Committee Name: Benefits Committee Agenda Date: 5/14/2015 Time: 10:00 am – 12:00am

advertisement

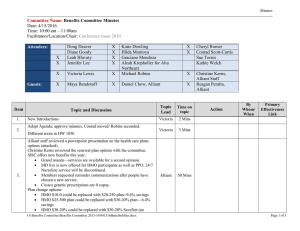

Agenda Committee Name: Benefits Committee Agenda Date: 5/14/2015 Time: 10:00 am – 12:00am Facilitators/Location/Chair: Conference room 2030 Attendees: Doug Deaver Diane Goody Leah Hlavaty Jennifer Lee Victoria Lewis Anne Lucero Loree McCawley Graciano Mendoza Alta Northcutt Michael Robins Cheryl Romer Conrad Scott-Curtis Sue Torres Kathie Welch Alliant Staff Guests: Item Topic and Discussion Topic Lead Time on topic 1. Adopt Agenda 2. Approve Meeting Minutes: 4/17/15 Benefits Committee Mtg. Victoria 3 Mins 3. Alliant: Affordable Care Act (ACA) presentation Alliant 40 Mins 4. Summary/Agenda Building Victoria 5 Mins 5. Next meeting date: Action By Whom/ When Primary Effectiveness Link 3 Mins Information Requested 1. To be added during the meeting 2. 3. Meeting Summary/Take Aways: 1. To be added during the meeting 2. 3. O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\051415BenefitsAgenda.docx Page 1 of 2 Agenda Item Topic Lead Topic and Discussion Time on topic Action By Whom/ When Primary Effectiveness Link Effectiveness Links 1. 5. Facilities Plan 6. Technology Plan 3. Mission Statement and Core 4 Competencies (Communication, Critical Thinking, Global Awareness, Personal and Professional Responsibility) Strategic Plan 1. Professional Development and Transformational Learning 2. Sustainable Programs and Services 3. Community Partnerships and Economic Vitality 4. Institutional Stewardship 5. Institutional Responsibilities Board Goals 7. Program Plans 4. Education Master Plan 8. Student Equity Plan 2. O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\051415BenefitsAgenda.docx Page 2 of 2 Minutes Committee Name: Benefits Committee Minutes Date: 5/14/2015 Time: 10:00 am – 11:00am Facilitators/Location/Chair: Conference room 2030 Attendees: Guests: X X X X X Item Doug Deaver Diane Goody Leah Hlavaty Jennifer Lee Victoria Lewis Maya Bendotoff X X X X X Anne Lucero Loree McCawley Graciano Mendoza Alta Northcutt Michael Robins John Govsky Topic and Discussion X X X Topic Lead Time on topic 1. New Introductions Victoria 2 Mins 2. Adopt Agenda Victoria 3 Mins 3. Alliant staff reviewed a powerpoint presentation on the Affordable Care Act (attached). Alliant 30 Mins 4. Summary/Agenda Building Victoria 5 Mins 5. Next meeting dates: Cheryl Romer Conrad Scott-Curtis Sue Torres Kathie Welch Alliant Staff Action By Whom/ When Primary Effectiveness Link Information Requested 1. 2. Meeting Summary/Take Aways: 1. To be added during the meeting 2. Effectiveness Links 1. 2. Mission Statement and Core 4 Competencies (Communication, Critical Thinking, Global Awareness, Personal and Professional Responsibility) Strategic Plan 5. Facilities Plan 6. Technology Plan O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\051415BenefitsMins.docx Page 1 of 2 Minutes Item Topic Lead Topic and Discussion Time on topic 3. 1. Professional Development and Transformational Learning 2. Sustainable Programs and Services 3. Community Partnerships and Economic Vitality 4. Institutional Stewardship 5. Institutional Responsibilities Board Goals 7. Program Plans 4. Education Master Plan 8. Student Equity Plan O:\Administrative Services\Benefits Committee\Benefits Committee 2014-15\051415BenefitsMins.docx Action By Whom/ When Primary Effectiveness Link Page 2 of 2 Cabrillo College ACA Overview May 2015 PURPOSE OF HEALTH CARE REFORM Improve access to healthcare Make coverage more affordable Require health insurance Larger employers must offer comprehensive, affordable coverage Create healthcare Exchanges No pre-existing conditions Coverage becomes guarantee issue Dependent coverage up to age 26 No cost preventive care Federal subsidies for lower income families Caps on employee contributions Expanded access to Medicaid Caps on non-claims costs Minimize cost-shifting for uninsured care Pilot programs to address healthcare cost, quality and transparency © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 2 ACA OVERVIEW WHAT HAS THE COLLEGE ALREADY DONE TO COMPLY? Cover dependent children up to age 26 Eliminate annual and lifetime maximums Offer no cost Preventive Care Meet new employee communication requirements Summary of Benefit Coverage Marketplace Exchange Notice Meet governmental reporting requirements – W2 Reporting Pay certain applicable fees and taxes Reinsurance Fee – Support state exchange risk pools PCORI – Funds a private, not for profit organization to help providers, payers and policy makers improve healthcare Industry Tax – Funds general operations of the ACA 2% to 4% of premium © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 3 PURPOSE OF HEALTH CARE REFORM 2015 Coverage & Benefit Mandates • Employer “Pay or Play” begins if 100+ FTEs (at renewal in most cases) Taxes & Fees • Health industry tax of about 2% (included in insured rates) – Paid by SISC Tracking & Reporting • 70% FTE offer threshold (2015 only) 2016+ • Employer “Pay or Play” applies to 50+ FTEs • 95% FTE offer threshold • Health industry tax – Paid by SISC • PCORI fees of $2 PEPY due 7/31 for selffunded – Paid by SISC • Reinsurance fee payment of $63 PEPY – Paid by SISC • PCORI fees (through 2019) – Paid by SISC • Reinsurance fee payment of $44 PEPY due 1/16– Paid by SISC • Cadillac tax of 40% on high value plans (2018+) • Coverage value on W-2s (if issue 250+ W-2s) • Coverage value on W-2s • Coverage level reporting to participants (1/31/16) and government (3/31/16) • Coverage level reporting to participants (1/31) and government (3/31) for prior year © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 4 ACA OVERVIEW FUTURE COMPLIANCE IRS Reporting - 2016 The ACA requires employers to provide certain reporting to the IRS and Employees in 2016 to prove coverage offered is sufficient Alliant will ensure that the College is aware of all of the IRS reporting Guidelines Cadillac Tax – 2018 The Cadillac Tax will require employers to pay an 40% excise tax on any portion of health insurance premium that is over a pre-determined threshold Assuming trend increases for the next three years, health insurance premiums would elevate above the current identified thresholds © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 5 ACA OVERVIEW PAY OR PLAY The Affordable Care Act requires large employers (50+ employees) to offer medical coverage that is… Affordable Comprehensive Full-Time Employees • Employee contribution for single coverage of lowest cost plan does not exceed 9.5% of employee’s income (W-2 income, actual wages, or federal poverty level safe harbor) • Coverage meets minimum value (60% actuarial value) requirement and meets Minimum Essential Coverage requirements • Offer coverage to all employees working 30+ hours per week and their eligible dependents (spouses not required) • Safe-harbors exist to define 30 hour determination … or the employer may pay annual penalties of $2,080 or $3,120 per employee for 2015 © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 6 ACA OVERVIEW PAY OR PLAY PENALTIES Effective October 1, 2015 for Cabrillo College (if the District offers affordable coverage to all ACA FT employees as of October 1, otherwise the effective date is January 1, 2015 Penalty A Penalty B Employer does NOT offer Minimum Essential Coverage (MEC) to “substantially all fulltime ee” Employer does offer MEC, but it is not Affordable $2,080 per each full time employee less 30 (less 80 in 2015) 1 FT EE goes to the Exchange, enrolls and gets subsidized coverage $3,120 per each subsidized employee © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 7 ACA OVERVIEW TO AVOID PENALTY A To avoid Penalty A, Employers are required: To offer access to coverage to essentially all (95% or more in) of FT employees (as defined) and dependents up to age 26 but there is no mandate to offer coverage for spouses “Currently defined” - Variable or part time employees, including substitutes, could be considered full time and These employees could expose the College to Penalty A if they represent more than 5% of the full time work force 70% for 2015 – New – Moves to 95% or more starting in 2016 No requirement to pay for dependent coverage © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 8 ACA OVERVIEW TO AVOID PENALTY B To avoid Penalty B At least one plan offered to full time employees and dependent children up to age 26 must be: Of minimum value (60% of medical expenses paid by plan) Affordable for self-only coverage – 9.5% or less of Box1 Wages, FPL, or Rate of Pay, depending on applicable Safe Harbor No requirement by ACA to offer coverage to spouses No requirement to contribute to cost of dependents Penalty B is $3,120 per year ($260 per month) on any employee that meets all of these requirements Qualifies for a federal subsidy from the Exchange based on total household income (excluding MediCal eligible participants) Elects and receives subsidized coverage from the Exchange Demonstrates that the lowest cost, minimum value coverage offered by the employer was not affordable for self-only coverage © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 9 ACA OVERVIEW SAFE HARBOR AFFORDABILITY TESTS The IRS has developed safe harbor tests A safe harbor is a means of complying with the law using a prescribed test W2 Earnings Safe Harbor Test The employee share of the premium required for the least costly, self only coverage must be less than 9.5% of the W2, box 1 wages paid to the employee Rate of Pay Safe Harbor Test Single coverage employee cost is less than 9.5% of employee’s lowest hourly wage x 130 Federal Poverty Level Safe Harbor Test This method examines whether the cost of coverage exceeds 9.5% of the Federal Poverty Line (FPL) An employer satisfies the FPL safe harbor if the employee’s contribution for the lowest cost plan for self-only coverage does not exceed 9.5% of FPL (See chart) © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 10 ACA OVERVIEW WHO IS ELIGIBLE FOR A SUBSIDY? 2014 Federal Poverty Level (not related to the FPL Affordability Safe Harbor for Employers) 138% federal poverty level 400% federal poverty level Household size Household income Maximum contribution* Household income Maximum contribution* 1 2 4 6 $16,105 $21,707 $27,310 $32,913 $127.50 $171.84 $216.20 $260.56 $46,680 $62,920 $95,400 $127,880 $369.55 $498.11 $755.25 $1,012.38 *Maximum contribution is based on monthly maximum affordable employee contribution for single coverage based on 9.56% of household income. The FPL safe harbor is based only on the FPL for a single individual for the applicable calendar year (divided by 12 – to get the monthly amount). Employers may use the FPL guidelines in effect six months prior to the beginning of the plan year. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 ACA OVERVIEW TO AVOID PENALTIES - SISC PLAN SOLUTION Requirements to avoid penalties: Coverage available must be at least a minimum actuarial value (60% of the cost of services) and must be affordable for the employee coverage on the lowest cost plan offered by the College. Solution: SISC renewals include a minimum value “Bronze” plan. It will not count against the maximum permitted number of plans SISC allows a group to offer. It will include only the minimum coverage required by ACA It will only feature two-tiers: Employee Only and Employee + Child(ren). It will NOT include an option for spousal/domestic partner coverage. It will NOT be offered with any option for dental, vision or life coverage. The primary purpose of the plan will be to allow Colleges to avoid exposure to Penalty A and B by: offering access to a minimum value plan to employees who HAD NOT previously qualified for SISC coverage and, providing a more affordable plan for single only coverage to employees who HAD previously qualified for SISC coverage. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 12 “AT RISK” COLLEGE PENALTY B SCENARIOS Employee enrolls in College coverage No Penalty Employee enrolls in spouse’s health plan No Penalty Employee is eligible to enroll in spouse’s “affordable” health plan No Penalty Employee remains uninsured No Penalty Employee’s household income qualifies for MediCal No Penalty Employee enrolls in individual coverage outside the Exchange No Penalty Employee enrolls in Exchange and household income is greater than 400% of the federal poverty level No Penalty Employee enrolls in the Exchange and, • Demonstrates they were full time employee and, • Demonstrates College coverage was unaffordable and, • Employee receives a federal subsidy College pays $260 per month penalty © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 13 ACA OVERVIEW EMPLOYEE CLASSES Full-Time Employee Based on facts and circumstances at their start date, the employee is expected to work an average of 30+ hours of service a week (regardless of how long their assignment is expected to be, unless Seasonal) – Offer Benefits Part Time Employee Reasonably expected at start date to work an average of less than 30 hours of service per week – Initial Measurement Period New Variable Hour Employee Based on the facts and circumstances at their start date, the employer cannot determine whether they will work 30+ or more hours of service a week because their hours are variable or otherwise uncertain – Initial Measurement Period New Seasonal Employee Hired into a position for which customary annual employment is six months or less – Initial Measurement Period 14 © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 ACA OVERVIEW SPECIAL CONCERNS: NEW GUIDANCE Adjunct Professors • “IRS suggests: for each classroom hour, count 2.25 hours (to account for preparation and grading) + an hour per week for each additional hour outside of the classroom performing required duties” • Must be reasonable method Volunteers • Allows exclusion of bona fide volunteers” (Note: many employees who receive stipends still must be included as employees under the employer mandate) Students in Work Study Programs • Excludes hours of service for positions subsidized through the federal workstudy program or similar state program 15 © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 ACA OVERVIEW CALCULATING HOURS OF SERVICE # Regular hours worked # Hours of paid time off + special unpaid leave # Months in measurement period Average # hours worked per month All employees Rehires # Hours of paid time off: include vacation, PTO, sick time, teacher breaks of at least 4 consecutive weeks Use all hours worked during measurement period if: # Hours of special unpaid leave: includes jury duty, USERRA and FMLA. These leaves don’t count against employees. Break in service is 13 weeks or less o 26 weeks or less for education employees Rule of parity Can treat as new employee if break in service is more than 13 weeks (26 weeks for education employee) © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 16 ACA OVERVIEW BREAK IN SERVICE RULES Break in Service Rules Employees must have a break in service of 26 weeks before they can be placed in a new initial measurement period or otherwise treated as a new employee for the purposes of pay or play For employment breaks of 4 or more weeks, the employer must “credit” hours of service as follows: Determining the average hours of service per week for the employee during the measurement period, excluding the employment break period, and using that average for the employee for the entire measurement period; or Crediting the employee with hours of service for the employment break period at a rate equal to the average weekly rate at which the employee was credited during the other weeks in the measurement period. NOTE Educational organizations are not required to credit employees with more than 501 hours of service for any employment break period in a calendar year (applies to continuing employees, not rehires; does not include special unpaid leave) © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 17 ACA OVERVIEW ADJUNCT FACULTY Counting Hours of Service for Adjunct Faculty The Employer Shared Responsibility IRS Section 4980H document, provides the following guidance for counting hours of service for adjunct faculty members who work variable hours: Employers should use a reasonable method of crediting hours of service that is consistent with the purposes of section 4980H An instructor’s hours should include not only classroom or other instruction time, but also include necessary hours that are needed to perform the employee’s duties such as classroom preparation time, etc. A method of crediting hours of service would not be reasonable if it only accounts for some of an employee’s hours of service with the goal to redefine as non-full time (for employees in positions that traditionally involve more than 30 hours per week). The Final guidance expressly allow crediting an adjunct faculty member with 2 ¼ hours of service per week for each hour of teaching or classroom time as a reasonable method for this test Other methods can be used as long as they are “reasonable” © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 18 ACA OVERVIEW STUDENT WORKERS AND VOLUNTEERS Student Workers The final regulations provide that hours of service do not include hours of service performed by students in positions subsidized through the federal work-study program or a similar state or local program There is no exception for student workers overall Volunteers The final regulations do not directly refer to stipend employees, however there is language included regarding “Bona Fide Volunteers” Hours of service for purposes of the pay or play rules do not include hours worked as a “bona fide volunteer.” The term “bona fide volunteer” means any employee of a government or tax-exempt entity whose only compensation from that entity or organization is in the form of: (i) reimbursement for (or reasonable allowance for) reasonable expenses incurred in the performance of services by volunteers; or (ii) reasonable benefits (including length of service awards) and nominal fees customarily paid by similar entities in connection with the performance of services by volunteers. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 19 FULL-TIME EMPLOYEES STANDARD MEASUREMENT PERIOD All employed when measurement period begins Standard Measurement Period Time over which employee hours of service are counted 3-12 months Administrative Period Time to determine full-time or part-time status based on average hours of service Up to 90 days Stability Period Time during which employee’s full-time or parttime status is locked Must be at least six (6) months long and cannot be shorter than measurement period Must = stability period for initial measurement period © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 20 PAY OR PLAY – FULL-TIME EE DETERMINATION Standard Measurement Period – October 1 plan year 1st Standard Measurement Period Admin Jun-16 May-16 Apr-16 Mar-16 Feb-16 Jan-16 Dec-15 Nov-15 Oct-15 Sep-15 Aug-15 Jul-15 Jun-15 May-15 Apr-15 Mar-15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 2016 2015 2014 1st Stability Period 2nd Standard Measurement Period 1st Standard Measurement Period, start measuring August 1, 2014. Administrative Period 2 months (August 1, 2015 – September 30, 2015). Stability Period 12 months (October 1, 2015 – September 30, 2016). © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 21 FULL TIME EMPLOYEES INITIAL MEASUREMENT PERIOD New variable hour and/or seasonal employees Max duration 13 months + fraction Initial Measurement Period Time over which new employee hours of service are counted 3-12 months Start on DOH or 1st of month following Administrative Period Time to determine full-time or parttime status based on average hours of service Up to 90 days Can split admin period if IMP starts 1st of the month following DOH Stability Period Time during which employee’s full-time or part-time status is locked Can’t be more than one month longer than Initial measurement period Must = stability period for ongoing measurement period Limited for employees deemed part-time © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 22 ACA OVERVIEW MEASUREMENT PERIODS Some basic rules for easier administration: Use 12 month initial measurement periods (IMPs) and associated 12 month stability periods – effectively have 12 IMPs in a year Start tracking new variable hour/seasonal employees on first of the month following date of hire o Note—new employees hired to work full-time must be offered coverage no later than 60 days of date of hire (CA) – recently repealed back to 90 days New variable hour, seasonal or part time employees whose hours of service measure as full-time will be considered full-time during the associated stability period An ongoing measured employee will always be in a measurement period and a stability period © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 23 PROPOSED REPORTING REQUIREMENTS FORM 1094-C AND 1095-C Starts in 2016 for 2015 calendar year Employer must report to the IRS by March 31, 2016 and each March thereafter, an electronic listing of every employee and retiree including all dependents enrolled in medical coverage and the months of coverage (College must e-file) Name Social Residence Months Covered Employer must issue to each employee by January 31, 2016 and each January thereafter, a certificate of coverage including the above information for the employee or retiree to file with their tax return to avoid the individual mandate penalty SISC Solution: To the extent SISC can do this as a service to member Colleges, or, if not as a service, then provide the information needed to do this to the member Colleges, SISC will. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 24 ACA OVERVIEW: CADILLAC TAX WHAT IS A CADILLAC HEALTH PLAN ? The Affordable Care Act includes a tax on benefit rich plans, known as the “Cadillac Tax” The tax is for health plans that have lower out-of-pocket costs and most health care services are covered The excise tax is 40% on any health plan premium over the following thresholds: $10,200 for Single Coverage $27,500 for Family Coverage Higher limit for workforces with older populations These amounts are benchmarked to the Federal Employee Health Benefit Plan (FEHBP) The Cadillac Tax includes the following: Medical premiums Non-Excepted Dental and Vision Premiums FSA, HRA and HSA Contributions The Cadillac Tax is meant to be charged to plan insurers and plan sponsors and would be collected and used to help defray America's multi-trillion dollar health care plan The Cadillac Tax is scheduled to become effective January 1, 2018 © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 25 Cadillac Tax - Illustration Cabrillo College Actives Early Retirees $10,200.00 Current Cadillac Threshold (2018) - Single $11,850.00 Current Cadillac Threshold (2018) - Single $27,500.00 Current Cadillac Threshold (2018) - Family $30,950.00 Current Cadillac Threshold (2018) - Family Blue Shield HMO $30-20% - Actives Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 33 $742.00 $8,904 $10,605 $11,531 $12,509 $162 $532 $924 Employee + 1 7 $1,453.00 $17,436 $20,767 $22,580 $24,496 $0 $0 $0 Employee & Family 27 $2,043.00 $24,516 $29,199 $31,749 $34,443 $680 $1,700 $2,777 $23,692 $63,457 $105,472 Projected Tax Blue Shield HMO $30-20% - Early Retirees Current Enrollm ent Annual Increase Employee Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 N/A N/A N/A 6% 9% 12% 6% 9% 12% 0 $742.00 $8,904 $10,605 $11,531 $12,509 $0 $0 $264 Employee + 1 1 $1,453.00 $17,436 $20,767 $22,580 $24,496 $0 $0 $0 Employee & Family 0 $2,043.00 $24,516 $29,199 $31,749 $34,443 $0 $320 $1,397 $0 $0 $0 Projected Tax Blue Shield HMO $25-500 w/Chiro - Actives Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 98 $792.00 $9,504 $11,319 $12,308 $13,352 $448 $843 $1,261 Employee + 1 48 $1,554.00 $18,648 $22,210 $24,150 $26,199 $0 $0 $0 Employee & Family 90 $2,186.00 $26,232 $31,243 $33,971 $36,854 $1,497 $2,588 $3,742 $178,620 $315,595 $460,322 Projected Tax Blue Shield HMO $25-500 w/Chiro - Early Retirees Current Enrollm ent Annual Increase Employee Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 N/A N/A N/A 6% 9% 12% 6% 9% 12% 9 $792.00 $9,504 $11,319 $12,308 $13,352 $0 $183 $601 Employee + 1 7 $1,554.00 $18,648 $22,210 $24,150 $26,199 $0 $0 $0 Employee & Family 0 $2,186.00 $26,232 $31,243 $33,971 $36,854 $117 $1,208 $2,362 $0 $1,649 $5,409 Projected Tax © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 26 Cadillac Tax - Illustration Cabrillo College Actives Early Retirees $10,200.00 Current Cadillac Threshold (2018) - Single $11,850.00 Current Cadillac Threshold (2018) - Single $27,500.00 Current Cadillac Threshold (2018) - Family $30,950.00 Current Cadillac Threshold (2018) - Family Blue Shield HMO $10-0 w/Chiro - Actives Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 14 $980.00 $11,760 $14,006 $15,230 $16,522 $1,523 $2,012 $2,529 Employee + 1 15 $1,900.00 $22,800 $27,155 $29,527 $32,032 $0 $811 $1,813 Employee & Family 15 $2,653.00 $31,836 $37,917 $41,229 $44,727 $4,167 $5,491 $6,891 $83,819 $122,697 $165,961 Projected Tax Blue Shield HMO $10-0 w/Chiro - Early Retirees Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 10 $980.00 $11,760 $14,006 $15,230 $16,522 $863 $1,352 $1,869 Employee + 1 6 $1,900.00 $22,800 $27,155 $29,527 $32,032 $0 $0 $433 Employee & Family 1 $2,653.00 $31,836 $37,917 $41,229 $44,727 $2,787 $4,111 $5,511 $11,412 $17,630 $26,796 Projected Tax Blue Shield PPO 80-E - Actives Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 29 $968.00 $11,616 $13,835 $15,043 $16,320 $1,454 $1,937 $2,448 Employee + 1 17 $1,807.00 $21,684 $25,826 $28,081 $30,464 $0 $233 $1,186 Employee & Family 9 $2,679.00 $32,148 $38,289 $41,633 $45,166 $4,316 $5,653 $7,066 $81,004 $111,010 $154,742 Projected Tax Blue Shield PPO 80-E - Early Retirees Current Enrollm ent Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 Annual Increase N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 19 $968.00 $11,616 $13,835 $15,043 $16,320 $794 $1,277 $1,788 Employee + 1 17 $1,807.00 $21,684 $25,826 $28,081 $30,464 $0 $0 $0 Employee & Family 0 $2,679.00 $32,148 $38,289 $41,633 $45,166 $2,936 $4,273 $5,686 $15,085 $24,267 $33,969 Projected Tax © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 27 Cadillac Tax - Illustration Cabrillo College Actives Early Retirees $10,200.00 Current Cadillac Threshold (2018) - Single $11,850.00 Current Cadillac Threshold (2018) - Single $27,500.00 Current Cadillac Threshold (2018) - Family $30,950.00 Current Cadillac Threshold (2018) - Family Blue Shield PPO 80-J - Actives Current Enrollm ent Annual Increase Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 N/A N/A N/A 6% 9% 12% 6% 9% 12% Employee 15 $861.00 $10,332 $12,306 $13,380 $14,516 $842 $1,272 $1,726 Employee + 1 13 $1,607.00 $19,284 $22,968 $24,973 $27,093 $0 $0 $0 Employee & Family 11 $2,382.00 $28,584 $34,044 $37,017 $40,158 $2,618 $3,807 $5,063 $41,427 $60,957 $81,592 Projected Tax Blue Shield PPO 80-J - Early Retirees Current Enrollm ent Annual Increase Employee Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 N/A N/A N/A 6% 9% 12% 6% 9% 12% 1 $861.00 $10,332 $12,306 $13,380 $14,516 $182 $612 $1,066 Employee + 1 1 $1,607.00 $19,284 $22,968 $24,973 $27,093 $0 $0 $0 Employee & Family 0 $2,382.00 $28,584 $34,044 $37,017 $40,158 $1,238 $2,427 $3,683 $182 $612 $1,066 Projected Tax Total Projected Tax Blue Shield PPO HDHP - B w/HSA Compatibility - Actives Current Enrollm ent Annual Increase Employee Current Monthly Cost Current Annual Cost 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 N/A N/A N/A 6% 9% 12% 6% 9% 12% 27 $701.00 $8,412 $10,019 $10,894 $11,818 $0 $278 $647 Employee + 1 3 $1,323.00 $15,876 $18,909 $20,560 $22,305 $0 $0 $0 Employee & Family 3 $1,998.00 $23,976 $28,556 $31,050 $33,685 $422 $1,420 $2,474 $1,267 $11,752 $24,899 Projected Tax Total Projected Tax Blue Shield PPO HDHP - B w/HSA Compatibility - Early Retirees Current Enrollm ent Current Monthly Cost Current Annual Cost N/A N/A N/A 6% 9% 12% 6% 9% Employee 1 $701.00 $8,412 $10,019 $10,894 $11,818 $0 $0 $0 Employee + 1 0 $1,323.00 $15,876 $18,909 $20,560 $22,305 $0 $0 $0 Employee & Family 0 $1,998.00 $23,976 $28,556 $31,050 $33,685 $0 $40 $1,094 $0 $0 $0 $436,507 $729,626 $1,060,228 Annual Increase Projected Tax Total Projected Tax 2018 Cadillac Tax Projected Tax - 40% Projected Annual Cost 2018 12% © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 28 DISCLAIMER The Affordable Care Act (“ACA”) is an extraordinarily complex law that will impact all areas of medical insurance in the U.S. Both federal and state agencies have been and will continue to issue temporary and final regulations that materially impact compliance requirements and necessitate new or modified compliance actions. This document and the related resources are intended to support a best practice approach to ACA compliance based on known regulations and practical responses to an evolving landscape. ACA compliance will be an ongoing process that will require regular updates to an employer’s strategy based on new regulations and marketplace developments. This document provides general information regarding the mandates under the Affordable Care Act (ACA). It does not provide a review of, or ensure compliance with, ACA mandates. Alliant Insurance Services, Inc. does not provide legal advice or legal opinions. Please consult counsel if a formal legal opinion is desired. © 2015 Alliant Insurance Services, Inc. All rights reserved. Alliant Employee Benefits, a division of Alliant Insurance Services, Inc. CA License No. 0C36861 29 Public Entity Benefits Group 100 Pine Street, 11th Floor San Francisco, CA 94111