Chiro $9/$35 Rx None Alternative 3 HMO 30-20% Zero Facility $5/$10 Rx None $2,000 / $4,000 $2,000 / $4,000 $2,000 / $4,000 $1,500 p/member $25 $25/$30 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $25 $25/$30 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $25 $25/$30 $25/$30** $0 No charge $150 at an Ambulatory Surgery Center; $300 at a Hospital $30 $30/$45 $30/$45** $0 No charge $500 / Admit $500 / Admit $500 / Admit 20% $100 $100 ((waived i d if admitted) d itt d) $100 $100 (waived ( i d if admitted) d itt d) $100 $100 ((waived i d if admitted) d itt d) $100 $150 ((waived i d if admitted) d itt d) 20%** 20%** 20%** 50%** Urgent Care $25 in your service area; $50 outside your service area $25 in your service area; $50 outside your service area $25 in your service area; $50 outside your service area $30 in your service area; $50 outside your service area Chiropractic Services (see separate rider) $10 (up to 30 visits per cal year)** $10 (up to $30 visits per cal year)** $10 (up to 30 visits per cal year)** $10 (up to 30 visits per cal year)** Skilled Nursing (up to 100/days/cal year Home Health Care $100 per day $25 (up to 100 visits p/cal yr) $100 per day $25 (up to 100 visits p/cal yr) $100 per day $25 (up to 100 visits p/cal yr) 20% $20 (up to 100 visits p/cal yr) $500 / Admit $500 / Admit $500 / Admit 20% $25 per visit $25 per visit** $25 per visit $30 per visit $500 / Admit $500 / Admit $500 / Admit 20% $25 Medco Generic/Brand** $5/$20 $10/$50 Self Injectables; Covered at generic or brand $25** Medco Generic/Brand** $7/$25 $14/$60 Self Injectables; Covered at generic or brand $25 Medco Generic/Brand** $9/$35 $18/$90 Self Injectables; Covered at generic or brand FINAL $30 Medco Generic/Brand** $5/$10 $10/$20 Self Injectables; Covered at generic or brand 5.5% 4.9% 4.0% -1.2% 2011 Renewal Plans Calendar Year Deductible Calendar Year Copayment Maximum Individual / Family MAJOR MEDICAL Physician Office Visit Specialist Visit Preventive Care Lab & X-Ray Outpatient Surgery Hospitalization Inpatient Ambulance E Emergency Room R Low HMO $25-500 w/Chiro Durable Medical Equipment Mental Health Care Inpatient hospital facility Outpatient Physician Visit Substance Abuse - (see separate rider) Inpatient Detox I Inpatient ti t hospital h it l facility f ilit Outpatient Physician Visit Outpatient Prescription Drugs (At participating Pharmacies only) Retail - 30 day supply Mail order - 90 day supply No annual deductible % ∆ to 2011 No charge Cabrillo changed to this plan for 10.01.2011 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution 13 Section 3: Options to Consider Recap of October 2011 Plan Options - PPO High Plans Calendar Year Deductible(s) Maximum *Co-Insurance Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Emergency Room (non-emergency) Preventive Care Routine Exam Diagnostic X-Ray & Lab Chiropractic Physical Medicine PT, OT Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Supply Generic Drugs Single Source Brand Name Drugs Multi Source Brand Name Drugs Brand Name Calendar Year Deductible % ∆ from 2011 Renewal Alternative 1 Alternative 2 Alternative 3 Alternative 4 PPO High (90-E $10, Rx 5-20 w $100 brand deductible) 90-C $30 Rx $7/$25 80%-C $20 Rx $5/$20 80%-D $20 Rx $5/$20 80%-D $30 Rx $5/$20 $300 p/ind; $600 p/fam $600 p/ind; $1,800 per fam In Network Out of Network $10; (does not apply to deductible or coinsurance 50% max.) 90% $600 p/day $100 copay Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 90% 90% Not covered unless pre auth $200 p/ind; $500 p/fam $300 p/ind; $900 per fam In Network Out of Network $30; (does not apply to deductible or coinsurance 50% max.) 90% $600 p/day $100 copay Ded waived; 100% 50% Ded waived; 100% Not Covered 90% 50% 20 Visits per year 90% 50% 90% 50% 90% 90% 90% Not covered unless pre auth $200 p/ind; $500 p/fam $500 p/ind; $1,500 per fam In Network Out of Network $20; (does not apply to deductible or coinsurance 50% max) 80% $600 p/day $100 copay Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 80% 80% Not covered unless pre auth $200 p/ind; $500 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $20; (does not apply to deductible or coinsurance 50% max) 80% $600 p/day $100 copay Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 50% 80% 80% 80% 80% Not covered unless pre auth $200 p/ind; $500 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $30; (does not apply to deductible or coinsurance 50% max) 80% $600 p/day $100 copay Ded waived; 100% 50% Ded waived; 100% Not Covered 80% 50% 20 Visits per year 80% 50% 80% 50% 80% 80% 80% Not covered unless pre auth 90% $600 p/day 90% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day $10 copay 50% $30 copay 50% $20 copay 50% $20 copay 50% $30 copay 50% 90% $600 p/day 90% $600 p/day 80% $600 p/day 80% $600 p/day 80% $600 p/day $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $100 per individual up to $300 per family $30 copay 50% Medco Rx plan $7/$25 Retail Mail 30 days 90 days $7 $14 $25 $60 $7 + cost diff $14 + cost diff None 4.9% 3.4% $10 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 None $10 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None $10 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None 3.6% 1.80% -0.2% 14 Cabrillo College - March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: Options to Consider Recap of October 2011 Plan Options - PPO Medium Plans Calendar Year Deductible(s) Maximum *Co-Insurance Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Preventative Care Routine Exam Chiropractic Physical Medicine PT, OT Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Supply Generic Drugs Single Source Brand Name Drugs Multi Source Brand Name Drugs Brand Name Calendar Year Deductible % ∆ from 2011 Renewal Alternative 1 Alternative 2 Alternative 3 Alternative 4 PPO Medium (80-G $10, Rx 5-20 w $100 brand deductible) 80%-E $30 Rx $9/$35 80%-G $30 Rx $5/$20 80%-G $20 Rx $5/$20 80%-D $30 Rx $5/$20 $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $10; does not apply to ded or max 50% 80% $600 p/day $100 copay 80% 90% of eligible expenses 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 20 Visits per year 80% 50% 80% 50% 80% 80% $300 p/ind; $600 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $30; (does not apply to deductible or 50% coinsurance max) 80% $600 p/day $100 copay 80% 90% of eligible expenses 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 20 Visits per year 80% 50% 80% 50% 80% 80% Not covered unless pre 80% auth 80% Not covered unless pre auth 80% $600 p/day 80% $10 copay 50% 80% $600 p/day $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $30; (does not apply to deductible or 50% coinsurance max) 80% $600 p/day $100 copay 80% 90% of eligible expenses 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 20 Visits per year 80% 50% 80% 50% 80% 80% Not covered unless pre 80% auth $600 p/day 80% $30 copay 50% 80% $600 p/day $500 p/ind; $1,000 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $20; (does not apply to deductible or 50% coinsurance max) 80% $600 p/day $100 copay 80% 90% of eligible expenses 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 20 Visits per year 80% 50% 80% 50% 80% 80% Not covered unless pre 80% auth $600 p/day 80% $30 copay 50% 80% $600 p/day $200 p/ind; $500 p/fam $1,000 p/ind; $3,000 per fam In Network Out of Network $20; (does not apply to deductible or 50% coinsurance max) 80% $600 p/day $100 copay 80% 90% of eligible expenses 80% 50% Ded waived; 100% 50% Ded waived; 100% Not Covered 20 Visits per year 80% 50% 80% 50% 80% 80% Not covered unless pre 80% auth $600 p/day 80% $600 p/day $20 copay 50% $20 copay 50% 80% $600 p/day 80% $600 p/day $10 copay 50% Medco Rx plan $5-20 w/$100 brand ded Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff $100 per individual up to $300 per family $30 copay 50% Medco Rx plan $9/$35 Retail Mail 30 days 90 days $9 $18 $35 $90 $9 + cost diff $18 + cost diff None $30 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None $20 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None $20 copay 50% Medco Rx plan $5/$20 Retail Mail 30 days 90 days $5 $10 $20 $50 $5 + cost diff $10 + cost diff None 4.8% 4.3% 2.1% 4.1% -0.3% 15 Cabrillo Collge - March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 3: Options to Consider Recap of October 2011 Plan Options – PPO Low Plans Calendar Year Deductible(s) Maximum *Co-Insurance Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Preventative Care Routine Exam Diagnostic X-Ray & Lab Chiropractic Ambulance Home Health Care 100 visits/yr (prior authorization required) Psychiatric Inpatient Outpatient Visits For Severe Conditions Outpatient Visits For Non-Severe Conditions Substance Abuse Inpatient For Acute Detox Outpatient Visits Outpatient Prescription Drugs Supply Generic Drugs Single Source Brand Name Drugs Multi Source Brand Name Drugs Brand Name Calendar Year Deductible % ∆ from 2011 Renewal Alternative 1 PPO Low (HDHP -B w/HSA Compatibility) HDHP A w HSA Compatibility $2,500 p/ind; $5,000 p/fam $5,000 p/ind or $10,000 per fam In Network Out of Network 90% 50% 90% $600 p/day $100 copay 90% 90% of eligible expenses 90% 50% 50% Ded waived; 100% Ded waived; 100% Not Covered 90% 50% 12 Visits per year 90% up to $25 p/visit 50% up to $25 p/visit 90% 90% Not covered unless pre 90% auth $1,200 p/ind; $2,400 p/fam $5,000 p/ind or $10,000 per fam In Network Out of Network 90% 50% 90% $600 p/day $100 copay 90% 90% of eligible expenses 90% 50% 50% Ded waived; 100% Ded waived; 100% Not Covered 90% 50% 12 Visits per year 90% up to $25 p/visit 50% up to $25 p/visit 90% 90% Not covered unless pre 90% auth 90% $600 p/day 90% $600 p/day 90% 50% 90% 50% 90% $600 p/day 90% $600 p/day 90% 50% 90% 50% Rx w/ Blue Shield Contracted Provider Rx w/ Blue Shield Contracted Provider Retail Mail Retail Mail 30 days 90 days 30 days 90 days $7 $14 $7 $14 $25 $14 $25 $14 $25 $60 $25 $60 $2,500 medical deductible must be met before $1,200 medical deductible must be met before co-pays apply co-pays apply 7.0% 20.4% 16 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 4: SISC Updates No major changes for 10/01/2012 Legislative Changes Women’s Preventive Services Changes to the CompanionCare Prescription plan Details to follow Rate Grid will be available May 18, 2012 SISC needs final plan changes by August 1, 2012 for October 1, 2012 effective date 17 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution Section 5: Next Steps Schedule meetings to discuss renewal and benefit options Set open enrollment dates 18 Cabrillo College – March 30, 2012 Copyright © 2012 Alliant Insurance Services, Inc. Confidential; not for distribution