Board Budget Study Session Horticulture Center March 2, 2015

advertisement

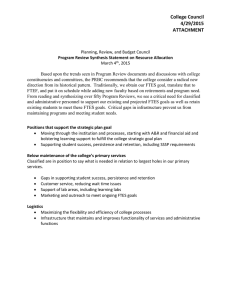

Board Budget Study Session Horticulture Center March 2, 2015 4:00 pm Agenda • Governor’s January 2015-16 State Budget Overview • 2015-18 Budget Planning • Enrollment Trends • Compliance Mandates (handouts) • Funding Formula • General Reserve • Outcome Based Funding Model • Unallocated One-Time (Operating Reserve) • Student Success Funding (SSSP) / Student Equity • Cabrillo Budget Overview • Budget Policy Goals to consider • Unrestricted General Fund Trend Analysis • Questions? Next Steps? 2015-16 Governor’s January Budget Best state budget in years Revenue Changes: (Ongoing) • 1.58% COLA • Increase in unrestricted general fund revenue • Access (growth) funds- subject to a growth formula still under review • Increase in SSSP (formerly Matriculation) /Student Equity Funding Revenue Changes: (One Time) • State Mandate Block Grant Expenditure Changes: • Unprecedented increases in PERS/STRS rates Continuous increases in medical benefit/retiree benefit contributions • Enrollment Trends Apportionment FTES History and VPI Projection 16,000 14,000 Historical 12,000 Projected FTES 10,000 8,000 6,000 Base (New 10,500 CAP) 4,000 Actual 2,000 0 20072008 20082009 20092010 20102011 20112012 20122013 20132014 20142015 20152016 20162017 Funding Formula Overview Funding for credit/noncredit FTES $49 million Funding for maintaining 10,000 FTES $ 5 million Funding for maintaining a state approved center (minimum of 1,000 FTES) Watsonville $ 1 million $55 million Total Shift to Outcome Based Funding Model Student Success Support Program (formerly Matriculation) • • • • Student Equity program requirements: “ . . . to close achievement gaps in access and success in underrepresented student groups, as identified in local student equity plans.” Student Equity Success Indicators are to measure: • • • • Student Orientation Student Assessment Student Education Planning Access ESL and Basic Skills Completion Degree & Certificate Completion Transfer Student Services (SSSP/Student Equity) Funding Increases Actual Revenue FY 2011-12 Unrestricted General Fund Restricted Student Services Funds 4% Projected Revenue FY 2015-16 Unrestricted General Fund Restricted Student Services Funds 8% 96% 92% Cabrillo Budget Challenges 2014-15: 2016-17: • Cabrillo projecting 10,887 FTES target • Deficit factor reduced from $1 million to $0.5 million • Cabrillo enrollment down at all locations • Cabrillo will be funded at 2014-15 level in 2015-16 • Permanent $2 million loss of funding will occur in 2016-17 • New cap may be 10,500 • We must maintain 10,000 FTES total and 1,000 FTES at the Watsonville Center –current enrollment is 1,100 FTES Unrestricted General Fund Revenue and Expense Trends FY 2009-10 thru FY 2017-18 $68 $66 Millions of Dollars $64 $62 $60 $58 $56 $54 Revenues $52 Expenses $50 2009-10 Actual 2010-11 Actual 2011-12 Actual 2012-13 Actual 2013-14 Actual 2014-15 Budget 2015-16 Projected 2016-17 Projected 2017-18 Projected General Unrestricted Fund Expense Categories as a Percent of Total Actual Expenditures FY 2013-14 2% 14% Salaries 21% 63% Benefits Retiree Benefits Everything Else Cabrillo 2015-18 Budget Planning 2016-17: Proposition 30 begins to phase out Loss of FTES impacts other programs: • Lottery, SIE, Deferred Maintenance, State Mandate Block Grant and Student Services Programs that receive funding based on FTES. • Reduces the Full-time Faculty Obligation Number (FON). Expenditure Changes: • Unprecedented increases in PERS/STRS rates continue • More increases in medical benefit/retiree benefit contributions Compliance Requirements: Concerns about meeting 50% law compliance Compliance/Mandates Faculty Obligation Number (FON) fall 2014 Cabrillo calculated FON: 176.6 Cabrillo actual FON: 184.4 50% Law FY 2013-14 = 50.82% STRS/PERS rate increases began in 2014-15 Restricted Program Matches SSSP: • Assessment • Orientation • Student Educational Planning • Student Equity Affordable Care Act Effective 10/1/15 (benefits plan year) New Sick Leave Law Effective 7/1/15 Reserves General Reserve Currently 5% Unallocated One-time funds “Operating Reserves” General Reserve • The General Reserve should not be allocated under any circumstances. • Using the General Reserve is a sign of fiscal insolvency. • Adverse impact on the District’s accreditation if the General Reserve drops below 5% Unallocated One-time Funds (Operating Reserve) One-time funds are generated from: o Unspent, unallocated base budget funds after the books are closed. o One-time funding received, not budgeted o Adjustments from the recalculation of state apportionment revenue for previous years are made up to three years after a fiscal year is closed at the local level General Unrestricted Fund Balance Required Reserve & Unallocated One-time 5 5 4 Available for Allocation (OneTime), $1.7 million 4 In Millions 3 3 2 2 Required Reserve (Unavailable), $3 million 1 1 - FY 2014-15 as of February 11, 2015 Risk Factors To determine reserves needed Cabrillo’s Base Budget Cabrillo’s base, unrestricted General Fund budget is approximately $58 million. Cabrillo’s General Reserve 5% = $3 million Revenue Trends Forecasted deficit spending requires a higher reserve to bridge the deficit. Enrollment Declining FTES requires an extra reserve to manage permanent fluctuations in FTES. Unfunded Deferred Facilities Maintenance Cabrillo’s estimate is $5 million per year (unfunded) Changes in Legislation / Compliance Mandates Cause increases in expenditures / decreases in revenue. Retiree Benefits Cabrillo’s future liability is approximately $17 million with $3 million funded. Budget Guidelines Options to consider • Develop a maximum percentage of salaries/benefits, not to exceed a certain percentage of base budget • Increase General Reserve percentage (from 5% to X%) • Continue to utilize Unallocated One-time Operating Reserves to fund college priorities • Allocate a fixed percentage of ongoing and one-time funds to the following: • Deferred Facilities Maintenance • Technology • Program Planning • Retiree Benefits • Equipment Replacement College Planning Council Feedback Some CPC Members recommended using One Time Funds for: Salary increases Bonus payments to employees Funding the Deficit Increasing Reserves Facilities Deferred Maintenance Fund Program Plan What actions are needed and when? • Develop and implement a restructuring plan for the college • $2 million in reductions equivalent to the revenue loss of 387 FTES; 3.5% • Reduce non-general fund programs as necessary • Balanced budget • Develop budget guidelines/procedures • Develop timeline: Phase in restructuring and reductions starting now- implement all reductions by July 1, 2016 Questions? Next Steps?